Global industrial crisis, but inflation drops

Lateral shifts in the commodity market, but there are some exceptions

Published by Luca Sazzini. .

Conjunctural Indicators Commodities Financial WeekThe Global Industrial Crisis....

Last week's economic analysis had revealed a critical situation for the Eurozone, which could go into recession in the fourth quarter of this year.

European PMI[1] index for November, recorded a value of 43.8 indicating a contraction of the manufacturing sector for the eighth consecutive month.

The US PMI index signalled a less worrying macroeconomic picture, however, it too recorded a negative monthly change, bringing it below the 50-point threshold.

This week saw the release of new estimates for China's PMI index, which continue to signal weakness in Chinese industry, albeit with varying intensity depending on the source of the survey.[2]

....and falling inflation....

As far as inflation is concerned, new Eurozone data came out this week, reporting a drop from 2.9% in October to 2.4% for November.

In particular, the countries that experienced a greater decline than expected were:

- Italy, which passed to the 0.8% from the previous 1.7% in October on the National Index of Consumer Prices for the Whole Community (NIC);

- France, which dropped to 3.4% from the previous 4% on the Consumer Price Index (CPI);

- Germany, c which went to the 3.2% a/a from the 3.8% of October on the Consumer Price Index (CPI)

...fuelling expectations of rate cuts.

These new figures combined with the slowdown in US prices over the past month, recounted in the recent article: "Inflazione e prezzi delle commodity", have further strengthened financial market expectations for an upcoming interest rate cut by the FED and ECB.

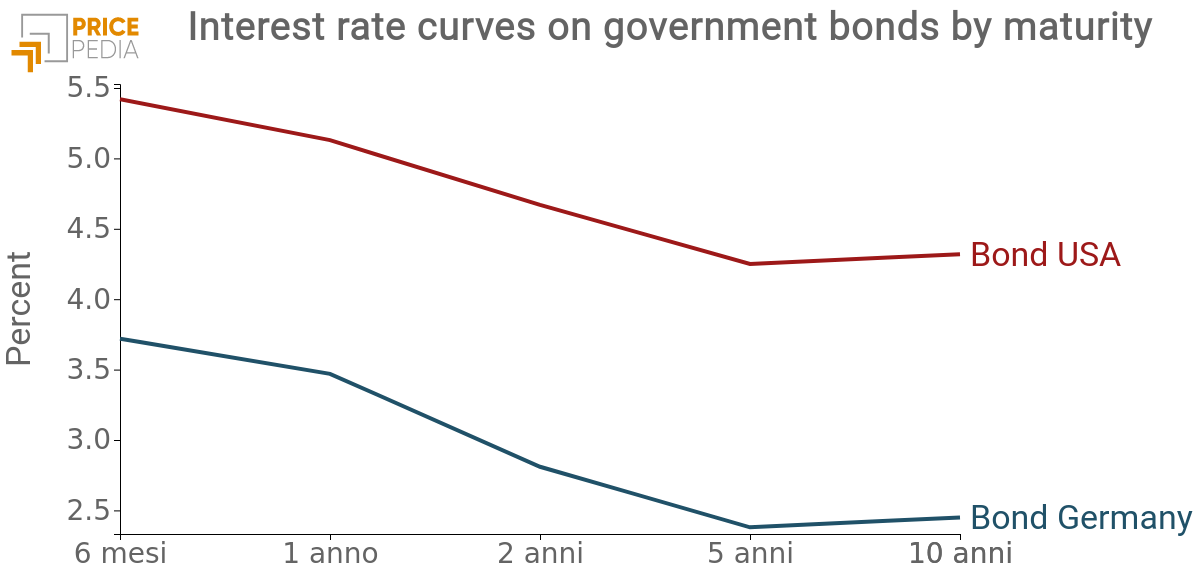

These expectations clearly emerge from the development of the nominal yield curves of US and Germany government bonds, which are both negatively sloped, with long rates lower than short ones.

