The "stop and go" of commodity prices continues

Global growth expectations are slowly improving but inflation is not yet fully tamed

Published by Luca Sazzini. .

Conjunctural Indicators Commodities Financial WeekMonetary Policy

The American economy continues to surprise with its resilience to the global economic downturn. The recent Summary of Economic Projections1 has revised upwards the forecasts for the American economy regarding GDP and the core deflator, while also downsizing the projections for the unemployment rate[2].

The FOMC meeting on March 19-20 has confirmed analysts' expectations of maintaining current interest rates in the United States.

During the press conference, Chairman Powell maintained an accommodative tone, not expressing particular concern about the unexpected rise in US core inflation, which could be due to seasonal effects. The Fed seems to confirm its intention to carry out 3 cuts of 25 basis points by the end of the year. However, Chairman Powell emphasized that the evolution of monetary policy will certainly depend on the inflation rate data, and it will not be possible to cut interest rates unless there is confidence that inflation will move substantially towards 2%. Except for specific unforeseen inflation shocks, the market continues to expect a first rate cut starting from June 2024.

Global Industrial Production

From the new data on flash estimates of the European composite PMI, it emerged that the eurozone economy almost stabilized in the month of March. The estimate of the composite PMI rose from 49.2 to 49.9, moving only one decimal point away from the 50-point threshold, which represents the dividing line between economic growth and contraction. The increase in the composite PMI is mainly attributable to the services sector, whose PMI increased from 50.2 to 51.1. On the other hand, the manufacturing sector continues to suffer, recording a contraction for the twelfth consecutive month.

Another emerging data concerns the possible decline in the cost of services and producer prices in March. This latter data could be particularly important to further confirm that the first rate cut by the ECB will take place in June 2024.

Remaining within the industrial production scope, new data on the Chinese economy has emerged this week. According to the Chinese Bureau of Statistics, industrial production increased by 7% on an annual basis in the month of February. The higher-than-expected figure is mainly attributable to the acceleration of general production, especially in the private industries and the electronics sector. There is also an increase in nominal fixed investments which, in February, rose by 4.2% on an annual basis.

In the first two months of the year, the contraction in the real estate sector investments decreased to -9% year-on-year compared to the -11% year-on-year recorded in the last two months of the previous year. This data continues to indicate a critical situation in the Chinese economy, which is, however, slowly improving.

Commodity Markets

Uncertainty about the intensity of the slowdown in inflation in industrialized countries and about the actual weakness of the global economic cycle is reflected in commodity prices and quick profit-taking after short-term trend periods recorded by prices. In the past week, in fact, the prices of some commodities have shown oscillations contrary to what appeared to be ongoing trends. This aspect has mainly affected the metals family: ferrous metals have interrupted their downward price trend, while non-ferrous metals recorded a decline at the beginning of the week, contrary to their previous upward trend.

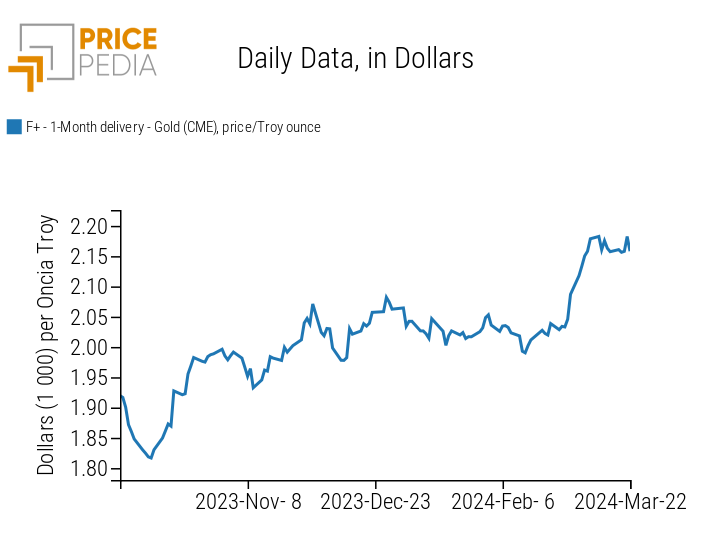

Even the price of gold has interrupted its growth phase, without registering significant movements in the opposite direction. The uncertainty about the price of gold stems from investors' fears that the Federal Reserve would only implement 2 cuts of 25 basis points by the end of the year (due to last week's inflation data), but after Powell's accommodative stance, they have been reassured.

