Increased costs and demand support the prices of electrical transformers

Published by Pasquale Marzano. .

Electrical Appliances Price Drivers

The energy transition involves the use of multiple sources, renewable and with low environmental impact, for the production of electricity. From this perspective, a fundamental role is played by electrical transformers, which allow the energy produced by various sources to be fed into the electricity grid and made available to domestic and non-domestic users.

Transformers were recently the subject of a prediction by Elon Musk who in an interview in July 2023 claimed a probable shortage of transformers as early as 2024.

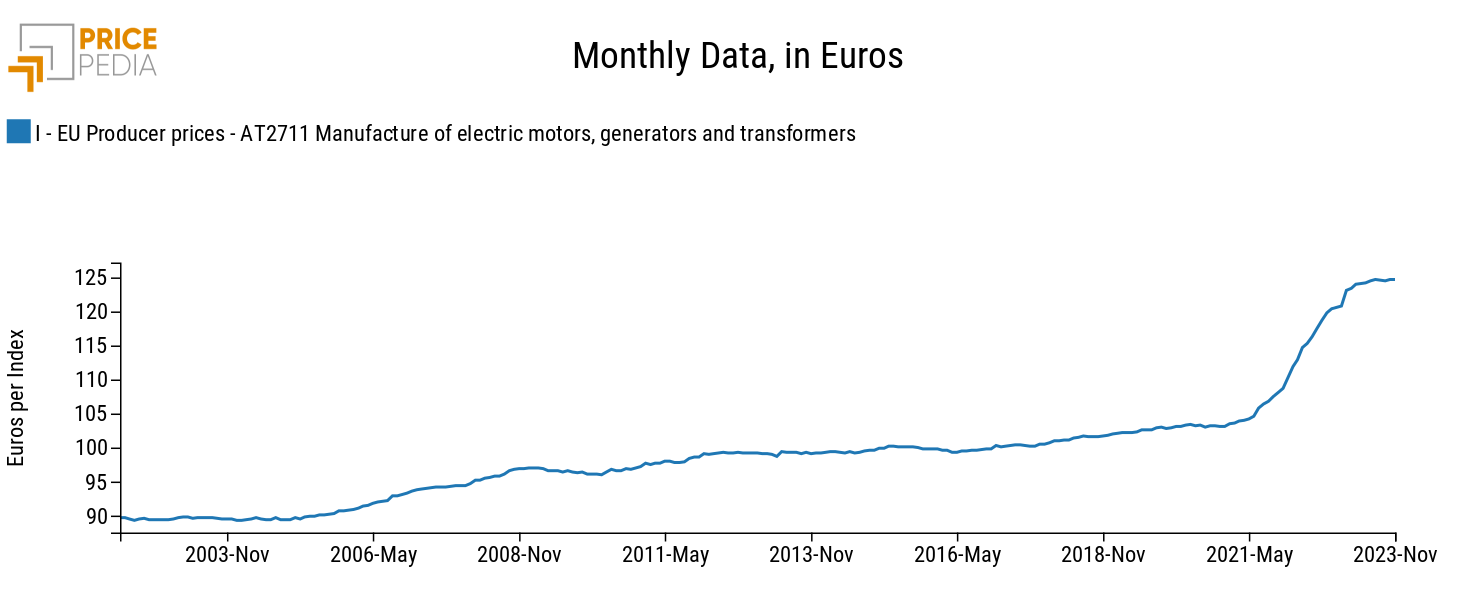

Starting from 2021, the price of electrical transformers has undergone a very strong growth, as reported in the article Should Cost for a 20 kVA dry-type electrical transformer. This growth is linked to the increase in production costs, which in the case of the transformer taken into consideration in 2022 have reached levels unmatched in the history of the last 23 years.

The following graph shows a different proxy of the cost of a transformer, given by the producer price index[1], sourced from Eurostat, relating to the manufacturing of electric motors, generators and transformers.

Chart 1: EU Producer Prices - Manufacture of electric motors, generators and transformers

Also in this case, the break with the past that occurred in 2021 is highlighted. In the most recent months the index has stabilized at the all-time high levels: on average in 2023 it is 21% higher than the values of 2019.

