Supply diversity limits price increases: the case of organic alcohols

Impact of Global Competition on Organic Alcohol Prices

Published by Luigi Bidoia. .

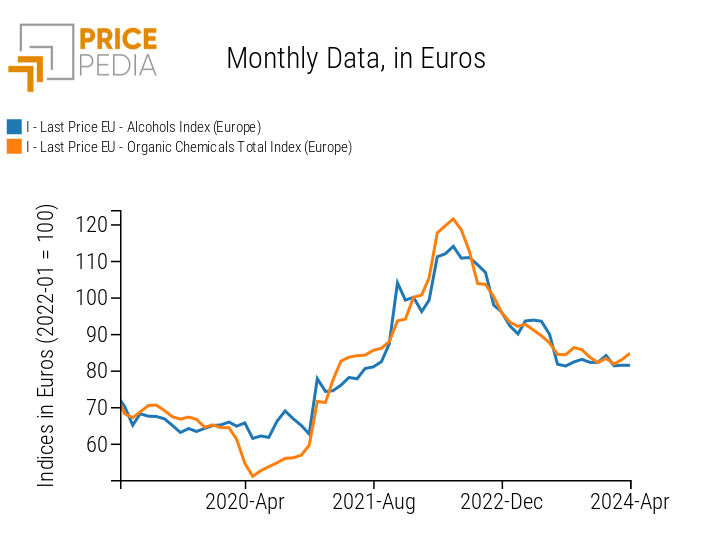

Organic Chemicals Price DriversWithin the field of organic chemistry products, one of the families that has experienced a less intense price cycle than the average is that of organic alcohols. In the following graph, the PricePedia index of organic alcohol prices is compared with the overall index of Organic Chemistry. It is evident that the price growth of alcohols in the 2021-2022 cycle was lower compared to the average price growth of all organic chemicals. The increase in alcohol prices, from the lowest point in May 2020 to the highest point in June 2022, was 86%, compared to an increase of 128% for the average price of the entire sector of basic organic chemical products.

PricePedia index of organic alcohols and total organic chemicals

Organic alcohols represent a significant share of the global chemical industry. The global foreign trade of these products exceeded 46 million tons in 2022, corresponding to a value of over 35 billion dollars, more than 5% of the total global trade of basic organic chemicals.

For a better analysis of the price dynamics of different products, it is useful to distinguish between

simple alcohols and specialty alcohols. The former have a relatively simple structure and are usually used as solvents or in the production of other chemical compounds. The latter contain additional functional groups or have more complex structures, making them suitable for specialized applications.

Simple Alcohols

Simple alcohols have significant economic importance as they are employed in a wide range of industrial applications. They are primarily produced through two fundamental processes: the fermentation of sugars and starches and the chemical synthesis from hydrocarbons.

Fermentation is a biological process in which microorganisms such as yeasts or bacteria convert sugars or starches into alcohol and carbon dioxide. This process is mainly used to produce ethanol but can be adapted to produce other types of alcohols, such as butanol.

The chemical synthesis of alcohols primarily occurs through two different processes, namely hydration and steam methane reforming. Both processes require the use of a hydrocarbon, but differ in the stages: the former directly involves the addition of water to a hydrocarbon, transforming it into an alcohol; the latter uses methane and steam to first produce a mixture which is then converted into methanol through a separate synthesis process.

The six charts that follow compare the prices of the input hydrocarbon with the price of the resulting alcohol. They allow for an analysis of the correlations between the levels and dynamics of prices.

