Fluorine industry: the criticality of fluorspar

The small number of fluorspar exporting countries keeps prices high for the entire fluorine industry

Published by Luigi Bidoia. .

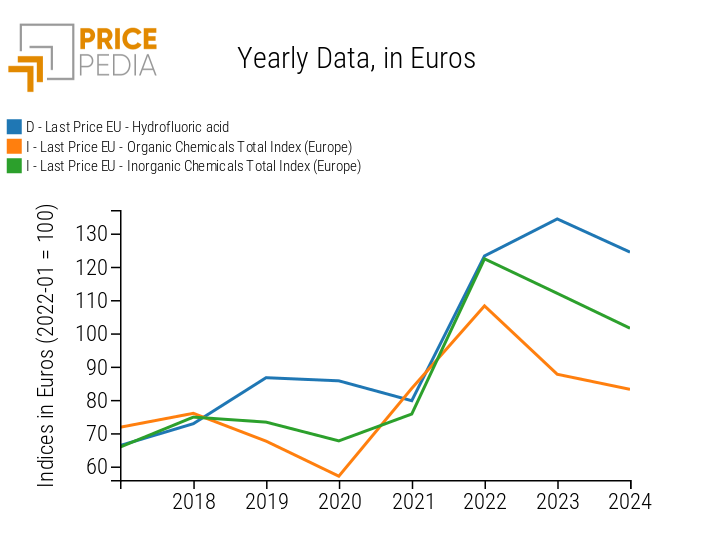

Inorganic Chemicals Fluorine and derivatives Critical raw materialsOne of the prices that has shown a completely misaligned dynamic with that of other commodities in recent years is that of hydrofluoric acid. The following graph compares the annual prices of this acid with the average prices of basic organic and inorganic chemicals.

Price Indexes PricePedia: hydrofluoric acid, organic chemistry and inorganic chemistry

From the graph, it is clear that, over the last few years, the prices of organic and inorganic chemical products have moved in line with each other. Conversely, the price of hydrofluoric acid has shown very different fluctuations. Specifically, in the three-year period from 2018 to 2020, it recorded positive changes, despite a decrease in other prices; on average, in 2021, it decreased when, conversely, other prices had already begun the long phase of increases during the biennium 2021-2022; only in 2022 did the price of hydrofluoric acid align with the growth of chemical prices; finally, it continues the growth phase even in 2023, against the sharp reduction in the average prices of chemicals.

Analyzing the determinants underlying this unique dynamic can be useful to delve into the mechanisms governing the different commodity markets, highlighting the relevant specific factors.

Hydrofluoric Acid: Uses and Production Process

Hydrofluoric acid is a weak and highly corrosive acid, used in many industrial processes, including:- in the semiconductor and electronics industry, it is used to remove oxides and other impurities from the surfaces of silicon wafers, making it indispensable for the production of integrated circuits and electronic components;

- in the production of fluorocarbons and hydrofluorocarbons: these derivatives of hydrofluoric acid are used as refrigerants in air conditioning systems and refrigerators;

- in the production of Teflon: hydrofluoric acid is used in the synthesis of polytetrafluoroethylene (PTFE), commonly known as Teflon;

- in the chemical and pharmaceutical industry, for the production of many compounds.

Hydrofluoric acid is produced by reacting calcium fluoride, found in fluorite, with sulfuric acid.

Fluorite

Fluorite (also known as Fluorspar or Acid Spar) is the main mineral from which fluorine is derived. There are two different qualities or grades of fluorite: acid-grade fluorite (or AcidSpar), with a calcium fluoride purity of at least 97%, primarily used to produce hydrofluoric acid; and metallurgical-grade fluorite (or MetSpar), with a calcium fluoride purity typically between 60% and 85%, used as a flux in metallurgical processes.

Fluorite is among the raw materials considered strategic by the European Union [1]. The element that makes it strategic is the importance of its industrial uses, particularly in the electronics industry as hydrofluoric acid, and, above all, the limited number of producing countries.