This type of situation indicates a recessionary and/or deflationary economic phase and incorporates expectations of an expansive monetary policy.

Commodity markets reaction

Currently, commodity markets continue to experience mostly sideways price movements, but the energy sector stands out, which remains characterised by a negative trend.

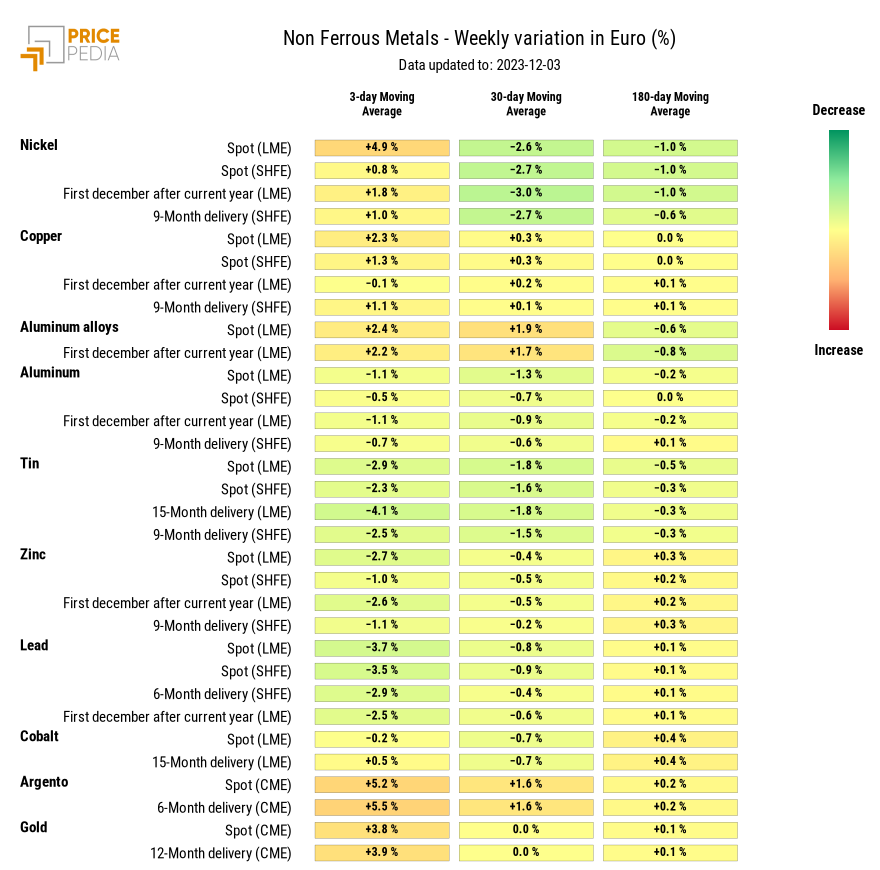

There are a few other exceptions, especially within industrial metals, where tin and lead prices have fallen.

The opposite case concerns the development of cocoa prices, which has peaked in the last period, driven by recent unfavourable weather phenomena.

