Recycling market sets aluminium prices

Recycling market has changed the relative price between aluminium and zinc

Published by Luca Sazzini. .

Zinc Aluminium Price DriversIn the article "Will the price of zamak remain higher than that of aluminium? " it was pointed out that in recent years there has been a reversal in the price level between aluminium and zinc. This reversal in levels seems particularly strange at a time like the present when energy is relatively expensive. Indeed, given the higher energy consumption required to produce aluminium compared to zinc, one might expect a positive difference between the price of aluminium and zinc, a gap not confirmed by the data.

The answer for the lower price of aluminium compared to zinc must be sought in the different weight that recycling of the metal has in the two markets.

For example, last year, aluminium recycling in Italy amounted to 73.6% of containers and packaging, or 60,000 tonnes. If only the recovery of beverage cans is considered, this percentage rises above 90%.

These figures are already well above the European targets of 50% aluminium recycling by 2025 and 60% by 2030.[1]

According to the European Union Commission, aluminium obtained from scrap, referred to as secondary aluminium, is set to play an increasingly important role in meeting global aluminium demand, contributing significantly to reduced environmental impact and efficient resource management.

The main advantages that are contributing to the growth of the secondary aluminium market are:

- product quality: aluminium can be recycled over and over again without any loss of quality.

- less energy required: the production of primary aluminium is one of the most energy-intensive industrial products, requiring on average between 14 and 17 kilowatt hours (Kwh) of electricity to produce one kilogram of aluminium. This value drops sharply for the production of secondary aluminium, obtained from scrap, which requires approximately 0.7 to 1.7 kWh of energy per kilogram.

- scrap availability: due to the increased use of aluminium in various sectors, but especially due to the development of a recycling economy, the availability of available scrap is set to grow.

It is undeniable that the zinc recycling market is also experiencing significant growth, which is set to continue in order to facilitate the energy transition. However, at present, the secondary zinc market is less developed than the aluminium market.

This should result in the price of scrap playing a less important role in the zinc market than that played by aluminium scrap in the relevant market.

To test the different influence of scrap price on metal price, we used statistical regression.

