Forecasting global commodity prices by monitoring the Chinese market

China plays a key role in discovering the prices of many global commodities

Published by Luigi Bidoia. .

Strumenti Forecast Price Drivers

The price of many commodities is determined in the Chinese market, which often matches or even surpasses the size of markets in the rest of the world. Chinese prices influence those in other global economic areas, especially through exports. In the case of commodities, the prices offered by Chinese companies in foreign markets tend to reflect those practiced in the domestic market.

The transmission of price variations from the Chinese market to other markets is not immediate, often requiring several months. Consequently, what happens in the Chinese market tends to be mirrored with a delay of a few months in other parts of the world, including the EU. Monitoring the Chinese market thus means anticipating potential price trends in Europe.

This article will illustrate, by way of example, some representative cases from three industries where this phenomenon is relevant: basic chemicals, textiles, and steel.

The Role of China in Chemical Commodities

With over $80 billion exported, China emerged in 2023 as the world's largest exporter of basic chemical products (organic and inorganic), followed by the United States and Germany. This export capacity of the dragon is the result of the significant growth achieved by the Chinese chemical industry over this century, initially focused on the domestic market and in recent years increasingly directed towards foreign markets.

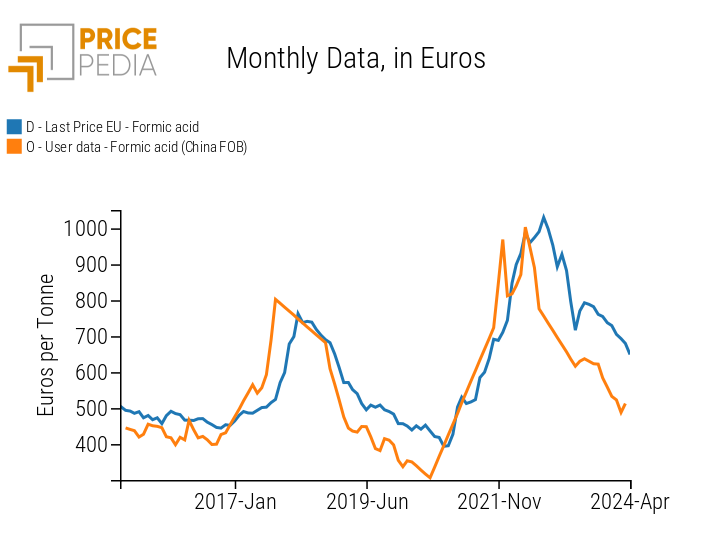

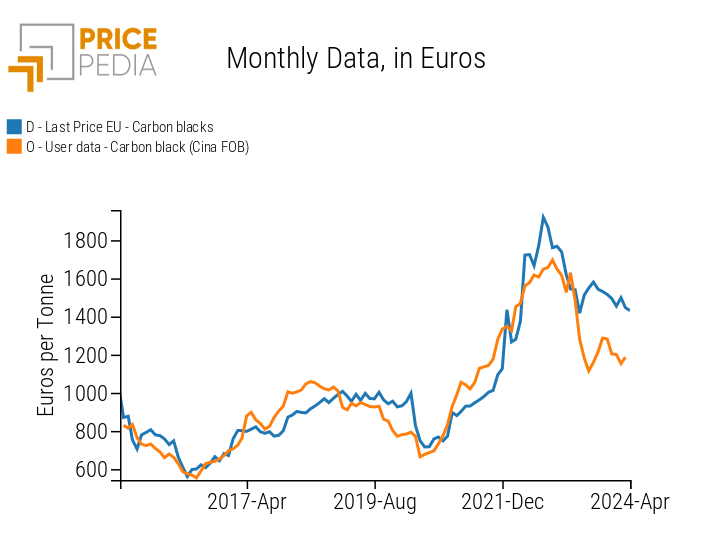

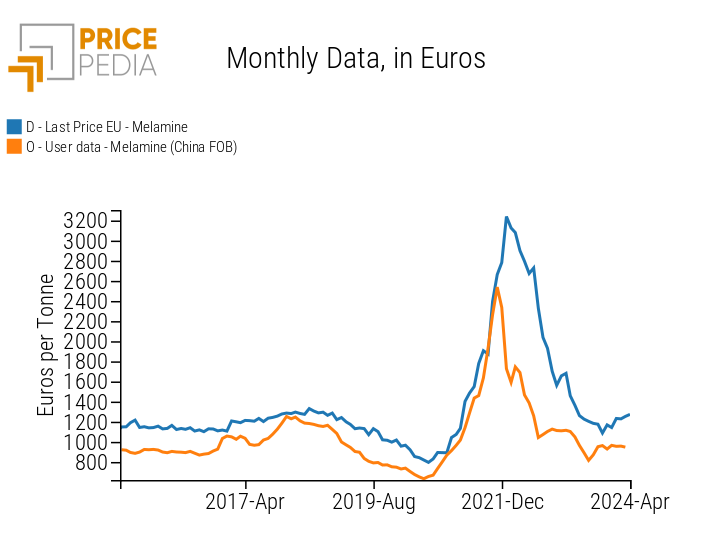

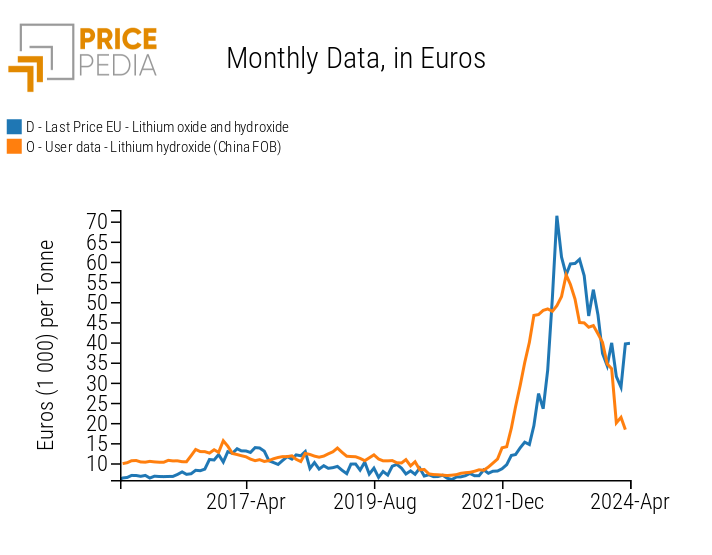

In the following graphs, the price of Chinese exports is compared with the EU customs price, derived from the average of import and export declarations of the 27 Union countries. The prices concern four chemical commodities important for their industrial uses: formic acid, carbon black, melamine, and lithium oxide.

Chart 1: comparison of Chinese export prices and EU customs prices

