Setback for non-ferrous and precious metals prices

First signs of economic recovery in the EU, but services are the locomotive

Published by Luca Sazzini. .

Conjunctural Indicators Commodities Financial WeekFlash PMI Estimates

The new flash PMI composite estimates for the United States and Europe have indicated growth in both economies.

In May, the Composite PMI for the United States reached a value of 54.4, marking a high since April 2022. This growth is mainly attributed to the services sector, with its PMI reaching a value of 54.8.

The European Composite PMI rose to 52.3, compared to 51.7 recorded in April.

The data on manufacturing PMIs also showed improvements compared to last month's values, but not enough to indicate growth in the European industry.

In the last month, the Manufacturing PMIs for the United States and Europe were 50.9 and 47.4, respectively, up from the previous month's values (50 USA and 45.7 Europe). Economically, the US data indicates slight growth in the manufacturing sector, as it is above the 50-point threshold, which represents the dividing line between economic growth and decline. Conversely, the eurozone figure is still significantly below 50, extending the period of declining industrial activity levels in Europe to 22 months.

Concerns Over Upcoming Interest Rate Cuts

This week, doubts have increased regarding upcoming interest rate cuts by Western central banks.

Concerns about European monetary policy are tied to the wage growth in the first quarter of 2024, which saw an increase from 4.5% to 4.7%. The recovery of the German economy has led to wage growth that has worried financial markets, given the approaching date for the next interest rate cut.

Currently, a rate cut by the ECB is still expected in June 2024, but the likelihood is increasing that the ECB will make only 2 cuts by the end of the year.

The FOMC minutes released this week show the Federal Reserve's concern about the persistence of US inflation in the first quarter of 2024. This news has increased financial operators' doubts about the start of a phase of US rate cuts already in 2024. However, it should be noted that these minutes refer to the meeting concluded on May 1 and therefore do not take into account the improvement in inflation that occurred in April 2024.[1]

Commodity Market Trends

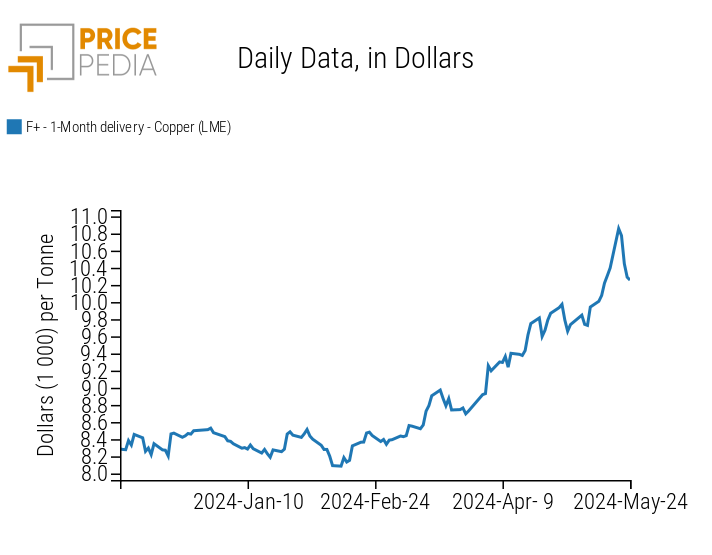

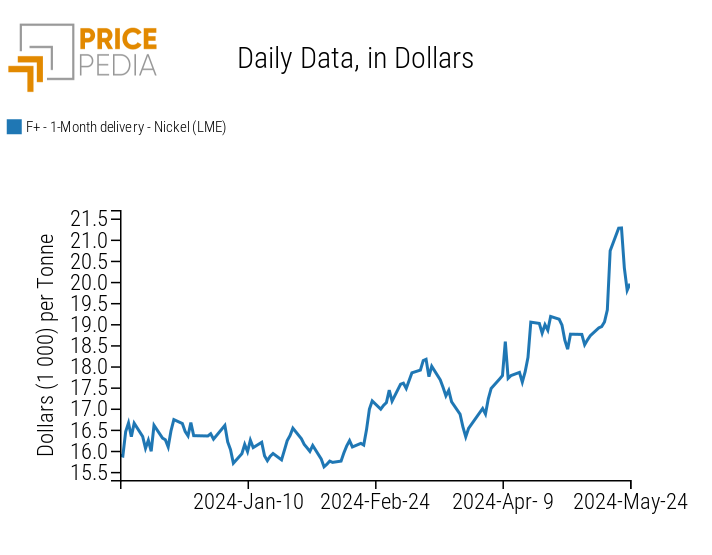

In the commodity markets, many commodities are following dynamics mostly related to speculative factors.

