Integrated Market Analysis: price dynamics between ores, scrap and metals

Expanding the analysis of prices of major non-ferrous metals beyond geopolitical tensions and expectations of energy transition

Published by Luigi Bidoia. .

Zinc Copper Non Ferrous Metals Aluminium Price DriversGeopolitical tensions and energy transition goals have brought raw material risks to the forefront. In the case of metals, the associated risk cannot overlook the evaluation of the risks related to the ores from which they are derived and the metal that can result from the recycling economy. From this perspective, two extreme cases can be indicated: magnesium and cobalt.

The Case of Magnesium

Magnesium is a unique metal because it can be extracted from seawater. The supply risk associated with seawater is naturally zero, while the risk associated with magnesium is very high given that 90% of the world's production capacity is installed in China.

The supply risk for magnesium metal is also high due to the limited recycled metal produced from the recycling economy. In 2023, recycled magnesium represented only 10% of the total magnesium supply.

The Case of Cobalt

Cobalt is the opposite case. If only mines with cobalt ores as primary production are considered, then the Democratic Republic of Congo is the only country in the world that produces cobalt ores. China imports almost all of the cobalt ores exported from Congo, fueling its cobalt production industry.

Cobalt ores are, however, also extracted, as by-products, from many copper and nickel mines.

This allows many countries other than China and Congo to supply the local metal industry.

For example, Canada, Finland, and Russia are among the top five cobalt metal-producing countries.

The supply risk of cobalt is therefore relatively low. It is also limited by the fact that recycled cobalt accounts for a significant share (25%) of total cobalt production worldwide.

The Case of the Four Most Produced Non-Ferrous Metals

Particularly significant is the case of the four most widely used and produced non-ferrous metals in the world:

- Aluminum: total production of over 100 million tons, of which 35% is recycled aluminum;

- Copper: global production of 25 million tons, of which 15% is from recycling;

- Zinc: global production of over 30 million tons, of which 30% is recycled zinc;

- Lead: global production of over 7 million tons, of which 60% is from recycling;

For all these metals, the world supply is little diversified: China is the world's largest producer, holding shares exceeding 33% and reaching up to 55% for aluminum.

The supply is more diversified for their respective ores. However, even in the case of ores, China plays a fundamental role, being the world's leading producer of lead and zinc ores with shares exceeding 40% and 30%, respectively.

Price relationships between metals and ores

Since ores represent a significant cost component in the production of related metals, it is logical to expect a close relationship between the price of the ore and the price of the primary metal. Additionally, given the importance of recycling for these metals, the price of scrap will also be correlated with the price of the ore, through substitution effects, and with the price of the metal, through the costs associated with recycled metal.

Studying the relationship between the prices of ores, scrap, and metals is essential to understand the behavior of these markets and how the interaction between demand, supply, and costs contributes to price formation. Furthermore, the prices of these four metals are quoted on the London Metal Exchange (LME), both as spot prices, with physical delivery in 3 days, and as futures prices, with deferred delivery. At the LME, not only physical operators but also financial operators participate, bringing their evaluations of market conditions and expectations of how these might evolve in the future.

It can be useful to conduct a statistical analysis of the existing relationships for each metal between the price of the ore, scrap, and the metal, both as physical and financial prices quoted on the LME. This analysis can reveal whether the financial price serves as a guide for the three involved physical prices, or if the relationships between the three physical markets (metal, ore, and scrap) generate economic signals to which the financial price must, in some way, align.

The most suitable statistical tool for this analysis is the partial correlation matrix. Unlike simple correlations, which measure the relationship between two prices without distinguishing between direct or indirect relationships (i.e., due to the presence of other correlated prices), the partial correlation matrix measures only the direct relationships between pairs of prices.