| Formic acid | Carbon-Black |

|

|

| Melamine | Lithium hydroxide |

|

|

From the analysis of the four charts, it is clear that Chinese prices have moved ahead of European prices in both growth and decline phases.

The relationship is particularly evident for formic acid, characterized by two strong price cycles over the last 10 years. China and India are the world's main producers. However, while India produces almost exclusively for the domestic market, China exports significant volumes of formic acid. In 2023, nearly 50% of global exports were from China. Naturally, in this situation, the price of formic acid is determined by the interaction between supply and demand in the Chinese market, and this price "informs" the rest of the world of the physical price of this commodity.

In the case of formic acid, the Chinese market not only drives the price dynamics but also acts as a price stabilizer for the EU market, given its consistently lower level compared to European prices.

Another case where the market is both a precursor and a stabilizer for the EU market is melamine. In this case, China is the absolute dominus of the global market, with two-thirds of the world's production capacity and a share of exports that well exceeds 50% of total world trade.[1]

The Chinese market clearly has a leading role in price setting for lithium oxide and carbon blacks as well. For the first commodity, China boasts a near-monopoly worldwide, with a foreign trade share of 75%. Lithium oxide has a strong substitute in lithium carbonate, where the global supply is more diversified, sometimes allowing EU prices to be lower than Chinese export prices.

For carbon blacks, China's role has historically been less significant. However, its importance for the EU market has increased in recent years due to the collapse of EU imports of carbon blacks from Russia.[2]

[1] For more on the European and global melamine market, see Exceptional cycle for melamine prices

[2] For more on higher EU carbon black market prices, see What determines the high price levels of pigments in Europe?

