Absence of substitute goods and market concentration: the case of Manganese

Analysis of critical raw materials identified by the European Commission

Published by Pasquale Marzano. .

Non Ferrous Metals Manganese Critical raw materialsThis article delves into the criticality of manganese for the European economy, according to the criteria of economic importance[1] and supply risk[2] for European businesses, illustrated in the analysis Critical Raw Materials: the importance of substitutes.

Manganese economic importance

Manganese is widely used in steel production (both as an alloying element and as a desulfurizing and reducing agent) because it improves mechanical properties without inducing brittleness. It is also used in battery production and various other industrial sectors.

In general, the sectors using manganese are as follows:

- Building and construction, 43%

- Metalware, 14%

- Transportation, 20%

- Engineering, 17%

- Batteries, 2%

- Domestic appliances, 2%

- Miscellaneous uses, 2%

In the coming years, the manganese market is expected to grow significantly, driven by increasing demand from the electric battery sector. This growth is expected to add to the current uses in other sectors.

In the context of critical raw materials, considering the fact that there are no appropriate substitutes for the applications illustrated, manganese becomes essential for the European economy.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Criticality of Manganese in the EU market

Although manganese is among the most abundant elements in the Earth's crust, the extraction and processing of the metal are particularly concentrated: in terms of ores extraction, over 60% of the global total is the prerogative of only three countries (South Africa, Australia, and Gabon); regarding manganese processing, the main player is China, with 58% of the global total.

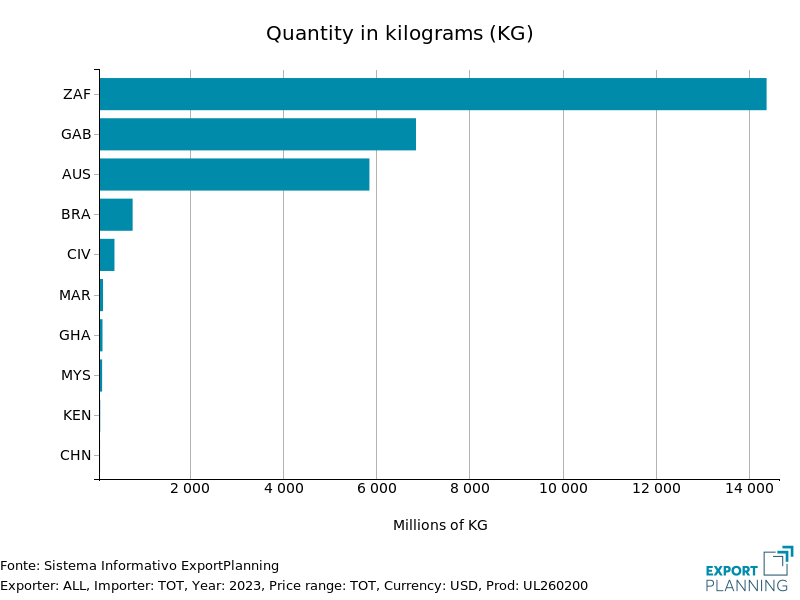

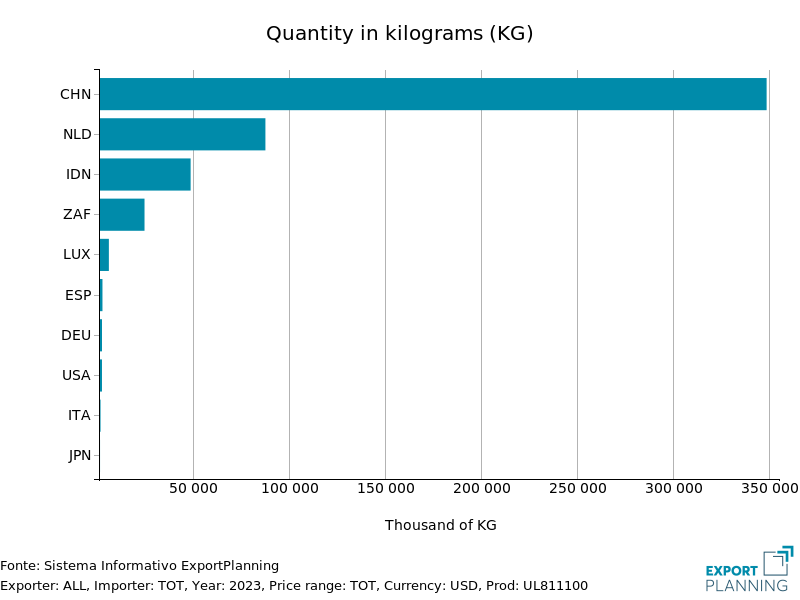

The market concentration is highlighted in the two graphs below, which show the main global exporters of both ores and metal (source ExportPlanning).

