Will the energy transition process generate a new super cycle in commodity prices?

Published by Luca Sazzini. .

Supercycle Analysis tools and methodologiesIn market analyses, experts are scrutinizing the dynamics of supply and demand in the commodity sector. They're pinpointing factors that could disrupt the market balance, leading to notable price fluctuations. A surge in demand typically triggers a price hike, followed by an eventual supply response. However, the market faces turbulence when supply can't keep pace with escalating demand. This imbalance stems from two key issues: first, prolonged demand growth shrouded in uncertainty, challenging supply adjustments due to high investment risks. Secondly, the supply growth is often hampered by the finite nature of natural resources. These intertwined factors complicate the market's trajectory, presenting a complex and intertwined economic puzzle.

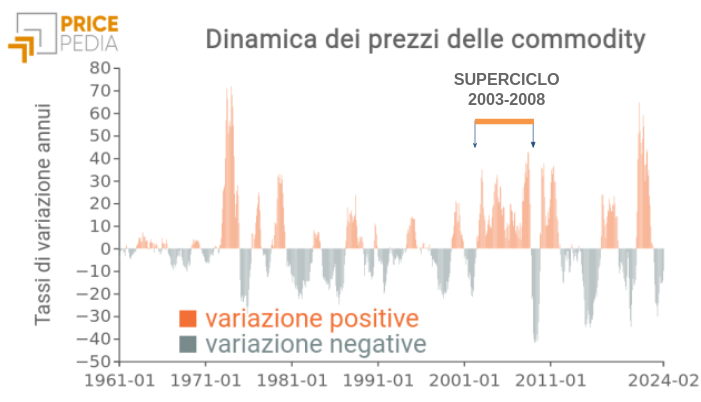

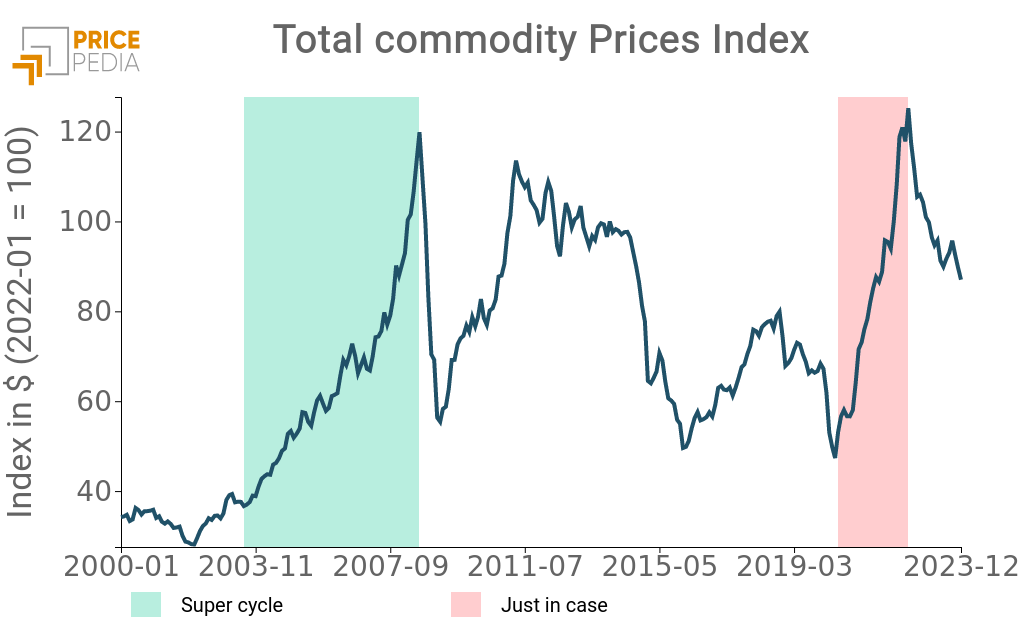

In the 21st century, the commodity market has experienced two significant and extended price surges. The first phase, from 2003 to 2008, coincided with China's rapid industrialization and urbanization, often described as a supercycle due to its intensity and duration. Demand outpaced supply, leading to delayed responses in commodity availability. The second surge emerged post-COVID, as global industry rebounded from the lows of spring-summer 2020, nearing pre-pandemic levels. This resurgence, coupled with the crisis in global shipping logistics, led companies to shift from "just in time" to "just in case" policies, significantly boosting commodity, processed goods, and components purchases[1].

A graph provides a visual representation of these two intense commodity price cycles in the European market.

Price index of total commodities

Analysts are currently debating two key issues. The first, a pressing matter, revolves around the Red Sea crisis, potentially triggering another global shipping logistics crisis. The second, more structural, concerns the potential emergence of a new supercycle driven by the energy transition.

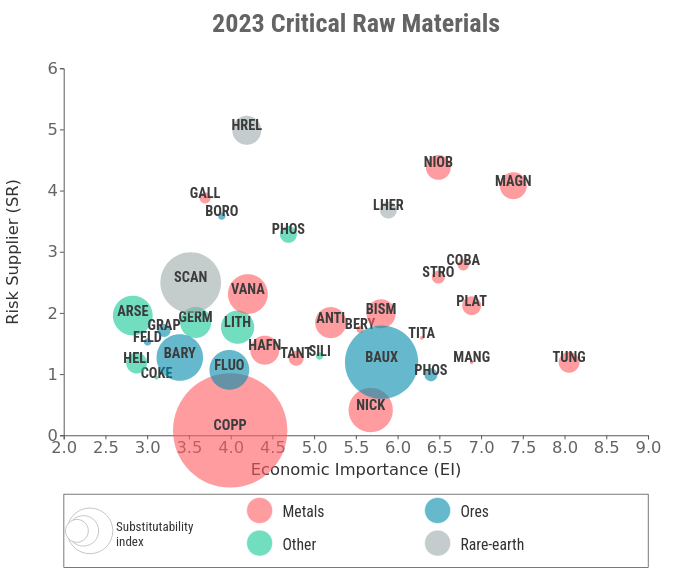

The debate on a new supercycle in commodities is intensifying, centered around the increased demand for raw materials essential in combating global warming through energy transition strategies. This shift heralds a future surge in raw material demand due to new infrastructure and technologies aimed at mitigating climate change. Additionally, factors like global population growth, necessitating new urban spaces and infrastructure, and strategic government considerations to secure supply chains and reduce import dependence, could significantly boost medium to long-term demand.

Super cycle and financial prices

The debate among analysts regarding the potential supercycle in commodity prices due to the energy transition is multifaceted. While many agree on the likelihood of increased demand, opinions diverge on its intensity and timing. A gradual rise in demand, matched by a corresponding increase in supply, may not lead to significantly higher commodity prices. However, a high degree of uncertainty could limit necessary investments to meet this demand, potentially triggering a price supercycle.

Paradoxically, more certainty about a future surge in demand could moderate price increases. Futures prices, reflecting future demand and supply imbalances, play a crucial role. Initially, futures contracts may see significant price increases, followed by spot contract prices through arbitrage mechanisms.

Conclusions

The widely acknowledged scenario among analysts suggests a significant increase in commodity demand linked to the energy transition. However, this alone does not guarantee a new supercycle in commodity prices. For such a cycle to occur, it would require a lack of corresponding supply adjustments due to high uncertainty, despite the anticipated mid-term demand surge.

[1] For an analysis of the differences in commodity price growth phases due to a super-cycle or the replacement of the 'just in time' purchasing approach by a 'just in case' approach, see the article "Supercycle or just in case".