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

The Role of China in the Textile Industry

If there is one industry where China still has no rivals, it is the textile industry. The dragon's share of foreign trade in 2023 was over 50%, down in recent years but still much higher than the closest competitor, India, whose share of world trade does not reach 10%.

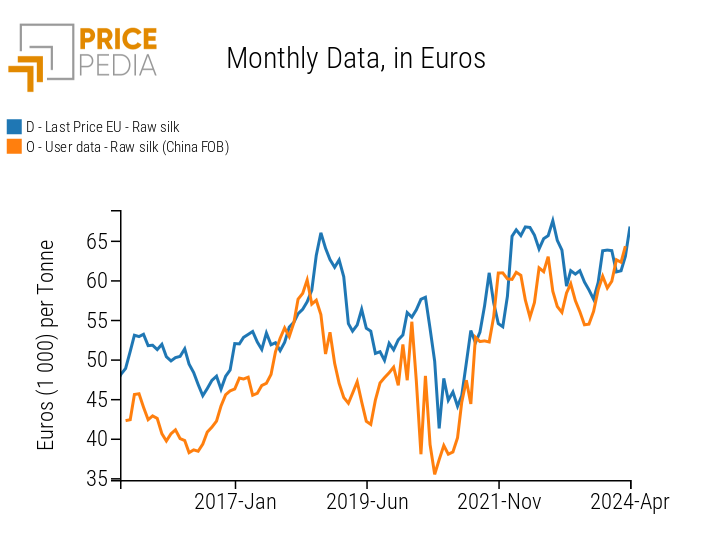

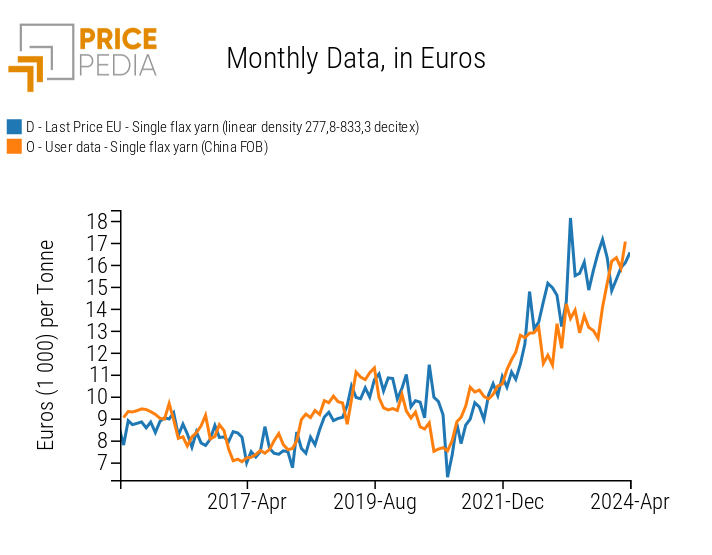

The two charts that follow show the price dynamics of raw silk and flax yarn. In each chart, the price of Chinese exports is compared with the EU customs price.

Chart 2: comparison of Chinese export prices and EU customs prices

| Raw silk | Flax yarn |

|

|

The importance of Chinese production in the global market for raw silk and flax yarns is summarized by the share of world trade that Chinese exports account for these two commodities. In both cases, they exceed 50%. This significant role of China results in global prices being heavily influenced by the supply and demand conditions in the Chinese market.

In the case of flax, Europe also plays an important role, especially in the case of the textile raw material, represented by scutched or hackled flax. In the last cycle of price increases for flax, the phase of price growth began with increases in Europe for scutched flax and then handed over to China in the prices of yarns [3].

[3] For an analysis of price increases in scutched and hackled flax in Europe, see Increasingly expensive flax in Europe

The Role of China in the Steel Industry

The Chinese industry also has a dominant role in the steel sector, having been the world's leading exporter for many years. In 2023, China exported over 60 billion worth of steel products, widening the gap with Japan, its main historical competitor, and maintaining its lead over Indonesia, an emerging steel producer.