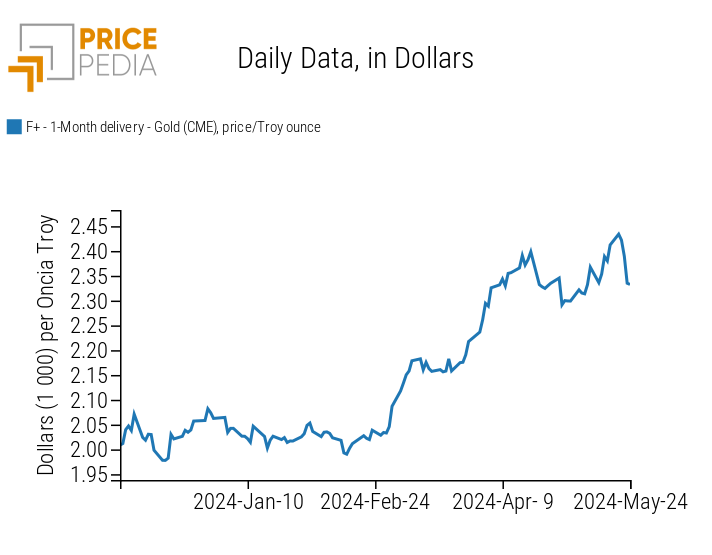

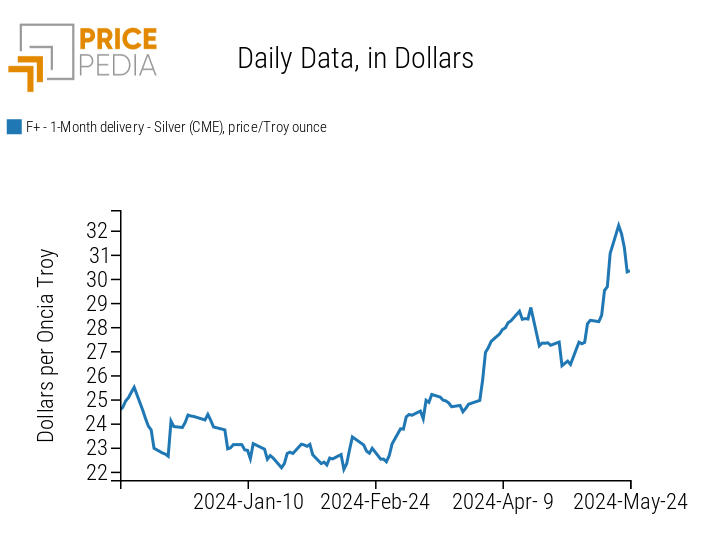

After the strong price increases of non-ferrous metals last week, the prices of copper and other non-ferrous metals have started to record sharp reductions. The prices of precious metals such as gold and silver, which reached new historical highs last week, have also started to decline in recent days.

Below are the spot prices of gold and silver, both quoted on the Chicago Mercantile Exchange (CME), and nickel and copper quoted on the London Metal Exchange (LME).

| Spot price of gold quoted on the Chicago Mercantile Exchange (CME) | Spot price of silver quoted on the Chicago Mercantile Exchange (CME) |

|

|

| Price of copper quoted on the London Metal Exchange (LME) | Price of nickel quoted on the London Metal Exchange (LME) |

|

|

Other markets that currently remain characterized by high uncertainty are those of cocoa and natural gas.

Cocoa has been experiencing strong price fluctuations for some time, while natural gas, although characterized by bearish fundamentals, is following an upward trend due to the potential effects of a complete interruption of EU imports from Russia.

[1] See last week's article: "The price gap of copper across different financial markets increases"

