April 2024 hot-rolled coils prices update

The futures maturity curve predicted the current price dynamics

Published by Luca Sazzini. .

Hot-Rolled Coils HRC Import tariffsIn the analysis carried out in the article Hot-rolled Coils USA: Future Continous, the peculiar dynamics of the curve for the expiry of future contracts of HRC (Hot Rolled Coils) were highlighted, indicating a possible price decrease for the first months of 2024.

In this article, we will provide an update on the market trend of hot coils to verify whether the expected decrease towards the end of 2023 has occurred or not. Additionally, we will conduct an analysis on prices to discover if there are specific characteristics that make certain types of coils more expensive than others.

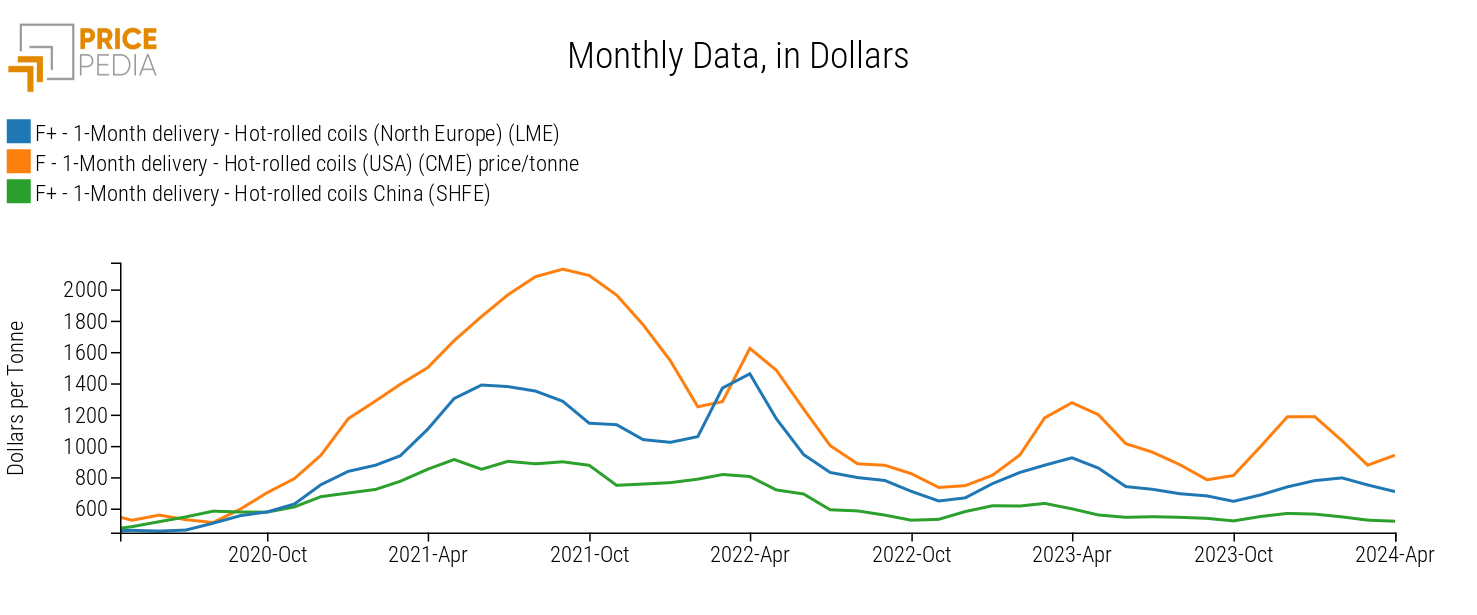

Trends in the Financial Markets of HRC

Within the financial markets, numerous spot contracts are negotiated for hot rolled coils, with significant differences in price levels depending on regional markets. Prices in the American market are generally higher than those in Europe, which in turn are higher than the Chinese market. These differences are justified by the presence of customs duties, higher in the United States (tariffs of 25% on imports from many countries, primarily China) and lower in Europe (see the Commission Implementing Regulation (EU) of June 9, 2023).

Dynamics of Spot Prices for Hot-Rolled Coils

Analysis of historical price series reveals that, despite significant variations in price levels, spot price dynamics are very similar to each other. This similarity in prices across various financial exchanges indicates a high degree of contamination between financial markets. If operators in Chicago expect an increase in HRC prices, these expectations will also influence the markets in London and Shanghai. This interconnection was also evident in the last increase that began in October 2023 when coil prices temporarily rose in the USA due to supply shortages caused by delivery delays. However, when supply managed to meet demand, spot prices in different financial markets returned to decline, demonstrating that the crisis in the US coil market was only temporary. This price dynamic followed in recent months has been perfectly aligned with the forecast of the future contract expiry curve reported in the previously mentioned article.

