Gold and steel at antipodes

Financial markets take refuge in gold as weak Chinese demand penalises ferrous metals

Published by Luca Sazzini. .

Conjunctural Indicators Commodities Financial WeekMonetary Policy

This week, the governing council of the ECB has confirmed the maintenance of current interest rates: the DFR1 will remain at 4% and the MRO2 at 4.5%.

The decision of the governing council was in line with the forecasts of analysts, who continue to expect a first rate cut in June 2024. As already anticipated last week, the importance of the March 7th meeting was not so much for the confirmation of the predictable maintenance of interest rates, but for the verification of the change in communication by the ECB. During the press conference, a first openness to a possible future rate cut emerged. President Lagarde stated that, although an immediate rate cut was not discussed, the council has begun discussions for a future scaling back of restrictive monetary policy.

The reason preventing the ECB from implementing an immediate rate cut lies in the current lack of data that ensures a return of inflation to 2%. The ECB's approach remains heavily data-dependent, which will be crucial to confirm the rate cut expected for June.

Currently, the ECB expects the average annual inflation rate to reach 2.3% in 2024, 2% in 2025, and 1.9% in 2026. The predicted economic growth for the eurozone is 0.6% in 2024, 1.5% in 2025, and 1.6% in 2026.

In light of this data, analysts expect 3 possible 25 basis points rate cuts by the end of this year, with some possibilities of even a fourth cut.

The US Employment Report

This week, new data regarding non-farm payroll in the United States has been released.

In February, the United States managed to create 275,000 new jobs, above the expected 200,000. However, this improvement is tempered by a rise in the unemployment rate, which increased to 3.9% from January's 3.7%.

The average hourly wage increased "only" by 0.1%, below analysts' expected 0.2% and significantly down from January's figure (0.5%). The data also reveals a significantly low labor market participation rate, which will encourage employers to avoid further wage increases. Overall, despite a significant increase in jobs, rising unemployment and weak wage growth suggest the beginning of a labor market cooling.

These data are consistent with a possible rate cut by the Fed in June 2024.

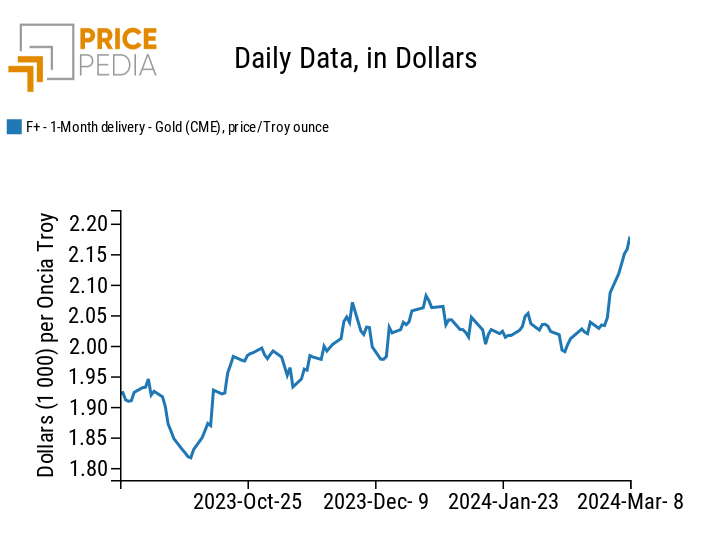

Recent Gold Price Dynamics

The news of a possible rate cut by the Federal Reserve, as early as June 2024, has accentuated the upward trend in gold prices, which in recent months, due to the current geopolitical crisis, had already sharply increased. Unlike other assets, it is not uncommon for gold to register significant price increases during periods of increased uncertainty. Gold is indeed considered a safe haven asset, and in the current scenario of macroeconomic weakness, its demand has greatly increased. In particular, the People's Bank of China has long started to increase its demand for gold due to the economic weakness of the Chinese market. In this scenario, gold has recorded a further rise due to the approaching rate cuts by both the Fed and the ECB, which according to the market, should both make a first rate cut in June 2024.

