Uncertain recovery for the Asian giant

Doctor Copper Says: copper price dynamics to monitor the economy

Published by Alba Di Rosa. .

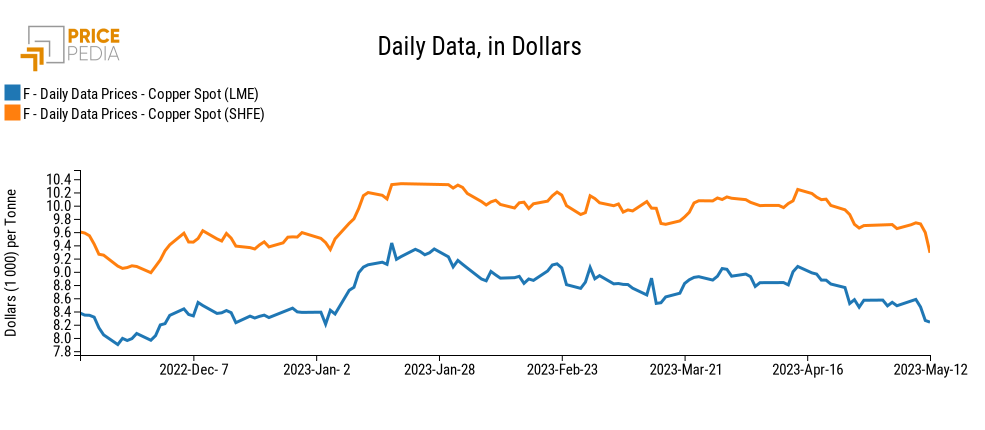

Precious Metals Conjunctural Indicators Copper Non Ferrous Metals Doctor Copper SaysIn the first part of the week, the price of copper confirmed the stability of early May. It is on Wednesday, May 10, that we can see the start of a slight slowdown, which was further accentuated yesterday, on Thursday, May 11: on both the London Metal Exchange (LME) and the Shanghai Futures Exchange (SHFE), the price of copper returned, in fact, to the levels of early 2023. Today there was another sharp decline in the price of copper at the SHFE, bringing the overall fall for the week close to -4 percent; more modest was the decline in the price at the LME, signaling that the weakness in demand affects the Chinese market more than the Western market.

Let us then delve into the events that, in recent days, have influenced financial markets' mood, as well as the price of Doctor Copper.

China news: weak demand and inflation at lows

A number of data were released this week that weighed on the price of copper. The General Administration of Customs of the People's Republic of China released preliminary foreign trade data for April, which darkened China's economic outlook and related forecasts for metal's demand.

In fact, looking at total trade data in dollars, we can see that Chinese exports grew by 8.5% year-on-year in April, compared with a significant drop in imports (-7.9%). In March, export growth was more dynamic, while import showed a modest contraction.

Thus, in the first 4 months of 2023 as a whole, China's merchandise exports confirmed a modest growth (+2.5%), due to the sharp contraction in the first two months of the year, while import fell by 7.3%.

Focusing on copper trade, Chinese imports of copper ores and concentrates showed a modest contraction in April (-1.1% year-on-year), compared to a more significant drop (-24.6%) for unwrought copper and copper products. In the first 4 months of 2023, imports for the two commodity groups fell substantially (-6% and -23.7%, respectively) compared to the same period of 2022.

Further news that negatively impacted copper price are the latest inflation numbers released by Chinese authorities on Thursday. The consumer price index hit a low point in April not seen since early 2021, limiting its growth to +0.1% year-on-year (-0.1% month-on-month).

These numbers reinforced market fears about the strength of China's recovery, which is disappointing initial optimistic expectations, and instead confirming the country's difficulty in embarking on a solid rebound, despite the removal of Covid restrictions. Along these same lines are the import numbers, which confirm weakness in Chinese domestic demand.

