Hidden curves: 2024 profitability also depends on their discovery

Information on the reduction of supplier costs can lead to better purchasing conditions

Published by Luigi Bidoia. .

Stainless Steel Inorganic Chemicals Vegetable oils Wood Hidden curves

2024 is preparing to be a difficult year for the Italian industry. Not a day goes by without one of the many institutions in the Italian industrial world reporting how activity levels are decreasing, orders are declining and business confidence is falling towards minimum values rarely experienced before.

In this situation, supporting profitability also involves negotiating purchase prices, taking care not to undermine the positive relationships developed with suppliers. The tool that allows this result (reduction of purchase prices while safeguarding the relationship with suppliers) is information, in particular that on the dynamics of the costs of its suppliers.

It is highly unlikely that a supplier will signal to its customers that its costs are decreasing. However, if it is the buyer who, during the negotiation phase, provides the supplier with evidence of a reduction in the prices of the supplier's most significant purchases, it is likely that the latter will recognize these dynamics, agreeing to renegotiate its sales prices.

These reasons lead us to consider information on the supplier's cost reduction curves particularly useful, especially when the price reduction is significant and such as to contribute to the reduction of the supplier's costs.

Below we will present four case studies of recent curves of price decreases, which suppliers tend to hide (hence the hidden attribute). They are only part of all the hidden curves of 2022-2023, but they represent some of the most significant cases:

- Austenitic stainless steel wide rolls;

- Coniferous wood;

- Alkaline hydroxides;

- Vegetable oils;

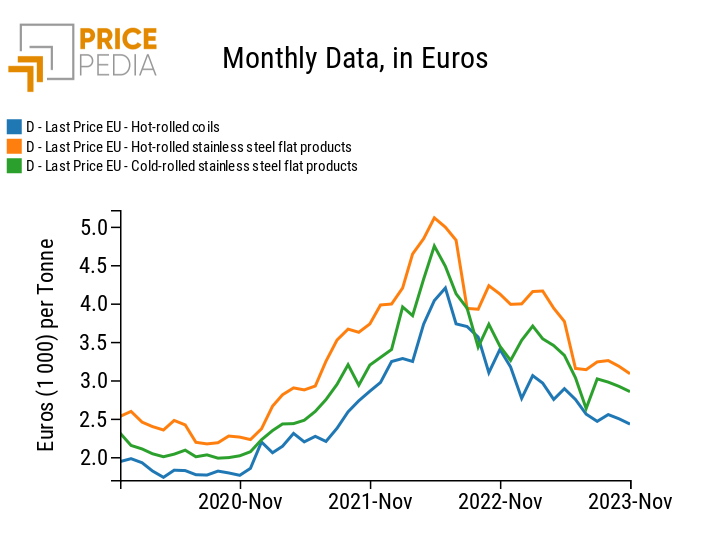

Wide rolls of austenitic stainless steel

Below are the price curves over the last four years for three types of austenitic stainless steel wide-rolls: hot-rolled coils and flat/sheets, both hot-rolled and cold-rolled.

The price of austenitic stainless steel wide rolls is strongly affected

from the prices of the non-alloy component (such as AISI 304 or 316, which use a nickel percentage of 8%).

The prices of this component, which increased relatively gradually in the initial phase of the recovery of industrial activities in 2021, literally exploded in March 2022, when nickel exceeded 35 thousand dollars per ton.

After Russia's invasion of Ukraine, Western countries imposed strong restrictions on imports from Russia, a key producer of nickel. In 2021, Russia, with 111 thousand tonnes per year, was the world's second largest exporter of raw nickel, after Australia. Western sanctions have severely reduced Russia's exports to Western countries. At the same time, Russian exports to other markets have increased, allowing the maintenance of overall supply levels on world markets.

Subsequently, the sharp reduction in global nickel trade that began in mid-2022 and continued in 2023 progressively weakened the price of nickel, which fell below $16,000 per ton during the month of November 2023.