Below is the price dynamics of gold, which this week reached new all-time highs.

Gold Spot Price quoted on the Chicago Mercantile Exchange (CME)

Commodity Prices

Except for the rising trend in gold prices, the trends of other commodities continue to remain relatively downward. The greatest reductions concern ferrous prices, driven by the weakness in Chinese demand. Prices of foodstuffs continue to follow different trends mainly driven by meteorological phenomena.

[1] Deposit Facility Rate (DFR) is the interest rate at which banks can deposit funds with the central bank.

[2] Main Refinancing Operations (MRO) is the interest rate at which banks can borrow funds from the central bank on a weekly basis.

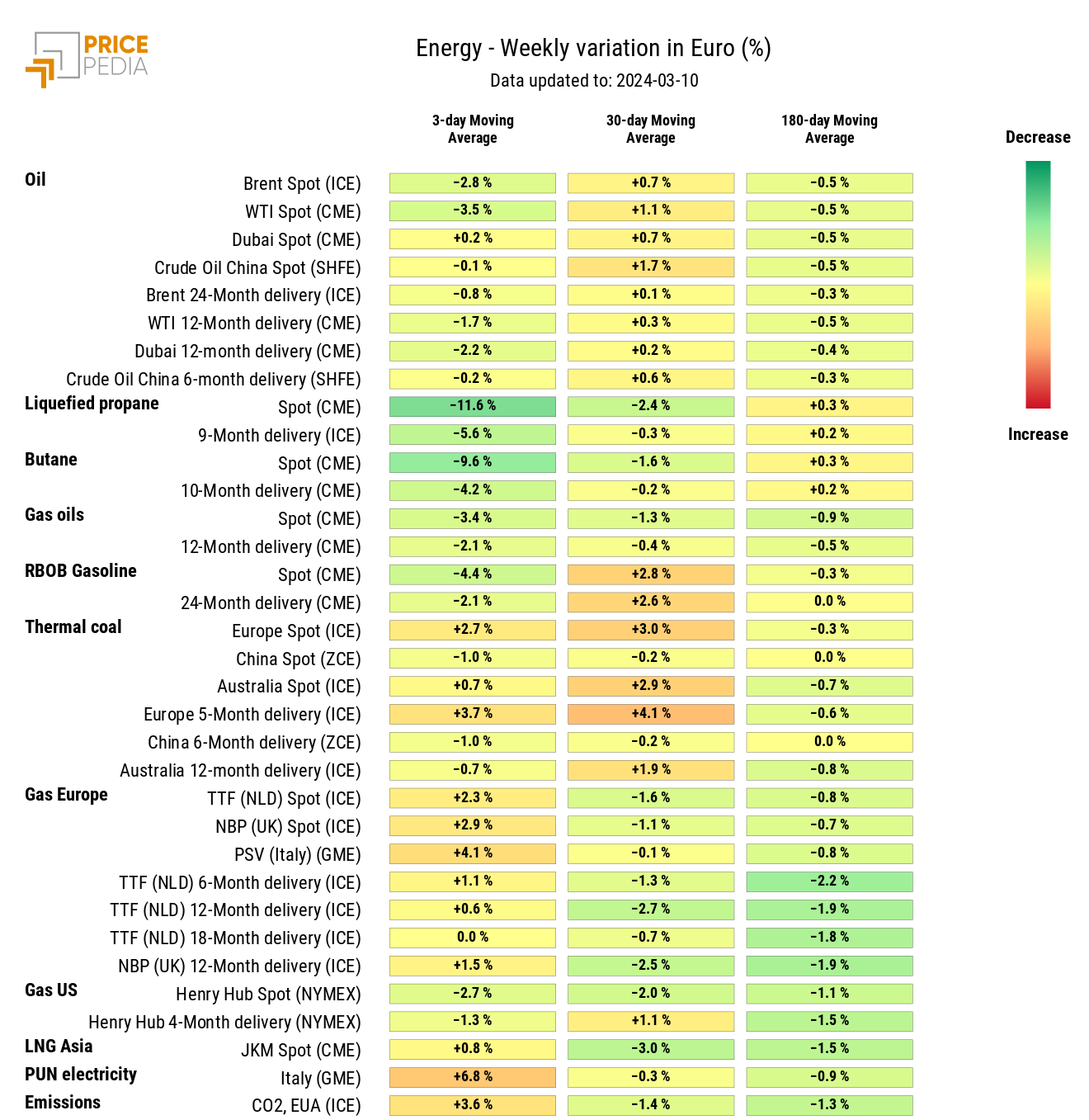

ENERGY

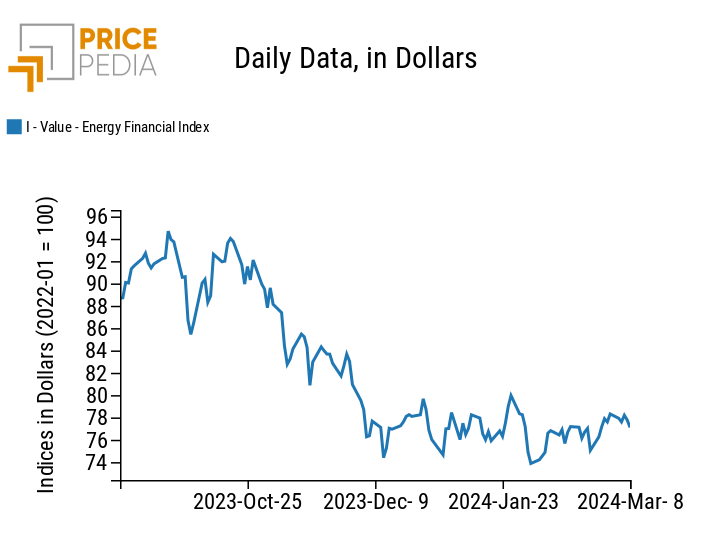

The financial index of energy products continues to remain characterized by high volatility and registers oscillations of opposite signs even this week.

