The price of paints is high: a decrease is possible, but not probable

Paint prices are supported by still high input prices

Published by Luigi Bidoia. .

Specialty chemicals Price Drivers

One product family that has experienced a quite exceptional price dynamic over the last three years is paints. Paints are speciality chemicals, produced in relatively small quantities and formulated for specific functions and specialised applications. They are often characterised by high added value, sophisticated production technology and specific performance requirements. They are therefore highly differentiated products.

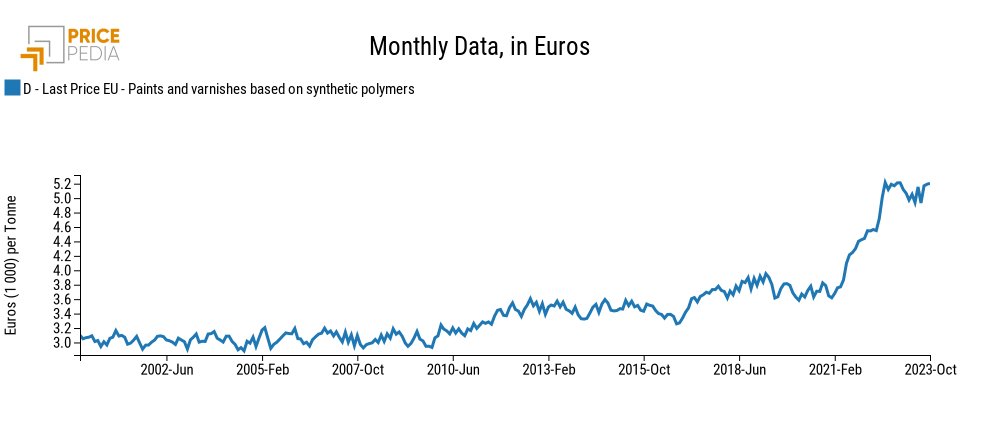

In theory, each paint could be characterised by its own specific price level with very different dynamics from other paints. However, if one considers the monthly price dynamics of 4 types of solvent-based paints (acrylics, polyester, other synthetics and natural polymer-based) since 2000, it can be observed that they are highly correlated with each other, so that an aggregate price index for solvent-based paints can be produced which can be considered representative of the price dynamics of the large paint family.

The following graph shows this index, derived by aggregating the customs prices of the four types of paint listed above.

Paints: price indices in euros

It is evident from this graph how, between the beginning of 2021 and the summer of 2022, paint prices experienced growth unparalleled in any other period in history. In the space of just over 18 months, average paint prices increased by almost 40%, whereas the increase over 20 years since the beginning of this century had not exceeded 30%. A second highlight of the recent paint price dynamic is the maintenance of the high levels achieved in 2022, even in 2023. From this point of view, paint prices are highly sticky.

The average price stability over the past year poses the problem of identifying its determinants. These can be sought in their production costs or in the market structure. This analysis has implications in terms of forecasting. In fact, if costs are among the determinants that are driving paint prices, then any reduction in these costs could result in a reduction in paint prices as well. Conversely, if the main determinant is market structure, which takes a long time to change, then it is very likely that there will be no significant reduction in paint prices in the near future. Let us therefore see whether the input prices of paint production can be considered a determinant of the current high paint price levels.

The production costs of solvent-based paints

Paints are the result of a combination of many components, which, however, can be grouped into four different input categories:- pigments: are used to give the paint colour;

- resins (or binders):bind the pigment to the painted surface;

- solvents: to dilute the paint and facilitate its application; they evaporate when the paint, once applied, dries.

- additives: represent a very broad spectrum and range from catalysts that accelerate the drying process of paints, to UV stabilisers that protect the paint from the sun's rays; from plasticisers that increase the flexibility and durability of the paint; to anti-corrosive agents, used to prevent rust and corrosion.

The wide range of additives makes a general analysis of them impossible. With the exception of very specific cases, however, their incidence in the production costs of paints is relatively limited, allowing an analysis of paint production costs based only on the first three input categories.

The purchase price of pigments

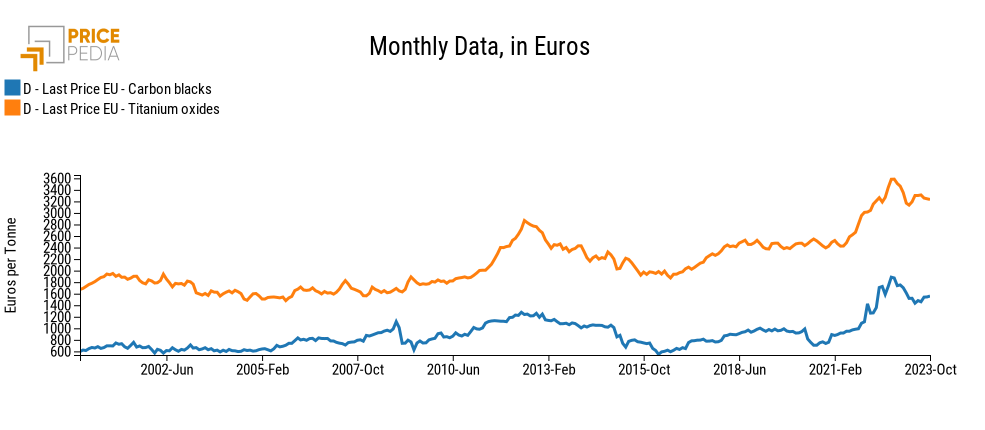

Pigments are also a very broad category. However, it is possible to consider two basic pigments, which are included in most colours, as representative of the price dynamics of this category. The two pigments are:- titanium dioxide: this is a white pigment, widely used to give coverage and opacity to paints;

- carbon black: is a black pigment used to impart colour, shade and depth to paints;

The following graph shows the two prices over the last 23 years.