ENERGY

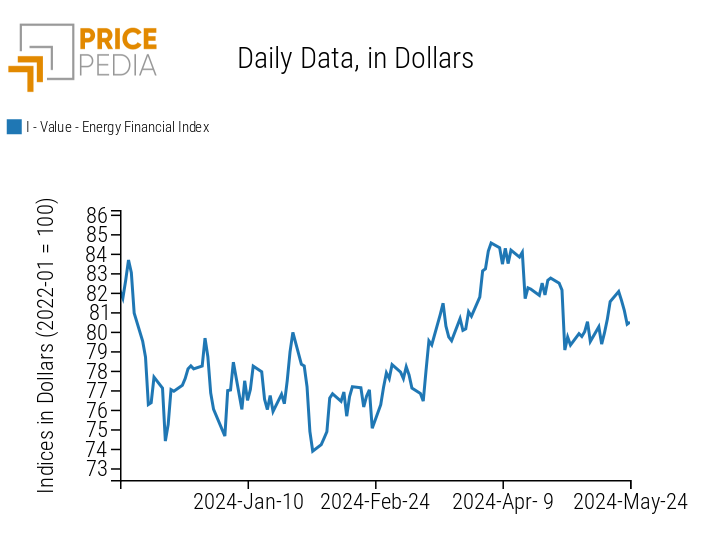

After a strong increase on Monday, the PricePedia financial index for energy dropped due to falling oil prices.

PricePedia Financial Index of Energy Prices in Dollars

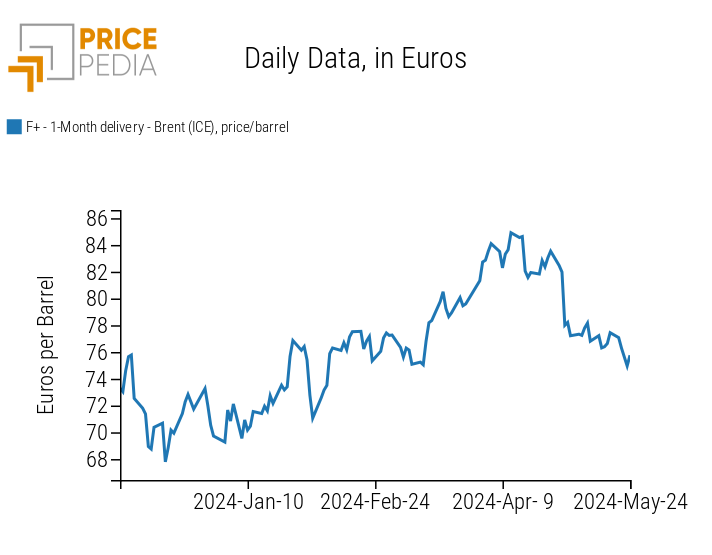

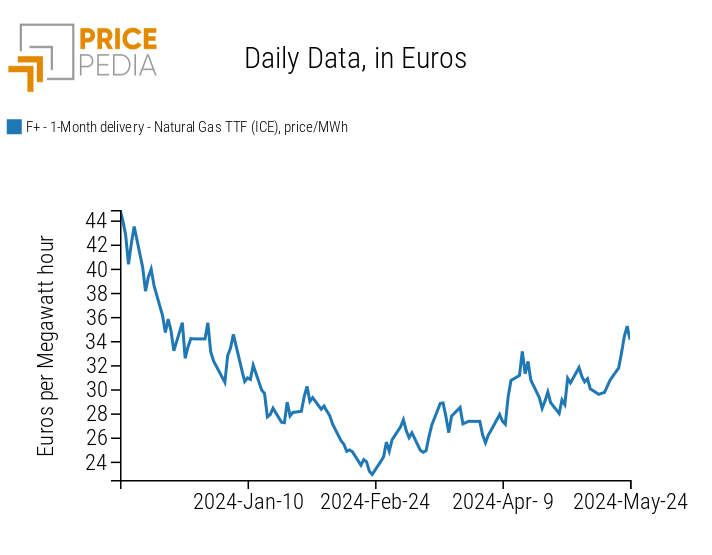

The following two charts show the euro prices of Brent crude oil and natural gas quoted at the Dutch TTF exchange point. Comparing the two charts clearly reveals the different dynamics of the two prices. On one hand, oil prices continue their downward trend after peaking in mid-April.

On the other hand, natural gas prices continue to rise. Statements from the Austrian energy company OMV about a possible halt in Russian gas flows to Austria, combined with maintenance at Norway's Troll and Kollsnes facilities, have supported the rise in TTF prices, which currently seem to be driven mainly by speculative factors. The current European storage level is 67%, higher than the same period last year (65%) and well above the five-year average (53%).