A further factor that has caused the increase in transformer prices is also to be found in the increase in demand, supported by energy transition policies, which has affected global markets.

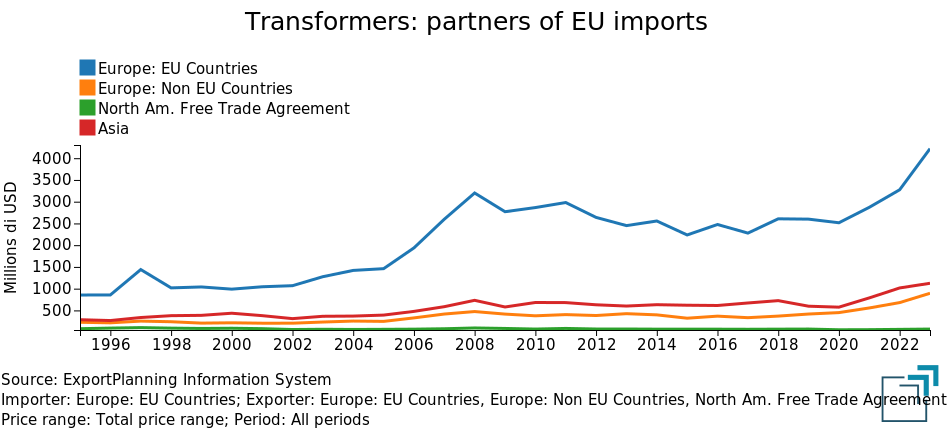

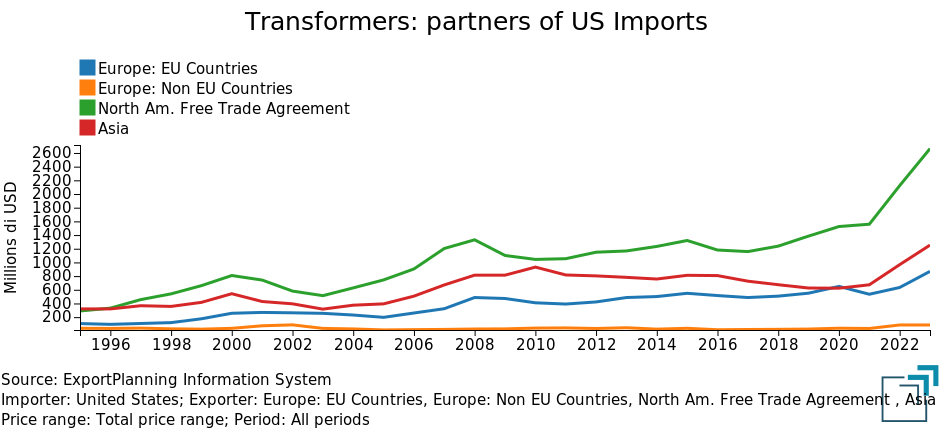

By analyzing foreign trade flows, it can be observed that the transformers market tends to be regionalised. The following graphs show the import flows of the EU and the United States from the main economic areas (EU and non-EU Europe, USMCA - former NAFTA - and Asia).

Chart 2: Transformers - EU and US suppliers ($ values)

European Union

USA

As can be seen from the graphs, the EU purchases electrical transformers mainly from its member countries of the European Community (over 60% of the total on average), while, for the USA, the main trading partners are Mexico and Canada (on average almost 50% of total imports).

Despite the high share of intra-area imports, Asia, especially China, represents an important supplier for both the EU and the USA.

Already in 2023 there was an increase in demand in the United States and the EU which was satisfied with greater imports from Asia, primarily China. Even in the case of transformers, Western industry must turn to China to satisfy rapidly growing demand.

A phase of homogenization of the world transformer market is underway, due to growth in Chinese exports to both the EU and American markets.

Therefore, what will happen on the Chinese market is becoming increasingly important for the US and EU transformer markets.

1. In the hypothesis of a competitive market, the sector mark-up can be considered constant. Under this hypothesis the dynamics of output prices is equal to the dynamics of input prices. Pasquale Marzano

Economist and data scientist. At PricePedia he deals with the analysis of commodity markets, forecasting models for raw material prices and management of reference databases.