The fall in commodity prices will slow down in 2024

PricePedia Scenario February 2024

Published by Pasquale Marzano. .

Last Price Forecast

The PricePedia scenario has been updated with information available as of February 7, 2024. Modest positive signs emerge relating to global industrial production, which in January recorded a positive MoM change compared to the December 2023 data, as indicated in the article "First weak signs of growth in commodity prices", and the slowdown of inflation in the Euro Area, which in January 2024 stood at +2.75% (from +2.9% in December 2023).

For the moment, according to the ECB, the inflation data do not justify a short-term lowering of interest rates: a too sudden change of direction in restrictive monetary policies could lead, in fact, to a further surge in prices.

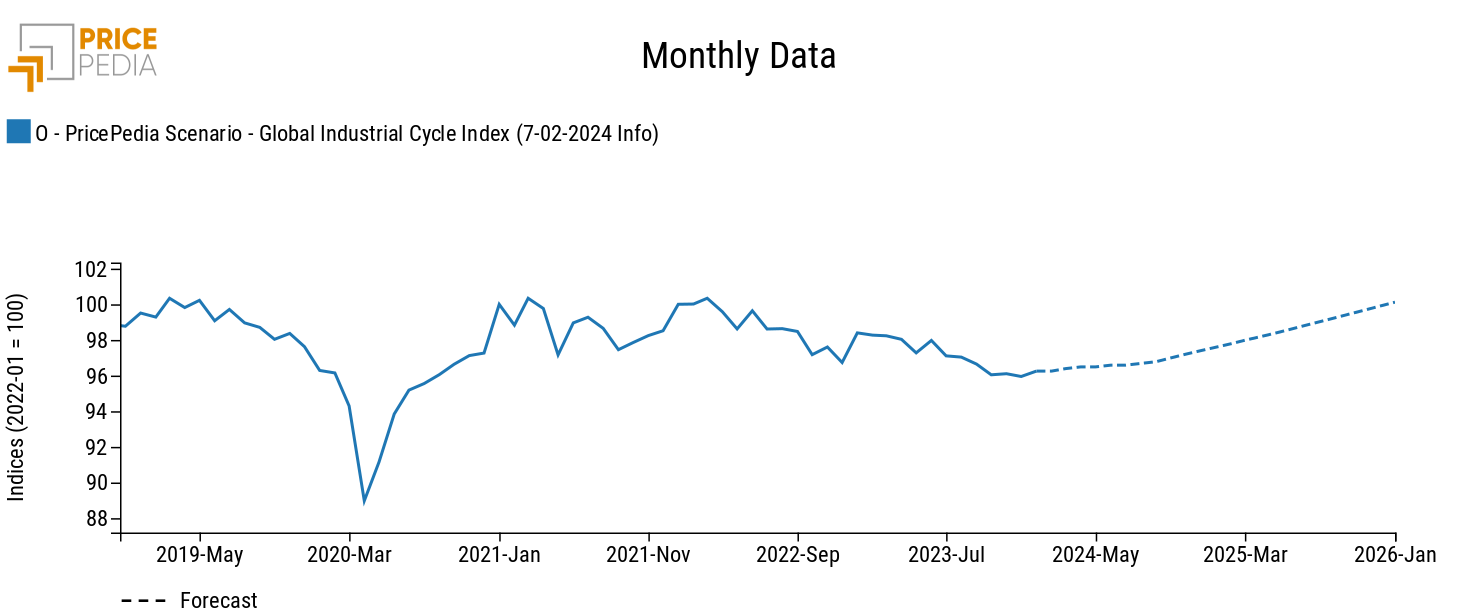

The following graph shows the forecast scenario of the global industrial cycle index[1] built by PricePedia.

In 2024, a dynamic of progressive trend reversal emerges compared to the values recorded in the final months of 2023. In the annual average, 2024 is however relatively stable, only -0.6% lower than the average levels of 2023 (in the previously published scenario the decrease was equal to -1%).

A less negative 2024 entails less intense growth in 2025 compared to the previous scenario: on average, in fact, 2025 increases compared to the average values of 2024 by +2.1% (previously +2.5%). Added to this aspect is also the effect of weakening demand for commodities due to the continuation of restrictive monetary policies.