PricePedia Financial Index of energy prices in dollars

From the energy heatmap, there is a growth in gasoline, thermal coal, and natural gas prices, alongside a fall in liquefied propane prices. The TTF price (Netherlands), the main reference point for European natural gas, remains slightly above 25 euro/MWh and despite recent declines, it continues to record a positive three-day moving average weekly change.

The Brent price, on the other hand, remains stable despite OPEC's decision to extend current production cuts until the second half, and the partial suspension of the Keystone pipeline by TC Energy Corp.

HeatMap of energy prices in euros

PLASTICS

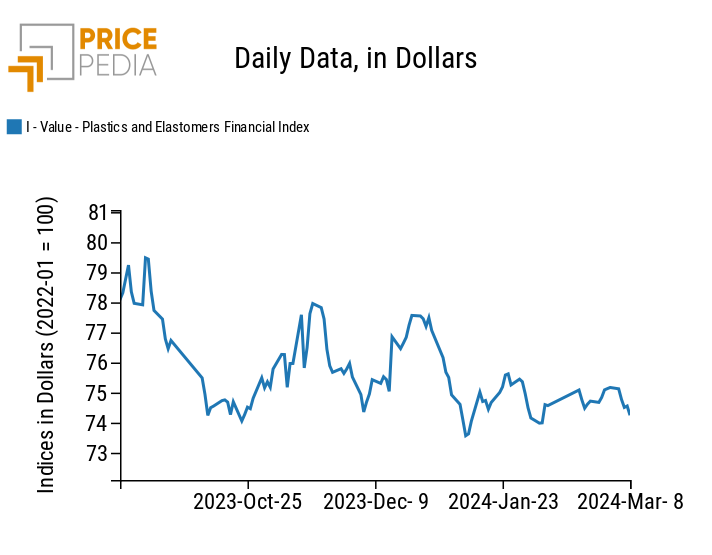

This week, the financial index of plastics quoted in China has experienced a slight downward flexion.