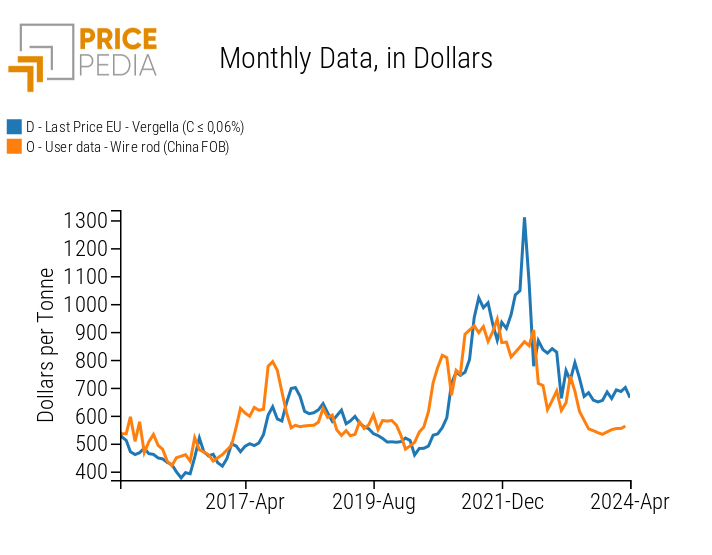

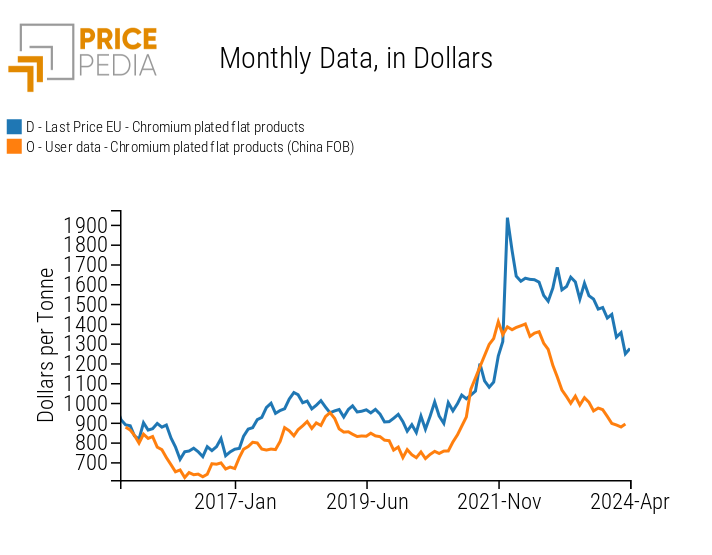

In the following charts, the price of Chinese exports is compared with the EU customs price. The prices concern wire rod and Chromium plated flat products.

Chart 3: comparison of Chinese export prices and EU customs prices

| Wire rod | Chromium plated flat products |

|

|

In the case of steel commodities, the European market is partially "shielded" from price dynamics in China, partly due to transportation costs and partly due to EU policies protecting the European steel market. EU imports from China in 2023 were limited to just over 4 billion dollars.

Despite this, comparing the price trends of Chinese exports of wire rod with EU customs prices indicates that Chinese prices tend to anticipate European prices, suggesting a significant relationship between Chinese and European prices.

A similar pattern characterizes the relationship between the export price of Chinese chromium plated flat products and EU customs prices.

However, it should not be excluded that spurious relationships might exist, where a third price (such as the cost of steelmaking raw materials) influences both Chinese export prices and EU customs prices, creating a statistical relationship between these two prices.

Conclusions

There is no doubt that the Chinese market plays a leading role in determining global prices for many commodities. Statistical analysis often highlights that Chinese export price trends precede those of EU customs prices. This does not necessarily imply a cause-and-effect relationship between Chinese prices and EU prices. There is always the possibility that there are unconsidered prices in the analysis that simultaneously influence both Chinese and EU prices, creating a relationship between them. It is possible to distinguish between different cases through an in-depth examination of the importance of the Chinese industry in the considered commodity and its world trade shares. Based on this additional information, for many chemical and textile commodities, a true cause-and-effect relationship seems to exist between Chinese prices and EU prices. Conversely, for the steel industry, the nature of the relationship between Chinese prices and EU prices will require further investigation.