Less Negative Industrial Cycle and Differentiated Growth for Commodity Prices in the Next Two Years

PricePedia Scenario March 2024

Published by Pasquale Marzano. .

Last Price Energy Food Hot-Rolled Coils basic thermoplastics Forecast

The PricePedia Scenario has been updated with information available as of March 8, 2024 and highlights a relatively less penalized economic cycle for 2024 compared to the previous year.

The latest data show a slowdown in inflation in the Eurozone, on an annual basis, from 2.8% in January to 2.5% in February. Although the ECB remains cautious about a reversal in monetary policy trends, analysts expect rate cuts to begin in June of this year (see Gold and steel at antipodes), laying the groundwork for a significant recovery in a new global economic cycle.

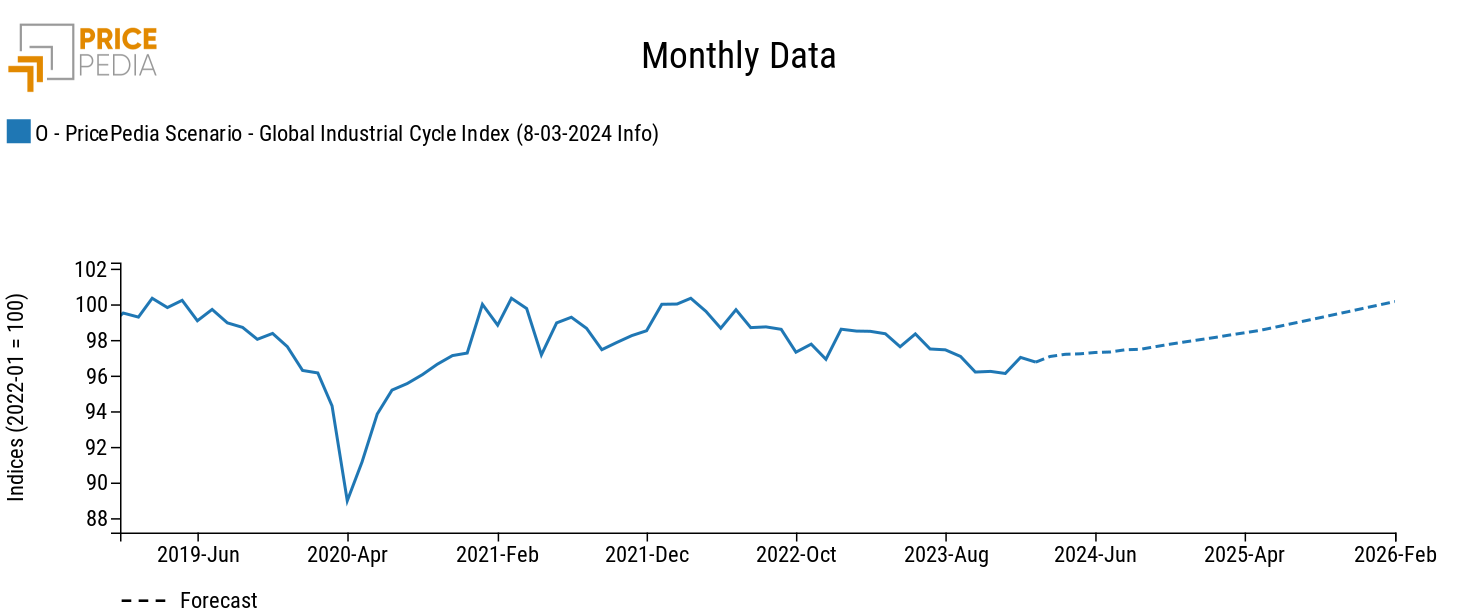

The following graph illustrates the forecast scenario of the global industrial cycle index[1] elaborated by PricePedia.