Comparison of input and output prices of organic alcohol production

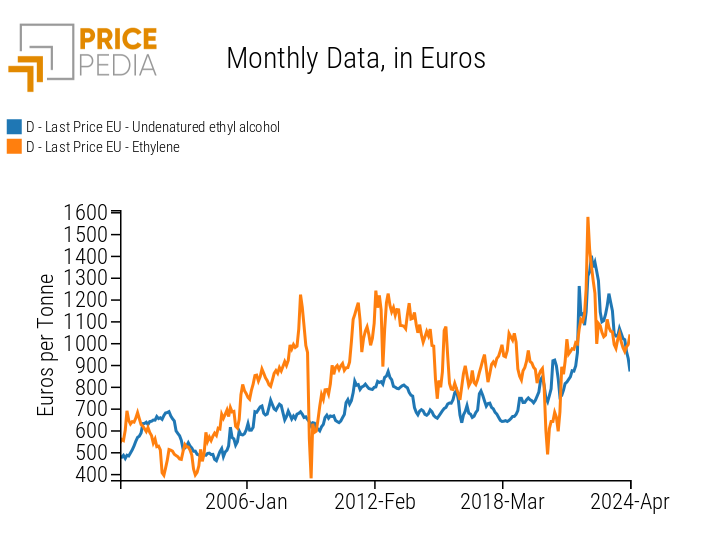

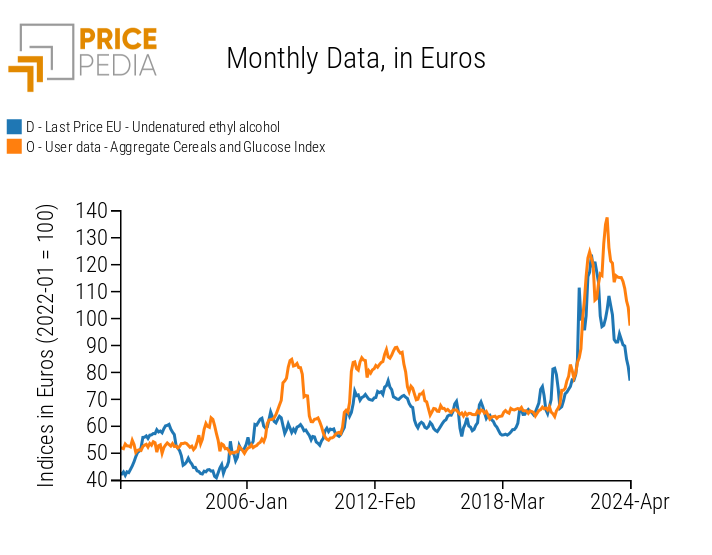

| Comparison between the prices of ethanol and ethylene | Comparison between the price indices of ethanol and biomass |

|

|

| Comparison between the prices of methanol and liquefied natural gas | Comparison between the prices of butanol and butene |

|

|

| Comparison between the prices of octanol and ethylene | Comparison between the prices of propanol and propylene |

|

|

Ethanol Price Analysis

The first two graphs compare the price of ethanol with a price index of glucose+cereals and the price of ethylene, the hydrocarbon from which ethanol can be chemically synthesised, respectively. The analysis of the two charts clearly shows no relationship between the price of ethylene and that of ethanol; on the contrary, the price dynamics of ethanol are very much correlated with the average prices of glucose and cereals, as one would expect from the absolute prevalence of the fermentation process over the chemical hydration process in the production of ethanol.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

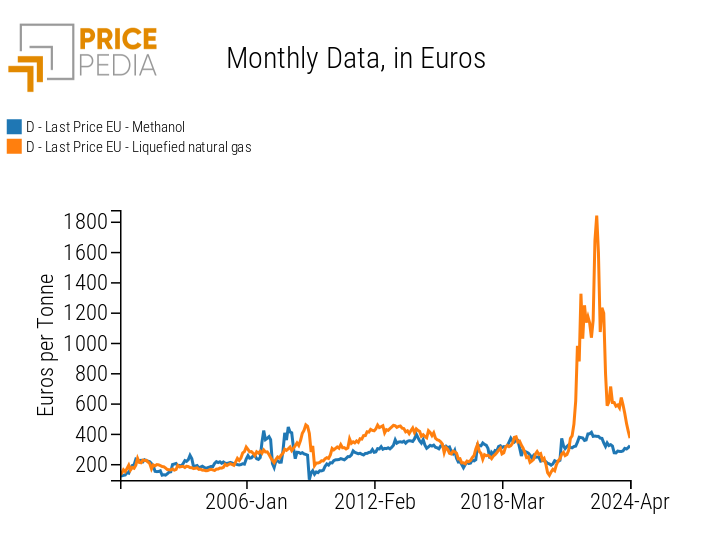

Methanol Price Analysis

The third graph compares the price of methanol with that of its main production input: natural gas.

The production process used is steam reforming of methane.