ENERGY

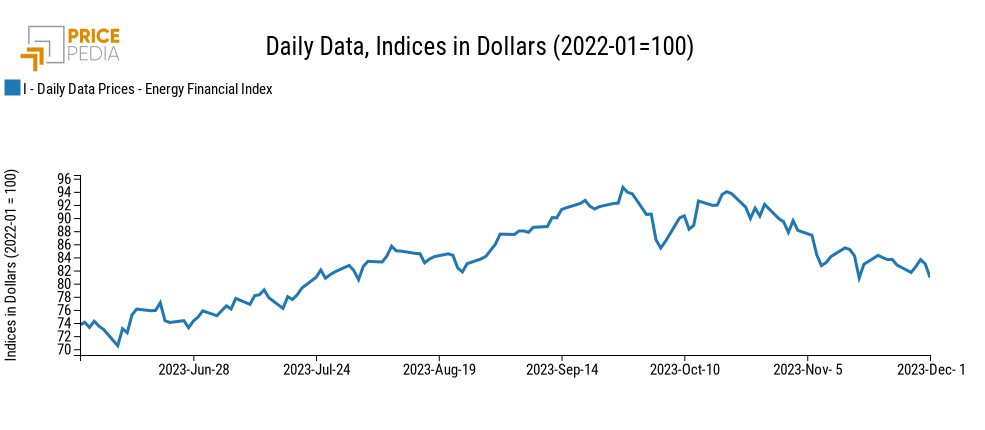

This week, the financial index of energy products continued to experience price fluctuations mostly related to short-term speculation. The price of Brent oil after rising to $83/barrel on Wednesday, collapsed to $79/barrel yesterday on the back of disagreements at the latest OPEC PLUS meeting.

PricePedia Financial Index of energy prices in dollars

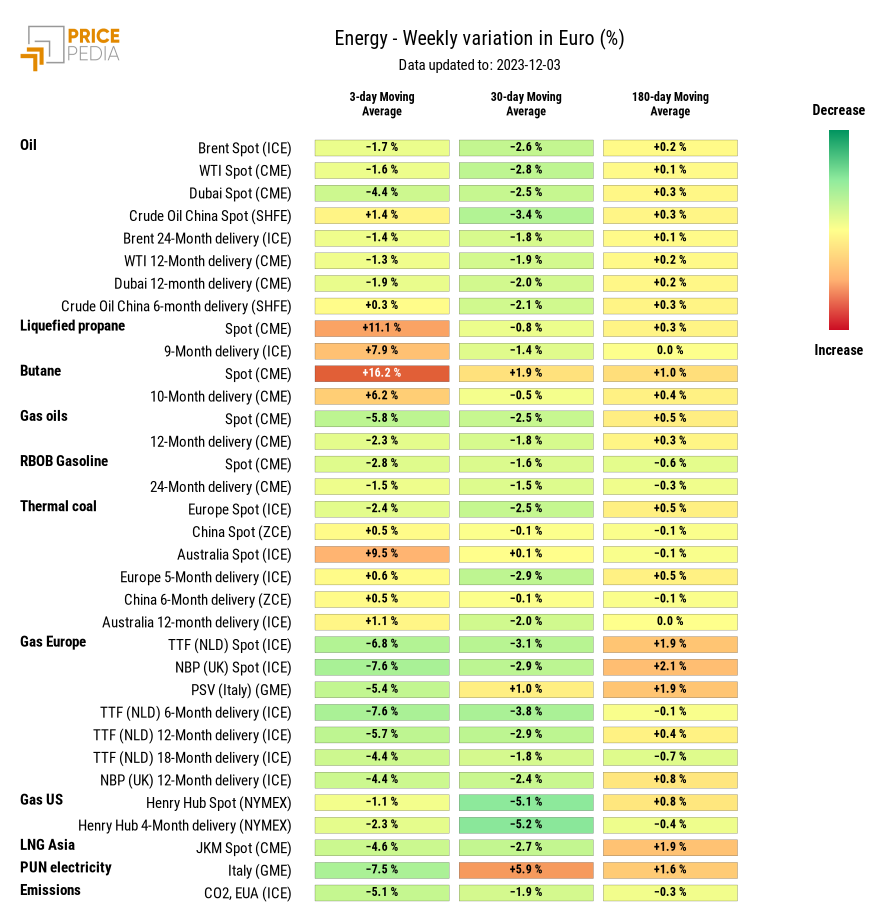

The 3-day moving average of the energy heatmap shows a weekly decrease in European gas and PUN prices, while the butane price increased sharply.