The prices of wide austenitic steel sheets have followed the dynamics of the extra-alloy component and after having exceeded, for some types of products, even 5000 euros/ton in May 2022, over the last 18 months they have almost halved their prices.

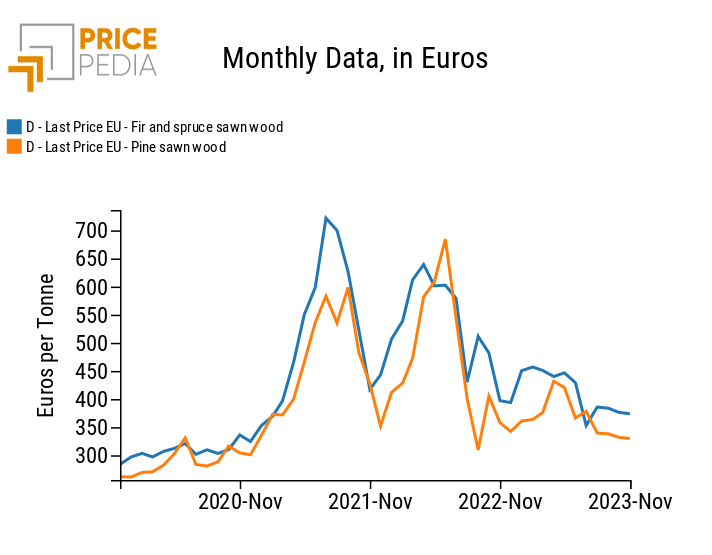

Coniferous wood

The following graph shows the price curves of pine and fir wood in recent years.

In Europe, conifer wood has just returned from four years of strong turbulence, due to increased consumption due to high investments in construction and the disappearance of imports from Russia. The major European exports to the American market have also contributed to the lack of supply on the European market, attracted by the completely exceptional prices listed on the Chicago Mercantile Exchange (CME), in two cycles over the last 3 years.

The first cycle concerned the post-Covid phase and led the prices of coniferous wood on the American market to reach the record level of $2000/ton. The second cycle occurred in late 2021 and early 2022, caused by lower supplies of lumber from Canada and an increase in tariffs on American imports. The result was a new record for timber prices on the CME, which also reached close to $2,000 in the summer of 2022 in this second cycle.

As seen from the graph on European prices of fir and coniferous wood, the effects of the turbulence on the American stock market are clearly evident on European prices. After approximately three months from the price peaks recorded on the CME, price peaks are also recorded on the EU market, although at decidedly lower levels than those in the USA. In the first cycle of 2021, prices in Europe exceeded 700 euros per ton, while in the second cycle they just exceeded 600 euros.

After the last peak in June 2022, the prices of wood in Europe, both fir and pine, recorded a phase of continuous decline which brought them to below 350 euros/ton in autumn 2023, at levels not very different from pre-Covid ones.

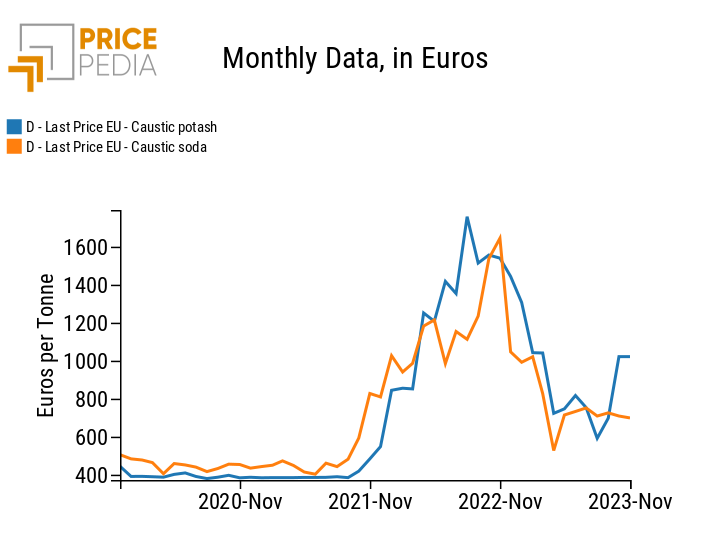

Alkaline hydroxides

Below are the price curves over the last four years of two alkaline hydroxides: caustic potash and caustic soda.