PricePedia Financial Index of dollar prices of plastic materials

FERROUS

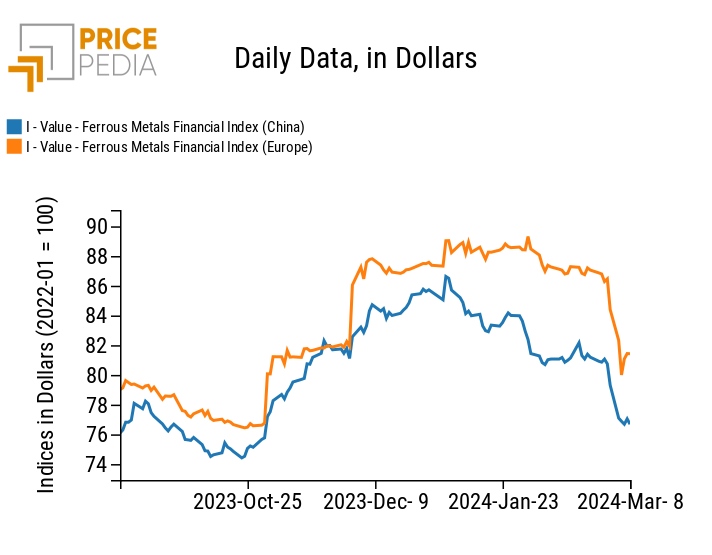

This week, the decreasing trend of the two ferrous indices has been strongly accentuated, recording significant price declines. The price decline continues to be attributable to an oversupply primarily caused by the weakness of Chinese demand for ferrous metals.

In the last days of the week, there is a weak recovery in the two indices, more pronounced for the European index.

