Industrial Cycle Recovery and Commodity Prices in 2025

PricePedia Scenario May 2024

Published by Pasquale Marzano. .

Last Price Forecast Forecast

The PricePedia Scenario has been updated with information available on May 8, 2024. Data on April inflation in the Euro Area (+2.38% on an annual basis) indicate a slowdown compared to March values (+2.43%), and seem to confirm the imminent reduction in interest rates by the European Central Bank (ECB). Although the lowering of interest rates in Europe in June is considered almost certain, there are still doubts about what the ECB's subsequent steps will be and, above all, whether the American Federal Reserve (FED) will follow the same path or, as is more likely, begin to lower interest rates later, reducing the room for further reductions during the year.

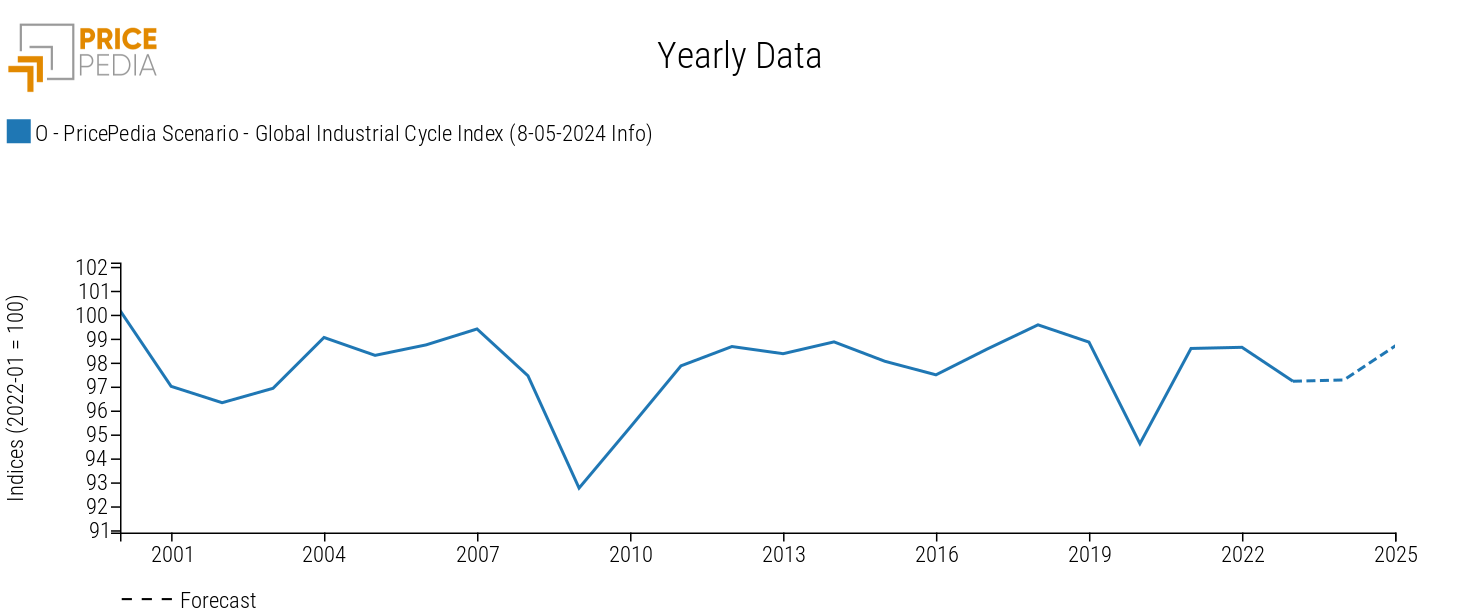

The postponement of the start of the interest rate reduction phase will tend to prolong the current situation of low levels of industrial activity globally. The following graph shows the global industrial cycle index[1] developed by PricePedia, which represents a proxy for global demand for industrial commodities.

In 2024, the global industrial cycle remains stable compared to the average values recorded in 2023, indicating the absence of significant stimuli for global manufacturing growth. The easing of restrictive monetary policies in the second half of the year should lay the groundwork for a more intense growth of the industrial cycle throughout 2025: on an annual average, it is more than +1.45% higher than the 2024 level, effectively returning to the average values of 2022.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Commodity Price Forecast

Being a proxy for global demand for industrial commodities, the dynamics of the global industrial cycle is a significant factor capable of influencing the trend of commodity prices.

