Fertilisers: the determinants of strong EU price growth

To study the possible future evolution of prices, a specific analysis of the various determinants is necessary

Published by Luigi Bidoia. .

Forecast Fertilizers Price DriversThe European agricultural world is suffering greatly from the sharp rise in fertiliser prices over the past 12 months.

The fertiliser industry transforms raw materials (air, natural gas and minerals) into products that provide plants with three essential nutrients: nitrogen, phosphorus and potassium. The unit price of fertilisers is relatively low (averaging less than $500/tonne), which drives the regionalisation of world trade into three major areas (Europe, North America and Asia) and reducing competitive pressures between the different areas.

Conversely, the high substitutability between the various fertiliser products pushes companies within each area to strong price competition of each area, to high price competition and an alignment between the price dynamics of the different products, as shown in the graph below.

The graph shows the time series of customs price levels for five fertiliser products. In addition to highlighting the strong alignment of the dynamics of the different prices, it shows how prices have been on average stable over this century, with two significant exceptions: the first was in 2008; the second in the most recent period. tterised 2008; the second the most recent period. The magnitude of the overall growth in the two different phases is very similar and lies between 150% and 200%.

In the first case, growth was interrupted by the financial crisis at the end of 2008. The analysis of the possible evolution of the current growth phase is the objective of this article.

- rising gas and electricity prices in Europe

- expectations of a blockade of European fertiliser imports from Russia

- speculative actions along the supply chain.

Energy price

The fertiliser industry uses gas and minerals as raw materials and requires large amounts of heat and electricity to achieve the temperatures and pressures necessary for the desired chemical reactions.

A high share of production costs is therefore accounted for by the cost of gas and electricity, whose variations have a strong impact on production costs.

The graph below shows the dynamics of gas prices in Europe (measured both at customs and on the TTF financial market) and of electricity in Italy, as a proxy for the price in Europe.

The graph clearly shows the magnitude of the increases in 2021 and 2022, which are dimensionally different from the relatively modest increases in 2008. The change in energy costs justifies the current increase in fertiliser prices much more than the increases in 2008.

Imports from Russia

The top four fertiliser exporters in the world are: Russia, China, Saudi Arabia and Canada.

China directs almost all its exports to Asia and Latin America.

Canada sells more than half of its fertilisers to the United States, with significant exports to Asia and Latin America. Conversely, exports to Europe are marginal.

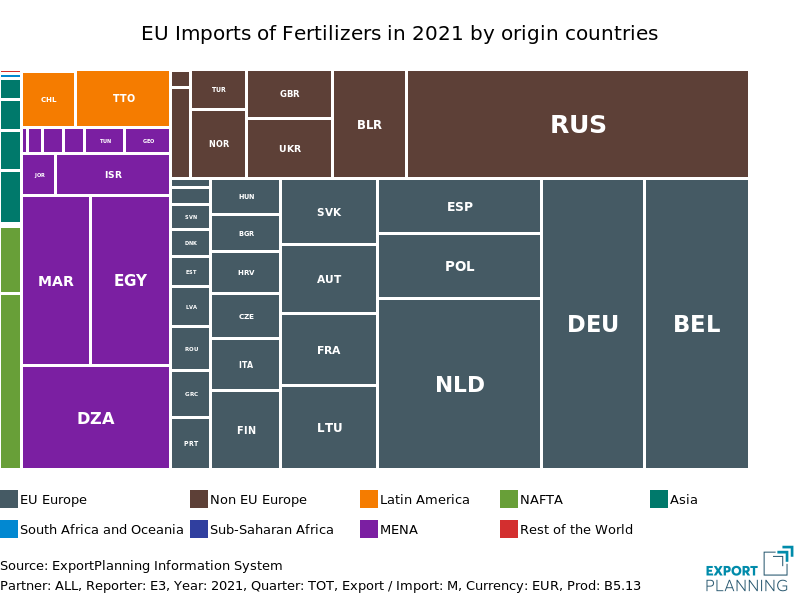

Saudi Arabia has India as its main market and exports to almost all other parts of the world, excluding Europe. Excluding intra-community trade, Europe imports mainly from Russia, Belarus and North Africa.

In this situation, a possible blockade of Russian and Belarusian exports to Europe would lead to a significant shortage of fertilisers on the European market. Russia had already banned the export of ammonium nitrate at the beginning of February 2022. In March, the Russian Ministry of Trade and Industry recommended that the country's fertiliser producers stop exports to the EU in retaliation for European sanctions triggered after the invasion of Ukraine.

Speculation

Faced with a high likelihood of a significant supply shortage, European fertiliser distributors increased prices significantly more than the already high producer price increases. A measure of these speculative actions can be obtained by comparing the panel prices recorded by the Milan Chamber of Commerce commissions with the customs prices of some fertilisers.

Price of fertilisers (euros per tonne)

|

|

|

|

Conclusions

More than in 2008, the recent sharp increase in fertiliser prices in Europe is caused by the sharp increase in gas and electricity prices in the Old Continent and expectations of a supply deficit due to reduced imports from Russia. Added to these pressures are increases in distribution margins.

These factors are unlikely to disappear any time soon, and will therefore continue to cause pressure on chemical fertiliser prices in the coming months.

The process of replacing Russian imports with those of other origins is already underway, but will take time to produce calming effects. However, the current high price levels could speed up the virtuous processes already in place, of optimising their use and replacing chemical fertilisers with organic fertilisers. The latter should also be favoured by a completed implementation of the EU Certification Regulation, which regulates fertilisers produced from recycled organic material.

The chemical fertiliser market could therefore receive a significant contribution from reduced demand along the

road to a new equilibrium.

During the course of 2022, supplier substitution and demand rationalisation could prove to be factors that will In the course of 2022, supplier substitution and demand rationalisation could prove to be factors that will calm prices, if not initiate their initial reduction from their current high levels. In 2023, the most significant contribution to price reductions is expected to come from the expected decrease in European gas and electricity prices.