HeatMap of energy prices in euro

PLASTIC MATERIALS

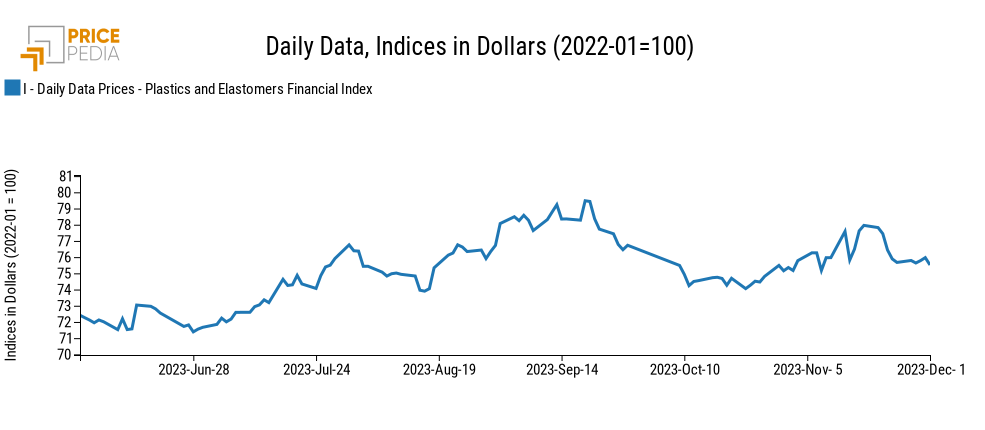

After a sharp fall last week, the plastics financial index stabilised momentarily.

PricePedia Financial Index of Plastics in dollars.

FERROUS

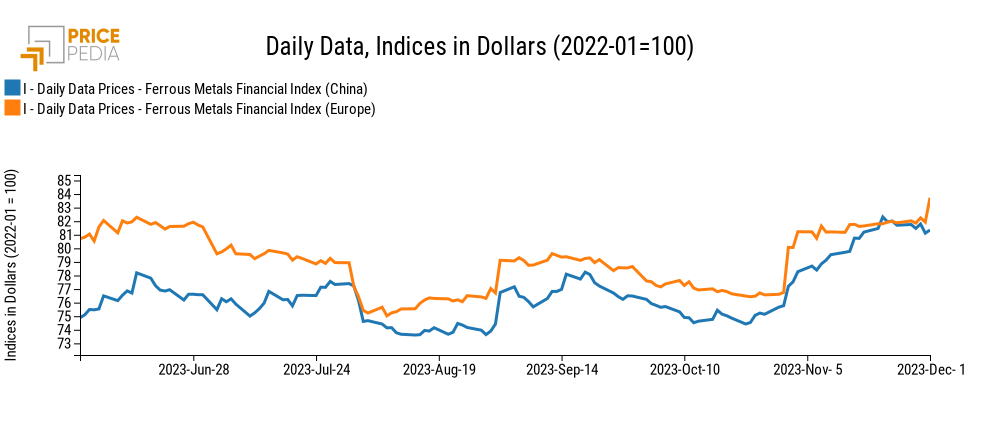

The upward trend of the China Ferrous Index, which had led it to overtake the Europe Ferrous Index, came to a halt this week. At the moment, the China Ferrous Index is again slightly below the Europe Ferrous Index.

The European ferrous index recorded a significant increase yesterday, driven by the rise in prices of the Continuous index of HRC (Hot Rolled Coil) listed on the CME (Chicago Mercantile Exchange). This, in turn, was determined by the replacement in the Continuous index of the futures contract for December 2023 deliveries (no longer subject to trading) with the one for January 2024 deliveries. This increase appears to reflect more technical aspects of the CME rather than changes in market conditions. Indeed, there are no signs of similar increases in the quotes of the corresponding commodity on the LME (London Metal Exchange).