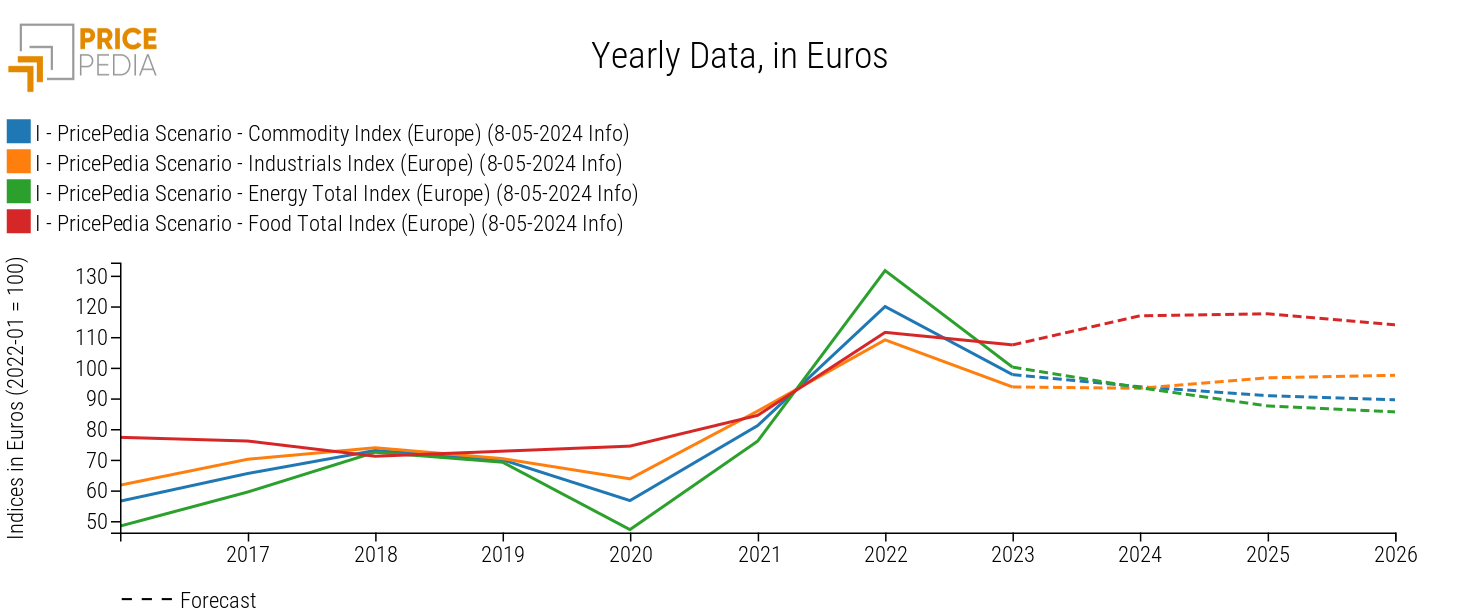

The following graph illustrates the price forecast for the main commodity categories (Industrial[2], Total Commodity[3], Energy, and Food).

The Total Commodity index shows a decreasing trend in 2024 and 2025, with average annual variations of -3.6%, as well as the Energy index, which records annual variations of -6.7% and -6.4% respectively in 2024 and 2025. Despite these decreases, energy raw material prices are over 23% higher than pre-pandemic levels. In particular, this trend is supported by the price of Brent, which, despite the downward trend compared to current levels, is expected to remain above $80/barrel in 2025, a level higher than the 2021 average.

As for Industrial commodities, on the other hand, the trend is more aligned with the global industrial cycle, with a phase of stability in 2024 (a decrease of -0.5%) and a progressive recovery throughout 2025, averaging almost +4%.

Slightly different is the trend of Food goods, which show growth on an annual basis even in 2024, mainly driven by products such as coffee, cocoa, and olive oil.

1. The global industrial cycle index is constructed by purifying the actual dynamics of industrial production from its trend. Since the supply of commodities tends to vary according to long-term economic growth expectations, while the demand for commodities is more linked to actual cyclical uses, the global industrial cycle index tends to reproduce the conditions of tension between demand and supply on the commodity market: when it increases, it means that the demand for commodities increases more than the supply; vice versa when it decreases.

2. The PricePedia Industrials index results from the aggregation of the indices relating to the following product categories: Ferrous, Non-Ferrous, Wood and Paper, Chemicals: Specialty, Organic Chemicals, Inorganic Chemicals, Plastics and Elastomers and Textile Fibres.

3. The PricePedia Total Commodity index results from the aggregation of the indices relating to industrial, food and energy commodities. Pasquale Marzano

Economist and data scientist. At PricePedia he deals with the analysis of commodity markets, forecasting models for raw material prices and management of reference databases.