Below is the historical series of gold prices, quoted on the Chicago Mercantile Exchange (CME).

Spot Price of Gold quoted on the Chicago Mercantile Exchange (CME)

[1] Report prepared by the Federal Reserve on forecasts of key macroeconomic indicators.

[2] For 2024, GDP growth has been revised from 1.4% to 2.1%, for 2025 from 1.9% to 2%, and for 2026 from 1.9% to 2%.

The core deflator for 2024 has been revised upwards to 2.6% (from the previously estimated 2.4%), while the estimates for 2025 (2.2%) and 2026 (2%) remain unchanged.

The unemployment rate for 2024 and 2026 has been lowered from 4.1% to 4%, while the estimate for 2025 is maintained at 4.1%.

ENERGY

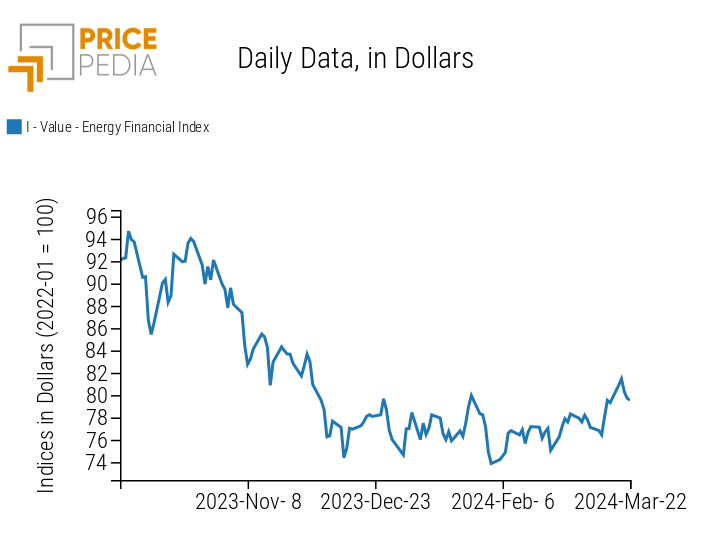

This week the financial index of energy products has recorded short-term fluctuations caused by the recent Ukrainian attacks on Russian oil refineries. After this bullish start, due to the temporary increase in oil prices, the energy index has undergone a correction that has lowered the price level again.