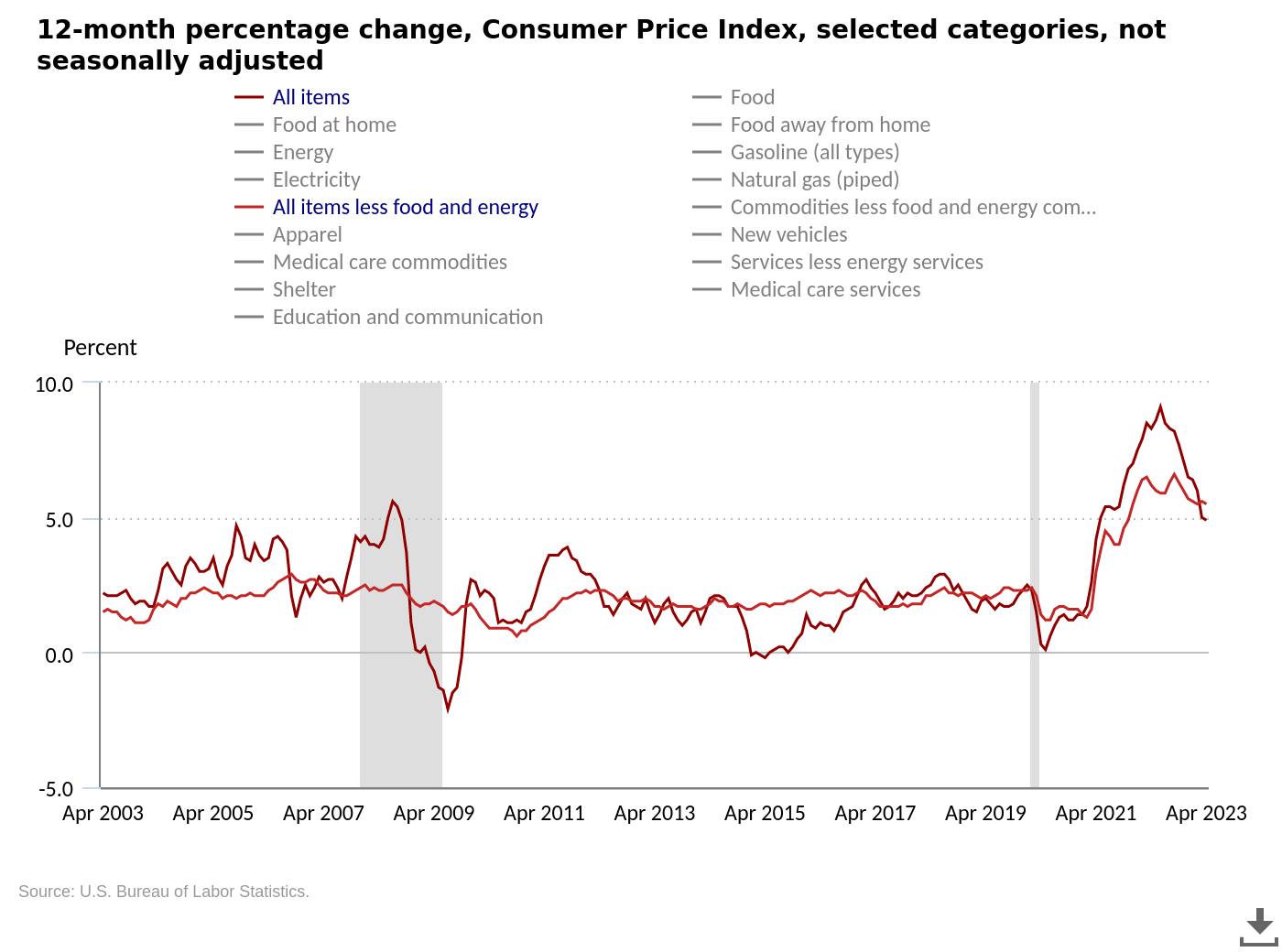

“Sticky inflation” in the US

Numbers regarding US inflation for April were also released this week. Compared to the Chinese case, an almost opposite trend is observed here: although declining, inflation still remains firmly on the scene. Indeed, the Consumer Price Index released by the US Bureau of Labor Statistics showed a +0.4% month-on-month increase, and a +4.9% growth year-on-year. The 4.9 percent increase remains, however, the lowest since April 2021.

Conclusions

The recovery of the global economy keeps confirming its uncertainties, as witnessed also by the price of gold, the ultimate safe haven asset, which remains at high levels again this week. Similarly, market expectations of a solid rebound for the Chinese economy, formulated in early 2023, clash with evidence of a modest recovery, also impacting the price of copper.

Noted for next week is the "LME Asia Metals Seminar," an annual meeting to be held in Hong Kong - for the first time in attendance since 2019 - which may provide useful insights into market trends and prospects for metals in 2023.