Signs of slight recovery in commodity prices

PricePedia's Monthly Update for April 2024

Published by Luca Sazzini. .

Last Price Global Economic TrendsThe PricePedia monthly commodity price update for April 2024 has been published.

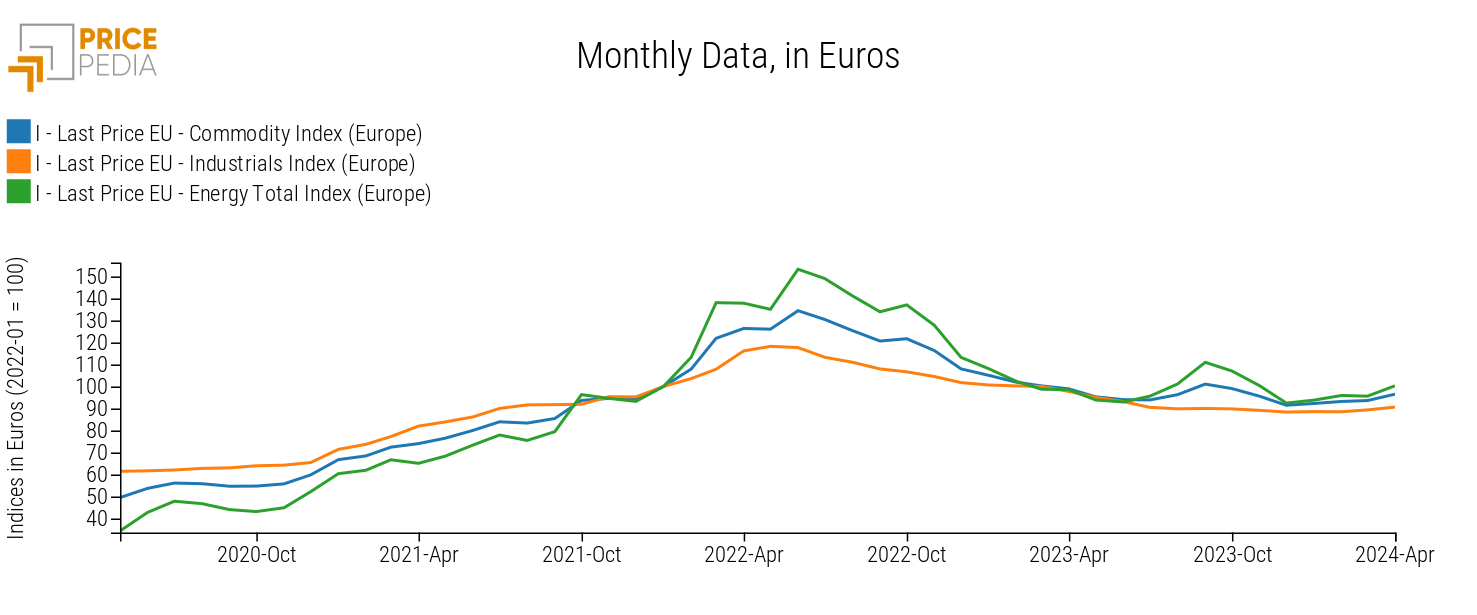

The dynamics of prices for raw materials and basic goods are depicted in the following graph, illustrating the aggregated PricePedia indices of Total Commodity1, Industrial2 commodities, and Energetics.

All three commodity indices show an increase in price levels for April 2024.

The price increase is most pronounced for energy commodities, while it only slightly rises for industrial commodities.

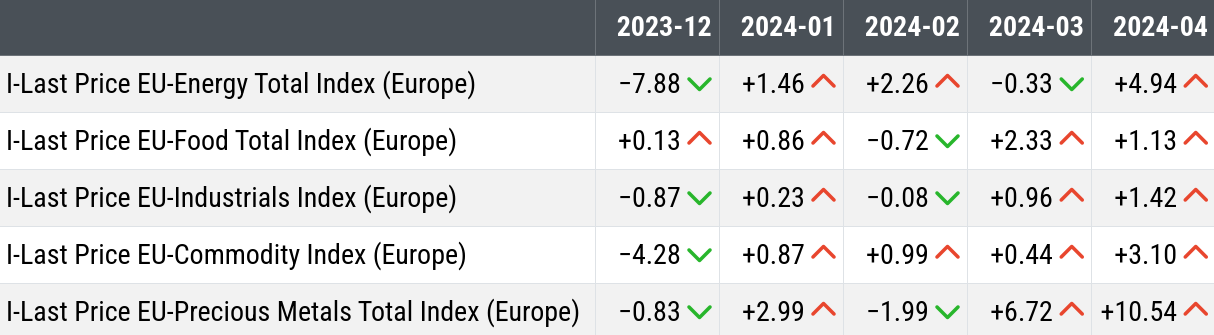

To analyze the price variations of commodities in more detail, the following table reports the month-on-month changes for all macrofamilies composing the PricePedia aggregate index (Total Commodity), including the total index for precious metals.

Month-on-Month Changes (%) in Euro

In April 2024, all macrofamilies listed in the table experienced a positive price change. However, these changes are relatively modest, except for the precious metals index, which recorded a price increase of over 10%.

The significant cyclical fluctuation in the precious metals index is mainly attributed to the rapid rise in gold prices, which recently reached record levels. This increase has been driven both by the prospect of an imminent interest rate cut by the ECB (expected in June 2024) and by increased demand from various central banks, particularly the Chinese central bank. Demand for gold as a safe-haven asset has significantly increased due to heightened uncertainty in recent times.