The prices in Europe of caustic soda (sodium hydroxide) and caustic potash (potassium hydroxide) are very similar in both levels and dynamics. This strong alignment is the result of:

- similar production processes: both are produced by electrolysis;

- high availability of minerals: both sodium and potassium are relatively abundant elements in nature.

- high economies of scale: the large market of both allows large-scale production;

- high diversification of applications: this tends to stabilize their demand;

- substitutability of the two products in some applications;

The characteristics of the production process, of the demand and of the price of the two products, leads to the segmentation of the world market into different regional markets, with a price strongly linked to the price of electricity, in turn, in Europe, linked to the price of gas. The prices in Europe of caustic soda and caustic potash have therefore been strongly affected by the gas crisis of 2022, well exceeding 1500 euros per tonne in the summer and autumn of 2022. In the same way they followed the subsequent decrease, falling below 800 euros/tonne in autumn 2023.

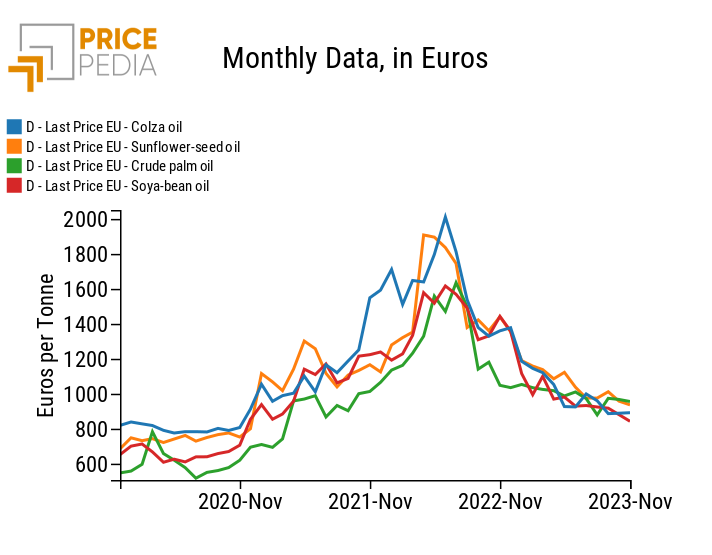

Vegetable oils

The following graph shows the price curves in recent years of the four main vegetable oils: rapeseed, palm, soybean and sunflower.

The strong substitutability in the use of vegetable oils translates into an equally strong relationship between their prices, despite the diversity of their sources. Sunflower oil recorded a strong increase in prices during 2022 in relation to the possible reduction of its imports from Ukraine.

Starting from a price of just over 1000 euros per ton, in April and May 2022, when it became clear that the war in Ukraine would not be short, the price of sunflower oil rose quickly to close to 2000 euros/ton. The increase in the price of sunflower oil drove the increase in the price of palm and soybean oils above the level of 1600 euros and that of rapeseed oils above 2000 euros.

In the following months, however, supplies of sunflower oil from Ukraine did not stop. Furthermore, the slight decline in imports of oils which was recorded in the months following the Russian invasion was partly offset by an increase in imports of sunflower seeds, both from Ukraine and Moldova, allowing us to dispel doubts about possible significant future shortages of sunflower oil on the EU market. As a result, speculative and precautionary purchases have ceased, gradually bringing most vegetable oil prices back below 1000 euros/ton.

The only vegetable oil that continues to record historically high prices is peanut oil, which even in these months at the end of 2023 continues to record prices above 1500 euros/ton.