2023, year of recovery? Early signs from the price of copper

Doctor Copper Says: copper price dynamics to monitor the economy

Published by Alba Di Rosa. .

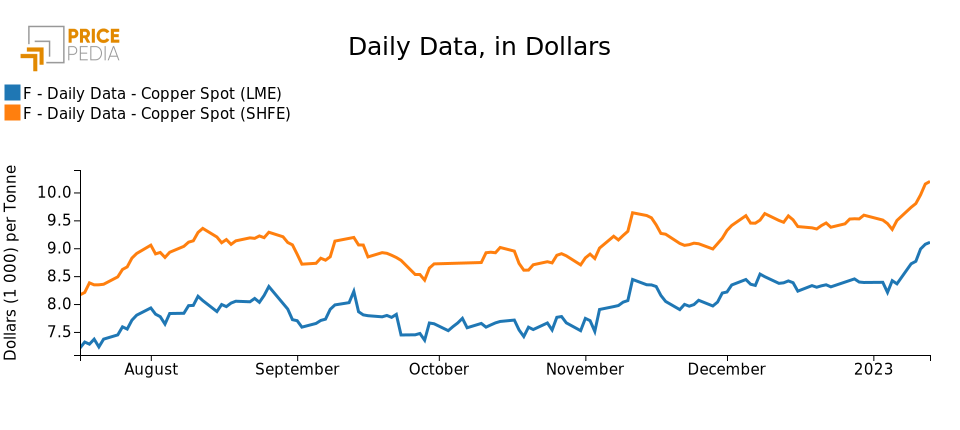

Exchange Rates LME Copper Non Ferrous Metals Hot-Rolled Coils Macroeconomics Doctor Copper SaysThe new year on financial markets opened, for the price of copper, with a clear upward trend. As can be seen from the chart below, since the early days of January, prices recorded on both the London Metal Exchange (LME) and the Shanghai Futures Exchange (SHFE) have embarked on a decidedly upward phase.

Over the past two weeks as a whole, dollar prices at the LME have risen 6.7 percent, compared with a 5.2 percent increase at the SHFE, returning to levels not seen since last June. For the first time since early summer 2022, copper at the LME exceeded $9,000 per ton.

The new year thus opens with a wind of optimism on the markets, which are focused more on the prospects of recovery for the Chinese economy - after the general easing of restrictive measures - than on the current situation of high pandemic spread in the country. Doctor Copper, in its role as a potential predictor of the dynamics of the real economy, thus also seems to confirm this optimism, anticipating a rebound in the real economy that has not yet occurred, but which is what investors are currently betting on. Thus, prospects for normalization are emerging and risk aversion is diminishing: markets see a recovery in Chinese economic activity and a relative increase in copper demand as now imminent.

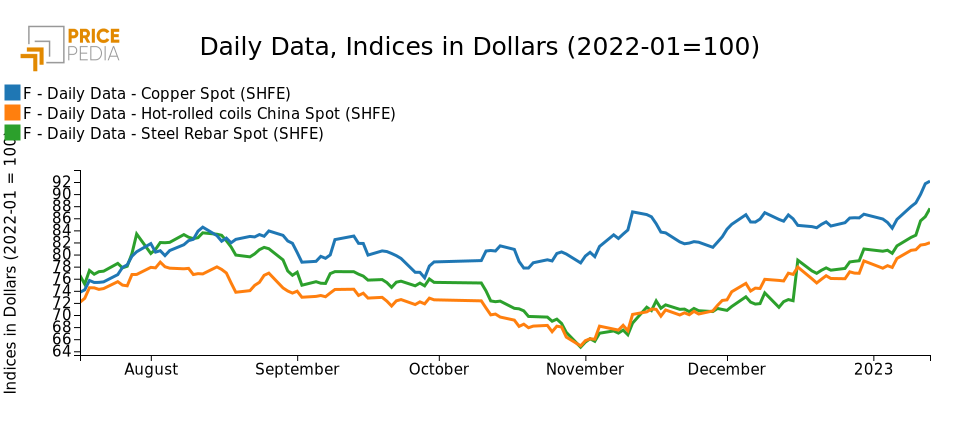

Also on the same trend are steel prices, another commodity of primary interest to the real estate sector. Steel prices have been rising since as early as December - in the wake of the easing of Chinese restrictions - and accelerating in recent weeks, as seen in the prices of hot-rolled coils and steel rebar listed on the SHFE.