The second index to show a significant change compared to the previous month is the total index for energy commodities, which grew by 5% in April. The increase in energy commodities is due to the recent escalation of geopolitical tensions in the Middle East involving Iran and Israel. This resulted in a rise in oil prices, which was accentuated by OPEC+'s ongoing production cuts to address weakness in the oil market demand.

As for the aggregate of industrial commodities, it recorded a growth of 1.4%, adding to the 0.9% growth registered in March.

Cumulatively, since the beginning of the year, the growth for industrial commodities has been 2.6%.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Analysis of Industrial Commodities by Product Category

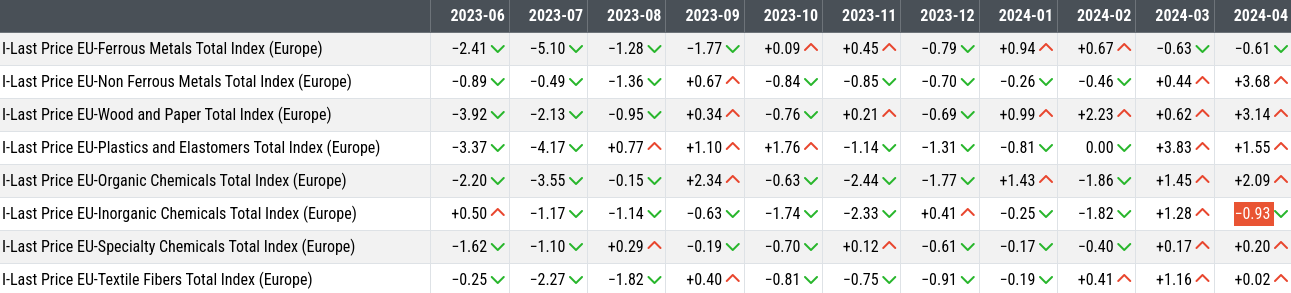

The following table presents the monthly dynamics of prices for the families composing the aggregate index of industrial commodities.

Month-on-Month Changes of Families Composing the Aggregate Industrial Index

The highest growth in April 2024 was recorded by prices of non-ferrous metals and the wood and paper index, consistent with what is happening in commodity financial markets.

In financial markets, non-ferrous metal prices have been on an upward trajectory for some time, starting with reduced supply from China and intensifying with Western financial markets' ban on delivering metals (copper, aluminum, and nickel) produced in Russia after April 12, 2024.

The growth in the wood and paper index also aligns with the current trend in financial markets, as it follows the increase in prices of European paper quoted on the NOREXECO financial exchange.

Other significant increases were also recorded in prices of basic organic chemicals and plastics and elastomers, supported by the recovery in oil prices and, more broadly, by energy commodities.

Two families, however, show a negative change (though very slight): ferrous metals and basic inorganic chemicals.

Regarding the former, the determining factors seem to be the sharp reductions that iron ores and coke coals, raw materials for the steel industry, have been experiencing for several months. Indeed, since the beginning of the year, the price of iron ores has decreased by 15% to 20%, depending on the types, while coke coal quoted on the Dalian Commodity Exchange (DCE) has decreased by over 20%.

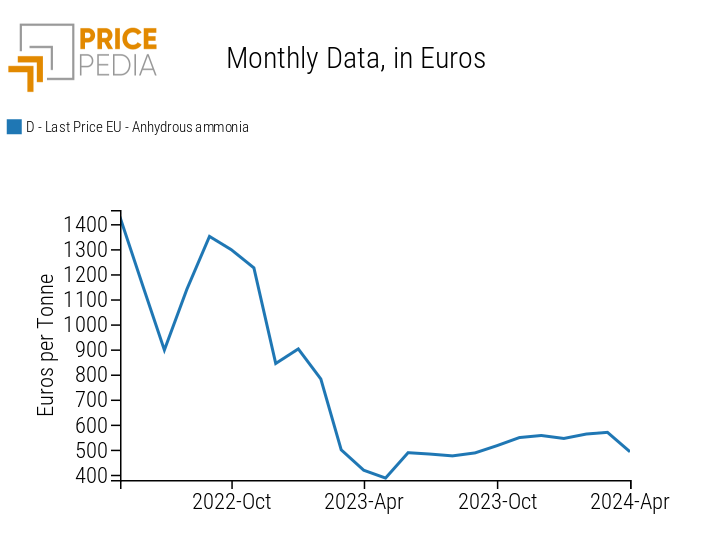

The decrease in prices of inorganic chemicals largely depends on a significant reduction in the price of a product within this aggregate: ammonia.

As shown in the following graph, the 14% reduction in this price should be interpreted as a correction compared to the increases this price had recorded during the second half of 2023 and the early months of 2024.

[1] The PricePedia Total Commodity index is the aggregation of Industrials, Food and Energy indices.

Precious metals indices are not included in the Total Pricepedia index because their dynamics reflect factors that are more financial in nature than real employment.

[2] The PricePedia Industrials index is the aggregation of indices related to the following categories: Ferrous Metals, Non-Ferrous Metals, Wood and Paper, Chemicals: Specialty, Organic Chemicals, Inorganic Chemicals, Plastics and Elastomers, and Textile Fibers.