Pigment prices for paints in euros

The level of the two prices is very different. The dynamics also differ significantly. In both cases, however, prices have remained relatively high over the past year compared to average prices in 2019, on average by more than 40%. They could therefore be a contributing factor to explain the current high level of paint prices. The analysis of their possible future development is crucial for an initial assessment of whether or not paint prices are likely to remain at their current high levels.

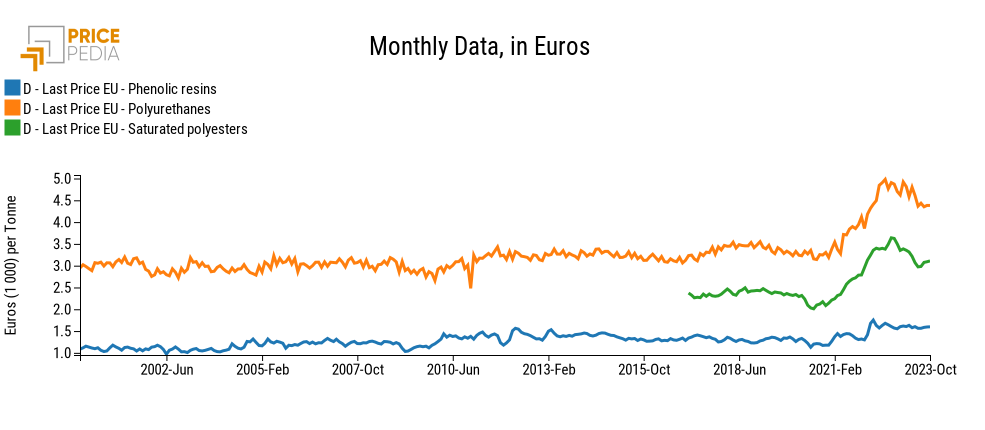

The purchase price of paint resins

The following graph shows the prices of three resins widely used in paint production: acrylic resins, polyurethanes and polyesters.

Euro prices of paint resins

The price level of the three resins is very different, which explains the higher average price of polyurethane paints compared to acrylic paints. Again, the current level is relatively high compared to the average levels in 2019, although this difference is no more than 30%

The purchase price of paint solvents

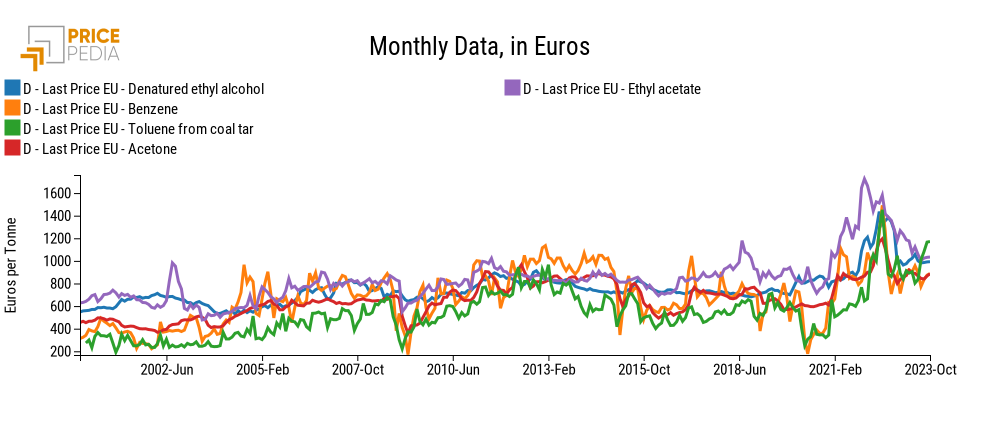

Of the many possible solvents that can be used to produce solvent-based paints, the following chart shows the prices of the following five: ethanol, benzene, toluene, acetone and ethyl acetate.

Euro prices of paint solvents

Price levels are very similar. The dynamics are also not very different, given the link with energy prices and the significant degree of substitution between the different solvents.

The average fall in these prices between the middle part of 2022 and the summer of 2023 was very high. However, their price level is still on average 40% higher than the average price in 2019.

Conclusions

The analysis of the prices of possible paint production inputs justifies large price differences of specific paints depending on the different production inputs, especially pigments and resins. This high difference in price levels does not, however, make it unnecessary to examine the aggregate paint price dynamics in order to predict their development.

Over the past three years, the growth of paint prices, although historically high, has been slower than that of costs. This could justify their current resilience even in the face of falling input prices.

If one compares the current paint prices with average prices in 2019 (30% higher on average) with the corresponding increases in the three main input families (pigments: over 40%; resins: almost 30%; solvents: over 40%), a situation emerges in which high prices are strongly supported by high costs. Any reduction in paint prices is therefore unlikely, unless there are significant price reductions in pigments, resins and solvents.