Update of long steel prices to May 2024

Regionality of long steel prices

Published by Luca Sazzini. .

Ferrous Metals Wirerod Long steels Price DriversIn the PricePedia information system, there are 4 daily prices observed in the financial markets related to the sector of non-alloy long steels. Two of these prices are quoted on the Shanghai Futures Exchange (SHFE) and concern steel rebar and wire rods, traded on the Chinese market; two are quoted on the London Metal Exchange (LME) and concern the price of exported steel rebar and the price of steel scrap imported from Turkey.

Scrap prices can be considered internal to the long steel sector because most of them are produced through electric furnaces, which use scrap as the main production input. The direct dependence of electric furnaces on steel scrap means that scrap prices significantly influence the production costs of long steels. Therefore, variations in scrap prices can have a direct impact on the prices of long steels produced using this technology.

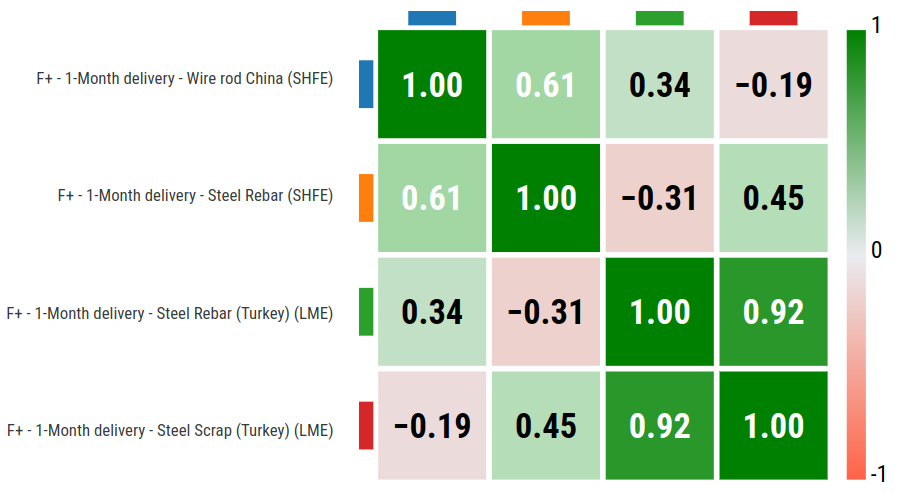

Partial correlation matrix of financial prices of non-alloy long steels

An analysis of the partial correlation matrix1 signals the existence of at least two partially connected global regional steel markets, only partially related to each other. Prices of long steels quoted within the same financial market show a high correlation coefficient, but there seems to be no interconnection between prices quoted in different financial markets. For example, while prices quoted on the London Metal Exchange (LME) have a correlation of 0.92 among them, and prices quoted on the Shanghai Futures Exchange (SHFE) have a correlation of 0.61 among them; the correlation between Chinese and European prices never exceeds 0.5, with some cases where this correlation is even negative.

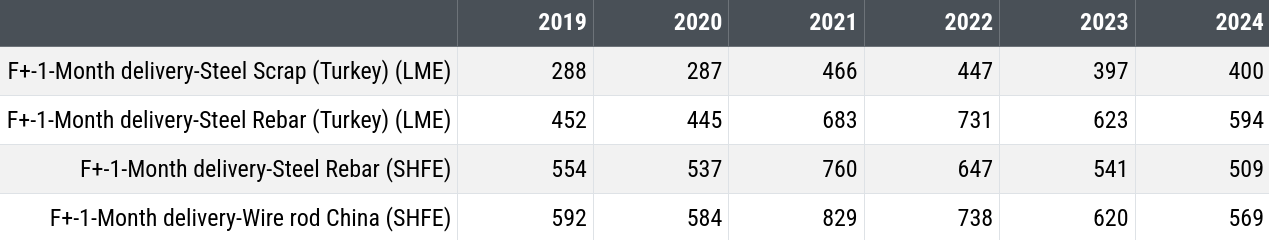

To further explore the relationship between the Chinese financial steel market and the European one, the table below shows the levels of average annual prices, expressed in dollars per ton, for the four prices analyzed above for the period 2019-20242.

Table of financial prices of non-alloy long steels, expressed in $/ton

An analysis of the data in the table highlights some important facts:

- Scrap prices represent over 60% of the prices of steel rebar exported from Turkey in all years, confirming the importance of this input in rebar production;

- In the recent commodity price cycle, the peak price point in China for long steel was recorded in 2021 well ahead of what was recorded in Europe and, especially, what was recorded in most global commodity markets;

- Until 2021, the price of rebar in China was higher than the European one; subsequently, this relationship reversed, and from 2022 onwards, the price of rebar in Europe is higher than the corresponding Asian price.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Impact of the financial market on the physical market

To integrate the analysis of financial prices with that of prices in physical markets, the corresponding analysis of prices of long steels in European physical markets is provided below.

