Price of magnesium in Europe: what criticalities?

The metal is part of the list of critical raw materials identified by the European Commission

Published by Pasquale Marzano. .

Non Ferrous Metals Magnesium Critical raw materials

In the article Critical Raw Materials: the importance of substitutes, the commodities of the Critical Raw Materials Act were identified and mapped according to the criteria of economic importance[1] and supply risk[2] for European companies. These raw materials play a strategic role for the European industry, especially in the context of energy and digital transitions.

This article will delve into the criticality of magnesium for the European market, given its position as the second most important raw material in economic terms and third in terms of supply risk.

Main Uses of Magnesium

Magnesium is the lightest among commonly used structural materials. It is primarily used in the automotive sector (48%), especially in the form of magnesium alloy casting, as it can reduce the overall weight and, in some cases, increase the strength of materials. Other applications include:

- packaging, 23%;

- construction, 13%;

- desulfurizing agent, 12%;

- transportation, excluding automotive, both civil and military, 4%;

The relevance of magnesium is also due to the fact that its substitutability with other raw materials is relatively low: in most cases, although the substitute product may have a similar or lower cost than magnesium, it exhibits inferior performance.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Magnesium Criticality in the EU Market

Since the late 1990s, China has assumed an increasingly central role as the world's factory, significantly altering the global magnesium market by becoming its main producer. This transition has led to a market shift from a relatively diversified supply (with players like Russia, Norway, and the United States) to one where China produces about 90% of the global total.

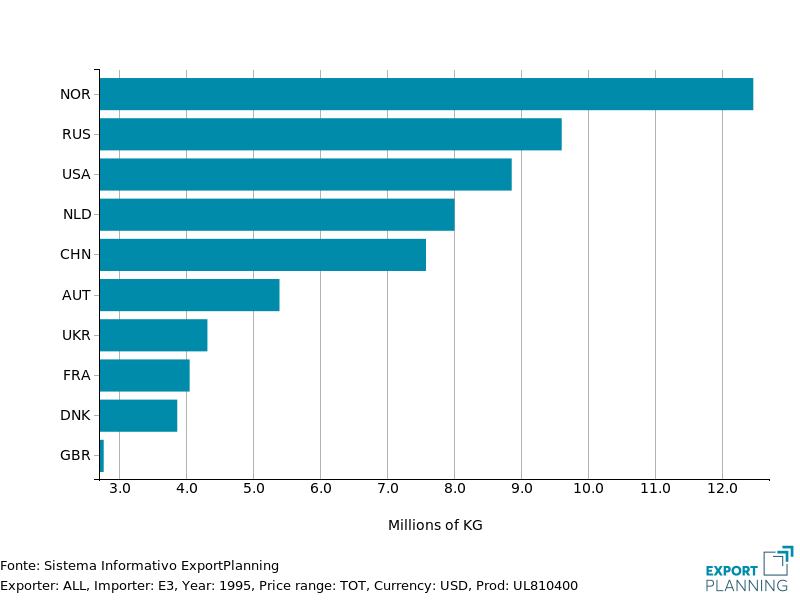

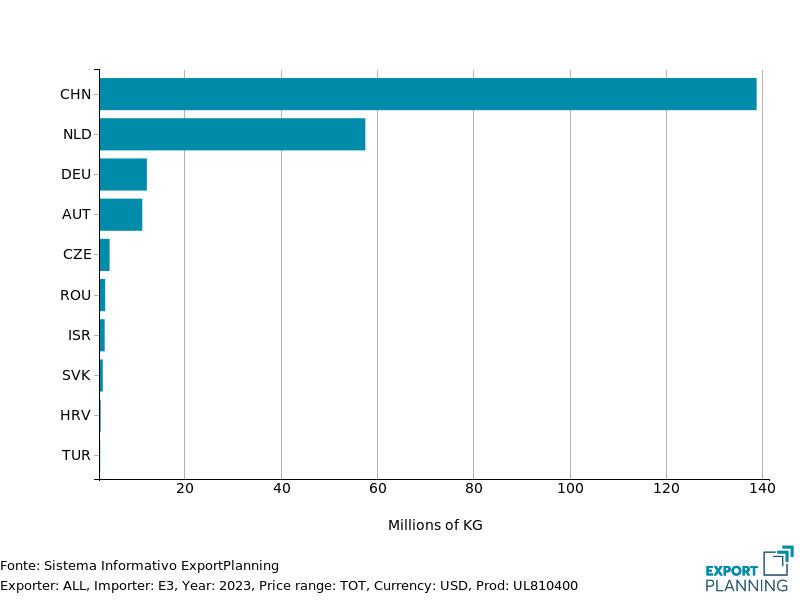

This global shift is also evident in relation to the EU, as shown by the following graphs, which depict the main magnesium suppliers to the EU in 1995 and 2023 (source ExportPlanning).