PricePedia Financial Index of Energy Prices in Dollars

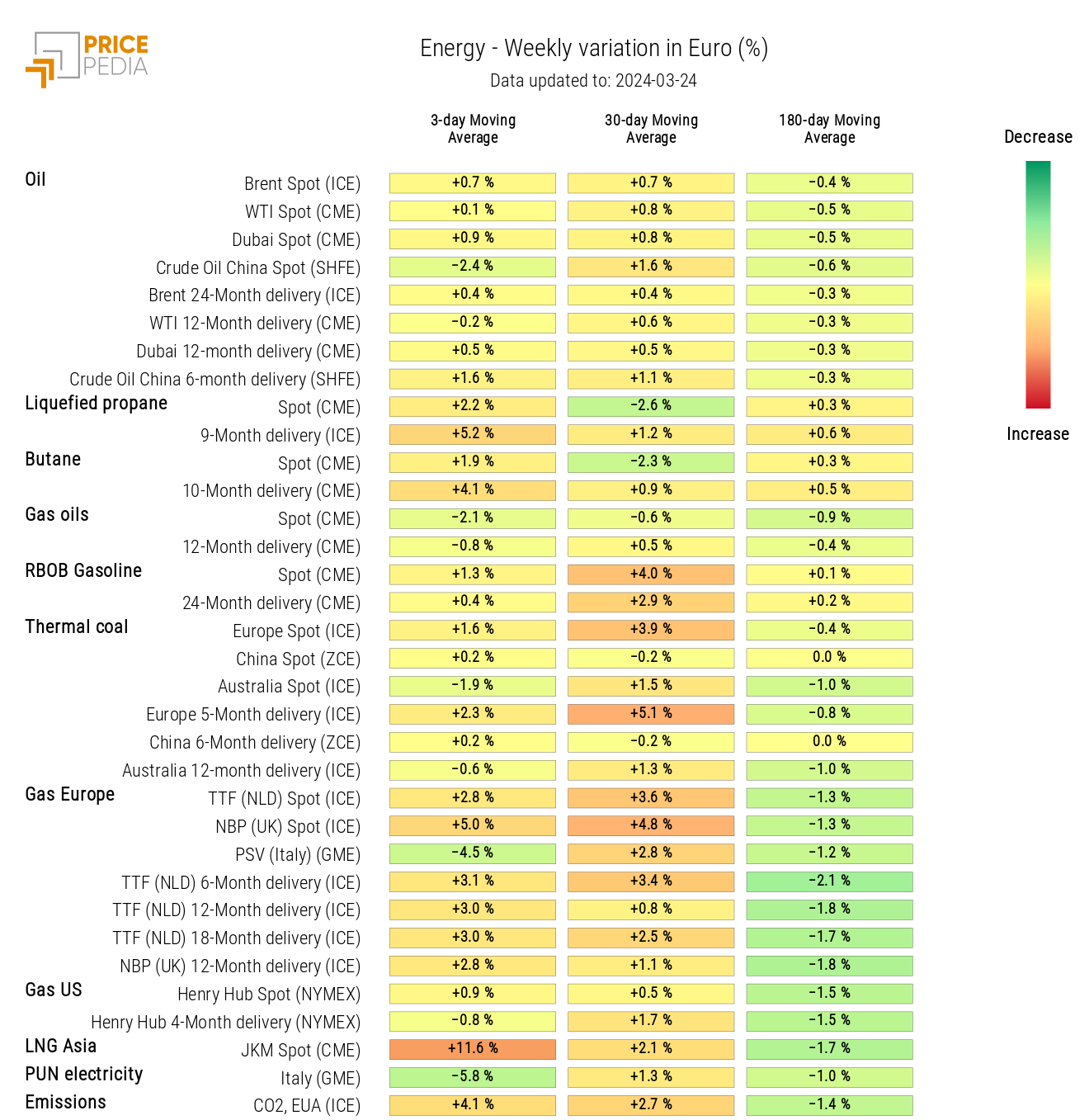

The heatmap of energy products indicates a more pronounced increase in gas prices and some petroleum derivatives (propane and butane).

Despite the rise at the beginning of the week, Brent prices do not show a significant increase, as they returned to decline as early as Wednesday and by the end of the week approached the level of $85/barrel.

HeatMap of Energy Prices in Euros

PLASTICS

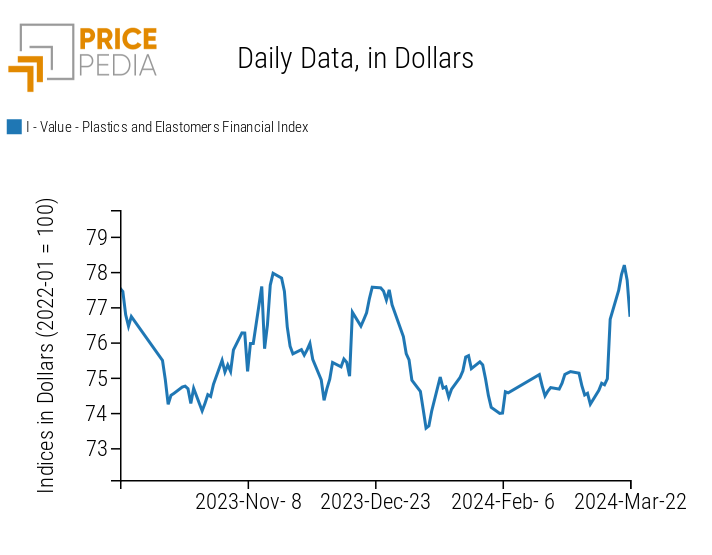

The financial index of plastics listed in China remains characterized by a positive trend but concludes this week with a downward correction.