The graph shows how the beginning of 2024 has led to a recovery in the industrial cycle compared to the lows of the last months of 2023. On average for 2024, the values are in line with those of 2023 (-0.2% on an annual basis), with a slight monthly upward trend. In 2025, annual growth is +1.5%, bringing the index around the highs of March 2021 by the end of the forecast period.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Commodity Price Forecast

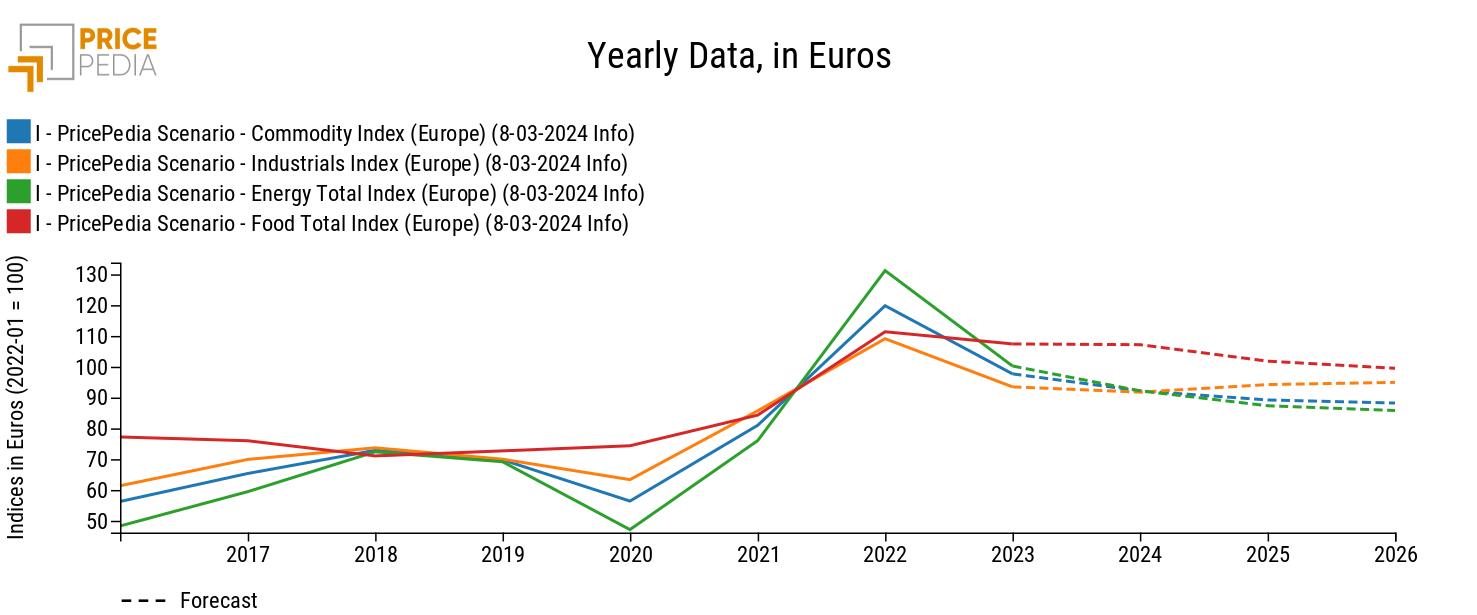

In order to highlight how the dynamics of the global industrial cycle influence commodity prices, the 24-month scenario for prices of the main commodity categories (Industrial[2], Total Commodities[3], Energies, and Food) is illustrated below.

As observed from the graph, although all indicators show reductions compared to 2023 values, it is evident that prices are expected to remain high. In no case is there a return to, not even near, 2019 levels.

Regarding Food commodities, they show relative stability in 2024, with values not far from those of the 2022-2023 biennium. In 2025, a more pronounced reduction of -5% on an annual basis is observed (resulting in prices being +21% higher compared to the 2021 average).

As for industrial commodities, the trend is more in line with that of the industrial cycle, with a reduction in 2024 (-1.8% compared to 2023) and a higher growth in 2025 (+2.7%).

