Russia effect on the price of pellets

Collapse of imports from Russia and more expensive gas behind higher prices

Published by Luigi Bidoia. .

Wood Price DriversAmong heat sources, wood has always played an important role, even if its calorific value is relatively limited and its use less practical than, for example, that of fossil fuels. A wood derivative that is similar in practicality to fossil derivatives is pellets, which in some ways can be considered, in domestic uses, a substitute for gas.

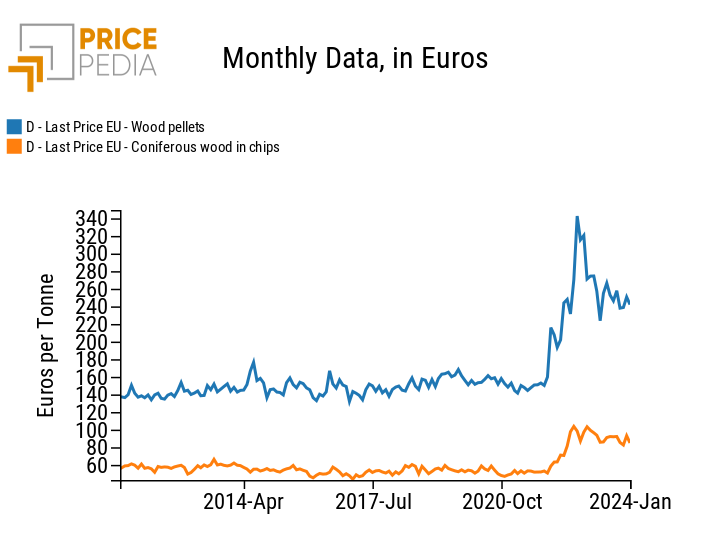

After recording very limited increases between 2009 and the end of 2021, going from 130 to 160 euros per ton, the customs price[1] of pellets more than doubled between the end of 2021 and end of 2022, and then settled at values close to 250 euros per tonne during 2023.

It is useful to ask ourselves whether, in the near future, the price of pellets will return to the levels prior to the 2022 shock, with a significant reduction compared to current prices, or whether the new level must be considered "acquired", making pellet prices significantly lower than 250 euro/ton unlikely in the future.

An answer to this question can be given by analyzing the possible determinants of the price of pellets, through three different effects:

- a supply effect, such as to create an imbalance between supply and demand on the EU market;

- a cost effect, via the price of the wood used as raw material;

- a cross effect of substitution, with the price of gas.

[1] The customs price essentially coincides with a production price, before transport and distribution costs, net of VAT.

Offer effect

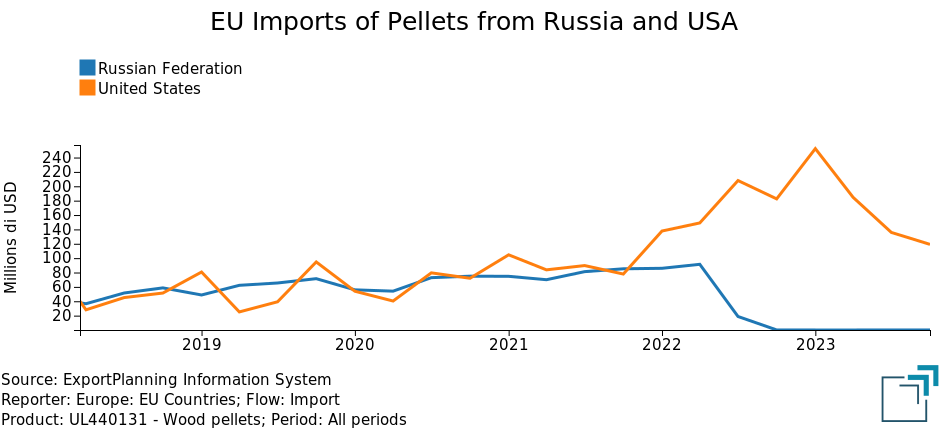

Before Russia's invasion of Ukraine and the resulting EU sanctions on trade with Russia, 15% of the pellets imported by the 27 EU countries were of Russian origin. Already from the first months of the invasion, EU imports of pellets from Russia began to decrease, until they completely disappeared in the autumn of 2022.

As the graph shown here highlights, in parallel with the reduction in imports from Russia, those from the United States have increased, but not in such a way as to entirely compensate for the lower imports from Russia.

Compared to 3.1 million tonnes of total EU imports in the last quarter of 2021, in the last quarter of 2023 these were 2.6, with a reduction of over half a million tonnes. These data seem to indicate without much doubt a reduction in supply over the last two years on the European pellet market.

Cost effect

The pellet can be produced with different wood essences, which have a good relationship between calorific value and price.

The higher this ratio, the greater the convenience of using the essence as a raw material for the production of pellets. The essences that have a good relationship between calorific value and price are conifers, beech and birch. In Europe, fir and pine wood are mainly used, given the greater availability of this wood.

An indicator of the costs of wood for the production of pellets can be represented by the price of coniferous wood in slabs. Pellets are also produced using processing waste, while conifer wood in plates has many uses other than the production of pellets. However, slab coniferous wood can be considered a benchmark for the price of different woody raw materials used to produce pellets.

The following graph therefore compares the price of pellets with the price of coniferous wood in slabs.

