The cost of freight rates as an indicator of global commodity demand: what signals?

Published by Pasquale Marzano. .

Freight Price Drivers

The cost of freight rates is an important indicator of maritime transportation and is often considered by economic operators as a good proxy for global demand for commodities. When the demand for commodities increases or decreases, so does the demand for the transportation of these commodities, leading to an increase or decrease in the cost of freight rates.

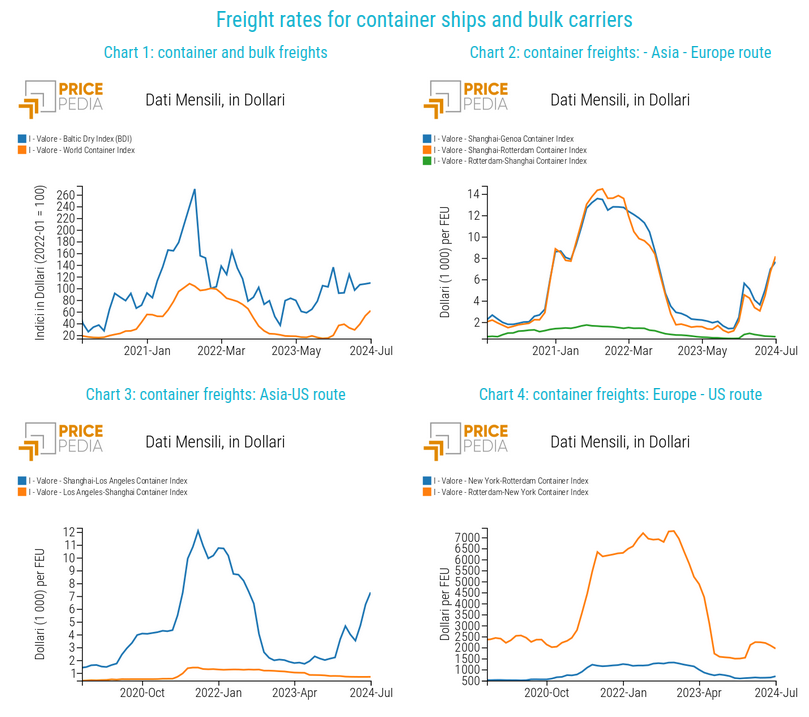

Over time, various companies have developed synthetic indices of freight costs, based on the size of the ships and the type of cargo transported. Based on this latter characteristic, it is possible to identify two indicators:

- Baltic Dry Index (BDI), elaborated by the Baltic Exchange, it refers to the transportation of dry bulk cargo like iron ore, cereals etc.;

- World Container Index (WCI), elaborated by Drewry, it refers to the freight rate for a 40-foot (FEU) container.

In the following graph the two indicators are shown, both expressed in US Dollar.

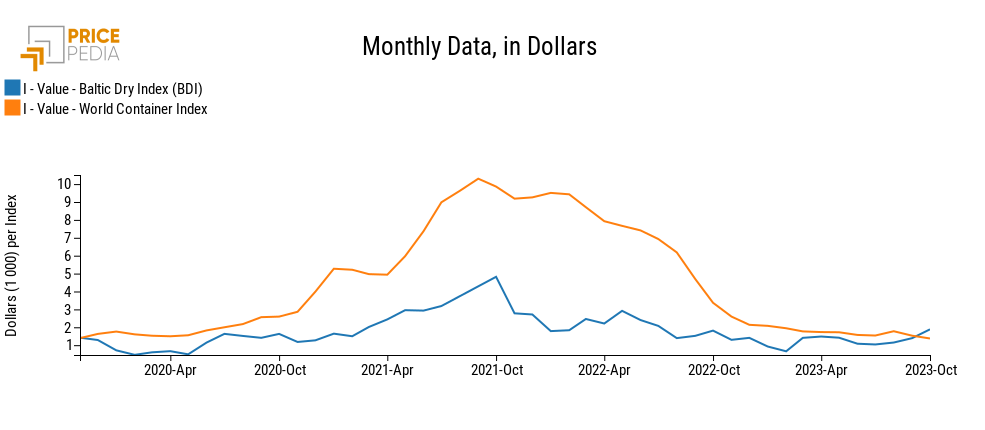

The chart depicts the dynamics recorded by the two indicators in recent years. The cost of freight rates has been characterized by an upward trend since the end of 2020 and reached high levels during 2021. The growth phase was influenced by the recovery of global trade after the end of widespread lockdowns. In the case of container rates, structural factors also played a role.

The issues related to structural factors completely subsided in the second half of 2022, and the levels of the WCI realigned with historically recorded values.

As for the BDI, it can be observed that after October 2021, there was a gradual easing of pressures due to the recovery of global trade, and the index returned to lower levels in the following months.

In 2023, the dynamics of the two indices appear to have become disaligned. The WCI continued to decline, and by September 2023, it had dropped below $1600 per FEU, a level recorded before the onset of the pandemic. On the other hand, the BDI, starting from February, underwent a change in direction compared to the previous months' downward trend. In fact, the average value for the first two weeks of October is more than 180% higher than the February 2023 average.

To understand if the recent dynamics of the BDI are driven by the beginning of a new phase of global raw material transportation growth and, consequently, global demand for commodities, the relationship between the BDI and some variables is estimated as described below. These variables are:

- US Dollar effective exchange rate;

- Global industrial cycle index, as a global commodity demand proxy;

- Iron ore financial prices, as a proxy of commodities transported via dry bulk cargo ships.

In the following chart the regression fit of the estimated model is illustrated[1].

As can be seen from the chart, the two series are strongly correlated. This indicates that exogenous variables contribute to determining the dynamics of cargo ship freight prices in the long term. The comparison reveals the greater volatility of the BDI compared to the long-term fit: this means that both the maximum and minimum relative peaks are more pronounced in the former than in the latter. Furthermore, in recent months, the fit's dynamics show a decline and do not account for the increasing trend in the BDI. This suggests that the observed increase in the BDI is not justified by the current dynamics of the global economic cycle.

This conclusion seems to be confirmed not only by the recent dynamics of the WCI but also by the long-term trend of the BDI, as shown in the following chart.

The current values are in line with historically recorded levels. They are far from the maximum peaks recorded in the first decade illustrated. Furthermore, the growth phase that characterized the index throughout 2021 appears rather downsized when compared to the long-term dynamics.

Vuoi restare aggiornato sull’andamento dei mercati delle commodity?

Iscriviti gratuitamente alla newsletter PricePedia!

Conclusions

The recent dynamics of bulk commodity freight rates (Baltic Dry Index) may suggest an ongoing recovery in the global trade of raw materials. However, the econometric analysis of the determinants of this indicator and its long-term analysis minimize the signaling importance of recent increases, placing them within the broad range of volatility that characterizes the indicator.

The current values are in line with historically recorded levels. They are far from the maximum peaks recorded in the first decade illustrated. Furthermore, the growth phase that characterized the index throughout 2021 appears rather downsized when compared to the long-term dynamics.

Conclusions

The recent dynamics of bulk commodity freight rates (Baltic Dry Index) may suggest an ongoing recovery in the global trade of raw materials. However, the econometric analysis of the determinants of this indicator and its long-term analysis minimize the signaling importance of recent increases, placing them within the broad range of volatility that characterizes the indicator.

1. The Engle & Granger model has been estimated for the relation. For a description of the Engle & Granger model see the footnotes 3-7 of the article Prezzo degli acciai lunghi: effetto costi e mercati finanziari.

The results are shown below:

Long-term regression results

Short-term regression results