Outlook for 2023, amid uncertainty and risks

Doctor Copper Says: copper price dynamics to monitor the economy

Published by Alba Di Rosa. .

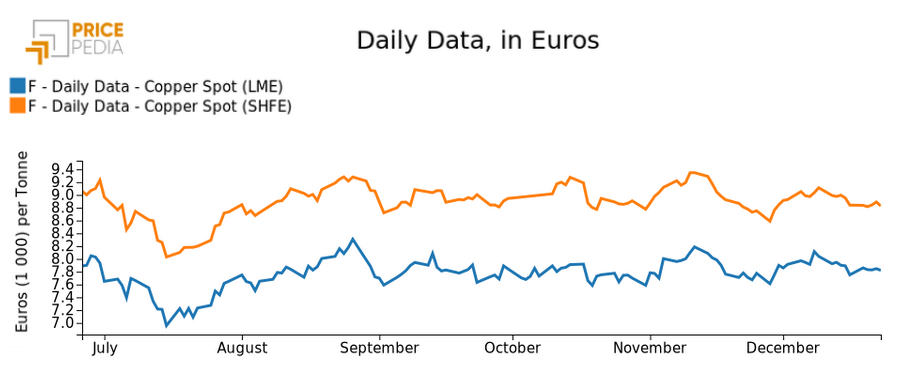

LME Copper Non Ferrous Metals Doctor Copper SaysIn recent days, the downward phase in copper prices that we reported last week seems to have been interrupted: in fact, for copper quoted on the Shanghai Futures Exchange (SHFE) we can see substantial stability in euro prices (+0.5% compared to the closing values of Friday, December 16), compared to a modest increase (+1.3%) for the price quoted on the London Metal Exchange (LME), as can be seen in the chart below.

News and outlook for 2023

How to frame copper's relative stability in the general market sentiment?

Ahead of the Christmas break, and after the release of last week's expected monetary policy news, financial markets seem to be heading into the year-end consolidating a generalized uncertainty about the outlook for 2023. Indeed, after the confirmation of a restrictive stance for both US and Eurozone monetary policy, recession risk remains front and center as central banks attempt to fight the inflationary spiral.

At the same time, pressure weighs on the Covid front for China, which is currently managing a growth in cases. Indeed, concerns remain about the impact of the new wave, this time curbed by fewer restrictions than in the past, in hurting China's economy and consequently demand for copper from its largest consumer.

Looking toward 2023, last week saw the Central Economic Work Conference, an annual meeting of Chinese leaders to decide priorities on the economic front to work on in the coming year. At the forefront is the goal of stimulating growth via domestic consumption in the face of two main changes: living with the pandemic and supporting the real estate sector.

Moving to the European front, some data from the last few days provide signs of partial optimism for 2023. In particular, the Ifo index, which measures the German business climate, was released: for the month of December, the index showed a remarkable rebound, returning to 88.6 after six consecutive falls, thanks to an improvement in business expectations for the next six months. In any case, the index remains below its long-term average, thus not erasing the risk of a recession.

Copper and industrial production

Thus, pulling the strings of 2022 on the copper price front, compared to the "pre-Christmas" closing prices recorded in December 2021, this year the market is set to close at levels about 8% lower than last year. As reported in a previous article, in the first part of 2022 the price of copper continued the climb that began shortly after the outbreak of the pandemic - a climb that was then reversed in spring with the onset of restrictive monetary policies and pressure from China's zero-Covid. In the face of growing fears of a recession, the price hit a low point in July, which was followed by only a partial rebound and relative stability in the fall months.

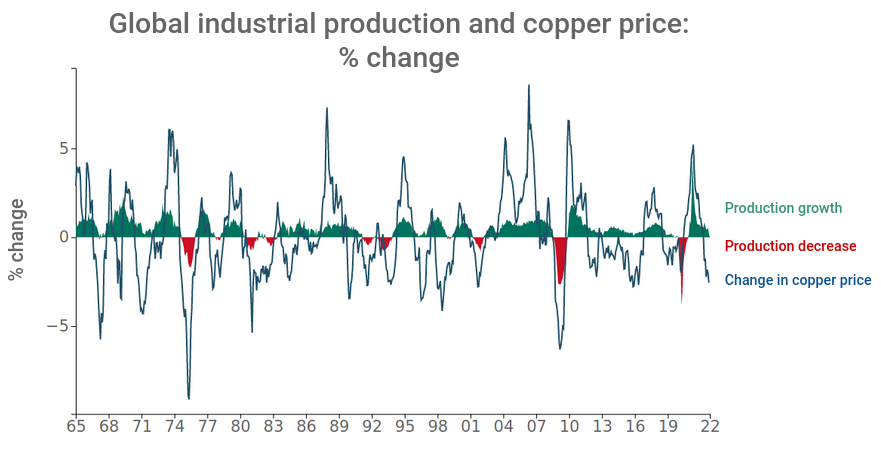

Comparing the price of copper with an additional indicator that provides signals regarding the outlook for the world economy, such as industrial production, we can see a fair amount of alignment in their respective long-term trends.

In particular, focusing on recent years, we see how aligned the collapses of the 2009 crisis and the Covid crisis appear to be, as well as the post-Covid recovery. In recent months, industrial production still appears to be in positive territory, but the change in copper prices is already in negative territory, thus confirming the possibility of downside risk to the real economy.