PricePedia Financial Index of Plastic Prices in Dollars

FERROUS

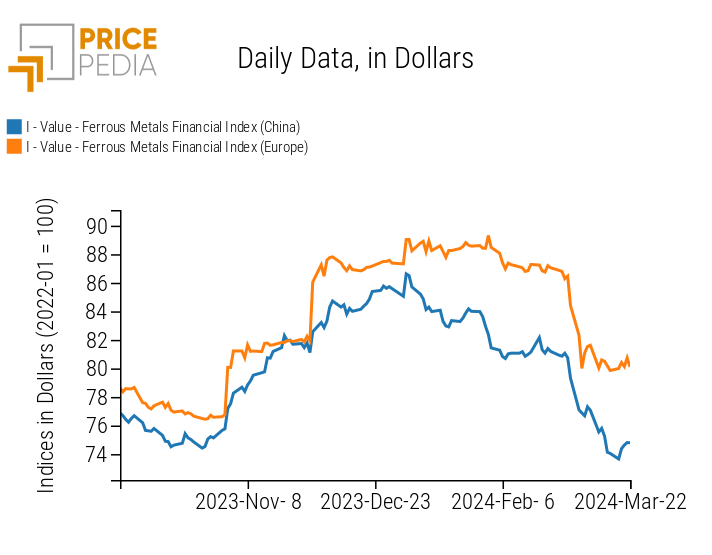

This week the two indices of ferrous metals have interrupted their declining price trend. In particular, the China ferrous index, which has experienced a more intense decline recently, has undergone a slight increase over the past week.

PricePedia Financial Index of Ferrous Metal Prices in Dollars

NON-FERROUS INDUSTRIAL

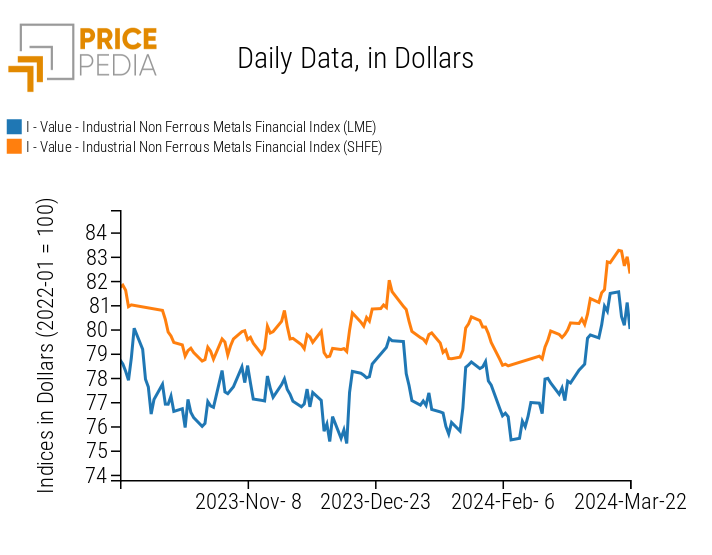

This week the two indices of non-ferrous metals recorded a significant decline, contrary to the dynamics of the previous weeks.

PricePedia Financial Index of Industrial Non-Ferrous Metal Prices in Dollars

From the heatmap of industrial non-ferrous metals, there is a decrease in lead and nickel prices, mainly occurring in the early days of the week.

HeatMap of Industrial Non-Ferrous Metal Prices in Euros

FOOD

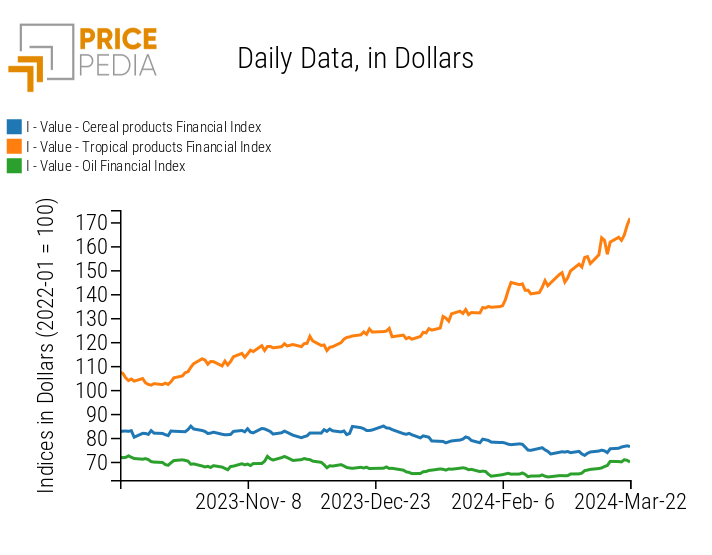

This week the financial index of tropical foods continues its upward price trend, driven by concerns about upcoming weather forecasts.

