Cobalt Criticality in the EU Market

Cobalt is one of the most critical raw materials for the European Union

Published by Luca Sazzini. .

Non Ferrous Metals Critical raw materialsIn recent years, the issue of security in raw material supply has become crucial for the European Union. In the Raw Materials Act of 2023, the EU outlined a series of actions aimed at reducing its vulnerability to so-called "critical" raw materials for the European economy. As described in Critical Raw Materials: the Importance of Substitute Goods, this criticality is assessed according to two parameters: economic importance and supply risk. An important role in determining the criticality of a raw material is also given by the presence or absence of effective substitute goods at a relatively low price.

A first example of a raw material that the European Union considers highly critical is cobalt. In this article, we will delve into the topic of cobalt criticality in the European market and analyze the dynamics of cobalt prices in the financial market and the physical EU market.

Main Uses of Cobalt

Global Uses

Globally, cobalt is primarily used in the production of lithium-ion batteries, used in portable electronic devices, energy storage systems, and electric vehicles (EVs). From 2013 to 2020, the percentage of cobalt consumption destined for lithium-ion batteries has increased significantly, rising from 44% to 57%. Other uses of cobalt include:

- Superalloys, mainly used in turbine engine components (13% of global consumption);

- Hard materials, used in carbides for cutting tools (8%);

- Pigments, used for coloring glass and ceramics and for paints (6%);

- Catalysts, for petroleum refining and plastics production (5%);

- Magnets, used in electric motors and speakers (4%);

- Tire adhesives and paint dryers (2%);

- Minor end uses, including food products, biotechnology, medicine, and electronics (5%).

Uses in the European Market

In the European Union market, the main uses of cobalt differ significantly from those in the rest of the world. For example, the percentage of cobalt destined for batteries and magnets is drastically lower, at 3% and 6%, respectively, as such productions mainly occur outside the EU. Other uses within the EU market include superalloys (36%), dissipative uses1 (29%), hard metals (14%), and catalysts (12%).

Cobalt Criticality in the EU Market

In the analyses developed by the European Commission, cobalt appears to be a highly critical commodity both for its economic importance and supply risk.

Its economic importance derives from the numerous industrial applications previously described, while the supply risk is due to Europe's strong dependence on imports of cobalt from foreign countries, particularly the Democratic Republic of the Congo.

Currently, cobalt extracted from the European Union comes almost exclusively from Finland and represents only 1.1% of global cobalt production, significantly lower than the percentage extracted from the Democratic Republic of the Congo (67%).

In addition to this dependence, another issue that has increased the criticality of cobalt is related to its low substitutability. Cobalt possesses unique chemical and physical properties such as high resistance to corrosion, temperature, and wear. Trying to replace cobalt with another material within a production process can therefore lead to a reduction in the performance of the final product.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Cobalt Market

Financial Market

Within financial markets, cobalt is traded in the form of cathodes, ingots, and briquettes. The main reference price for all these forms of cobalt is published by the London Metal Exchange (LME).

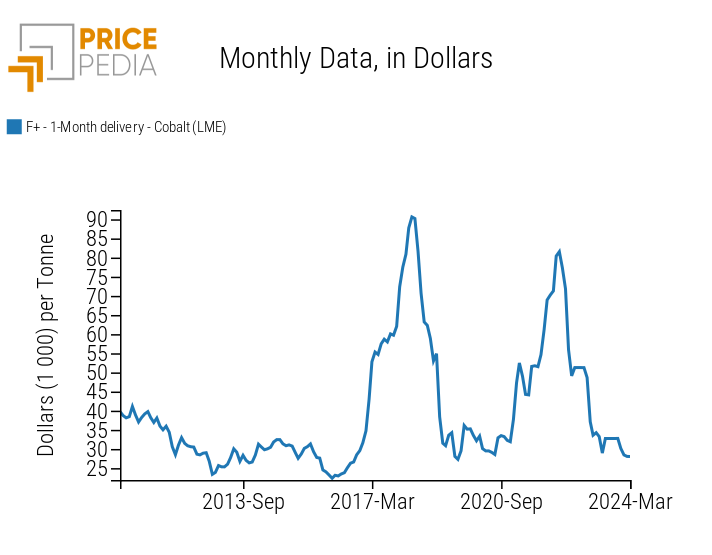

Spot Price of Cobalt, quoted on the London Metal Exchange (LME)

From the analysis of the historical price series, 2 price cycles of LME cobalt emerge.

The first cycle begins with the price growth from the second half of 2016 to the first quarter of 2018, during which cobalt prices increased from a value of $23,800/ton to over $90,000/ton, with an increase of almost 300%.

