Opening of international markets and safety of raw materials

The case of slab coniferous timber highlights the importance of a plurality of international supply to control prices

Published by Luigi Bidoia. .

Wood Engineered wood Price Drivers

With Russia's invasion of Ukraine, the gas crisis in Europe and the progressive expansion of the ban on the import of commodities from Russia, the issue of raw material safety has returned to the center of attention of European institutions. The debate that has developed has often placed the globalization that has characterized the world economy in the last 30 years in the dock.

For critics of the openness of world trade and globalization, the latter has not only led to a decrease in jobs in industrialized countries and an increase in economic and social inequalities, but has also caused an increase in the risk of raw materials.

The cause lies in the greater interdependence between nations, which makes some countries vulnerable to geopolitical turbulence in other parts of the world.

Observation of the facts of recent years indicates, on the other hand, that the opening of world trade can be part of the solution to the raw materials risk and not the source of the problem. Two facts, in particular, lead to this assessment:

- the importance that many developing countries, with China in the lead, have had in increasing the supply of commodities on the world market;

- more recently, the ways in which the EU freed itself from the constraints that tied it to commodity imports from Russia.

This article delves into the second point, describing the case of the price of coniferous wood in slabs. This case is perhaps relatively unimportant, but it is emblematic of what the costs could have been for the European economy if European companies had not been able to find alternatives to imports from Russia on international markets in a relatively easy and cost-effective way.

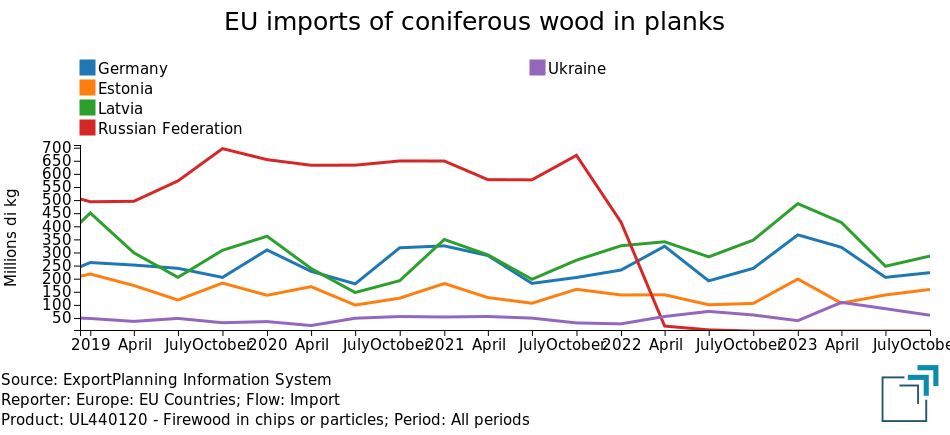

EU imports of coniferous wood in planks

Coniferous wood in small plates or particles is a material obtained by shredding raw wood or wood waste. It is used directly as fuel (chips) in biomass boilers, stoves or thermal power plants, or further processed to produce wood pellets or panels.

Until 2021, the main exporter of this material to the EU was Russia, with a volume of material that exceeded 2.5 million tonnes in that year. Following the invasion of Ukraine, EU imports from Russia quickly disappeared, as shown in the graph shown here.

As can be seen from the graph, the alternative for European companies to imports from Russia consists of intra-EU imports from Germany, Estonia and Latvia and extra-EU imports from Ukraine. Faced with the collapse of imports from Russia, EU import flows from other countries have increased, but not enough to compensate for Russian flows. Overall, the EU, from the five countries considered here, after having imported 5.5 million tonnes of coniferous wood in small plates and particles in 2021, saw imports collapse to 3.5 million tonnes in 2023.

Effects on EU prices

The limited substitution of imports of coniferous plank wood from Russia has naturally reduced the supply of coniferous plank wood on the EU market, with the effect of supporting the price level.

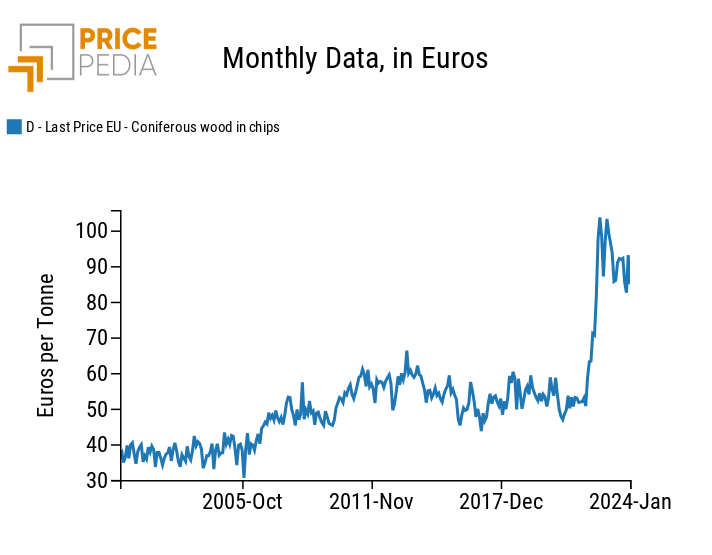

The following graph shows the dynamics of their customs price.

Price of coniferous wood in plates

There is no doubt that plank coniferous wood has changed in price levels following the ban on imports from Russia. Throughout the last decade the price was relatively stable, within the range of 50-60 euros per ton. For over two years, however, the price has been above 85 euros/ton, with peaks that have gone beyond 100 euros/ton.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Conclusions

The case of the price of coniferous wood in slabs is emblematic in reminding us how, without multiple offers on the international market, the collapse of imports from a country can translate into a price shock that can hardly be reabsorbed in the short term.

As regards specifically slab coniferous wood, this fact suggests still high prices in the near future and, consequently, relatively high prices also for pellets[1] and for wood panels.

In more general terms, however, this case recalls the importance of open world trade, with a plurality of exporting countries, as a factor in mitigating raw materials risk.

[1] In the article "Russia effect on the price of pellets" you can find the results of an econometric estimate linking the price of pellets to the price of coniferous wood in slabs.