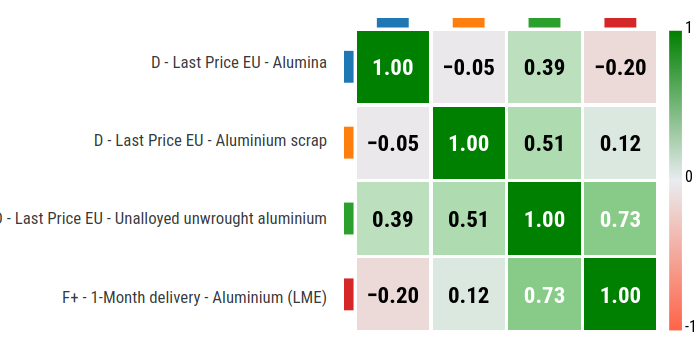

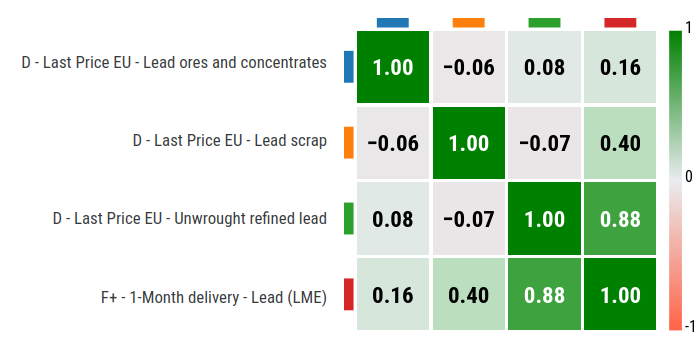

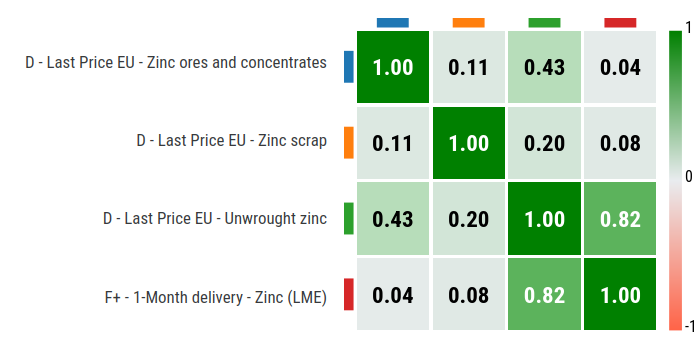

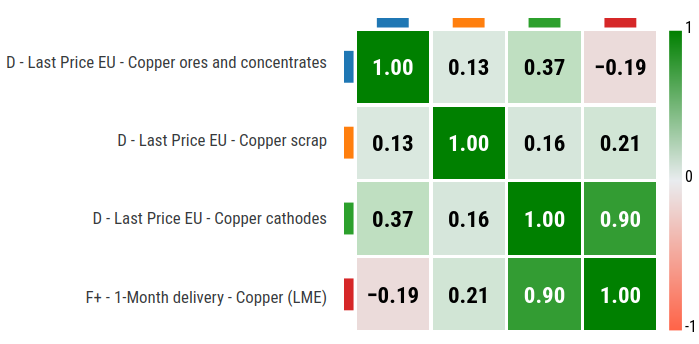

In the following figure, the partial correlation matrices for the four considered metals are shown. Each matrix displays the partial correlations between the pairs of prices for the ore, scrap, and metal, both as physical and financial prices. Values close to +1 indicate a strong direct relationship between the pair of prices considered, while values close to zero indicate the absence of a direct relationship.

Partial correlation matrix between ore, scrap and metal prices

| Aluminum | Lead |

|

|

| Zinc | Copper |

|

|

The analysis of these data allows us to extract the following signals:

- In the case of aluminum, the relationship between the physical price and the financial price of metal is relatively low, while the relationship between scrap and metal is relatively high, confirming the importance of recycling for this metal. The price of ore[1] is partially related to the physical price of the metal;

- The case of lead is similar to that of aluminum, with the difference, however, of the greater role played by the financial price. It is strongly correlated with both the physical metal price and the scrap price;

- The cases of zinc and copper are similar to each other and different from those of aluminum and lead. In these cases, the scrap price is not directly correlated with the other prices, while the correlation between the mineral price and the physical metal price is significant. For zinc and copper, the incidence of mineral costs is relatively high. As expected, copper is characterized by a high direct correlation between the physical price and the financial price of the metal.

Conclusions

An isolated analysis of the market for a single metal may not capture all the relevant factors that influence its price. Only an integrated analysis of the markets for minerals, scrap, and metal, including their respective physical and financial prices, can provide a comprehensive understanding of the economic forces at play. Although this integrated analysis is not immediate, a preliminary analysis of the different relationships can be conducted using the partial correlation matrix of the various prices involved.

The reported results confirm the strong direct relationship between the physical price and the financial price of the metal, with variability ranging from a particularly intense relationship for copper to a relatively less intense one for aluminum. However, contrary to expectations, the direct relationship of the metal's financial prices does not always extend to scrap and minerals. In some significant cases, a direct relationship between the prices of minerals and scrap with the physical price of the metal has emerged.

This implies that, in the relationship between the physical prices of minerals, scrap, and metal, there may be signals regarding the actual supply and demand situation in the markets, net of the effects exerted by the evaluations and expectations of financial operators, implicit in the financial prices of the metal.

[1] The main ore from which aluminium is extracted is bauxite, with an intermediate step given by the production of alumina. In order to analyse the relationship between the price of aluminium and the price of its mining input, in this analysis we have considered the price of alumina to be the most suitable price of this input.