The financial markets reaction two weeks after Hamas attack

Financial markets are confident about a non expansion of the conflict

Published by Luca Sazzini. .

Conjunctural Indicators Commodities Financial Week

The explosion on the evening of October 17th that caused hundreds of deaths at the Al Ahli Hospital in Gaza had significant political repercussions, which further heightened financial market concerns.

Initially, the blame for the attack was attributed to Israel, but doubts emerged later regarding the true culprit. This tragedy triggered a series of reactions aimed at influencing the oil market, especially. Hossein Amirabdollahian, the Foreign Minister of Iran, called on Islamic countries to take concrete actions in response to the "war crimes and genocide" in Gaza committed by the Israeli regime. Among the proposed actions was the possibility of imposing an oil embargo and expelling Israeli ambassadors.

In light of this, OPEC stated that it had not planned any immediate action or emergency meetings in response to Iran's comments, adding the exact words: "We are not a political organization."

Clearly, the price of oil did not remain unaffected by these events and experienced the beginning of a rally that did not exceed $93 per barrel.

The increase in oil prices also affected many other energy prices, such as thermal coal. The only exceptions are the spot prices of European and American gas, as news came this week of the cancellation of the strike that was supposed to begin last Thursday at Chevron's Gorgon and Wheatstone LNG facilities. However, Asian JKM gas prices remain high, experiencing a significant increase this week.

Also, the prices of precious metals like gold and silver have seen significant rises in recent weeks. These increases have been accompanied by a notable appreciation of the Swiss Franc, confirming the ongoing shift of capital towards assets capable of preserving their value in the face of particularly adverse events.

| Dynamics of precious metals | |

| Gold Spot (CME), price/Troy ounce | Silver Spot (CME), price/Troy ounce |

|

|

ENERGY

The attack on Gaza's hospital this week caused energy index prices to rise.

PricePedia Financial Index of energy prices in dollars

The heatmap of energy commodities highlights the increase in prices of petroleum products and their derivatives. Notably, the price of Asian JKM gas experienced a weekly percentage change in the three-day moving average exceeding 25%.

HeatMap of energy prices in euro

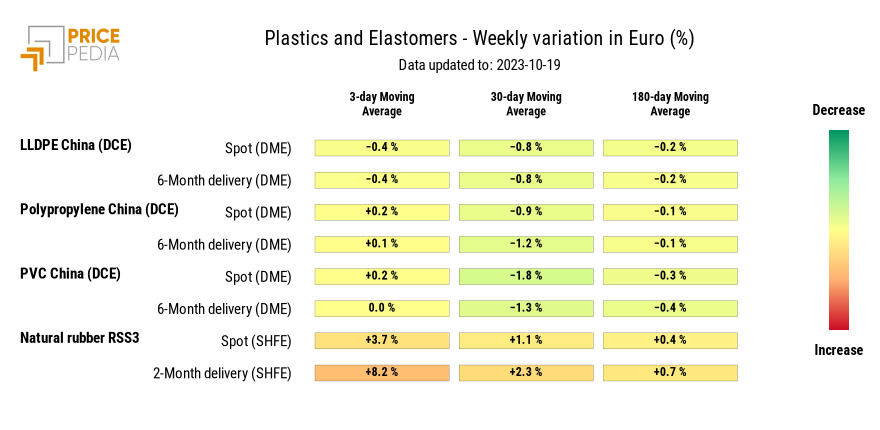

PLASTIC MATERIALS

This week, the index of Chinese plastic materials did not experience significant changes.

PricePedia Financial Index of Plastics in dollars.

The following heatmap displays the prices in euros of the plastic materials included in the index.

HeatMap of plastics prices in euro

The heatmap reveals a significant increase in the prices of natural rubber RSS3, especially concerning futures with a two-month delivery, which saw a 6% change this week.