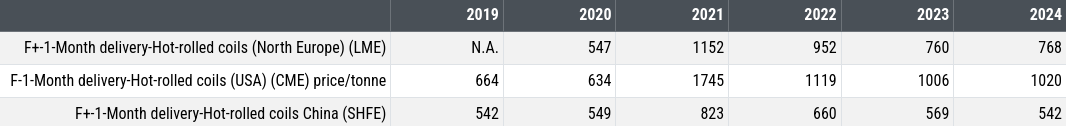

Analysis of Annual Average Prices

To have a clearer view of the trend in the hot coil market in recent years, a table of financial prices in dollars, representing the values of the annual averages of HRC, is provided below.

Table of Financial Prices in Dollars of Annual Averages of HRC

Analysis of the table above shows significant price variations, especially for the period 2020-2021, during which coil prices experienced an unprecedented upward trend. In the European market, the average annual price variation in 2021 was 110%, while in the United States, it reached 175%. The Chinese market, on the other hand, maintained greater stability, recording a 50% variation. After these considerable increases in 2021, the variation in the annual average prices was negative in 2022 and 2023. In 2024, a slow change in trend is glimpsed: as of the current date (April 15, 2024), there is a timid recovery in the prices of North European (LME) and US (CME) hot coils, although it is very slight.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

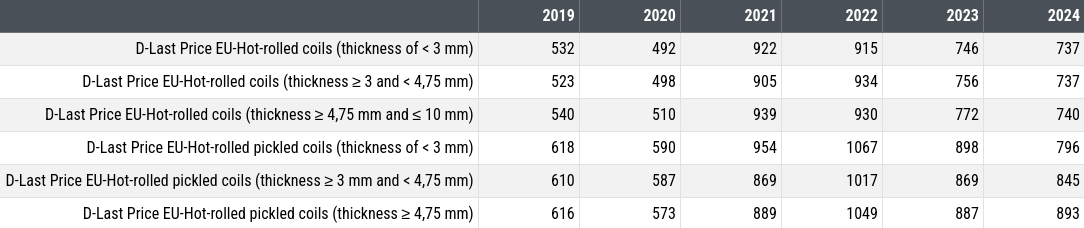

Dynamics of the European Customs Market

After analyzing the dynamics of hot coil prices in different financial markets, we proceed with the analysis of HRC prices within the European customs market. In order to conduct a comparable analysis with that of financial prices, the annual price averages of HRC expressed in dollars are also reported in this case instead of euros.

Table of European Customs Prices in Dollars of Annual Averages of HRC

The table highlights variations in the average annual prices of hot rolled coils, observed at the customs of the 27 EU member states, showing greater stability compared to financial prices. It is interesting to note that price variations seem to be influenced mainly by the type of coils, with a significant distinction between pickled and non-pickled coils. In 2021, non-pickled coils showed price variations of over 80% compared to the previous year, while pickled coils recorded increases ranging from 48% to 61%. This difference appears to be attributable to a greater responsiveness of non-pickled coils to financial prices. In 2022, while the prices of pickled coils continued to rise at sustained rates, ranging from 12% to 18%, the prices of non-pickled coils showed zero growth.

Another difference that emerges between pickled and non-pickled products concerns the price differential. On average, the former tend to cost over 10% more than the latter. This discrepancy is greater in hot coils with a thickness of less than 3 millimeters, which, from 2019 to 2024, recorded a price premium of 14% compared to non-pickled coils of the same thickness. In 2023, for example, pickled coils with a thickness of less than 3 mm had an average annual price of $898/ton, 20% higher than non-pickled coils of the same thickness, which were quoted at $746/ton.

Excluding differences due to pickling, the customs prices reported in the table are perfectly aligned with each other, indicating how the European HRC market is able to "discover" a "unique" market price month after month, based on demand and supply conditions and operating costs, but driven by financial ones. Furthermore, the thickness of the coils does not seem to significantly affect the price. As shown in the table, there are alternating years where prices slightly increase with thickness, and years where the relationship appears to be the opposite. The differences in thickness are always very small and attributable to more causal than systematic effects.

Conclusions

From the analysis of financial prices of hot rolled coils (HRC), a strong alignment in price dynamics is evident among the three main global regions: North America, China, and Northern Europe. Despite being shielded from tariffs in force, these three markets tend to influence each other through financial operators' expectations.

The European physical market for HRC reflects, with a limited delay, the dynamics and levels of European financial prices. It indicates a high degree of competitiveness, with prices of different product types quickly converging towards a "unique" market price, consistent with demand and supply conditions and operating costs, but guided by financial ones.

Pickled coils have a structurally higher price compared to non-pickled coils, in line with the higher production costs of these products.