Comparing the two series, there seems to be no relationship between the price of gas and the price of methanol.

Specifically, the price of methanol did not reflect the sharp increases in natural gas prices during the 2021-2022 biennium.

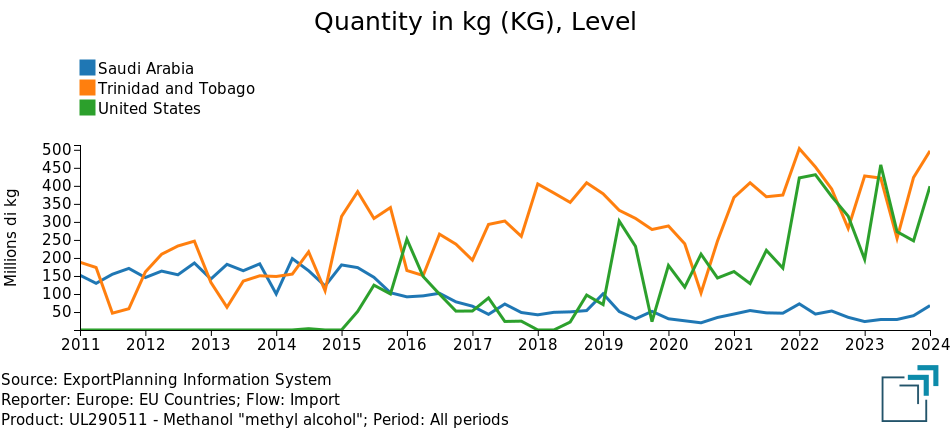

The reason is due to the intense price competition in the European market among the offerings from the three major methanol-producing countries: Saudi Arabia, Trinidad and Tobago, and the United States. The high availability of raw materials in these countries has led to the development of a competitive methanol industry.

In the first 15 years of this century, the EU exclusively imported methanol from Saudi Arabia and Trinidad and Tobago, with nearly equal shares. Imports from the United States were non-existent. In 2008, the shale oil revolution began in the United States[1], which within a few years led to the price of gas in the United States being less than half the average global price of natural gas, resulting in strong development of the American chemical industry based on gas. By 2015, the American industry began exporting to the EU, gaining market shares especially against Saudi Arabia. As shown in the chart here, in recent years, the United States and Trinidad and Tobago have taken the leadership in the EU market, relegating Saudi Arabia to a secondary role. Naturally, this intense competition has translated into particularly low methanol prices in the EU market.

