Closing of the year with overall stable financial prices of commodities

2023 ended with commodity prices driven only by phenomena specific to the different markets

Published by Luigi Bidoia. .

Conjunctural Indicators Commodities Financial Week

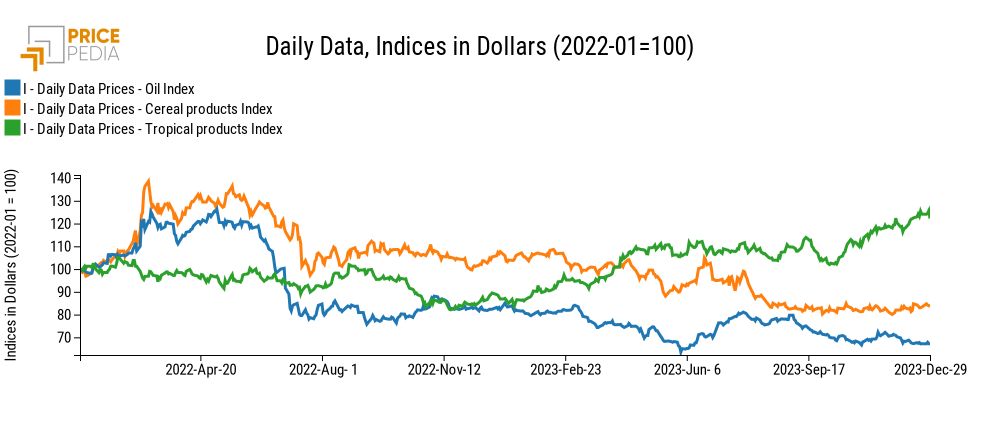

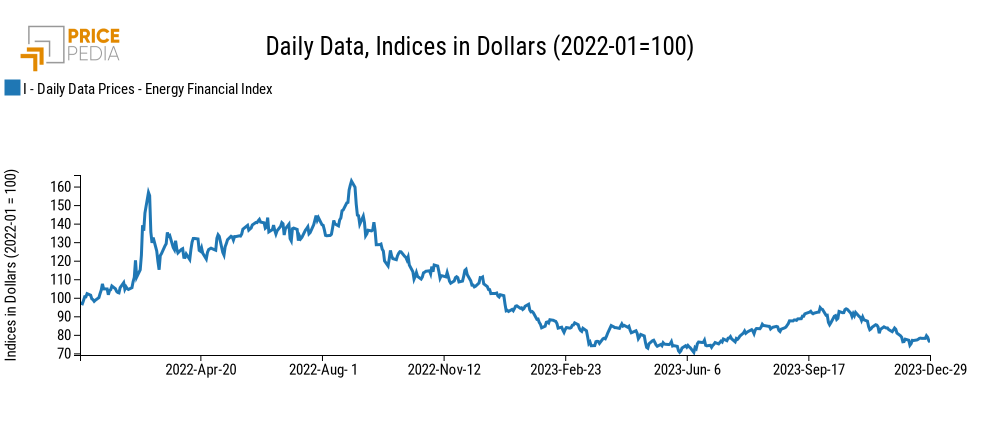

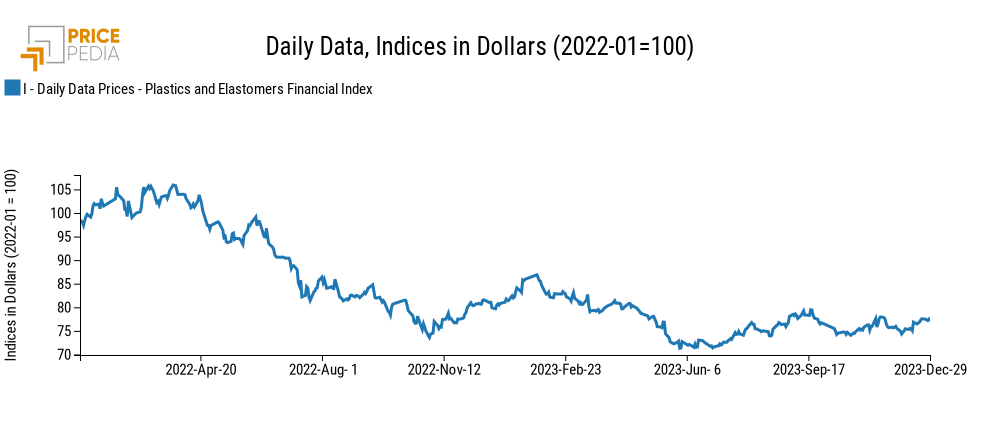

With yesterday's prices, a year came to an end which, from the point of view of the dynamics of the financial prices of commodities, can be divided into three phases. In the first, corresponding to the first half of the year, the price reduction phase that began in the summer of 2022 continued, with the exclusion of only agricultural goods, supported, in particular, by the prices of tropical agricultural products.

