Pig iron price as an indicator of cast iron cost

The tensions that had driven prices to record highs in 2022 have subsided

Published by Pasquale Marzano. .

Ferrous Metals Price Drivers

Pig iron is one of the main cost factors in the production of cast iron. These castings can be produced by melting and subsequently processing pig iron or, alternatively, by using scrap and electric energy. Both of these processes require a significant amount of energy, and for this reason, in recent years, the energy crisis has had a significant impact on production costs. Additionally, there has been an increase in the price of pig iron, which has risen from a long-term average of 300 euros per ton in the years 2000-2020 to average values exceeding 500 euros.

The following graph shows the trend in the price of pig iron in the European market.

As can be seen from the graph, cast iron ingot prices started to trend upward as early as 2021. During 2022, concerns related to the conflict between Russia and Ukraine, and the potential EU sanctions against Russia, supported prices in the European market to the extent that they reached historic highs between August and October of the same year[1].

However, these concerns did not materialize, as the EU did not impose sanctions on European imports of cast iron from Russia, unlike what happened with other steel products. Instead, the EU managed to replace imports of cast iron from Ukraine with those from countries like Brazil and South Africa, as discussed in a previous article.

All of this, combined with a global economic downturn and a decrease in energy costs, led to a reduction in cast iron ingot prices in the first part of 2023. In recent months, the price reduction trend has continued, although at a slower pace compared to the early months of the year.

An econometric model for the pig iron prices

In order to better understand the historical dynamics of cast iron ingot prices, it is useful to estimate an econometric model based on its determinants as indicated below:

- Steel should cost (Blast furnace) charge, as a proxy for the production cost of cast iron.

- Steel should cost (Electric arc furnace, composed by scrap and electric energy), as a substitute product for pig iron in the production of cast iron.

- Global industrial cycle, as a proxy for the supply and demand dynamics in the steel markets.

The graph presented highlights the high correlation of cast iron ingot prices with the long-term fit determined by the aforementioned exogenous variables. Furthermore, the levels of the two series appear to be closely aligned.

The dynamics of the long-run fit indicates, therefore, that the model estimated is able to explain quite accurately the trend in the price of pig iron. Thus, such a model can be a robust tool for elaborating forecasts with respect to its price and, consequently, the cost for cast iron.

1. The pig iron price tensions are observed on the US market too. See US customs price for Nonalloy pig iron (phosphorus ≤ 5%) - Import.