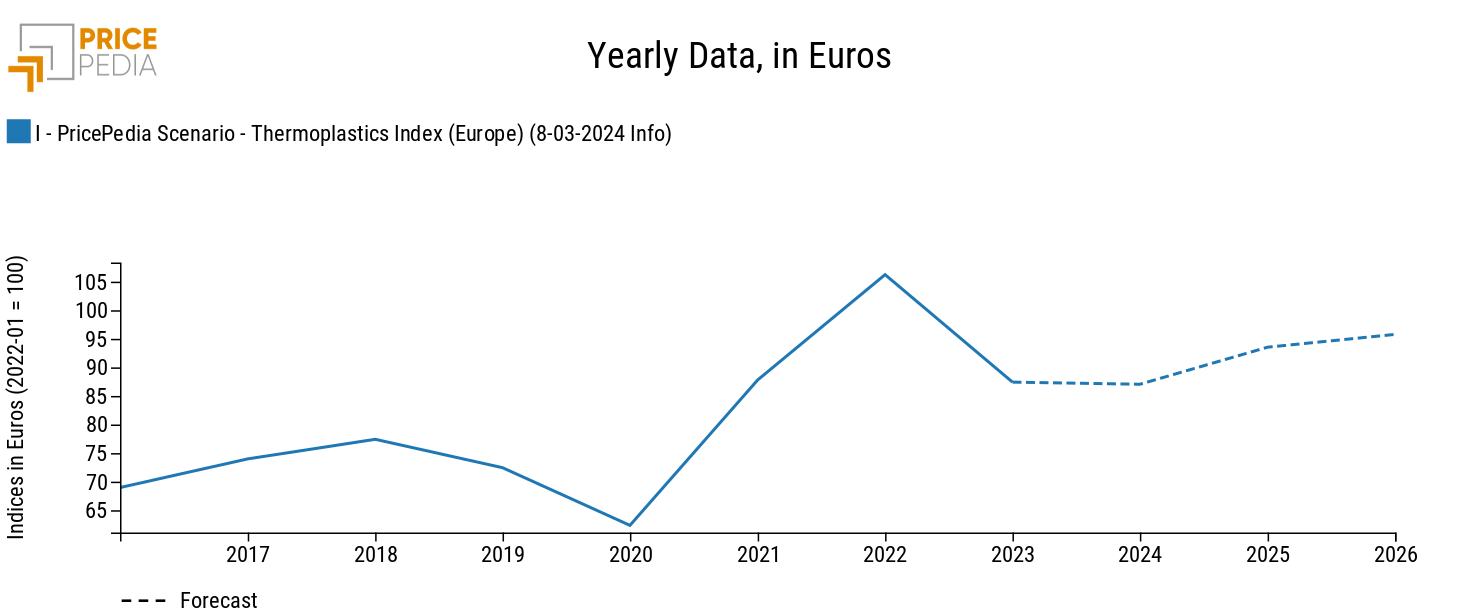

Within industrial commodities, there are significant differences in dynamics depending on the specific category. Two illustrative cases are reported below: on one hand, the aggregate index of thermoplastics supported by the dynamics of the global industrial cycle, on the other hand, the index of hot-rolled steel coils influenced by decreases in raw material costs (especially iron ore).

Aggregated indices forecasts, in euros (2022-01 = 100)

Thermoplastics

Hot Rolled Steel Coils

After a relatively stable 2024, thermoplastic prices are forecasted to grow by +7.5% annually in 2025, stabilizing above 2021 levels. Conversely, the prices of steel coils are marked by a decreasing trend in both 2024 and 2025. However, even for coils, the price levels in 2025 will be higher than those of 2021.

1. The global industrial cycle index is constructed by purifying the actual dynamics of industrial production from its trend. Since the supply of commodities tends to vary according to long-term economic growth expectations, while the demand for commodities is more linked to actual cyclical uses, the global industrial cycle index tends to reproduce the conditions of tension between demand and supply on the commodity market: when it increases, it means that the demand for commodities increases more than the supply; vice versa when it decreases.

2. The PricePedia Industrials index results from the aggregation of the indices relating to the following product categories: Ferrous, Non-Ferrous, Wood and Paper, Chemicals: Specialty, Organic Chemicals, Inorganic Chemicals, Plastics and Elastomers and Textile Fibres.

3. The PricePedia Total Commodity index results from the aggregation of the indices relating to industrial, food and energy commodities. Pasquale Marzano

Economist and data scientist. At PricePedia he deals with the analysis of commodity markets, forecasting models for raw material prices and management of reference databases.