Price of pellets and coniferous wood in slabs (euros/tons)

Both prices present a level break in the first months of 2022. In the regression results reported in the Appendix, the price of coniferous wood in slabs is the main determinant of the price of pellets, with a long-term elasticity of 0.7. This means that a 10% increase in the price of softwood pellets tends to translate into a 7% increase in the price of pellets.

Cross substitution effect with the price of gas

In many cases pellets can be considered a substitute for gas home heating. This substitutability leads to a cross-substitution effect in the respective prices. If the price of one increases, demand tends to shift from the first to the second, causing an increase in the price of the substitute good as well. Similarly, when one of the two prices decreases, the shift in demand towards the decreasing price also causes a reduction in the second price.

In the estimate reported in the appendix, the long-term elasticity of the price of pellets to changes in the price of gas is equal to 0.1. Since the price of gas in 2023 was 90% higher than the average gas price of the previous decade, this produced an effect on the price of pellets equal to a higher price of 9%.

Conclusions

Faced with a price that before the 2022 shock had never exceeded 160 euros per ton, in 2023 the price of pellets stabilized at a level close to 250 euros/tonne. Three factors contribute to determining this higher price level:

- the reduction in supply on the European market, due to the elimination of imports from Russia, only partially offset by greater imports from the United States;

- the higher price of coniferous wood in slabs;

- a natural gas price still 90% higher than the average gas price of the last decade.

The probability that these factors will persist over time is high. Therefore, the new pellet price levels can be considered acquired.

Appendix: an econometric estimate

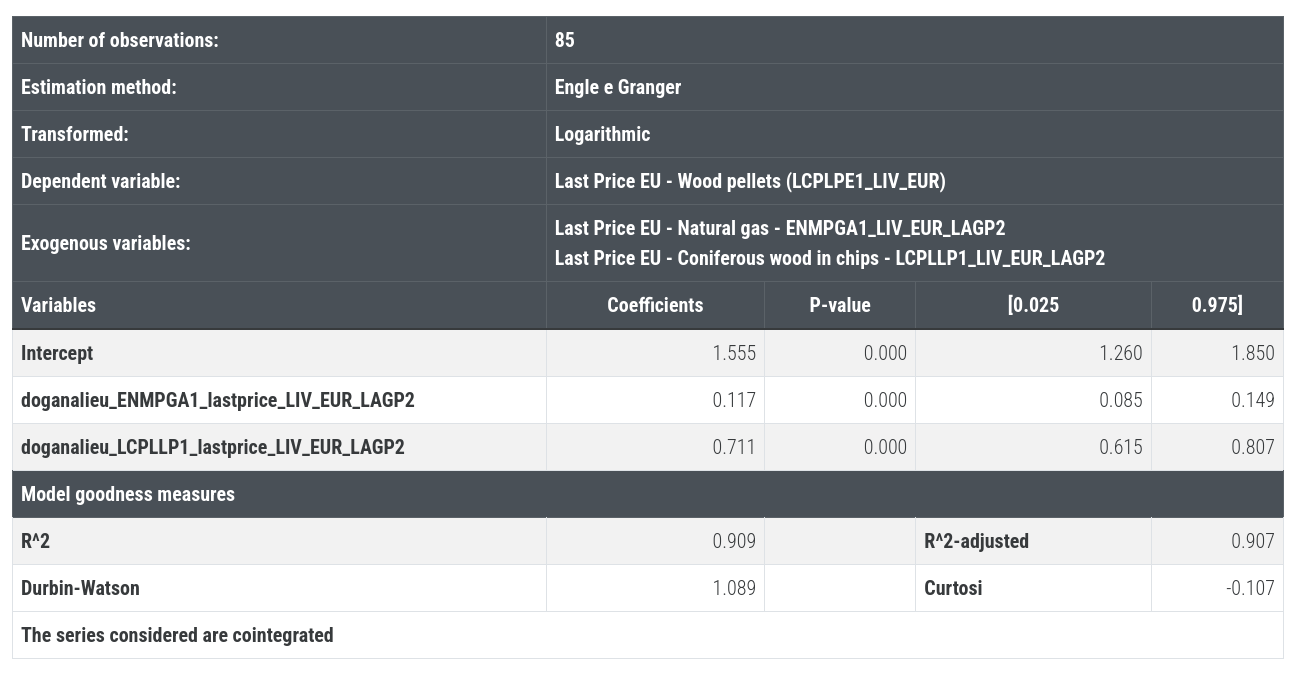

To study the relationship between the price of pellets and the two explanatory variables given by the price of natural gas and the price of coniferous wood in plates, the dynamic specification of Engle and Granger was used, with two equations, one for the short term and one for the long one.

The results of the short-run equation are very good, with highly significant coefficients,

an impact effect of 0.4 and an error correction coefficient of -0.5.

Below are the results of the long-term equation, which allow us to further analyze the economic component of the estimated model. The variables are expressed in logarithms, allowing the estimated coefficients to be interpreted as elasticity.

Estimation results of the long-run pellet price equation

The results of this equation are statistically very good. The probability that the value of the coefficients is zero (P-value) is zero; the percentage (R2) of variations in pellet prices explained by variations in the regressors exceeds 90%.

Even from the point of view of economic reliability, the results are very good, with the elasticity of the price of pellets to variations in the prices of natural gas and wood in slabs equal to 0.12 and 0.71 respectively.