Supplier pricing policies: a case study on rapeseed oil

Summary indicators can support the evaluation of suppliers, but cannot replace it

Published by Luigi Bidoia. .

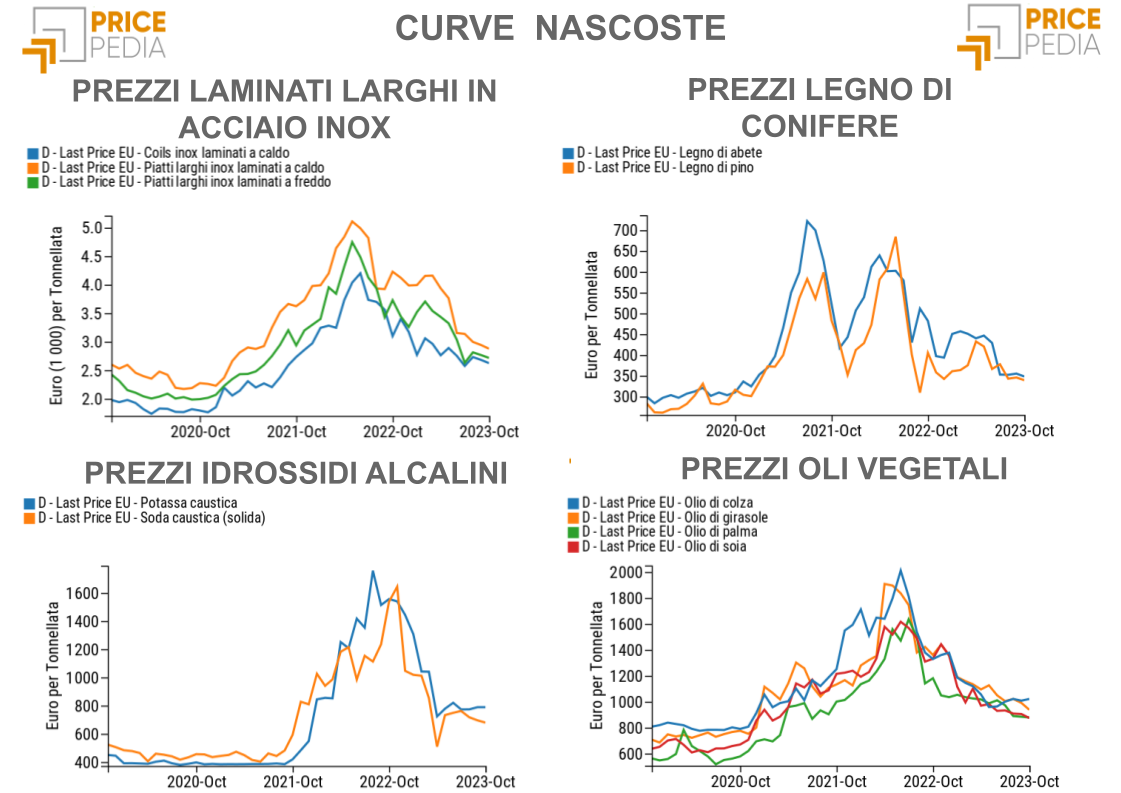

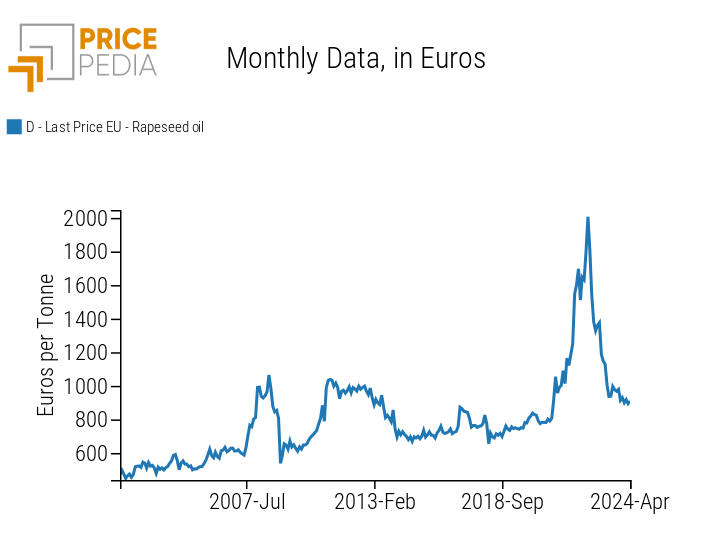

Vegetable oils Procurement IntelligenceIn recent years, all vegetable oil prices have undergone significant changes in their levels. Among the various oils, rapeseed oil has experienced the highest percentage variations. Between June 2020 and June 2022, the price of rapeseed oil increased from less than 800 euros per ton to over 2000 euros, then fell below 1000 euros in the following 12 months. The graph below shows that the variations in the 2021-2023 period have no comparison with the past history of this oil's prices.