The second phase, corresponding to the third quarter of the year, was characterized by the substantial stability of all price families with the exclusion of the growth in energy prices, supported by the reductions in oil production implemented by OPEC PLUS .

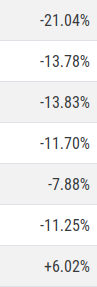

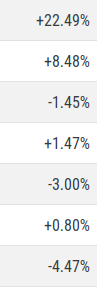

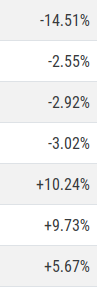

Change rates of the PricePedia indices in the indicated period

| PricePedia financial price indices | Jan23-Jun23 | Jul23-Sep23 | Oct23-Dec23 |

|

|

|

|

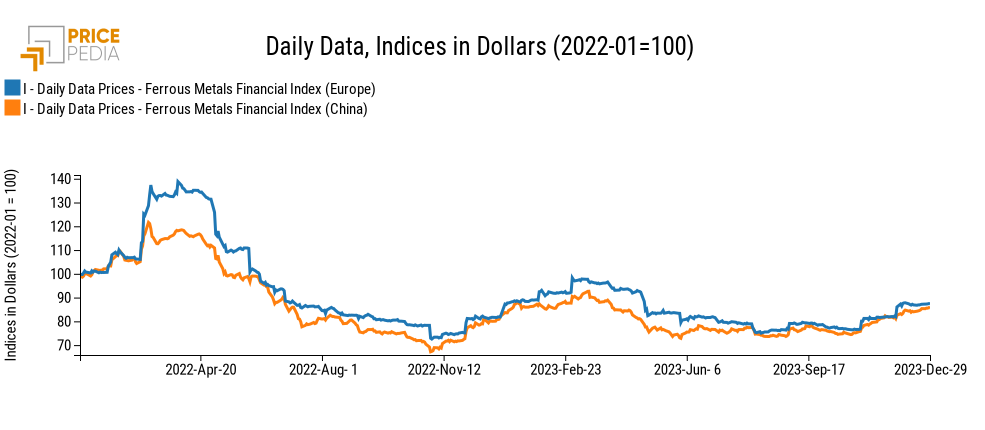

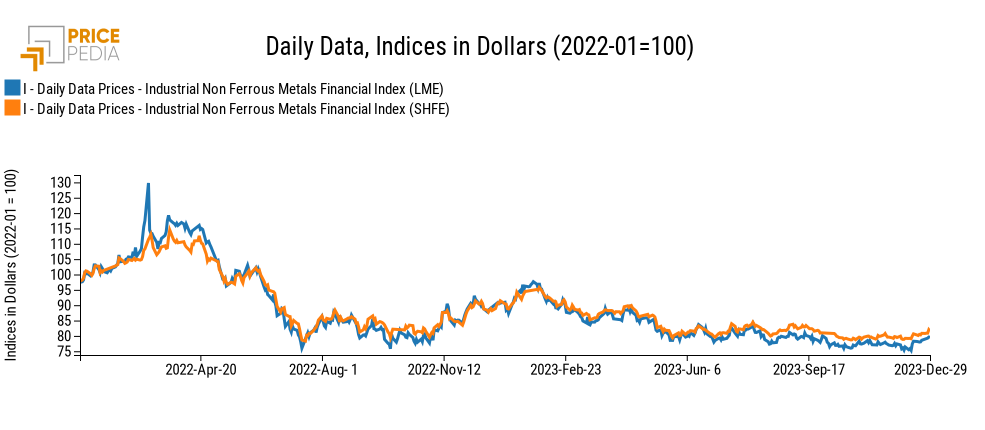

In the last phase, corresponding to the last quarter of the year, energy prices took an inverse path in the face of weak demand due to the European industrial crisis and the weak recovery of the Chinese economy. Prices of industrial non-ferrous metals also fell slightly, in the face of weak global industrial demand. Conversely, in the last quarter the ferrous price index increased, driven by the growth in prices of HRC hot coils in the US Midwest detected by the CRU Group.

This dynamic seems to be attributable more to short-term phenomena than to the start of a robust phase of price increases.

As regards specifically the last week of 2023, this is characterized by:

- energy prices tend to be weak, with the price of Brent again below 80 dollars per barrel and the price of gas at the TTF below 35 euros/Mwh;

- substantial stability of industrial metals, both ferrous and non-ferrous, with the exception of aluminium, which increased significantly on both the London Metal Exchange and the Shanghai Future Exchange;

- a further rise in US HRC prices, which in the last days of 2023 returned above 1100 dollars per ton.

- substantial stability in the prices of agricultural commodities.

Below are the Pricepedia indices of daily prices during 2023.

PricePedia Financial Index of energy prices in dollars

PricePedia Financial Indices of dollar prices of plastic materials

PricePedia Financial Indices of dollar prices of ferrous metals

PricePedia Financial Indices of dollar prices of industrial non-ferrous metals

PricePedia Financial Indices of food prices in dollars