After this strong increase due to market expectations related to the growing demand for cobalt for electric vehicle (EV) batteries, there was an equally sharp price decline that brought LME cobalt prices back to the same pre-growth values.

The second price cycle begins with the growth in 2021, attributable again to the development of the electric vehicle (EV) market, and ends with the price collapse in 2022, generated by oversupply and slowing demand for electric vehicles. Since then, cobalt prices have not risen significantly and currently stand at around $28,000/ton. However, it is expected that in the coming years there will be a new phase of cobalt price growth due to the energy transition.

European Customs Market

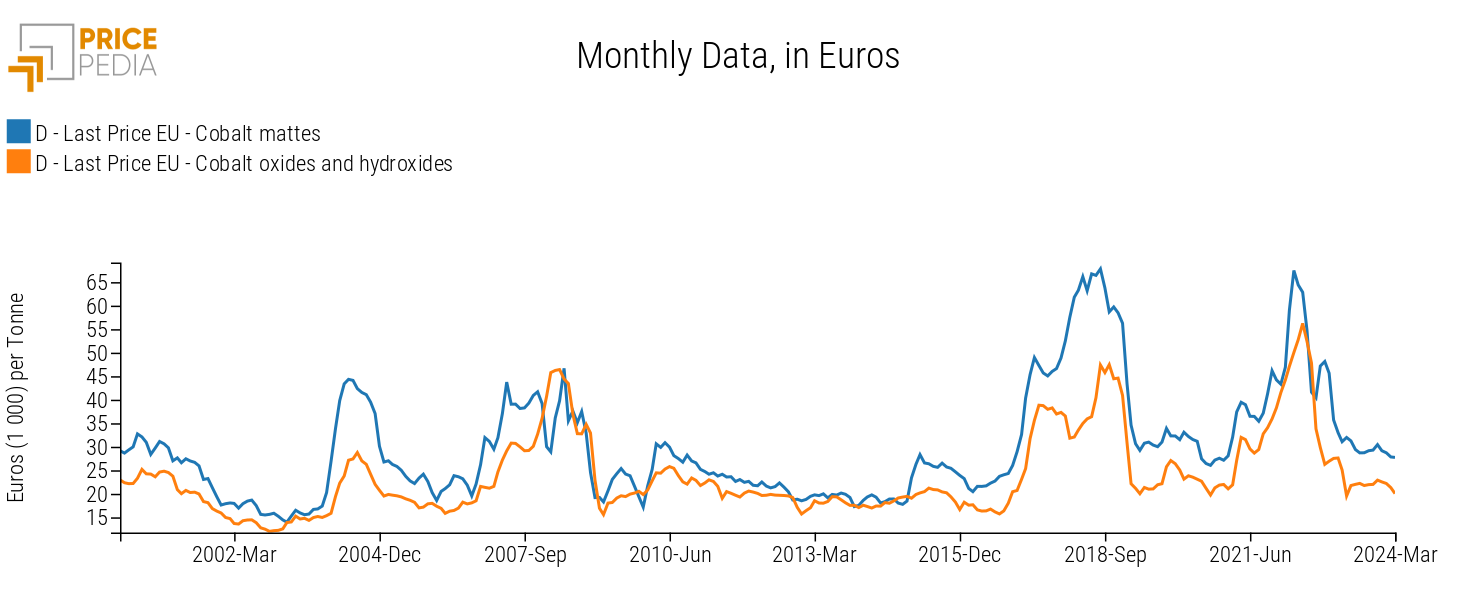

Within the European customs market, there are two different prices for non-mining cobalt: cobalt metal and cobalt oxides and hydroxides.

European Customs Prices of Non-Mining Cobalt

The historical price series collected at the customs of the 27 European Union countries indicate that cobalt prices, although characterized by different levels, maintain the same dynamics previously observed for LME prices.

Conclusions

From the analysis conducted, the high criticality of cobalt within the European market has emerged due to both its economic importance and supply risk. Europe has been trying for some time to find a substitute for cobalt, but this challenge is not at all simple given the unique properties of this product.

From the historical series of financial and customs prices, it emerged that cobalt had two important price cycles, both initiated by the growth in demand for electric vehicle batteries. When the EV market, however, began not to meet expectations, cobalt prices returned to their original levels, canceling out the previously recorded growth. After the two recent price cycles, the uncertainty about the possible future dynamics of cobalt prices is maximum. What is certain is the strong price elasticity to changes in demand, not only actual but also expected. Furthermore, the high percentage of cobalt used worldwide for the production of electric vehicle batteries makes the price of cobalt in the European market strongly dependent on what happens in the Chinese market.

[1] Dissipative uses refer to all those uses where cobalt is consumed and cannot be reused. This happens, for example, in the production of paints, ceramic pigments, and tire adhesives.