PricePedia Financial Indices of ferrous metal prices in dollars

INDUSTRIAL NON-FERROUS

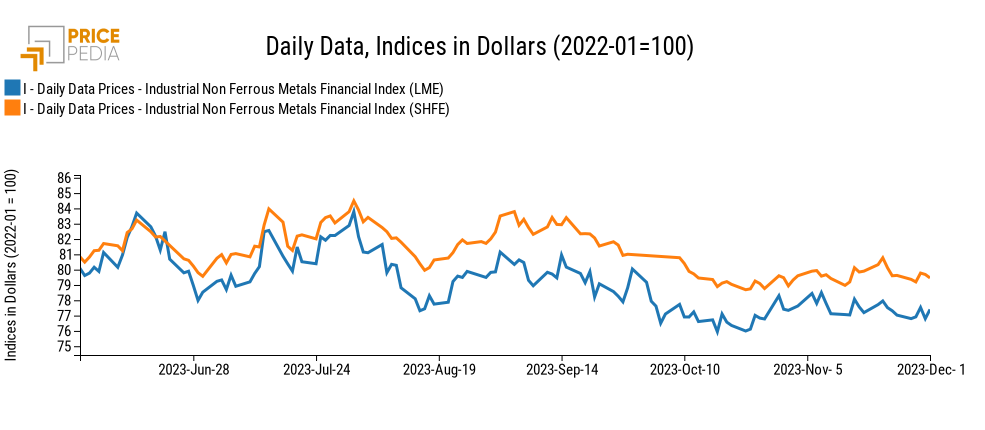

Looking at the graph of the two industrial non-ferrous indices, one notices mostly lateral price movements.

PricePedia Financial Indices of non-ferrous metal prices in dollars

The heatmap shows the reduction of the 3-day moving average of tin and lead prices.

HeatMap of non ferrous metal prices in euro

FOOD

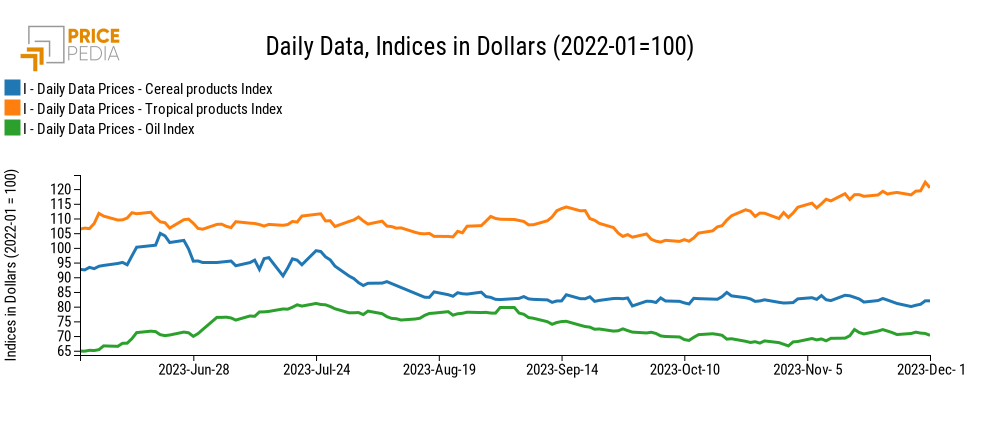

The financial index for tropical food products continued to grow slightly, while the cereals index decreased slightly. The oils index stabilised more than the other two.

