New effects on HRC prices due to the total ban on steel imports from Russia

With the ban on slab imports, the European steel industry will be completely disconnected from the Russian one

Published by Luigi Bidoia. .

Hot-Rolled Coils EU sanctions against Russia HRC Price Drivers

On 30 September 2023, the EU's eleventh package of sanctions against Russia came into force for continuing its illegal war against Ukraine.

This package contains many types of sanctions. Among these, the one that could have the greatest effects on commodity prices in the EU market concerns the tightening of restrictions on imports of steel products. The new measure includes both the extension of products subject to the direct import ban and the obligation of EU importers to demonstrate that commodities imported from countries other than Russia were not produced using inputs from Russia.

The lower supply of steel products imported, directly or indirectly, from Russia will determine a modification of the balance between supply and demand on the EU market with the effect of supporting, ceteris paribus[1], an increase of prices. In the article "The effects on the price of coils due to the ban on imports from Russia" an analysis is reported which quantifies a 13% increase in the price of non-steel coils hot worked products (HRC), due to the ban on importing these goods from Russia which came into force on March 22, 2022.

It may be useful to try to define, on the basis of the available information, what the effect of the new additional restriction could be on the price of European steel products.

In the first half of 2023, the EU imported 2 million tonnes of steel products from Russia and 16 million tonnes from other third countries. Imports from Russia fall entirely within the sanctions of the 11th package. Conversely, only a part of imports from other countries will be affected by the package.

Effect due to the control of imports from third countries

To evaluate the possible effects of restrictions on imports of steel products from countries other than Russia but which incorporate Russian inputs, it is necessary to examine the countries other than the EU to which Russia exports. In fact, it is the imports from these countries that could use inputs from Russia.

Russian exports of steel products are mainly destined for three countries: Kazakhstan, China and India. EU imports of steel products from these three countries do not reach 10 million tonnes and represent a relatively small share of their steel exports. It is reasonable to hypothesize that, for at least two countries (China and India), steel production that uses Russian inputs are sold either on the domestic market or exported to markets other than the EU, sending only products free of Russian inputs to the EU.

From a volume point of view, these sanctions could translate into a decrease of a few hundred thousand

of tonnes, given that the total EU imports from Kazakhstan do not reach half a million.

Some other effects may be had in terms of administrative costs, due to learning and producing the documentation necessary to certify the absence of Russian input.

Overall, the effect of this ban on European steel prices is expected to be negligible.

Effect due to the ban on imports from Russia

As already indicated, the EU continues to import steel products from Russia amounting to 4 million tonnes per year. If we analyze the volumes of the first half of 2023, the imported steel products now concern only a few codes, as shown in the table shown here.

EU imports of steel products in the first half of 2023

| Commodity | Imports first half of 2023 | Effective date of ban |

| 000 tons | ||

| Unalloyed steel billets | 1 | 1st April 2024 |

| Unalloyed steel blooms | 73 | 1st April 2024 |

| Unalloyed steel slabs | 1890 | 1st October 2024 |

| Blooms of alloy steel other than stainless | 0 | 1st October 2024 |

| Alloy steel slabs other than stainless steel | 25 | 1st October 2024 |

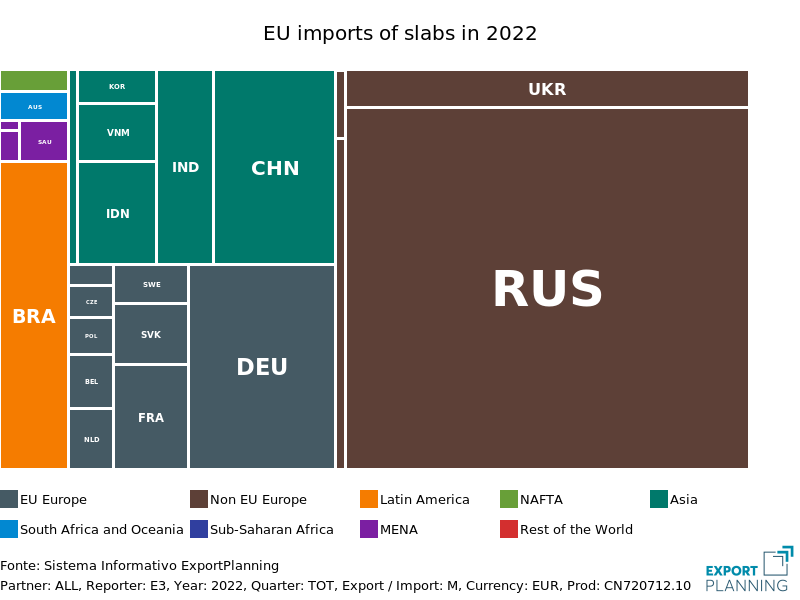

Among these, only unalloyed steel slabs have significant volumes, so much so that some effect on the market can be hypothesized. The following graph shows information regarding EU imports of slabs.

EU imports of non-alloy steel slabs

|

|

The graph on the left shows EU imports of slabs in 2022 by country of origin. Imports from Russia represent almost all imports from non-EU countries and more than half of total EU imports. The graph on the right shows the dynamics of quarterly imports from Russia over the last 23 years. They have experienced continuous growth throughout this century.

Overall, the leading role played by Russia in the supply of slabs on the European market is evident.

This material is mainly used to produce hot rolled coils (HRC). Hence the lower imports of slabs from Russia could translate into a reduction in the supply of coils on the European market by almost 4 million tonnes per year.

If we consider that the reduction between the second half of 2022 and the first half of 2023 of approximately 2 million tonnes of HRC imported from the EU from Russia produced an increase in the HRC price of 13%, the lack of of a double slab supply will hardly be neutral on the EU market.

The EU Commission is aware of this possible effect so much so that it has postponed the application of the ban until October 2024, with the hope that in the next 12 months the competitive forces within the European steel industry will bring about changes that reduce the possible effects on HRC prices , expected between the end of 2024 and the beginning of 2025.

Conclusions

The progressive breaking of the existing links between European steel and Russian steel has costs in terms of higher prices of steel products on the EU market. The ban on HRC imports from Russia, which came into force in March 2022, had an effect on their prices on the EU market, increasing them, between the second half of 2022 and the first half of 2023, by 13%. These effects could be reabsorbed in the near future, under the pressure of the competitive forces operating on the market. At the same time, however, it is likely that the most recent EU restrictions on slab imports will also translate into new support for HRC prices on the EU market at the end of 2024.

Overall, a reasonable estimate of the impact on European HRC price levels due to EU sanctions on Russian steel is that they will increase by between 10% and 15% from spring 2022 to well into 2025.