| Euro price of Brent crude oil | Daily price of natural gas at TTF |

|

|

PLASTICS

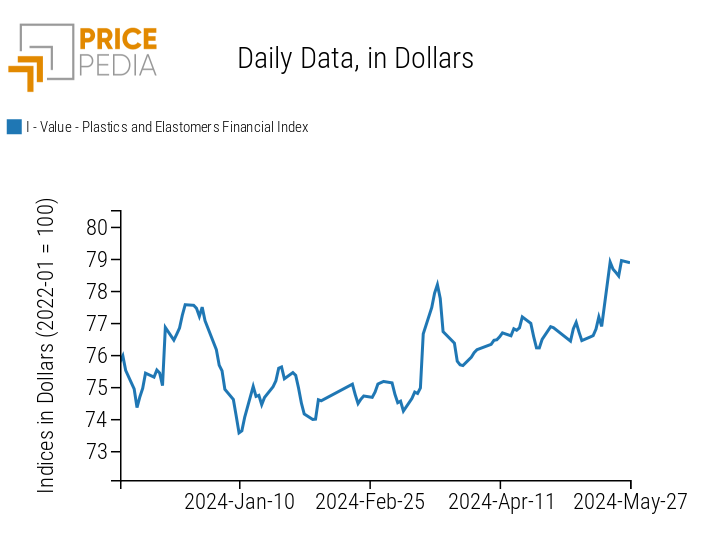

The financial index for plastics and elastomers recorded a strong increase on Monday, stabilizing at these levels in the following days.

PricePedia Financial Indices of Plastic Prices in Dollars

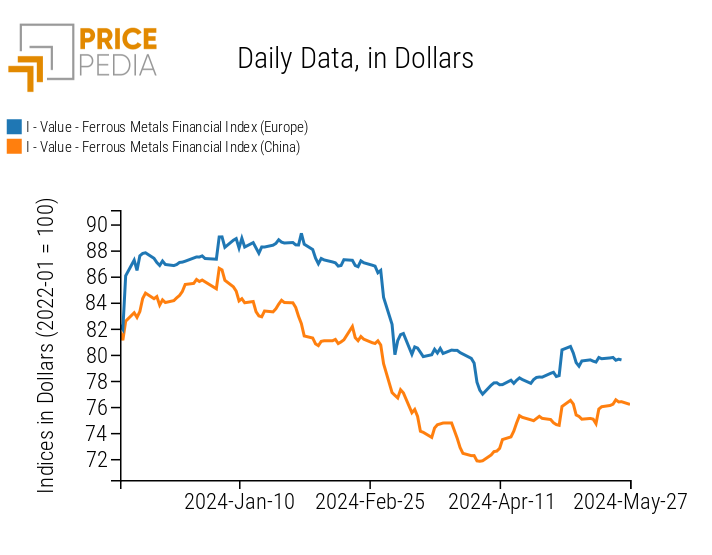

FERROUS METALS

The prices of ferrous metal indices continue to show weak fluctuations, keeping price levels relatively stable.

The slight positive fluctuation in the Chinese ferrous index over the past two weeks is attributed to the rising prices of wire rods, quoted on the Shanghai Futures Exchange (SHFE).

PricePedia Financial Indices of Ferrous Metal Prices in Dollars

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

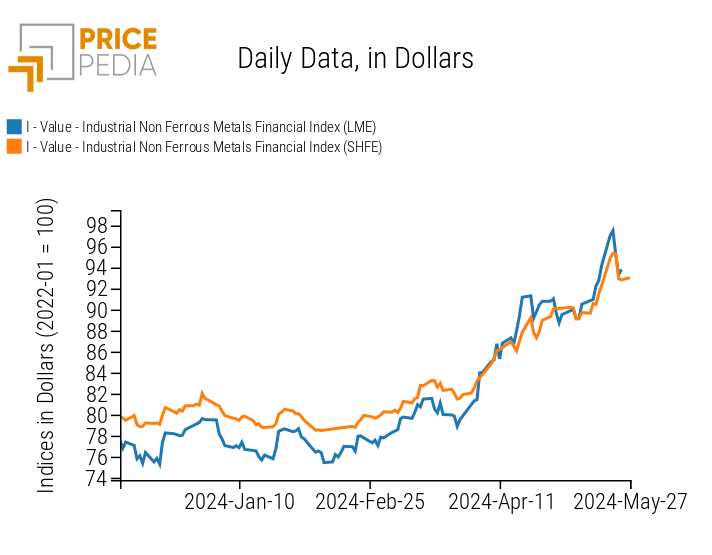

INDUSTRIAL NON-FERROUS METALS

This week, the upward trend in industrial non-ferrous metals came to a halt, with significant price reductions recorded at both the London Metal Exchange (LME) and the Shanghai Futures Exchange (SHFE).

