Commodity prices amid sticky inflation and weak economic cycle

PricePedia Scenario October 2023

Published by Pasquale Marzano. .

Last Price Forecast

The PricePedia scenario has been updated with the information available as of 5 October 2023. Once again, the scenario is characterized by the high level of inflation in the Euro Area, which in September was equal to 4.3%. Although it decreased compared to August 2023 levels (5.2%), this reduction was not enough to avoid a further increase in interest rates by the European Central Bank (ECB) of 25 basis points.

The transfer of the effects of restrictive monetary policy to the real economy tends to occur with a certain delay; therefore the weakness in global demand could continue even after the easing of the measures to combat inflation implemented by the ECB and other central banks.

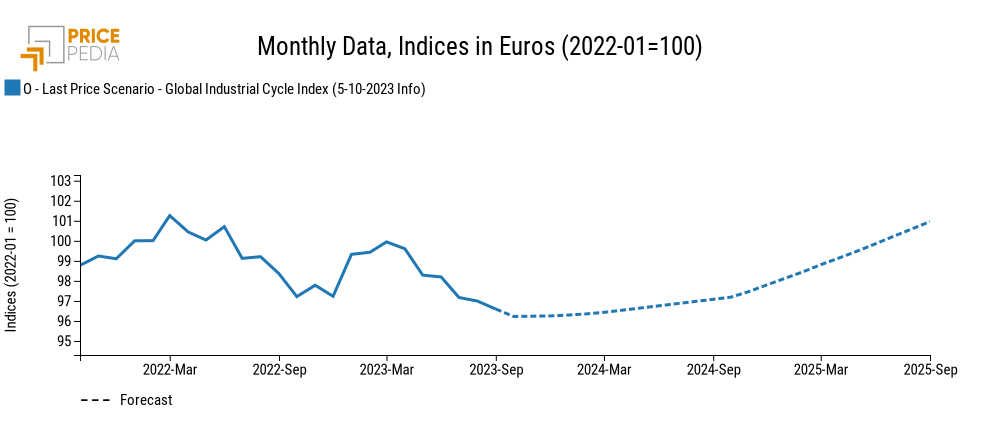

Below is the scenario of the global industrial cycle[1] developed by PricePedia.

As can be seen from the graph, compared to 2022 the index recorded a decrease of -1.4% in 2023. A turnaround occurs in 2024 which, however, is still too weak to show growth in annual terms. In fact, on average in 2024, the index decreases by -1% compared to the average levels of 2023.

Forecasting commodity prices

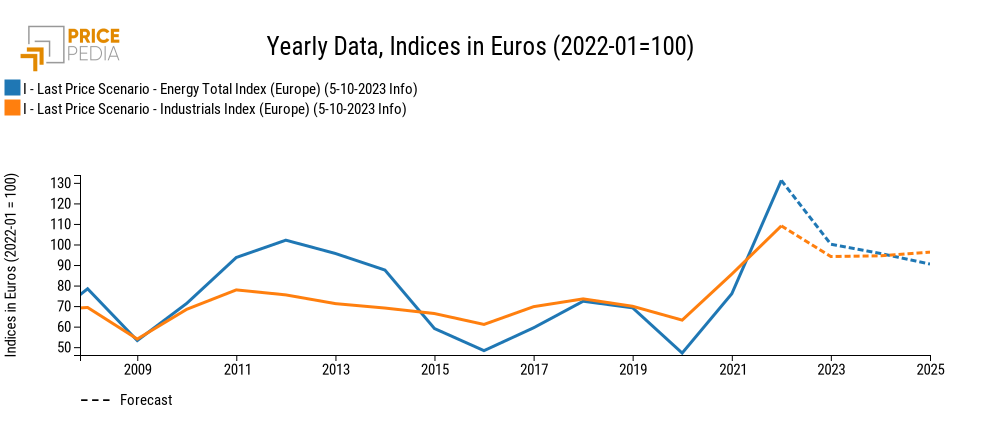

The dynamics of raw material prices is affected by the weakness of global demand for commodities, represented by the global industrial cycle. In 2023 this tends to lead to a decrease in prices compared to the maximum peaks recorded in 2022. However, the impact of inflation on the prices of commodities located further down the production chains will tend to keep prices at higher levels than the long-term average. The following graph illustrates the forecast in euro of the aggregate indices of industrial commodities[2] and energy commodities.

After the peak recorded in 2022, energy commodity prices are expected to decrease by -23.7% on average in 2023. The downward trend is expected to continue also in 2024, when the index is expected to show a decline of -4.5%.

As regards industrial commodities, however, after the fall in 2023, estimated in the order of -14%, in 2024 prices remain stable at the values of the previous year, on average +35% higher than 2019 levels .

The case of steel coils

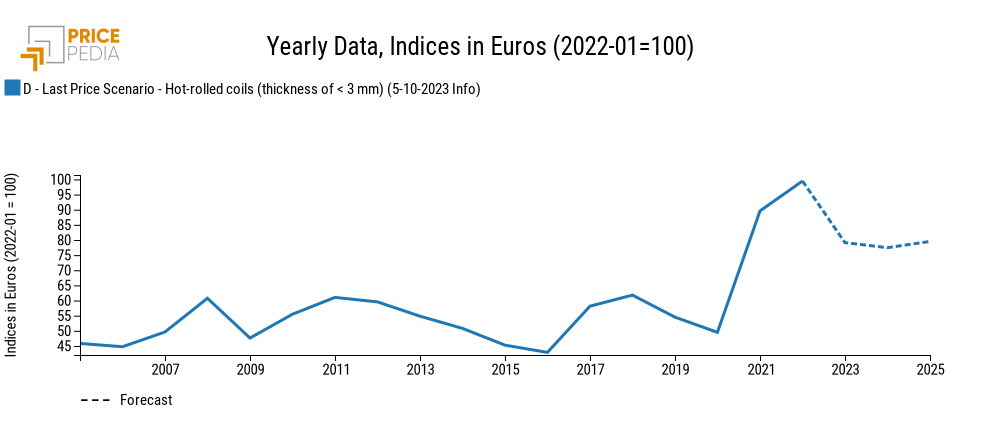

The following graph shows the forecast of the price of steel coils (HRC), in euros per ton.

The price of the HRC follows a dynamic very similar to that of the industrial commodity index, recording a decline in 2023 equal to -20.4% compared to 2022. Over the following two years, the HRC prices tend to remain above above 2019 levels by more than +40%.

In this case, in fact, a further element that will tend to characterize the price of HRC, and of steel products such as slabs, are the EU sanctions on imports of steel products from Russia, as analyzed in the article "New effects on HRC prices due to the total ban on steel imports from Russia".

1. The global industrial cycle index is constructed by purifying the actual dynamics of industrial production from its trend. Since the supply of commodities tends to vary according to long-term economic growth expectations, while the demand for commodities is more linked to actual cyclical uses, the global industrial cycle index tends to reproduce the conditions of tension between demand and supply on the commodity market: when it increases, it means that the demand for commodities increases more than the supply; vice versa when it decreases.

2. The PricePedia industrial price index results from the aggregation of the indices relating to the following product categories: Ferrous, Non-Ferrous, Wood and Paper, Chemicals: Specialties, Organic Chemicals, Inorganic Chemicals, Plastics and Elastomers and Textile Fibres.