Global Manganese Trade: Main Exporters

Ores

Metal

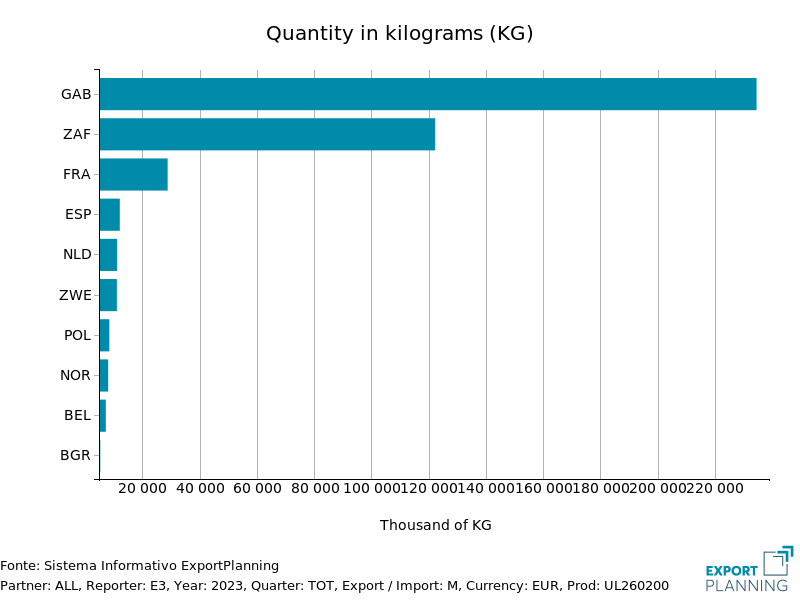

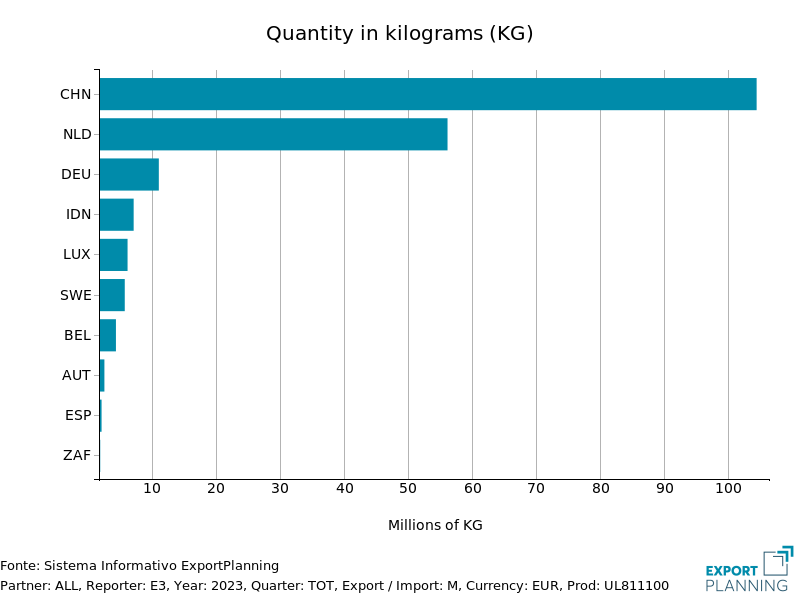

Looking at the data on European imports of manganese ore and metal, the situation is confirmed.

Manganese: Main Suppliers to the EU

Ores

Metal

In terms of ores, the main supplier to the EU is Gabon (second in the global supplier ranking), followed by South Africa (the world's leading exporter). Regarding European metal imports, China remains by far the main partner country for the EU.