The financial index of edible oils continues to show an increasing trend but begins to undergo small downward corrections.

The financial index of cereals, on the other hand, begins to deviate from its recent downward trend, recording a price increase.

PricePedia Financial Index of Food Prices in Dollars

CEREALS

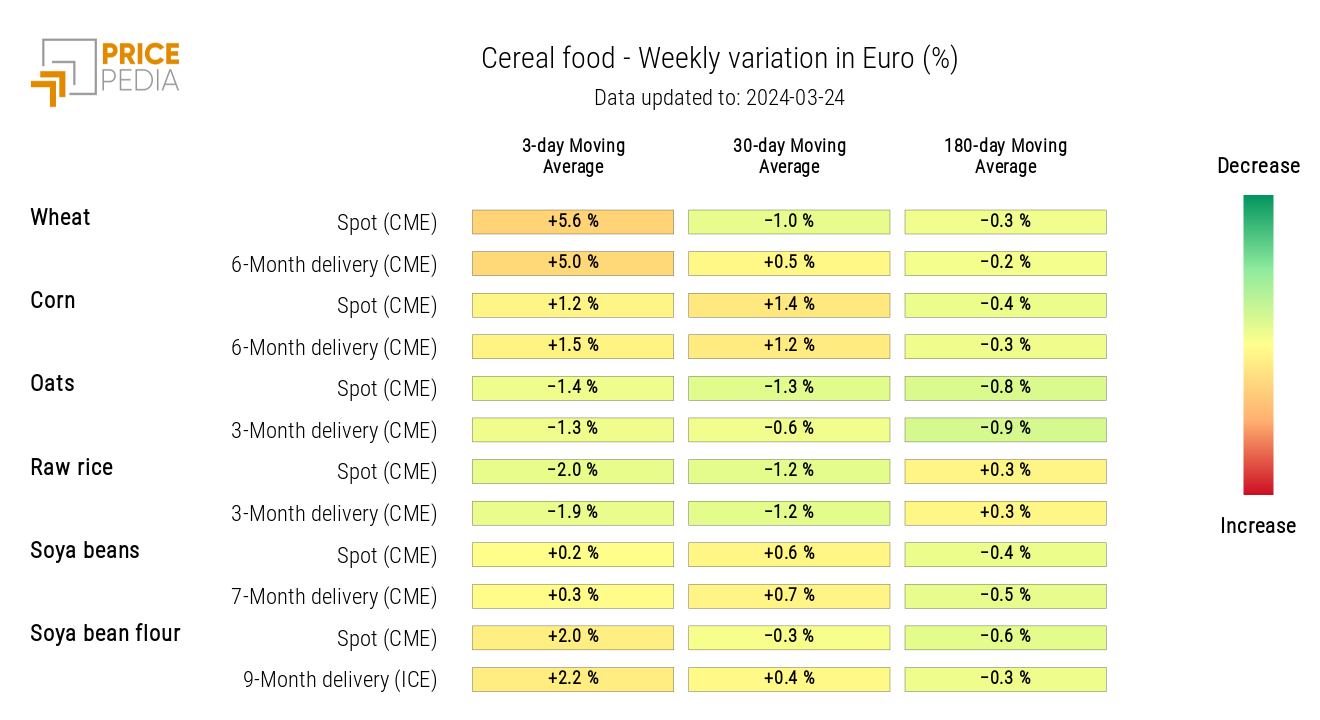

The cereal heatmap indicates an increase in wheat, corn, and soybean prices, while oat prices have decreased.

HeatMap of Cereal Prices in Euros

TROPICAL

The tropical food heatmap continues to show an increase in cocoa prices.

HeatMap of Tropical Food Prices in Euros

"

"