PricePedia Financial Indices of food prices in dollars

TROPICAL FOOD

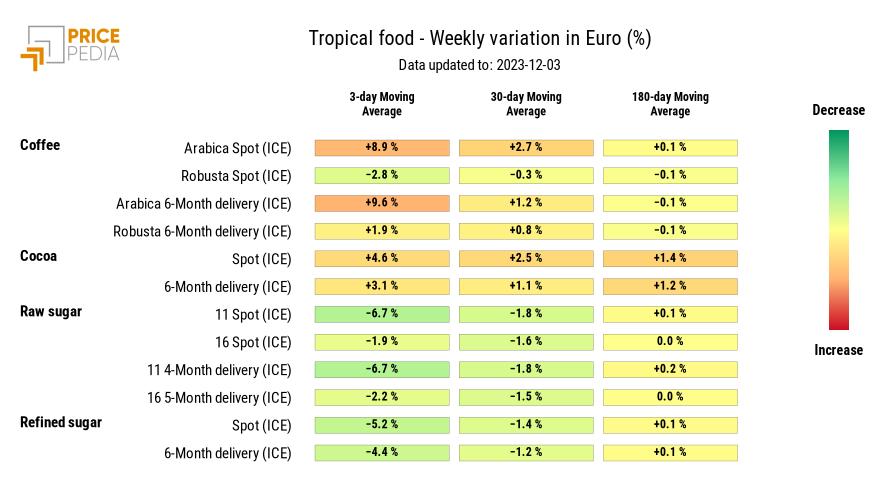

Below is the tropical food heatmap, which shows the most significant weekly change due to the increase in cocoa and coffee prices.

HeatMap of tropical food prices in euro

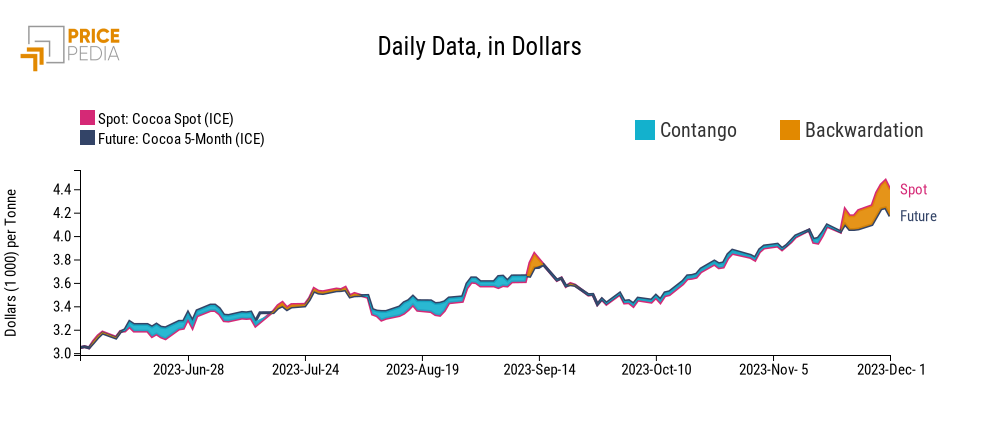

The price of cocoa continues to follow a phase of strong price increases, which has led it to reach its highest peak in 44 years. Below is a graph showing the historical series of cocoa prices quoted on ICE (International Commodity Exchange)..

The main cause of the sharp increase in cocoa prices is the reduction in production in West Africa, a region that alone supplies over 80% of the world's cocoa. Ghana and Ivory Coast, in particular, are facing several challenges that have led to insufficient production to meet global demand. The causes of the production reduction are manifold. Among short-term factors are adverse weather conditions, such as continuous rains preventing the drying of the beans, and the spread of diseases. Among longer-term factors, an important one is the necessary constraints on deforestation aimed at expanding cocoa plantations. If this is the expected outcome of environmental conservation policies initiated by major global chocolate producers, aimed at improving the sustainability and efficiency of existing cultivation, it may lead to an increase in cocoa cultivation on grassy lands, with rising production costs due to increased labor and resource needs. The price structure on the ICE for future deliveries is in backwardation, with the 5-month futures growing but at a slower pace compared to the spot price. In a market structurally under tension, a short-term shortage has been added, which operators believe can be overcome within a few months, leading to a partial reduction in cocoa prices.

[1] The Purchasing Managers Index (PMI) is an economic indicator based on monthly reports and surveys directed at the buyers of private companies.

A level above 50 signals an increase in the level of activity by businesses, while a value below 50 indicates an expectation of contraction in business activity.

[2] For the month of November, the China NBS (National Bureau of Statistics of China) reports a Chinese manufacturing PMI of 49.4 (slightly down from the last recorded value in October, which was 49.5), while Caixin-Markit reports a PMI value of 50.7.