PricePedia Financial Indices of Industrial Non-Ferrous Metal Prices in Dollars

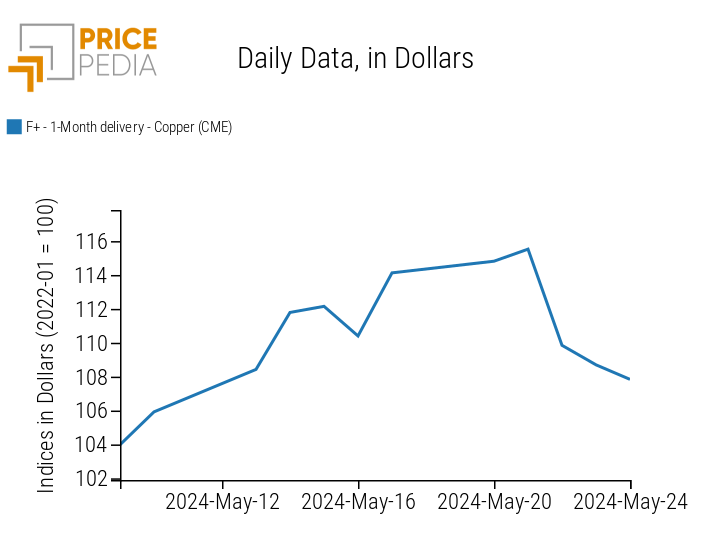

The most significant example of this sudden change in direction is the price of copper quoted on the Chicago Mercantile Exchange (CME), which decreased by nearly 7% in three days.

Price of Copper in Dollars Quoted on the Chicago Mercantile Exchange (CME)

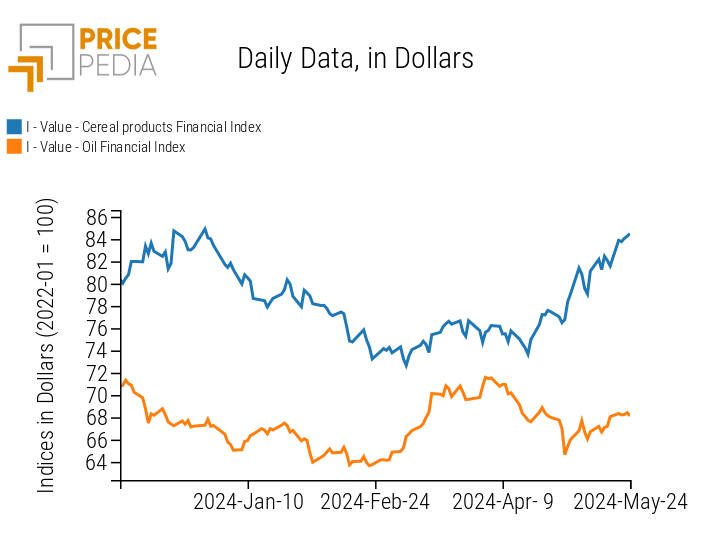

FOOD

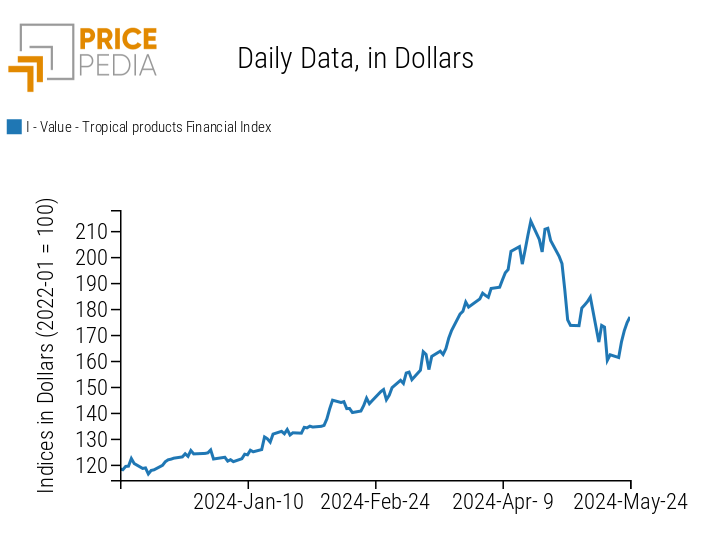

This week, there were increases in the index of cereals and edible oils. The tropical index also recorded an increase, driven by the continued rise in coffee prices, along with a new phase of cocoa price increases.

| PricePedia Financial Indices of Food Prices in Dollars | |

| Cereals and Oils | Tropical |

|

|