EU Magnesium Supplies

1995

2023

As seen in the graphs, China went from being the fifth supplier to the EU in 1995 to becoming the main supplier in 2023. Notably, Chinese exports to Europe grew significantly, from nearly 8 ktons to over 140 ktons.

The price of EU Magnesium depends on the price in China

Given China's role in the magnesium market, it follows that China is its price-maker, as happens in many other commodities markets (see the article Forecasting global commodity prices by monitoring the Chinese market for more details).

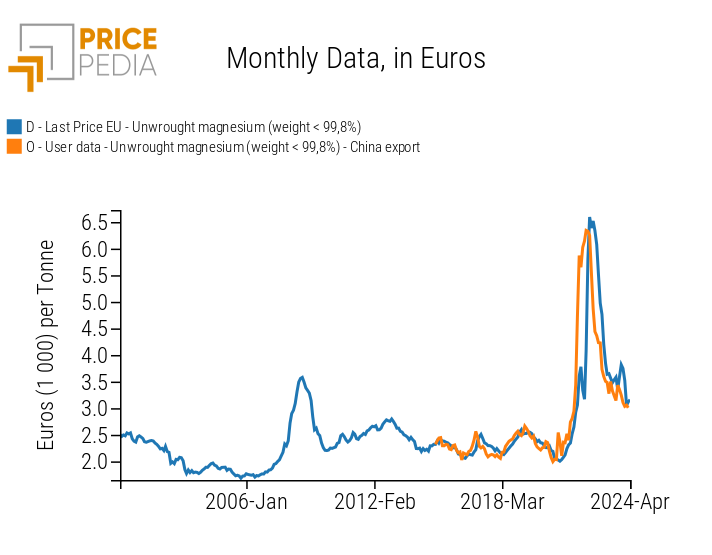

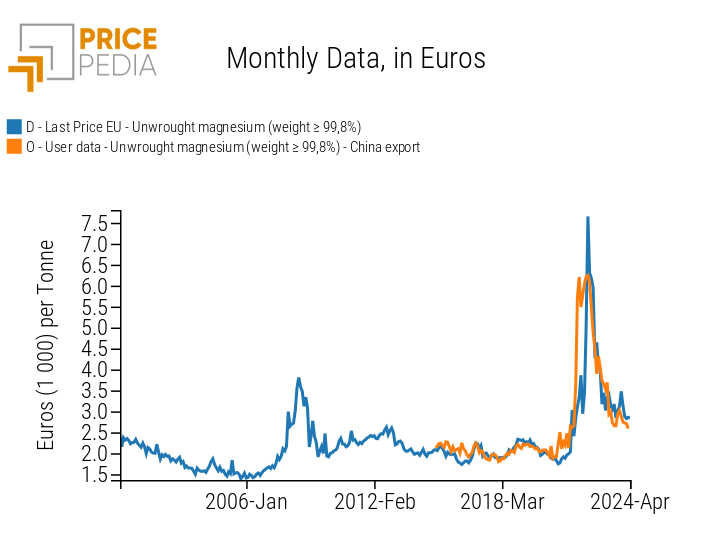

This is also evident from the comparison between Chinese export prices and EU customs prices developed by PricePedia, as shown in the following graphs.

Magnesium: China and EU Prices Compared

Unwrought magnesium (weight < 99.8%)

Unwrought magnesium (weight ≥ 99.8%)

Both graphs show a strong correlation between Chinese export prices and the EU market prices. Additionally, it can be observed that the Chinese price tends to lead the price dynamics in the European market by about a quarter. This is particularly evident in the 2021-2022 price cycle, where both the sharp increase and subsequent decrease were reflected in the European market a few months later than indicated by Chinese prices.

Conclusions

As with many other commodities, European magnesium supplies are heavily dependent on a single dominant player, China. It is the main global producer, leading to a very high supply risk for European companies, which is why magnesium has been classified as a critical raw material.

Dependence on China means that any price shocks in China are transferred to the European market within a few months. Monitoring these prices thus becomes a useful tool for predicting prices in the European market.

1. The economic importance indicator outlined in the Critical Raw Materials Act defines the importance of a commodity based on the number of applications and the added value generated by the user sectors.

2. The supply risk indicator defined by the Commission reflects the risk of supply disruption of a given commodity and mainly depends on the degree of EU imports, the concentration of imports in a few countries, and the governance of the supplying countries. It is measured both at the extraction phase of the raw material and at the first processing phase.

Pasquale Marzano

Economist and data scientist. At PricePedia he deals with the analysis of commodity markets, forecasting models for raw material prices and management of reference databases.