Forecasting of commodity prices

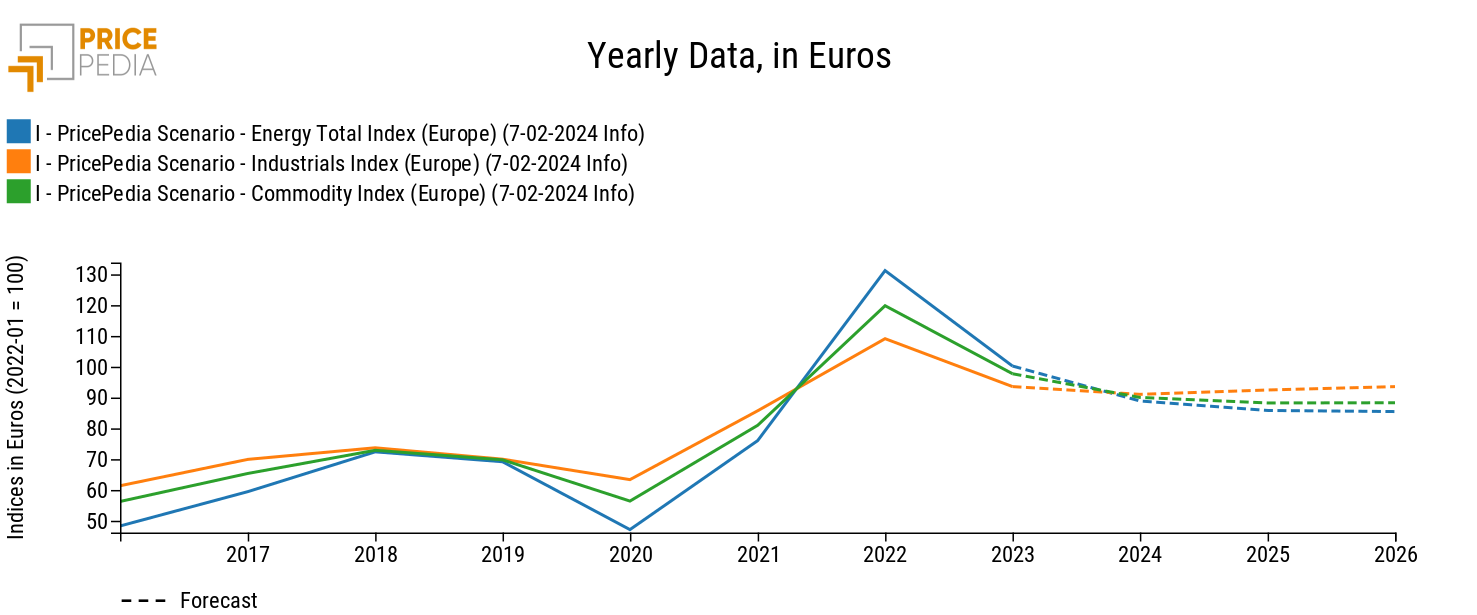

The effect of the dynamics of the global industrial cycle on commodity prices is illustrated in the following graph, which shows the dynamics of the main product aggregates (Industrials[2], Total commodities[3] and Energy).

As can be seen from the graph, in annual terms the decline in prices continues for all three aggregates considered. However, this trend is slowing down, with annual percentage changes in 2024 less intense than those in 2023.

Below is the table that compares the average annual rates of change of the current scenario with those of the previous scenario.

PricePedia scenario: estimates and forecasts compared

| 2023 | 2024 | 2025 | ||||

|---|---|---|---|---|---|---|

| Pre-estim. Dec-2023 (%) | Pre-estim. Jan-2024 (%) | Jan-2024 Scenario (%) | Feb-2024 Scenario (%) | Jan-2024 Scenario (%) | Feb-2024 Scenario (%) | |

| Total Commodities | -18.7 | -18.4 | -7.8 | -7.9 | -0.5 | -2.0 |

| Industrials | -14.4 | -14.3 | -2.9 | -2.7 | 2.5 | 1.6 |

| Energy | -23.9 | -23.6 | -11.2 | -11.3 | -1.8 | -3.5 |

The comparison shows that the annual changes in 2024 remained substantially stable between the two scenarios. Industrial commodity prices show a less downward trend in the last scenario (-2.7%) compared to the previous one (-2.9%). However, as regards 2025, growth is less intense than in the previous scenario.

As regards energy commodities, prices are expected to decrease also in 2025. The effect of the tensions due to the Israeli-Palestinian conflict seems limited for the moment.

1. The global industrial cycle index is constructed by purifying the actual dynamics of industrial production from its trend. Since the supply of commodities tends to vary according to long-term economic growth expectations, while the demand for commodities is more linked to actual cyclical uses, the global industrial cycle index tends to reproduce the conditions of tension between demand and supply on the commodity market: when it increases, it means that the demand for commodities increases more than the supply; vice versa when it decreases.

2. The PricePedia Industrials index results from the aggregation of the indices relating to the following product categories: Ferrous, Non-Ferrous, Wood and Paper, Chemicals: Specialty, Organic Chemicals, Inorganic Chemicals, Plastics and Elastomers and Textile Fibres.

3. The PricePedia Total Commodity index results from the aggregation of the indices relating to industrial, food and energy commodities. Pasquale Marzano

Economist and data scientist. At PricePedia he deals with the analysis of commodity markets, forecasting models for raw material prices and management of reference databases.