PricePedia Financial Indices of dollar prices of ferrous metals

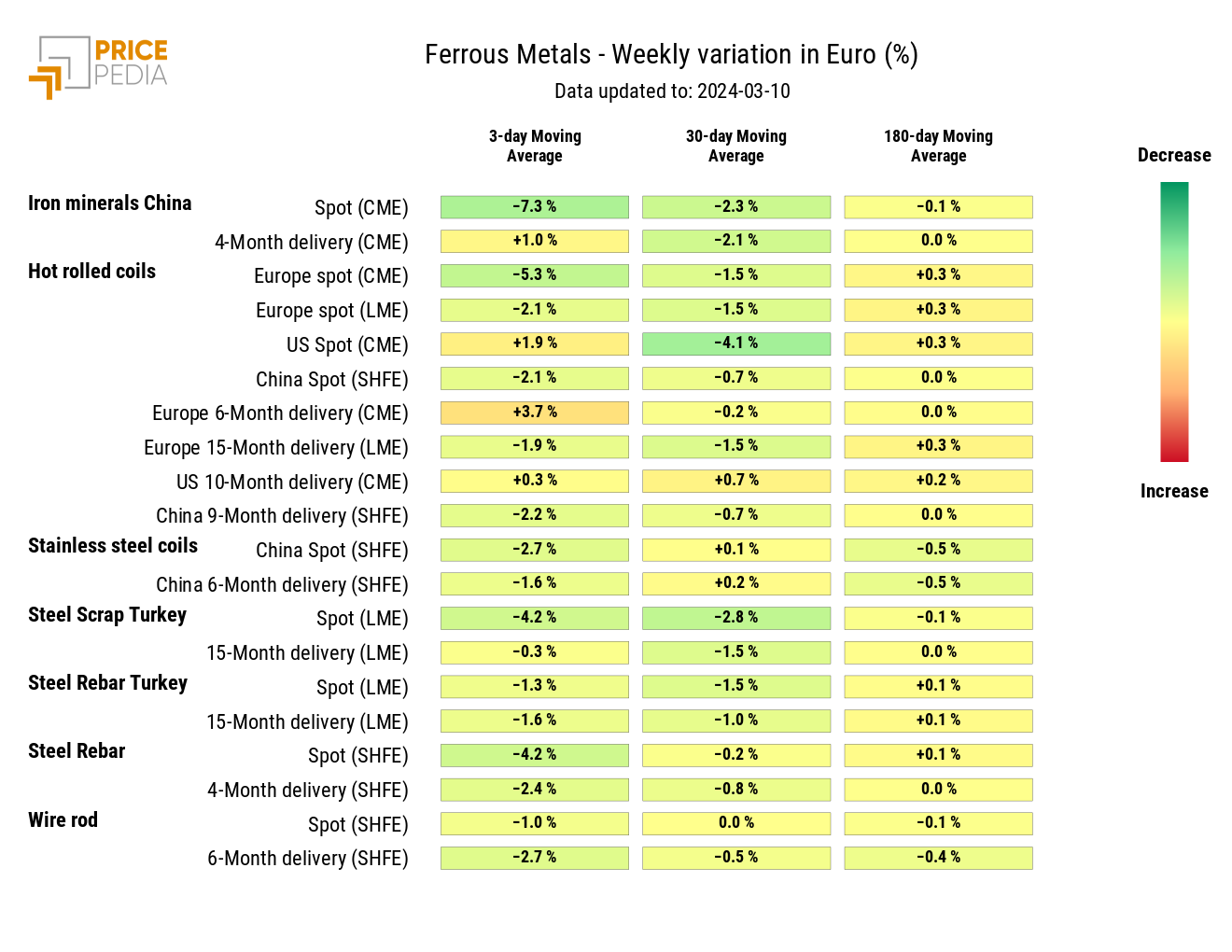

The following heatmap provides an overview of the price trends in euros for ferrous metals.

The heatmap shows generalized price reductions for ferrous metals: from iron ore to coils; from Turkish steel scraps to steel bars.