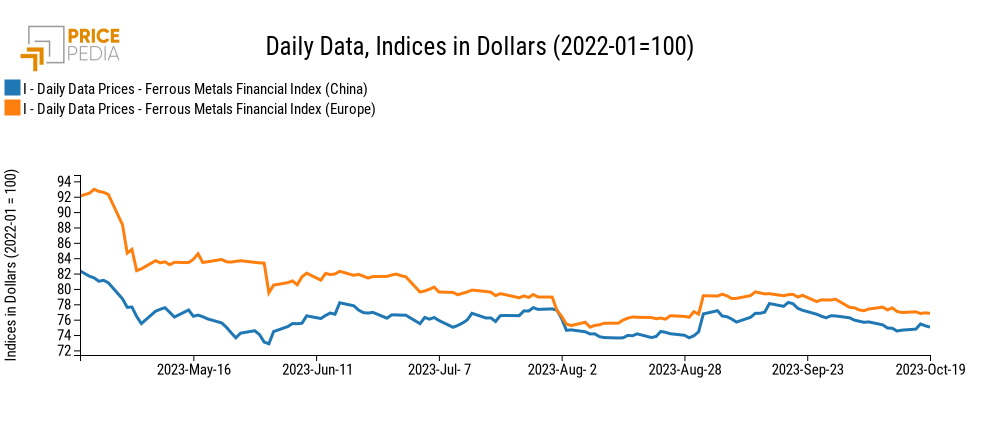

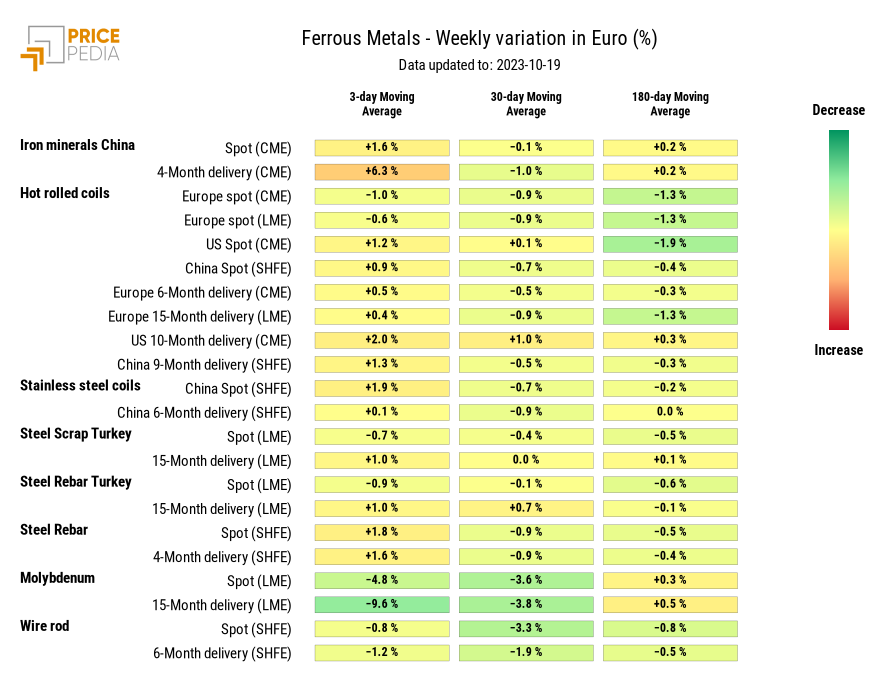

FERROUS

Also this week there has been stability in the ferrous indices, which continue to show no significant price changes.

PricePedia Financial Indices of ferrous metal prices in dollars

The following heatmap gives an overview of the evolution of ferrous metal prices, expressed in euro.

Aside from iron ore future prices (+3%) and molybdenum prices (-10%), there were no significant weekly changes.

HeatMap of ferrous metal prices in euro

NON FERROUS

This week both non-ferrous indices recorded only short daily fluctuations due to severe events of the Gaza Strip.

PricePedia Financial Indices of non-ferrous metal prices in dollars

From the heatmap there are no particular variations of the three-day moving average, except for the precious metal prices

HeatMap of non ferrous metal prices in euro

FOOD

This week witnessed growth in the cereal and tropical index, while there was greater stability in the food oils index.

PricePedia Financial Indices of food prices in dollars

CEREALS

With the exception of oats, there is a general increase in cereal prices, especially for soybean flour, which recorded a weekly growth over 9%.

HeatMap of cereal prices in euro

TROPICAL FOOD

All the prices of the tropics show a strong increase, the most significant variation is that of coffee that has experienced a weekly increase of close to 8%.

HeatMap of tropical food prices in euro

FOOD OILS

The heatmap shows a slight decrease in food oils, with the exception of palm oil, which results in a slight increase.

HeatMap of oil prices in euro