EU imports of methanol

Price analysis of other simple alcohols

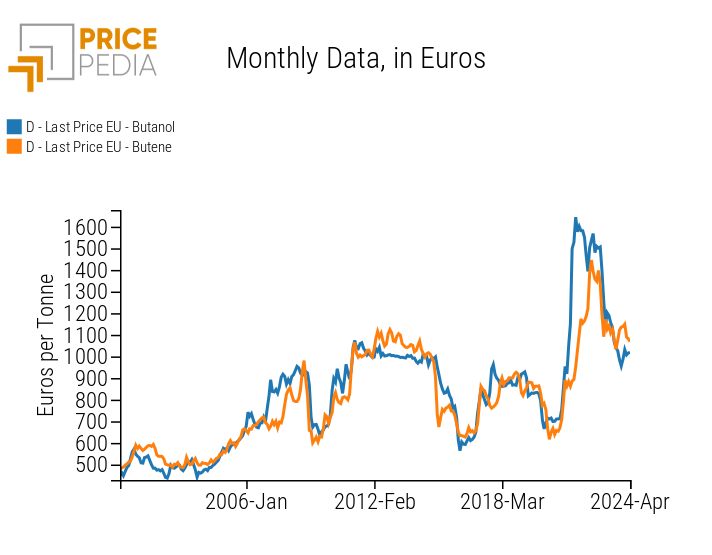

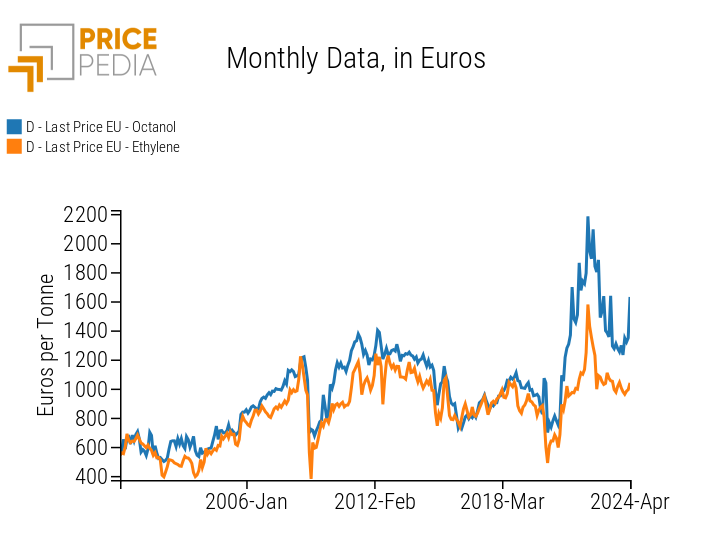

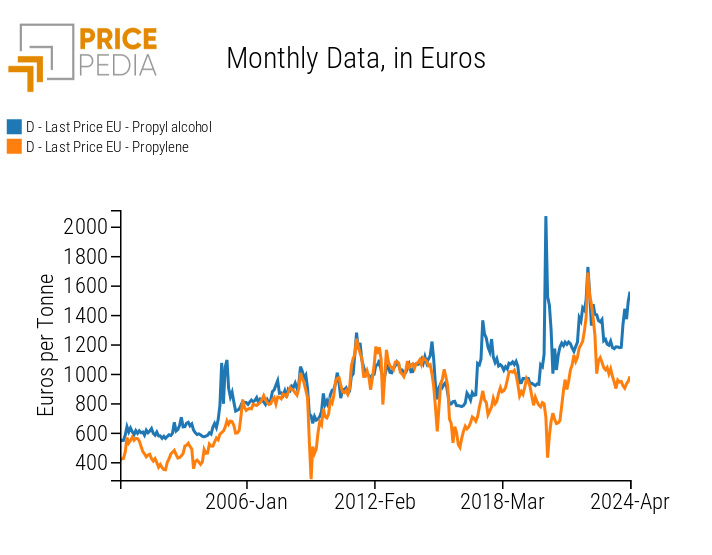

The last three charts, related to Propanol, Butanol, and Octanol, highlight the significant relationship between the price of the hydrocarbon and the alcohol obtained through hydration.

Price Levels

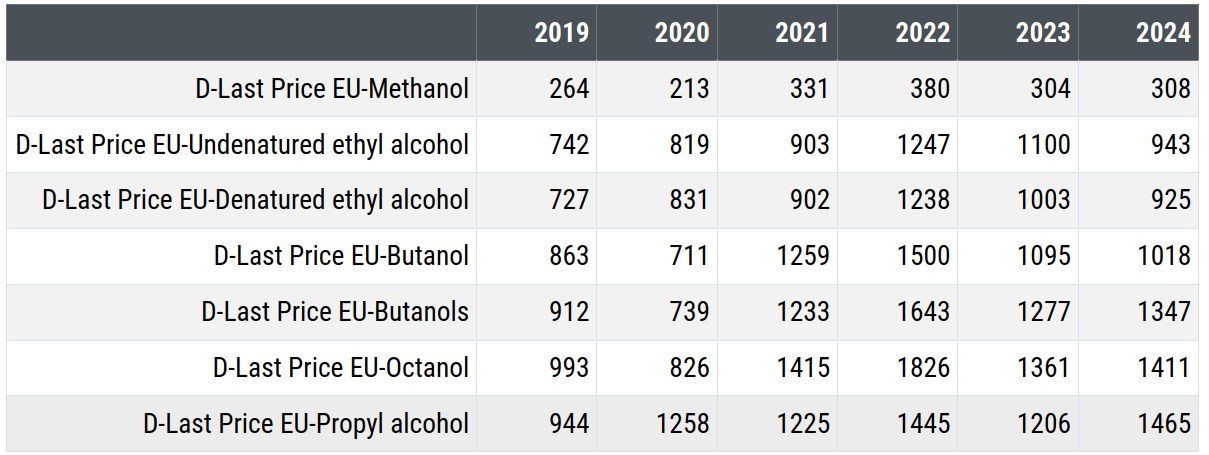

The following table shows the annual prices over the last 5 years[2] of various simple alcohols, allowing a comparison between the different price levels.