In this analysis, we have distinguished wire rods from other long steels. wire rods differ from other long steels due to some specificities:

- Production process: wire rods are produced through a hot rolling process, in continuous coils;

- Dimensions and shape: wire rods generally have a smaller diameter (from 5 to 25 mm) compared to many other types of long steels;

- Final use: wire rods are often used as input materials for other products such as cables, springs, bolts, and screws;

Wire rod price

The table below shows the average annual price from 2019 to 20242 of some specific wire rods available on the European market.

Table of European customs prices for wire rods, expressed in €/ton

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|---|

| D-Last Price EU-Wire rod in wound coils | 478 | 441 | 720 | 880 | 624 | 611 |

| D-Last Price EU-Wire rod (C ≤ 0,06%) | 495 | 450 | 739 | 894 | 642 | 634 |

| D-Last Price EU-Wire rod (C 0,06%-0,25%) | 482 | 441 | 709 | 862 | 621 | 589 |

| D-Last Price EU-Wire rod (C 0,25%-0,75%) | 567 | 496 | 732 | 951 | 705 | 691 |

| D-Last Price EU-Wire rod (C > 0,75%) | 536 | 472 | 723 | 973 | 714 | 649 |

| D-Last Price EU-Wire rod (diameter ≥ 14mm) | 567 | 496 | 754 | 1039 | 797 | 696 |

| D-Last Price EU-Non-alloy free-cutting steel wire rod | 632 | 544 | 782 | 1149 | 837 | 781 |

An analysis of the dynamics of these prices indicates the strong alignment that exists among the prices of different wire rods. The common trend results in a price differential among different types of wire rods that tends to remain constant over time.

The product indicated in the table as wire rod in wound coils is characterized by the imperfect circularity of its section, but by the presence of serrations, collars, and cavities that make its production easier and somewhat less expensive. This justifies its slightly lower price compared to other types of wire rods listed in the table.

Wire rods with indicated carbon content are wire rods with a circular section and a diameter of less than 14 mm. The prices of these wire rods differ slightly depending on the carbon content. The most significant carbon discriminator is the 0.25% percentage that distinguishes mild steels (with carbon content below 0.25%) from hard steels (with carbon content above 0.25%). Mild steel wire rods have a generally lower price than hard steel wire rods.

Wire rods with a diameter greater than 14 mm have a price generally higher by 50-100 euros per ton compared to wire rods with a smaller diameter.

The type of wire rode that is the most expensive within the European market is the non-alloy free-cutting steel wire rode, which is specially designed to be easier to work with and characterized by a high degree of wear resistance.

Price of other long steels

The table below shows the average annual price from 2019 to 20242 of some long steels available on the European market.

Table of European customs prices for other long steels, expressed in €/ton

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|---|

| D-Last Price EU-Waste and scrap of iron or steel | 234 | 223 | 362 | 387 | 340 | 352 |

| D-Last Price EU-Steel rebar | 473 | 429 | 668 | 830 | 619 | 598 |

| D-Last Price EU-H sections profiles | 584 | 527 | 829 | 1141 | 825 | 770 |

| D-Last Price EU-Bars (rectangular cross-section) | 540 | 498 | 777 | 1092 | 785 | 717 |

| D-Last Price EU-Bars (circular cross-section) | 697 | 606 | 804 | 1086 | 950 | 897 |

| D-Last Price EU-Bars and rods of automatic steel | 888 | 784 | 1059 | 1485 | 1242 | 1099 |

The above table highlights the price cycle of long steels within the European market. With the exception of steel scrap, which is the only product to experience a price increase in the 2023-2024 biennium, all other types of steel experience a decrease in prices over the past year. In particular, long steel prices experience an initial general decline in the 2019-2020 biennium, followed by a growth phase lasting until 2022, followed by a further decline, which continues into the first part of 2024.

Prices of long steels in the EU market are characterized by slight differences based on the ease of processing of the individual type of steel. For example, prices of bars and rods of automatic steel, circular bars, and H-section profiles tend to be on average higher compared to those of rectangular bars, due to their better workability. Rebar and steel scrap, on the other hand, have lower price levels, as they are used as production inputs for the production of more complex long steels, such as bars.

Conclusions

The financial prices of non-alloy long steels quoted within the same financial market showed a high correlation coefficient among them, especially regarding rebar and Turkey steel scrap quoted at the LME, which have a correlation of 0.92.

Prices belonging to the Chinese SHFE exchange showed little correlation with those belonging to the European LME exchange, confirming the hypothesis that there are at least 2 global regional markets for non-alloy long steel.

From the analysis of European customs prices, it emerged that wire rods in wound coils are the cheapest product within the wire rods family, while non-alloy free-cutting steel wire rods are the most expensive within the EU market, given their easy workability and high resistance.

With the exception of steel scrap, all long steel prices recorded a reduction in the average price level in the 2023-2024 biennium.

[1] Partial correlation indicates the degree of relationship between two variables excluding the effects due to any associations by additional variables.

[2] As of the date of this article, May 13, 2024, the average annual price for 2024 includes only the average of the first 5 months of the year.