Recycling impact on aluminium and zinc prices

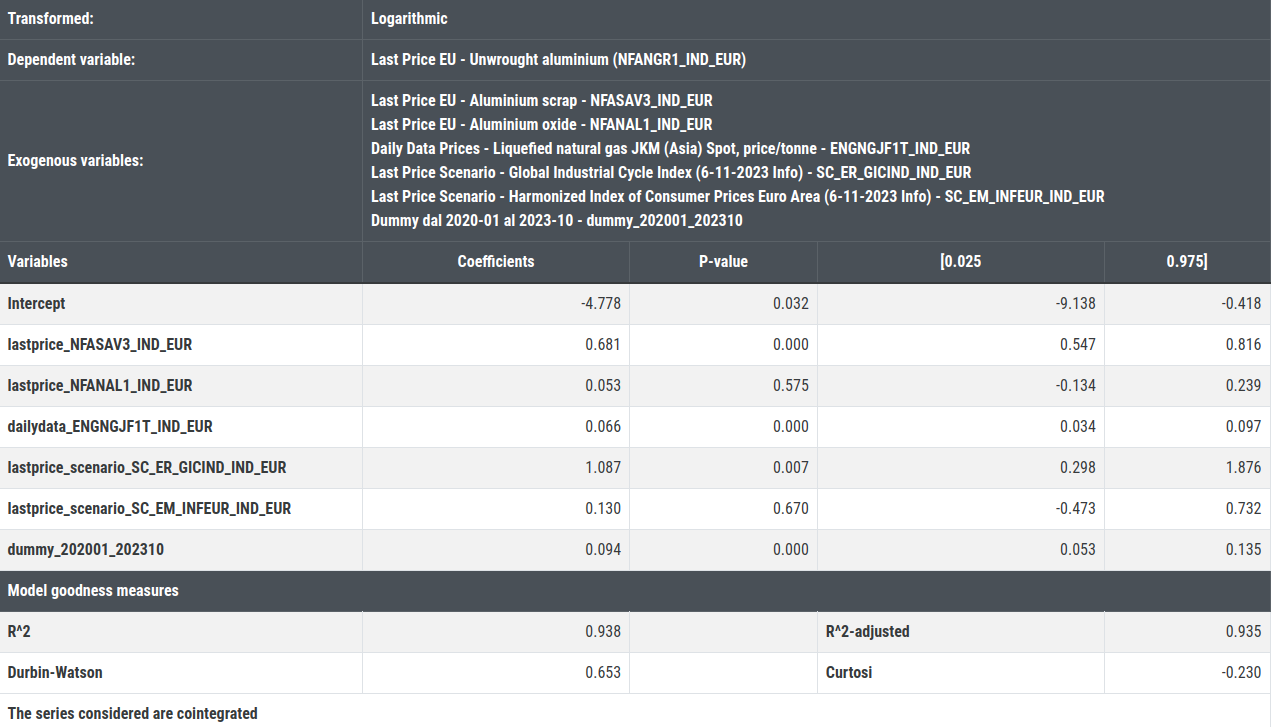

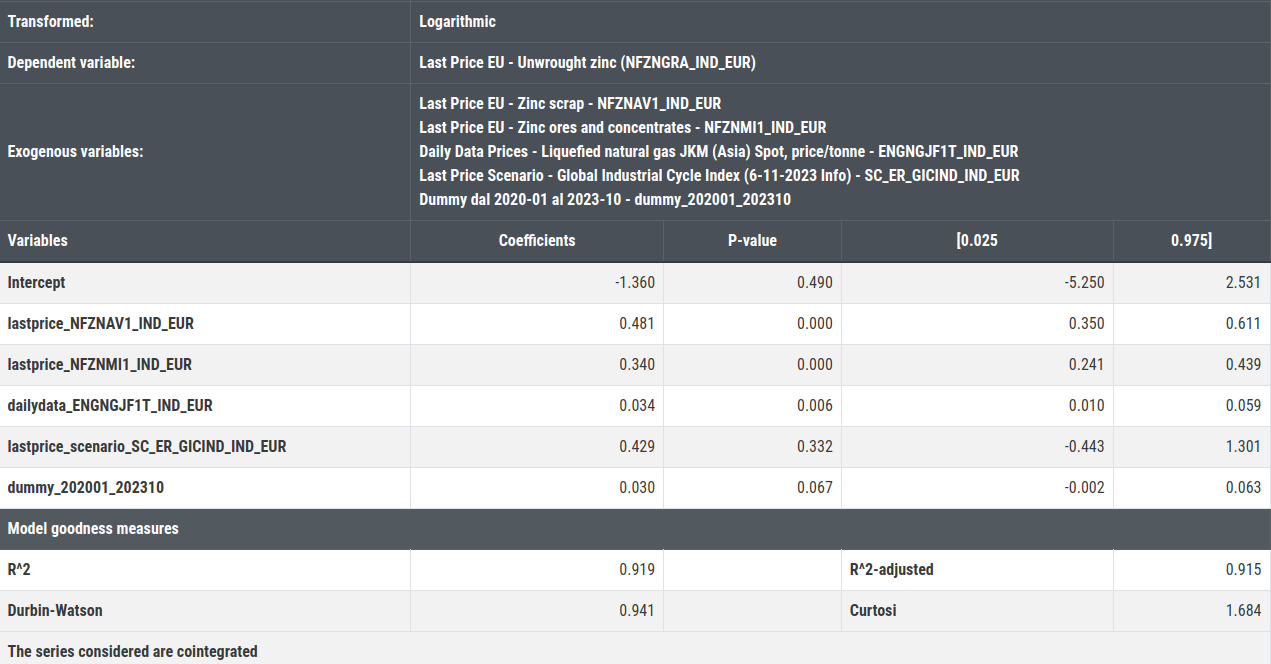

In order to analyse the impact of recycling within the aluminium and zinc market, an econometric model was constructed in which the time series of the metal (aluminium or zinc) was regressed with the following explanatory variables:

- Scraps;

- Commodities, other than energy;

- Liquefied Natural Gas JKM;

- Economic cycle;

- Consumer Price Index;

- Temporal dummies (2020-01 : 2023-10).

The first variable in the model is the most important as the objective of the analysis is to study the impact of scrap on the prices of the two metals.

The second variable represents the cost of commodities other than energy. In the case of aluminium, the reference raw material is alumina, while in the case of zinc, it is zinc ores and concentrates.

Liquefied Natural Gas JKM is used as a proxy for the cost of the energy required to produce the two metals.

The business cycle is a variable representing the strength of market demand.

The consumer price index is a proxy for the cost of labour and services required for metal production.[2]

Temporal dummies serve to capture the different price dynamics of aluminium and zinc that have occurred over the past few years.

Below is a table containing the estimation results of the long-run variables.

Elasticity of aluminium and zinc prices to different explanatory variables

| Explanatory variables | Aluminium price | Zinc price | ||

| Coefficient | P-value | Coefficient | P-value | |

| Scraps | 0.68 | 0.00 | 0.48 | 0.00 |

| Commodities, other than energy | 0.05 | 0.58 | 0.34 | 0.00 |

| Liquefied Natural Gas JKM | 0.07 | 0.00 | 0.03 | 0.01 |

| Economic cycle | 1.09 | 0.01 | 0.43 | 0.33 |

| Consumer Price Index | 0.13 | 0.67 | 0 | n.d. |

| Temporal dummies (2020-01 : 2023-10) | 0.09 | 0.00 | 0.03 | 0.07 |

The regression output shows that the coefficient of aluminium scrap (0.68) is higher than that of zinc scrap (0.48).

Since the dependent variable and the explanatory variables are expressed in logarithms, the regression coefficients indicate the elasticities of the dependent to changes in the exogenous.

This means that ceteris paribus, a 10% increase in aluminium scrap prices leads to a 6.8% increase in the price of aluminium, while an increase in zinc scrap leads to a 4.8% increase in the price of zinc.

But what differentiates the two markets the most is the different impact of the price of minerals. In the case of aluminium, in fact, the effect of the alumina price is very low and, above all, the estimation results indicate with "certainty" that it is different from zero. In the case of zinc, on the other hand, the ore price is relatively high and the estimation results indicate with "certainty" that it is different from zero.

These data support the hypothesis that the recycling market influences the price of aluminium more than zinc.

Energy prices are significant in both the aluminium and zinc markets.

In particular, the aluminium market is more sensitive to energy prices (0.07) than the zinc market (0.03).

Conclusions

Regression results showed that the recycling market influences the price of aluminium more than zinc.

The aluminium price showed an elasticity of 0.68 to the scrap price, while the zinc price showed a lower elasticity of 0.48.

Another aspect revealed in this analysis is that zinc prices are sensitive to zinc ore and concentrate prices, while aluminium prices are indifferent to alumina trends.

This analysis allows us to justify in terms of the different importance of the recycling market the higher price that zinc has on international markets compared to aluminium. However, it is also a clear indication of the importance of the recycling market in reducing energy consumption and commodity prices, and improving security of supply.

Appendix

The results of long-term estimates using the Engle and Granger method are presented below.

[1] See Unindustria Roma

[2] Wages are being assumed to be indexed to inflation.