Different trends for stainless steel prices

Dynamics influenced by extra-alloy components

Published by Pasquale Marzano. .

Ferrous Metals Stainless Steel Price Drivers

Starting from the end of 2020, and until May 2022, the prices of stainless steel (inox) products have been subject to sharp increases, averaging +120%. This growth is mainly characterized by the dynamics of extra-alloy components, as well as by the price of non-alloy steel.

In particular, the price trend differs based on the different alloys considered. In PricePedia the following product categories are distinguished:

- austenitic stainless steel products[1];

- ferritic stainless steel products[2];

- other stainless steel products[3].

The dynamics of the first two product categories will be analyzed below. The third concerns, in fact, a residual category.

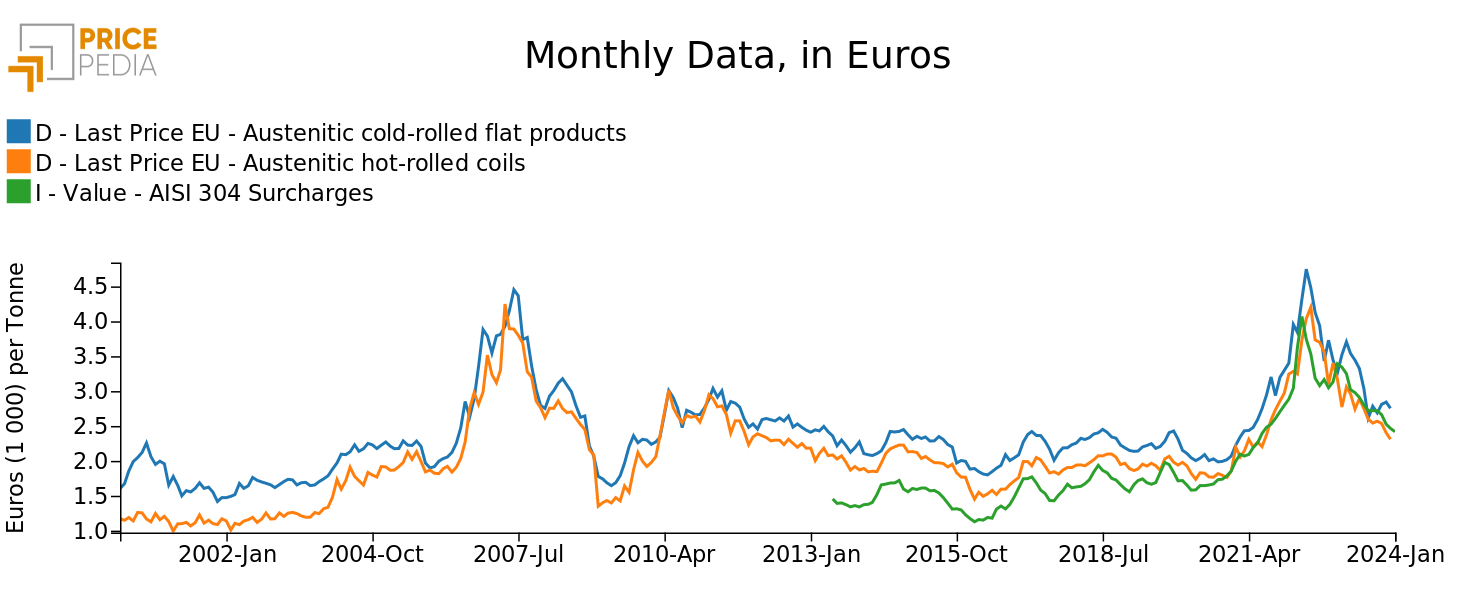

Austenitic steels

Austenitic stainless steels are characterized by a nickel content that can vary from 6% to over 20%, based on the characteristics that the products must have. The comparison graph between the prices of austenitic plates and austenitic coils and the price of the extra alloy 304 (with chromium content equal to 18% and nickel equal to 8%) is illustrated below.

As can be seen from the graph, the price dynamics of austenitic steels is strongly linked to that of the extra alloy. Note how the maximum peaks of 2007 and 2022 are very similar in levels for both austenitic products considered, although the absolute maximum point occurred in May 2022.

Furthermore, starting from the latter, prices are characterized by a decreasing trend. This trend in the most recent months has brought prices around summer 2021 levels.