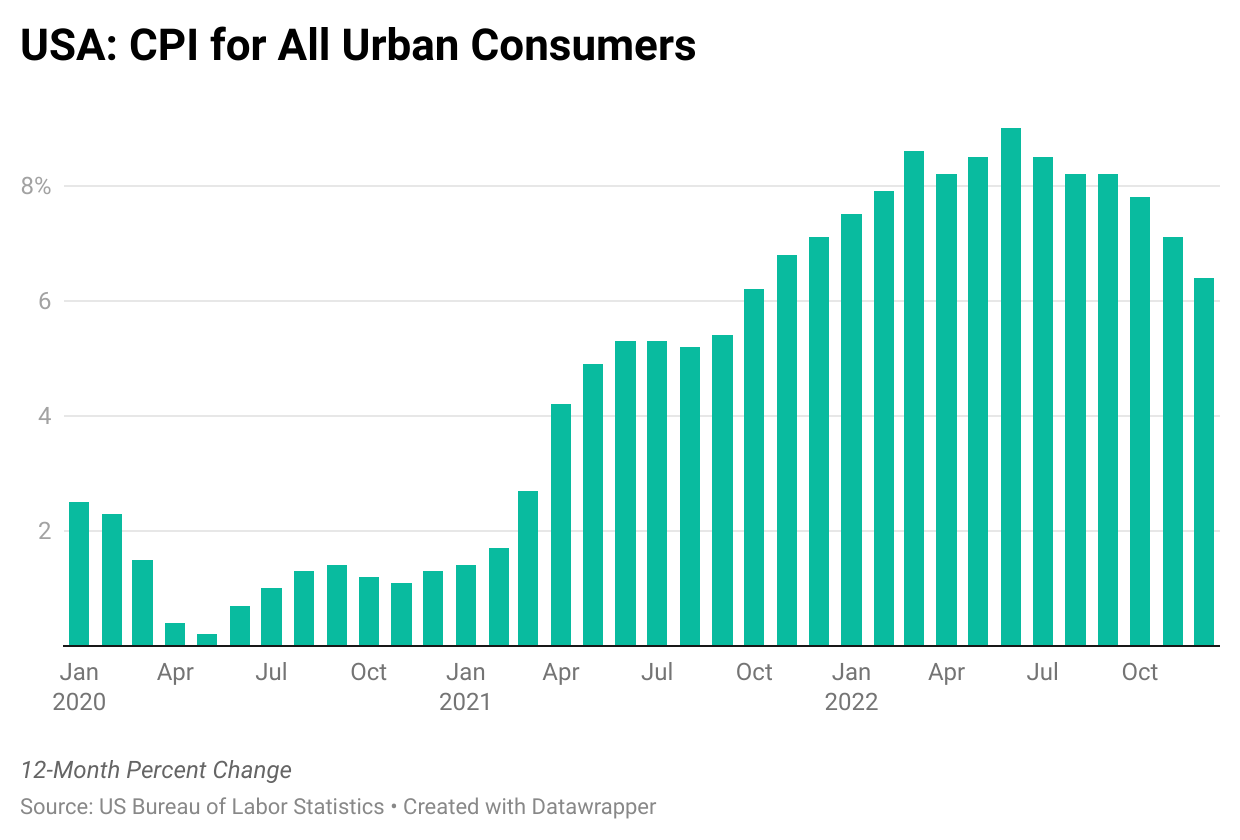

Widening our gaze to the forex front, at the opening of the year the dollar confirmed the weakening path started at the end of 2022, thus helping to support metal prices. Yesterday the exchange rate against the euro touched 1.08, in the wake of the latest US inflation data.

Indeed, on Thursday, January 12, the US Bureau of Labor Statistics released the Consumer Price Index for December. The increase on a YoY basis again confirmed its decelerating trend, marking +6.5%, and a contraction of 0.1 percent MoM: this is the first negative change since May 2020.

The inflation numbers thus go a long way toward raising investors' hopes for a normalization of the FED's monetary policy and a slowdown in the pace of hikes.

Not only markets, but also experts, are beginning to see a light at the end of the tunnel. According to recent statements by Kristalina Georgieva, Managing Director of the International Monetary Fund, there is confidence in a turnaround for the world economy at the end of 2023 if China continues toward normalization on the pandemic front and no worsening takes place for the Russia-Ukraine conflict. In any case, the world economy remains prey to significant fragility and 2023 may also prove a tough year.