Customs Price of Rapeseed Oil in Euros

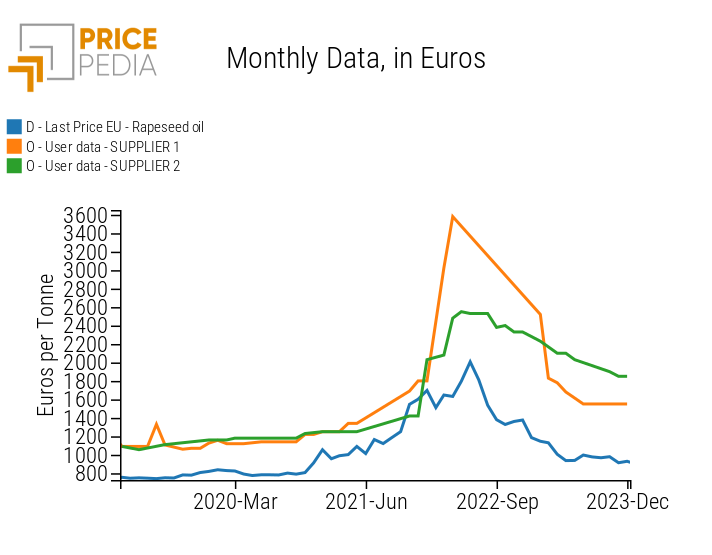

The availability of actual prices charged by some suppliers to a specific company allows us to briefly analyze how they have adjusted their selling prices over the years based on market price dynamics. This information also enables an evaluation of their pricing policies.

The following graph shows the prices charged by the two suppliers from the beginning of 2019 to the end of 2023. The graph also shows the customs price of rapeseed oil.

Rapeseed Oil: Comparison between Two Suppliers' Prices and Market Prices

The analysis of these data reveals some particularly interesting aspects.

Until the beginning of 2021, the two suppliers charged substantially equal prices, with a markup of about 350 euros over the customs price of rapeseed oil. Since the customs price can be considered equivalent to a production price for high purchase volumes, the markup represents the distribution compensation for the logistical and transportation services provided.

With the increase in customs prices, a clear difference began to emerge between the pricing policies of the two suppliers in 2021. While the first supplier quickly adjusted their prices to market levels, the second supplier applied much more moderate increases, ending 2021 with prices lower than the customs prices. This different behavior became more pronounced in 2022, with the first supplier asking for very high prices at the beginning of 2022, peaking at over 3500 euros/ton, requested and obtained for a sale in April 2024. The second supplier also increased prices in 2022, exceeding the level of 2500 euros/ton between May and August 2022.

Particularly interesting is the price decline phase in the second half of 2022, during which both suppliers tried to maintain high prices even when customs prices recorded a significant reduction. Of particular interest is 2023, when the first supplier reduced prices sharply, while the second supplier's reduction was much slower.

It is useful to note that at the end of 2023, after 7 months of customs prices for rapeseed oil being below 1000 euros/ton, the prices of both suppliers showed high markups compared to pre-pandemic levels, amounting to 600 euros for the first supplier and 900 euros for the second supplier.

Supplier Evaluations

Evaluating the two suppliers in terms of benefits for the company to purchase from one or the other is not easy, because it depends not only on prices but also on the quantities purchased.

A simple comparison of the average prices of the two suppliers would be correct only if the company had always purchased equal volumes from both suppliers. In this case, the average price of the two suppliers over the past 5 years would be 1712 and 1625 euros/ton, respectively, with a slightly more negative assessment for the first supplier.

However, it is likely that the purchasing company has optimized its purchases, trying to buy higher quantities from the supplier with lower prices and lower quantities, almost nil, from the supplier with higher prices, month by month. Therefore, if we consider the actual purchases, the average price of the two suppliers turns out to be 1468 and 1815, respectively, with a much better assessment for the first supplier.

Even this measure can be distorted. In fact, it does not incorporate the period in which the purchases were made. If the purchases from the first supplier were mainly made during periods of low prices, while those from the second supplier were made when the market price of rapeseed oil was very high, then we would reach a different conclusion, evaluating the second supplier as more convenient than the first. In this last case, the absolute level of the prices at which the purchases were made is not as important as their differential compared to market prices. Based on actual data, purchase volumes, and market prices, the average markup during the period for the first supplier was 480, while for the second supplier, it was 610.

Finally, it may be useful to observe that this last calculation also significantly depends on the company's purchasing choices, which continued to buy from the second supplier even in the second half of 2023, when its prices were continuously higher than those of the first supplier. The reasons can be various, including maintaining an active relationship with a supplier that was important during the peak period of high prices to moderate the company's purchase prices.

Conclusions

The detailed analysis of purchases made of the same product from multiple suppliers can provide useful insights into the importance of different suppliers in containing the company's purchase costs. The comparative evaluation of multiple suppliers must be considered with great caution because the results depend not only on the pricing policies implemented by the various suppliers but also on the purchasing policies implemented by the company. Paradoxically, if a company were to purchase goods

only from the supplier that sells at the lowest price at any given time, all suppliers would tend to become equivalent, as they would all be optimal, even if at different times.

The operational conclusion of this analysis is that comparative evaluations of suppliers, based on numerical processing of purchase volumes and prices, can make an important analytical contribution to a structured supplier evaluation process, but they cannot replace it.