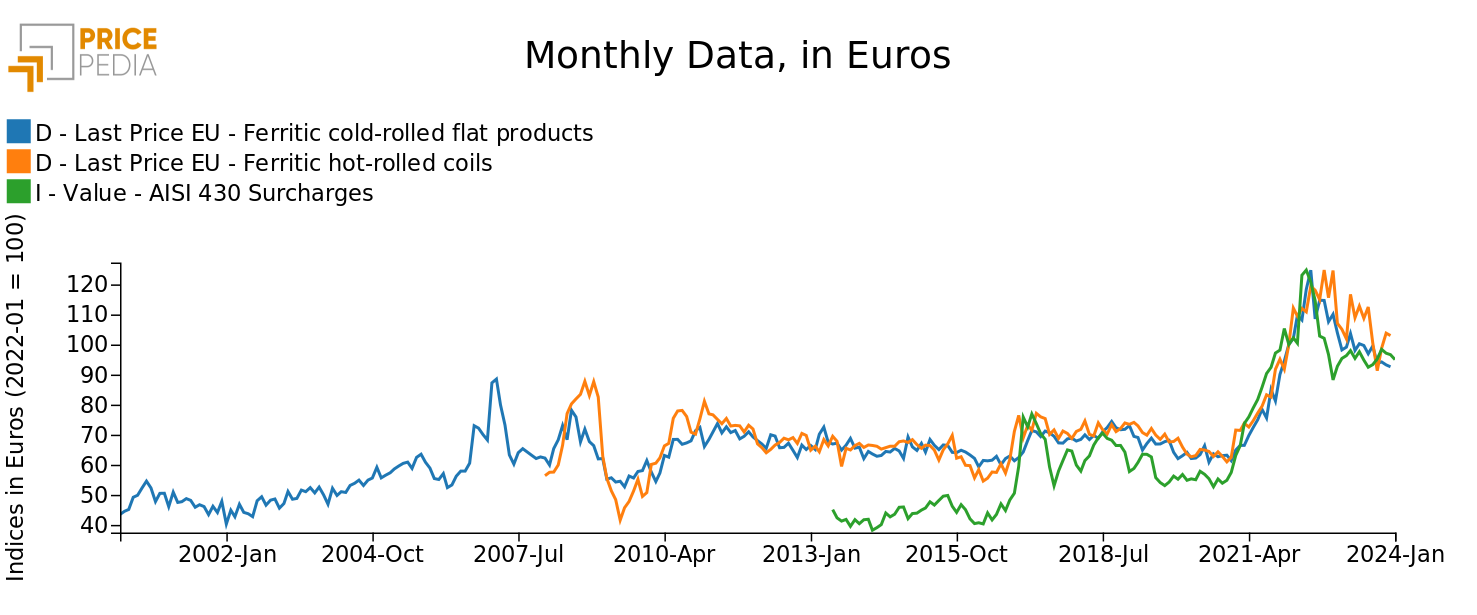

Ferritic steels

Unlike austenitic steels, ferritics are characterized by a practically zero nickel content and are therefore influenced by the price of the main alloy component, i.e. chromium. The following graph compares the price trend of two ferritic stainless steel products (cold rolled plates and hot rolled coils) with that of the extra alloy AISI 430, which has a chromium content of 16.5%.

Although differences emerge relating to the period 2013-2016, in which the extra alloy has a lower price, even in the case of ferritics the price trend is similar to that of the reference extra alloy component, represented by AISI 430.

In the case of ferritic plates, the maximum point of June 2022 is more than 40% higher than that recorded in 2007. In general, for both ferritic products the prices are relatively stickier than in the case of austenitics, so much so that the decreasing trend of the last 18 months has failed to bring prices back to the levels of early 2021. In the current phase, therefore, high values above the long-term average are observed.

Conclusions

This brief analysis shows how the price of austenitic steels is fundamentally driven by the extra-alloy price, given the high incidence of the cost of nickel as a percentage of the final price of steel. For these steels, therefore, assessments of the dynamics of the extra alloy are crucial in guiding procurement choices. Conversely, as regards ferritic steels, the extra-alloy component, despite being an important component, is not equally decisive in driving the dynamics of the final price. In this case, both evaluations of the extra alloy and of the other steel price components are necessary during the procurement phase.

1. Austenitic steel products are contained in the Ferrous product category and are divided into Austenitic stainless steel flat products, Austenitic stainless steel long products and Austenitic stainless steel coils.

2. Ferritic steel products are contained in the Ferrous product category and are divided into Ferritic stainless steel flat products, Long ferritic stainless steel products and Ferritic stainless steel coils.

3. The other stainless steels are contained within the product category Ferrous in Other stainless steels.

Economist and data scientist. At PricePedia he deals with the analysis of commodity markets, forecasting models for raw material prices and management of reference databases.