Manganese prices compared

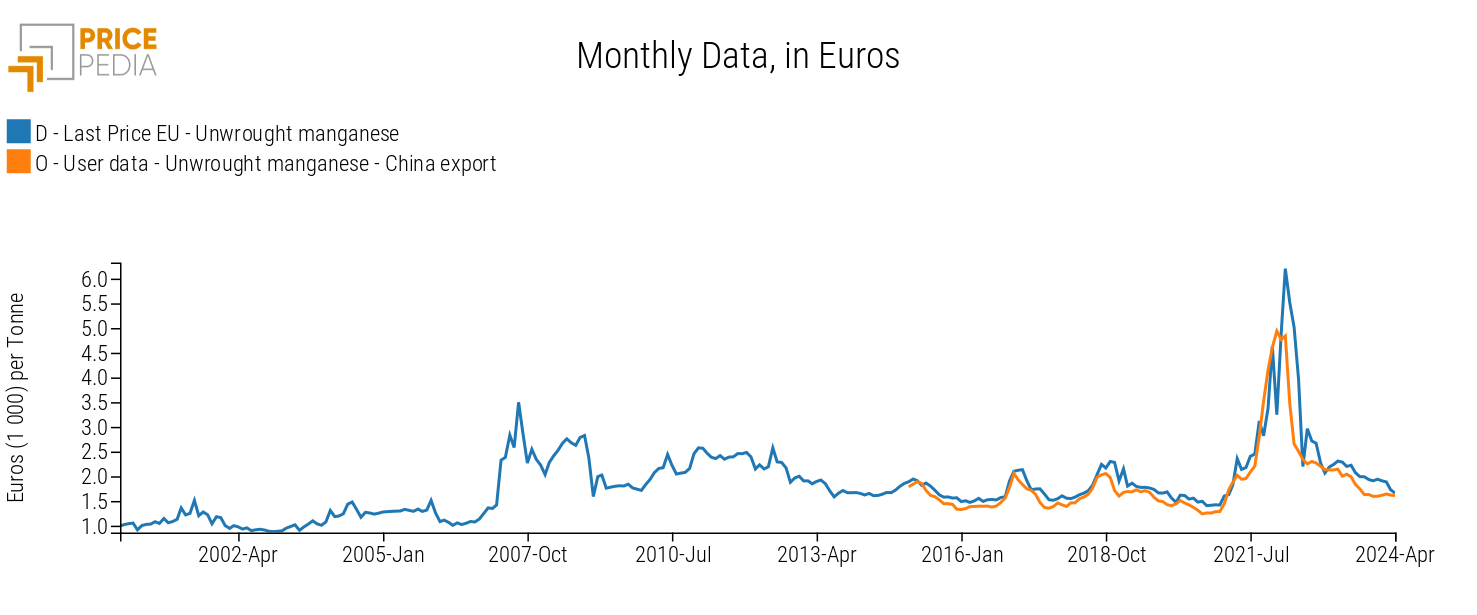

China's dominance in global raw manganese production means, as in the case of magnesium (see the article Price of magnesium in Europe: what criticalities?), that the European price is strongly linked to the Chinese price. The following graph shows the comparison between the Chinese export price of manganese and the EU customs price, both developed by PricePedia, in euros per ton.

The two prices are strongly aligned. The Chinese export price of manganese tends to anticipate the corresponding European price by about two periods. This means that any price changes in China tend to transfer to the European market with a two-month delay.

Conclusions

For European businesses, monitoring developments in China is crucial in the case of manganese as well. In this context, the Chinese export price of the metal can be a useful tool for anticipating trends related to the prices of their purchases.

1. The economic importance indicator outlined in the Critical Raw Materials Act defines the importance of a commodity based on the number of applications and the added value generated by the user sectors.

2. The supply risk indicator defined by the Commission reflects the risk of supply disruption of a given commodity and mainly depends on the degree of EU imports, the concentration of imports in a few countries, and the governance of the supplying countries. It is measured both at the extraction phase of the raw material and at the first processing phase.

Pasquale Marzano

Economist and data scientist. At PricePedia he deals with the analysis of commodity markets, forecasting models for raw material prices and management of reference databases.