Copper price registers fears on the Chinese front, as well as restrictive monetary policies

Doctor Copper Says: copper price dynamics to monitor the economy

Published by Alba Di Rosa. .

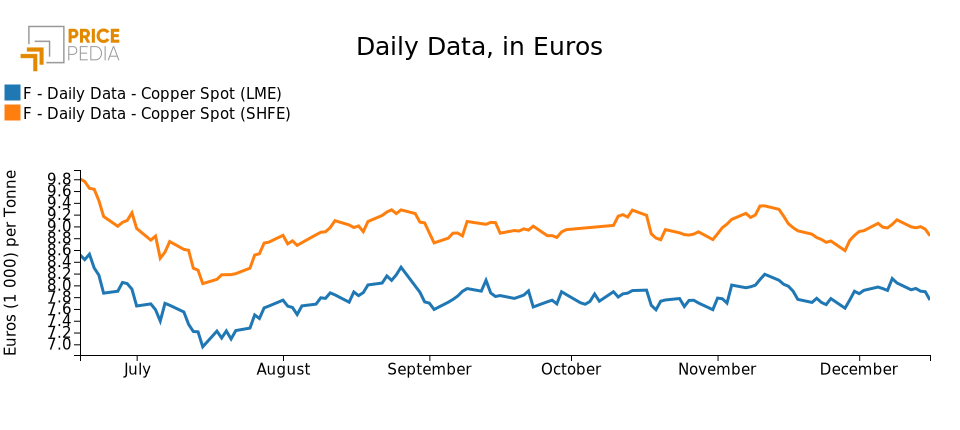

Exchange Rates LME Copper Non Ferrous Metals Doctor Copper SaysAfter an upward phase in the first week of December, copper prices on both the London Metal Exchange (LME) and the Shanghai Futures Exchange (SHFE) embraced a downward trend in recent days. Let us then delve into the events and news that have driven these dynamics.

Good news from China, but uncertainty remains for the coming months

The main news that drove the rise of copper prices in the early days of December was the relaxation of Chinese health restrictions: this is in fact the Asian country's first major step in this direction, following rumours on the subject that had been circulating for months, and protests at the end of November in several cities around the country.

The turnaround was announced on December 7, with the release of 10 new guidelines that relax some restrictions: for example, the possibility of home quarantine for asymptomatic people or those with mild symptoms is introduced; checks for domestic travel and access to public places are also reduced.

The news of a gradual abandonment of China's zero-Covid policy was welcomed by the markets, as can be seen from the rising price of copper in the first few days of December: in the face of a long-awaited normalization, expectations of growing demand from the world's largest consumer of the metal are thus strengthening.

The markets' optimistic reaction to the easing of restrictions can also be seen in the appreciation of the yuan's exchange rate, which has then stabilized in recent days.

In fact, after the initial enthusiasm linked to the announcements, in the last few days fears have also emerged: this change of course on the part of China could bring with it a significant increase in cases, after the restrictive health policy conducted over the last three years, which has led to a relatively low incidence of the virus in the country.

Markets therefore remain uncertain about possible developments, and their impact on an economy that is already showing some signs of difficulty. Reflecting these fears, the price of copper decreased this week, down more than 2% at the SHFE and 3% at the LME from last Friday's closing values.

Also weighing on market sentiment, and worrying for Chinese demand for copper, were the latest data released on Thursday, December 15, by the National Bureau of Statistics of China, which confirmed the current economic slowdown. In particular, retail sales continued their downward trend in November, falling 5.9% YoY, after the modest 0.5% drop recorded in October. On the other hand, industrial production was in positive territory last month (+2.2% YoY) - down, however, from the 5% increase recorded in October.

The central banks’ week

However, it hasn't been just China to dominate the scene in recent days: central bank decisions have also weighed on investor sentiment.

On December 13-14, the US Federal Reserve held its meeting, which led to a 50 basis points rate hike, in line with market expectations (4.25%-4.50%). Although down from the previous 75 basis points rise, the Fed wanted to make it clear that this signal cannot be interpreted as a gradual abandonment of the restrictive monetary policy conducted to date. US inflation is indeed falling, but it is still well above target, and it is therefore still premature to say that price dynamics could be at the beginning of a solid normalization path.

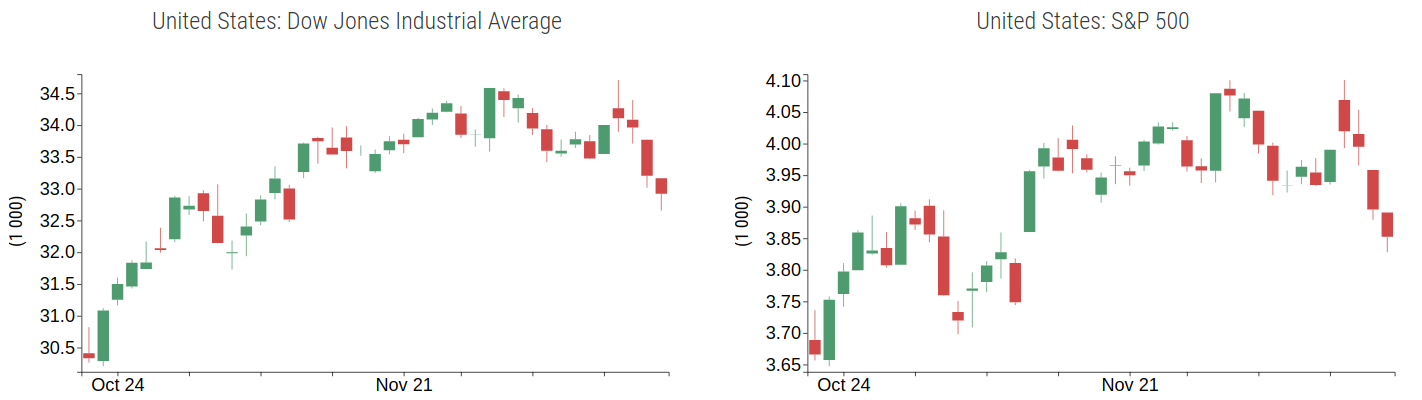

The Fed's tone has pushed down market sentiment, weighing not only on the price of copper, but also on the recent dynamics of the American stock markets.

US Stock Exchange Indexes: Dow Jones and S&P500

Source: DailyDataLab.

On December 15 the ECB released its monetary policy decision. The rate increase decided by the central bank was 50 basis points, coupled with the announcement of a determined continuation of the pace of increases, in relation to the substantial revision of inflation expectations, and the projections that inflation could remain above the target for a long time to come.

The ECB also predicted a possible contraction of Eurozone GDP in Q4 2022 and Q1 2023, in connection with the current crisis on the energy front, high uncertainty, the global economic slowdown and the effects of a restrictive monetary policy.

As for the Bank of England, which met on the same day, monetary policy rates were also risen by 50 basis points. Like the American stock exchanges, European stock exchanges also reacted downwards. The commodities front was also penalized, as can be seen from the recent fall in copper prices, due to fears of a slowdown in the world economy and a consequent reduction in demand.