HeatMap of Ferrous Metal Prices in euros

INDUSTRIAL NON-FERROUS

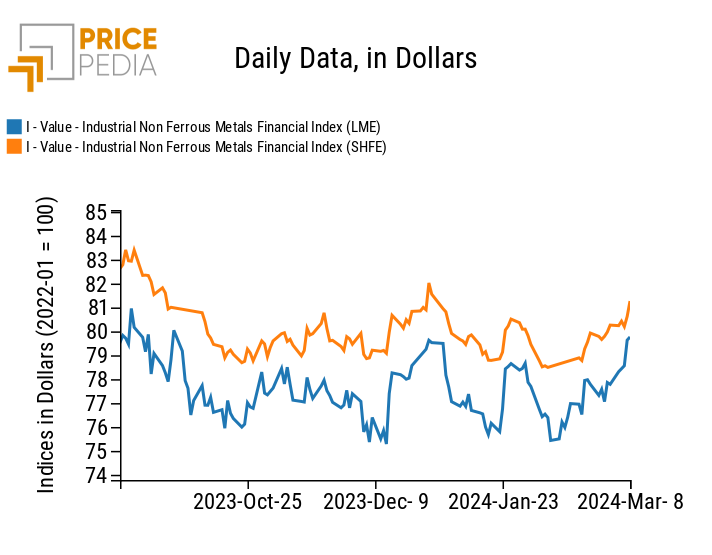

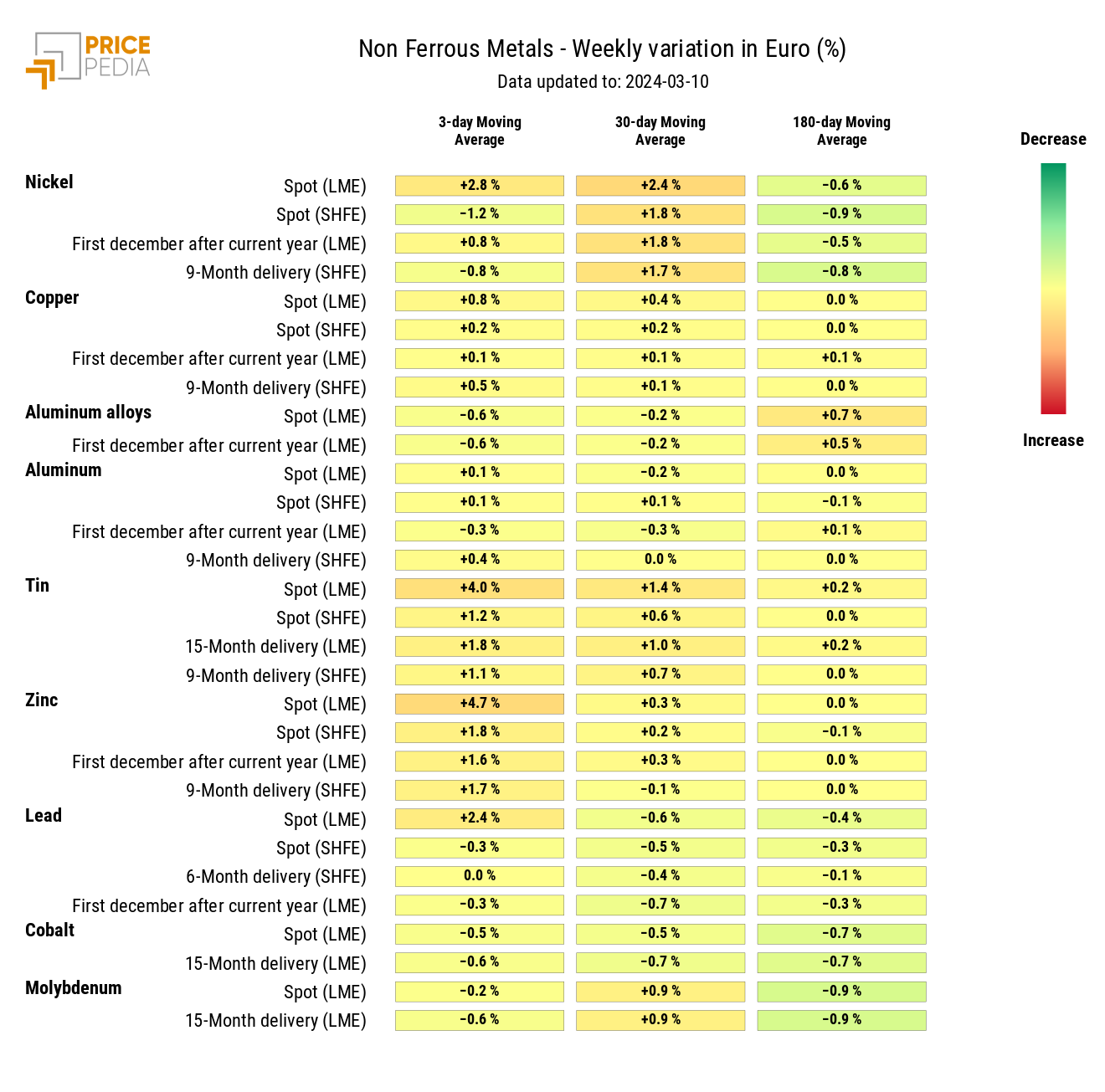

The indices of industrial non-ferrous prices show a weekly growth that was more pronounced in the LME (London Metal Exchange) market than in the SHFE (Shanghai Futures Exchange).

PricePedia Financial Indices of dollar prices of industrial non-ferrous metals

The non-ferrous metals heatmap shows a general but contained increase in non-ferrous metals quoted on the London Metal Exchange.

The two non-ferrous prices that record the most intense weekly increase in the three-day moving average are tin and zinc.