Three countries (China, Mexico, and South Africa) hold half of the world's reserves and are the leading producers of Fluorite. From a production perspective, China holds a leadership role and drives the global pricing of fluorite.

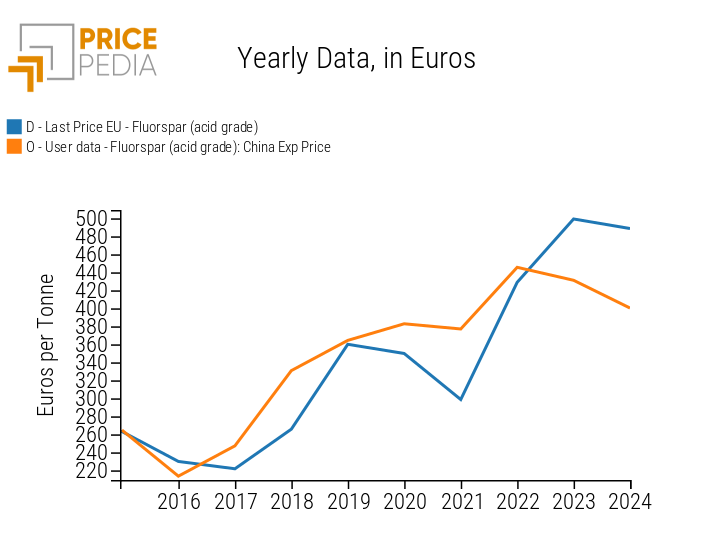

The following graph compares the price of acid-grade fluorite from Chinese exports with that of EU imports. The Chinese price clearly conditions and anticipates that of the EU, with the notable exception of 2021. In that year, EU importers managed to contain the price of imported fluorite by partially replacing Chinese imports with imports from Mexico.

Comparison between the price of fluorite from Chinese exports and EU imports

Over the course of this century, the EU has implemented a process of progressively replacing acid-grade fluorite from China with that from Mexico. At the beginning of the century, the EU almost exclusively imported from China, while imports from Mexico were practically nil. Over the years, EU imports from Mexico have progressively increased to reach a peak of 186 thousand tons in 2020. Simultaneously, imports from China have shown a progressive reduction, eventually ceasing in 2021.

In 2022, imports from Mexico and South Africa were not sufficient to cover EU demand, necessitating significant purchases from China again, with the effect of realigning EU prices with those of China.

Effect of Fluorite Price on Hydrofluoric Acid Price

In order to verify the effects of the increase in the price of acid-grade fluorite on the price of hydrofluoric acid, we estimated a regression model where the price of hydrofluoric acid is a function of the price of fluorite (acid grade), the price of sulfuric acid, and the EU consumer price index. The regression results are very robust. They allow us to measure a long-term elasticity of the price of hydrofluoric acid to the price of fluorite of 0.4. This means that price increases of fluorspar imports into the EU of 60% and 10% in 2022 and 2023, respectively, cumulatively resulted in a price increase of hydrofluoric acid of almost 30% over the two-year period.

Conclusion

The case of hydrofluoric acid highlights the importance of having a plurality of exporting countries to moderate prices in the international commodity markets. In the case of fluorite, the mineral from which hydrofluoric acid is derived, the global supply being substantially limited to three exporting countries (China, Mexico, and South Africa) makes the global price particularly sensitive to market conditions existing in one of the three countries. Since 2018, a limited supply in the Chinese market has led to an increase in fluorite prices, initially only in the Chinese market and subsequently in the EU market. The largest increases in the EU market occurred after 2021, when the EU resumed imports from China due to a reduction in imports of Mexican origin.

In this situation, the price of EU imports of fluorite (acid grade) and consequently the European price of hydrofluoric acid will remain high until the Chinese fluorite market registers a rebalance between demand and supply and a reduction in prices.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

[1] For an analysis of the raw materials considered critical by the EU Commission see Critical Raw Materials: the importance of substitutes