April 2024 rubber prices update

Financial markets signal a recovery in natural rubber prices not yet seen in the European market

Published by Luca Sazzini. .

Elastomers Natural Rubber Price DriversAfter registering a downward phase that affected the end of 2022 and the entirety of 2023, some commodity prices are experiencing a reversal in trend. Among these raw materials is natural rubber, whose financial prices from the beginning of 2022 to August 2023 fell by -27% before starting a phase of slight recovery, despite the persistence of a weak global demand situation.

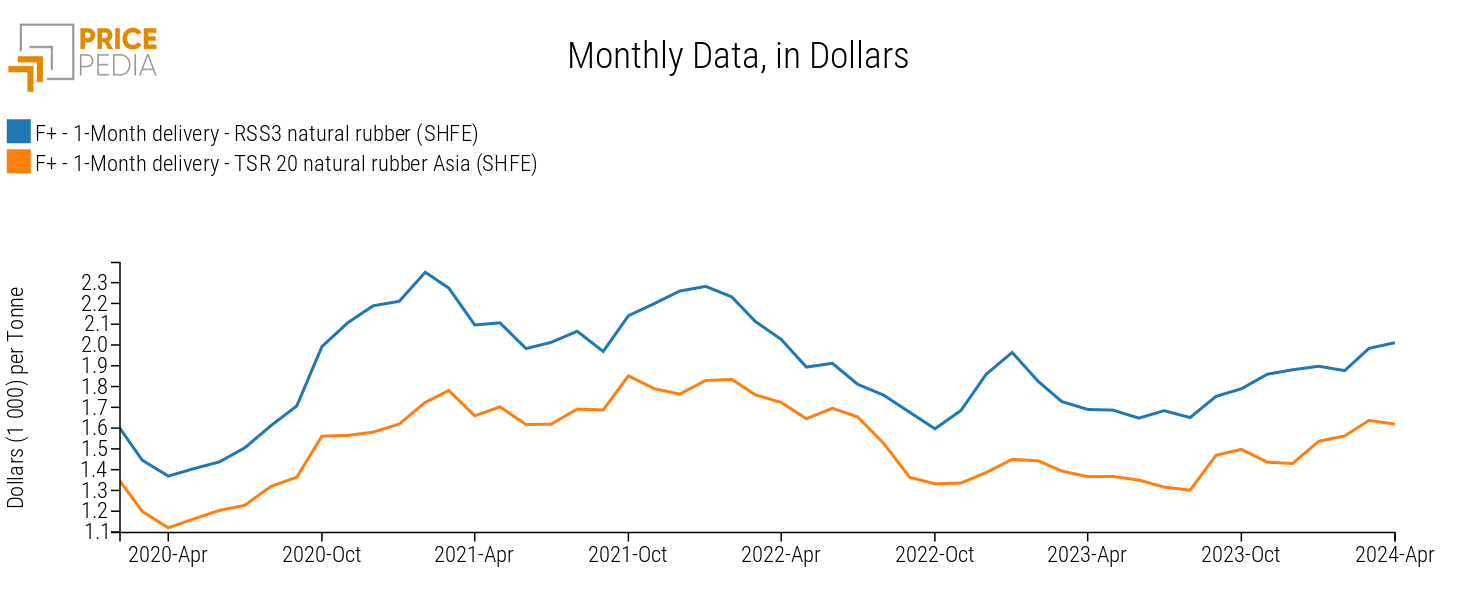

Below are the financial prices of RSS3 and TSR 20 Asia natural rubbers, both quoted on the Shanghai Futures Exchange (SHFE).

Spot Prices Dynamics of Natural Rubbers

With the exception of some weak oscillations, the chart indicates that since August 2023, the prices of both natural rubbers have continued to follow a moderate growth.

In April 2024, not yet concluded (current article date: April 22, 2024), the prices of TSR 20 Asia rubber experienced an initial downward correction, which however does not appear to be a reversal of the upward trend. At the moment, in fact, the financial prices of RSS3 and TSR 20 Asia natural rubbers are both following an upward trend and since August 2023 have recorded increases of 22% and 25% respectively.

Annual Average Analysis

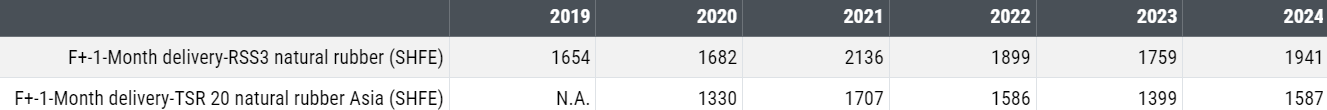

To have a clearer view of the financial price trends of natural rubber, one can observe the dynamics of the annual averages, reported in the following table.

Table of Annual Average Financial Prices of Natural Rubbers

The table provides information on the average annual levels of financial prices of natural rubbers and how these levels have varied over the past few years.

From the analysis of the average annual prices, a similar trend is observed between the financial prices of the two rubbers, but with a "structural" difference in price levels. RSS3 natural rubber, being a high-quality rubber characterized by low dirt content and excellent color, has had an average annual price in recent years approximately $360/ton higher than TSR 20 Asia rubber.

From the analysis of the annual average prices of the two rubbers, it emerges that the average annual price of natural rubber rose significantly in the 2020-2021 biennium before declining until 2023.

In the last year, however, the two financial prices of RSS3 and TRS 20 Asia rubbers have returned to increase, going from levels of $1759 and $1399/ton to prices of $1940 and $1587/ton respectively.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Analysis of European Customs Prices

After an initial analysis conducted on financial prices, the following analysis concerns the main types of rubbers present in the European customs market, considering both natural and synthetic rubbers.

In order to conduct a comparative analysis with financial prices, we have also reported in this case the rubber prices expressed in dollars instead of euros.

Table of European customs prices in dollars of annual averages of natural rubbers

From the analysis of the table, interesting data emerges when compared with financial ones.

The annual average of European rubber prices is still decreasing in the last two years, with the exception of that related to TSNR natural rubber. This difference in dynamics between financial prices and European customs prices may be attributable to the presence of a regional market characterized by different dynamics.

Focusing solely on the comparison between smoked sheets of natural rubber and RSS3 natural rubber, there are no significant price differences between the European customs market and the financial market. The difference between the European customs price and the Asian financial price in recent years has been positive, ranging between $100-200/ton, with the exception of the 2021-2022 biennium, in which this difference increased to $500/ton. The first months of 2024 signal a new exception where it is the Asian financial price that is higher than customs prices, indicating an anomaly that markets will likely adjust in the near future.

Extending the analysis to synthetic rubbers, it can be noted that the price of a specific type of rubber can vary greatly depending on the specific characteristics that distinguish the product. For example, the average price in 2024 of NBR rubber ($3677/ton) is more than double that of E-SBR rubber ($1597/ton). The synthetic rubber market thus appears to be a market characterized by a high degree of price differentiation based on the specific characteristics of each product.

Conclusion

From the analysis of Asian financial prices of natural rubbers, it emerges that these have returned to increase in the recent period. However, this recovery of financial prices has not yet occurred within the European market, which continued to record a decline even in the first months of 2024. This aspect may be attributable to the regionality of the rubber market, which could be driven by different dynamics depending on the specific reference market.

European customs prices of synthetic rubbers also showed a high degree of differentiation in price level based on the specific product characteristics.