HeatMap of industrial nonferrous metal prices in euros

FOODSTUFFS

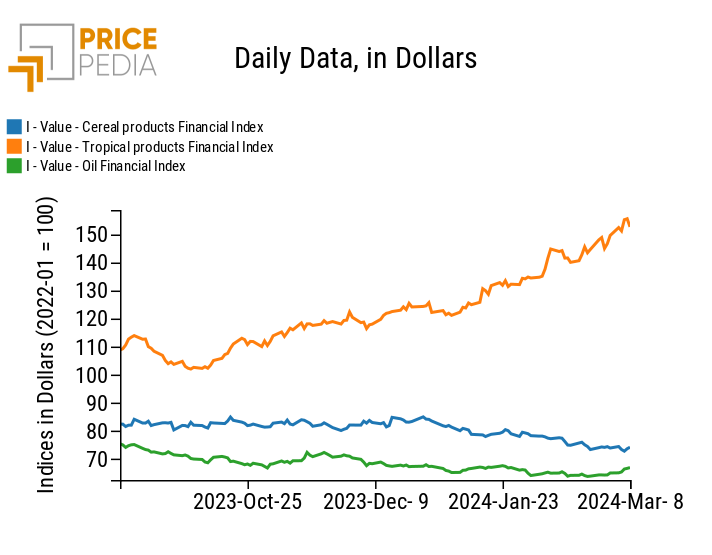

Foodstuff indices continue to exhibit diametrically opposed dynamics.

While the cereal index continues its downward phase, the tropical and oil indices record price increases.