Price of simple organic alcohols (euros/tonne)

The analysis of this data shows the low price of methanol. Thanks to competition between Saudi Arabia, Trinidad and Tobago, and the United States, even in 2022, the price of this alcohol remained very low and did not exceed 400 euros per ton.

The price increase of ethanol during the generalized price increase of commodities in the 2021-2022 biennium was also much more contained compared to most prices. EU imports of ethanol are subject to a high duty (of 200 and 375 euros per ton for non-denatured and denatured ethanol, respectively) that protects community production from imports from non-European countries. However, the high supply of ethanol outside the EU market was a constraint on the price growth in the EU during the 2021-2022 biennium. This is confirmed by the strong growth in EU imports of denatured ethanol, from Brazil and, especially, the United States, recorded in the three-year period from 2021 to 2023.

Prices of other alcohols also increased in a relatively contained manner. Particularly, the price of propanol increased slowly in the 2021-2022 biennium. Here too, the reason can be traced to aggressive trade policies currently pursued by American companies and, especially, those from South Africa, aimed at gaining EU market shares.

Specialty Alcohols

After exploring the world of simple alcohols, it may be useful to consider an equally significant category: that of specialty alcohols. Their more complex molecular structure makes them ideal for specific and sophisticated applications, in a wide range of sectors, from the pharmaceutical and cosmetic industries to the production of plastics and advanced solvents. Their production and handling require more sophisticated technological processes compared to simple alcohols, reflecting the importance of precision chemistry in the synthesis of highly specialized compounds.

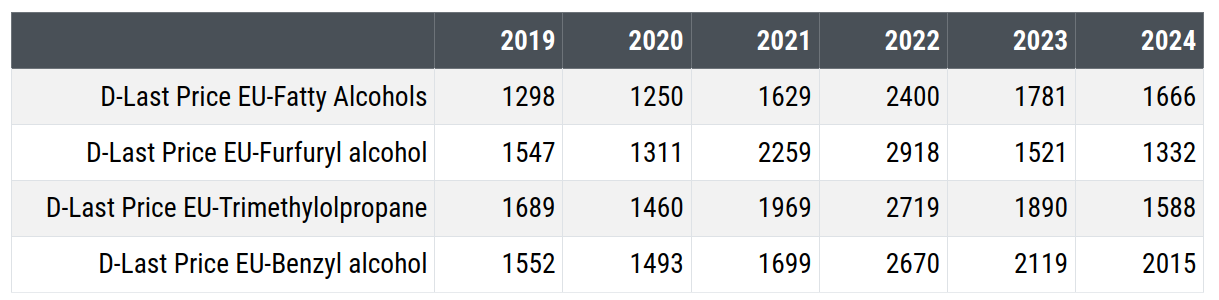

The following table shows the prices for the years from 2019 to 2024[2] for specialty organic alcohols.

Price of Specialty Organic Alcohols (euros/tonne)

Their price level is much higher compared to that of simple alcohols, consistent with the greater complexity of the production process and a more niche demand.

Furthermore, their price elasticity from 2021 to 2023 was greater compared to that of simple alcohols, with an initial phase of higher growth followed by a significant reduction phase.

Conclusion

The analysis of the dynamics over the last 5 years in the prices of organic alcohols reveals the importance of supply diversity in moderating price fluctuations. Despite the challenges posed by global commodity price dynamics, the organic alcohol sector has shown constraints on strong price increases. Competition among the world's leading producers and a broad global supply have played a crucial role in containing price rises in the EU market. This underscores the importance of maintaining an open and competitive market policy, which not only ensures lower price volatility but also stimulates innovation and efficiency within companies.

In conclusion, the case of organic alcohols provides an interesting example of how the multiplicity of supply can be a fundamental condition for stabilizing markets in times of economic uncertainty.

[1] For a detailed description of this revolution and its effects on gas prices in the United States, see the section dedicated to this revolution in the article The speculations that have upset the European gas market

[2] The price for 2024 is calculated as the average of the first four months.