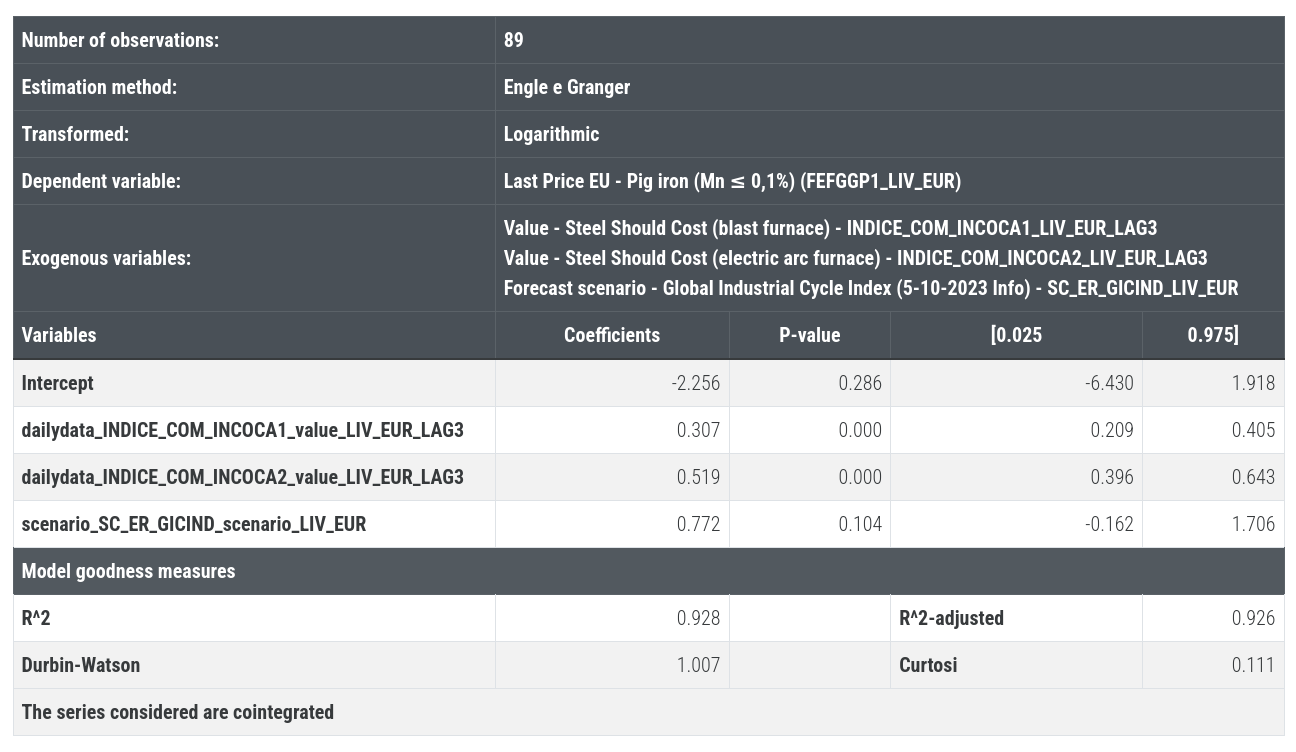

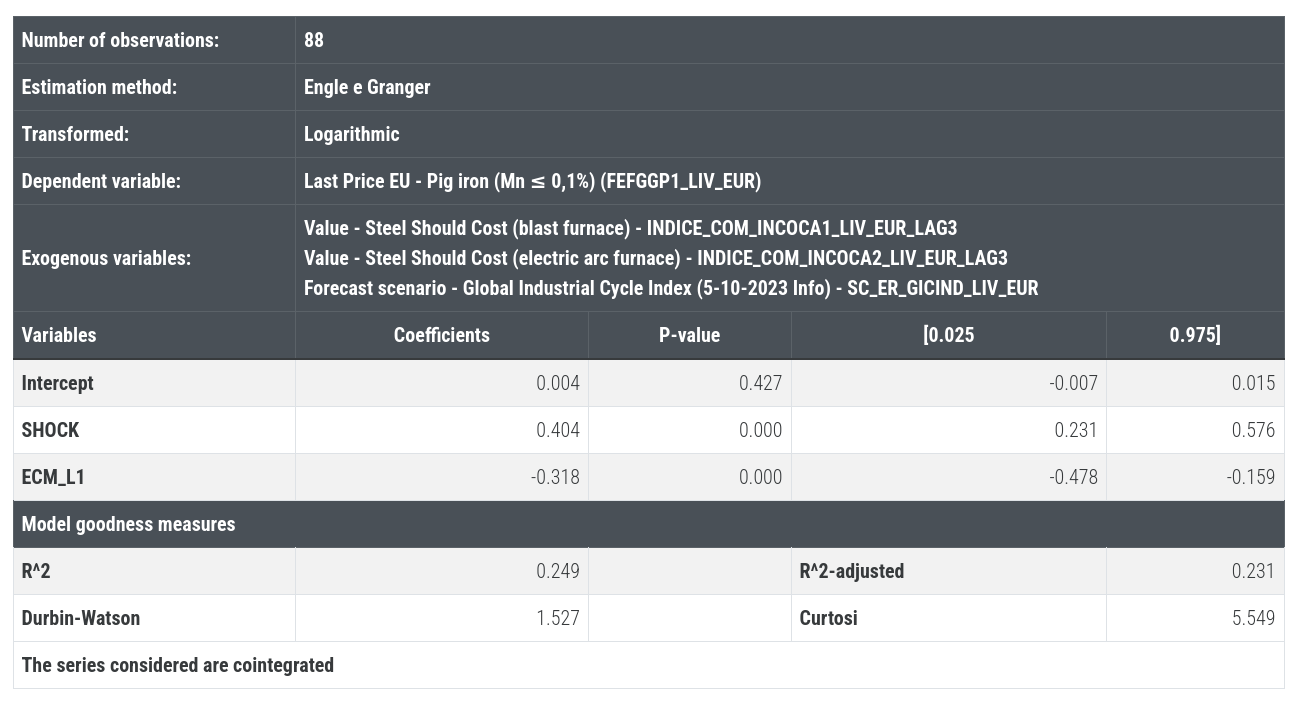

2. The Engle & Granger model has been estimated for the relation. For a description of the Engle & Granger model see the footnotes 3-7 of the article Prezzo degli acciai lunghi: effetto costi e mercati finanziari.

The results are shown below:

| Long-term regression results |

|

| Short-term regression results |

|