PricePedia Financial Index of Dollar Prices for Foodstuffs

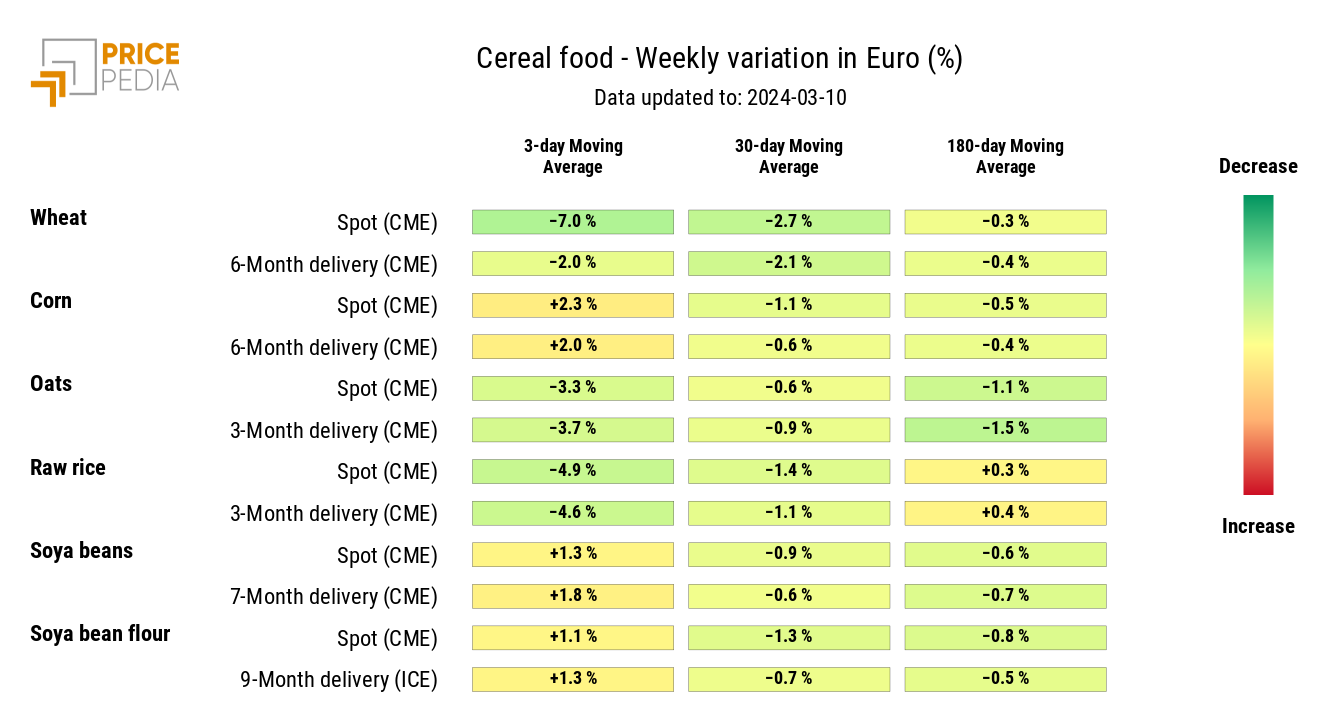

CEREALS

The cereal heatmap signals a sharp decline in wheat prices, followed by a milder decrease in oat prices.

HeatMap of Cereal Prices in euros

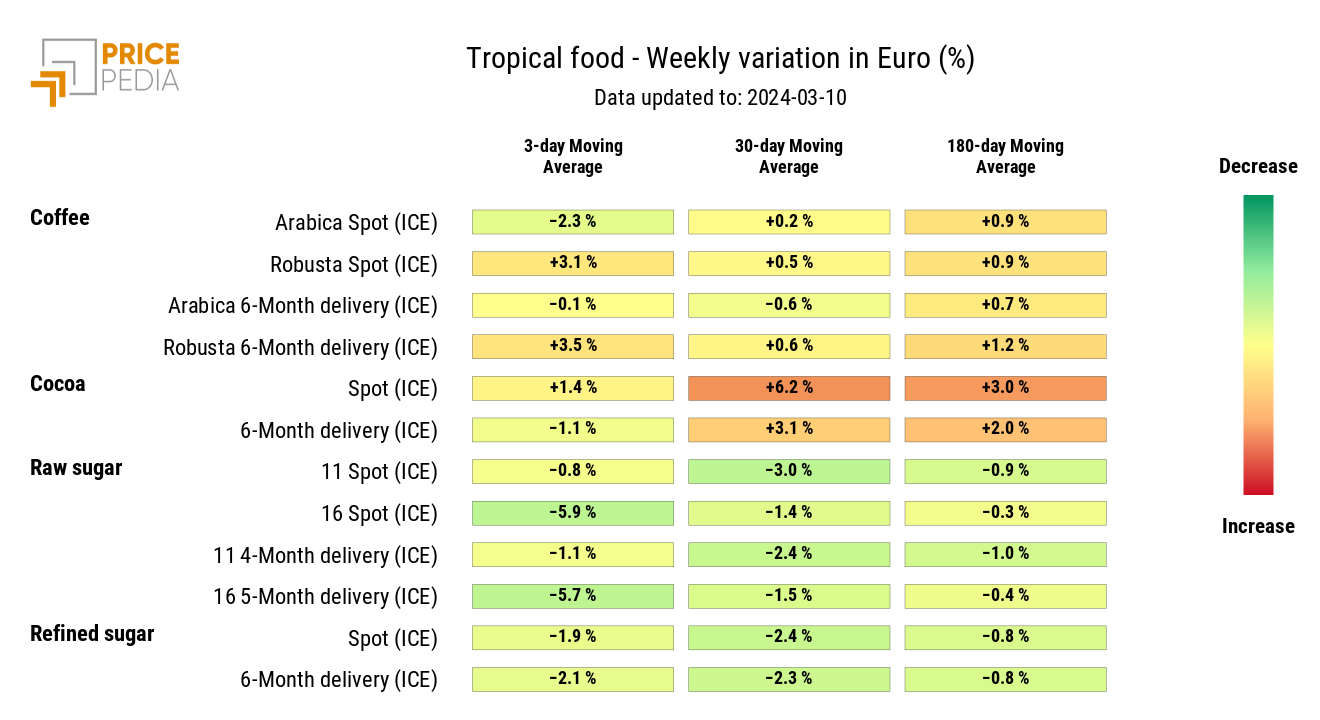

TROPICAL

The tropical heatmap signals an increase in robusta coffee and cocoa prices, alongside reductions in sugar prices.

HeatMap of Tropical Food Prices in euros