Concerns about inflation and transport costs rise

OPEC meeting on 2 June is expected to extend the cuts for the second half of the year

Published by Luca Sazzini. .

Conjunctural Indicators Commodities Financial WeekGrowth of EU Inflation

The new data regarding the consumer price index (CPI) of the eurozone indicated a growth in both headline and core inflation.

Headline inflation recorded growth, rising from 2.4% y/y in April to 2.6% y/y in May.

The core index, which excludes the most volatile components (energy and food), recorded inflation growth to 2.9% y/y from the previous 2.7% y/y.

The sector that contributed the most to the price growth was services, which saw an annual growth of 4.1% compared to May 2023.

The increase in the consumer price index in the euro area has raised concerns about the future monetary policy of the European Central Bank (ECB).

For the meeting next week (June 6), the market still expects a forthcoming interest rate cut, but uncertainty is growing over when the second rate cut will take place.

It is unlikely that the ECB will make a second rate cut by September 2024, and markets fear that there will be only 2 cuts by the end of the year, instead of the 3 previously announced.

Concerns for International Trade

The worsening of the escalation in the Middle East is intensifying the Houthi attacks, which threaten to extend the area of their attacks and increase their intensity. Just this week, another ship transiting the Red Sea was hit by Yemeni rebels. Fortunately, there were no reported injuries, but international transport costs continue to rise.

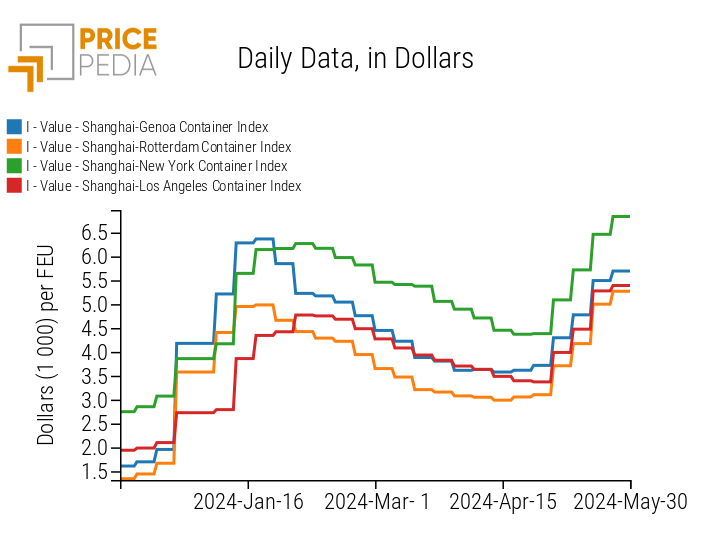

Below is a chart showing the trend of container ship freight rates departing from Shanghai.

Shipping Freight Rates from Shanghai

The chart above indicates the sharp rise in container ship costs, which, to avoid potential Houthi attacks, are forced to circumnavigate Africa, increasing both delivery times and fuel costs.

As shown in the chart, the increase in freight rates on Asia-Europe routes has also affected Asia-America routes, leading to an increase in freight rates for these as well.

Commodity Trends

The energy commodities market is awaiting the OPEC videoconference on Sunday, June 2.

Currently, the market expects a continuation of oil supply cuts for the second half of the year. If this does not occur, downward pressure on oil prices could increase, at least in the short term.

According to analysts, a tightening of the cuts is unlikely, as some countries have already opposed the current supply cuts, but an extension into 2025 remains possible.

The metals sector seems to have stabilized more over the course of this week. Prices for non-ferrous and precious metals have seen smaller decreases compared to last week.

The price of copper on the London Metal Exchange (LME) fell below $10,000 per ton on Friday.

The ferrous market remains largely stable.

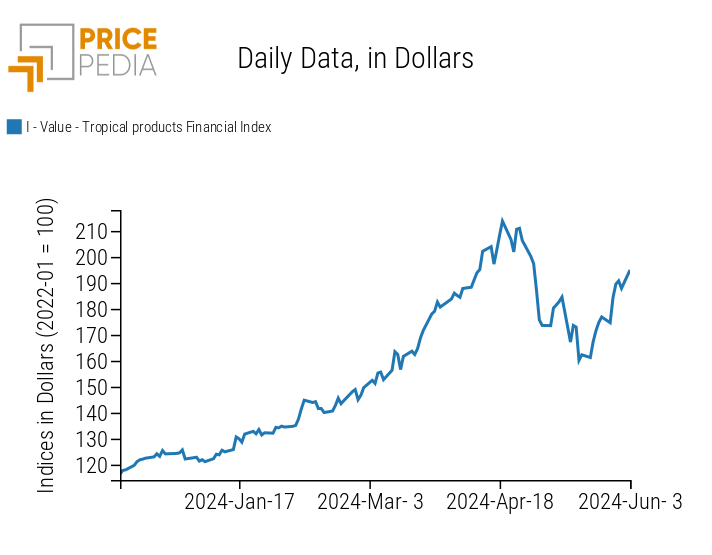

Meanwhile, high volatility persists in the tropical food sector, with further price increases this week for cocoa and coffee.

ENERGY

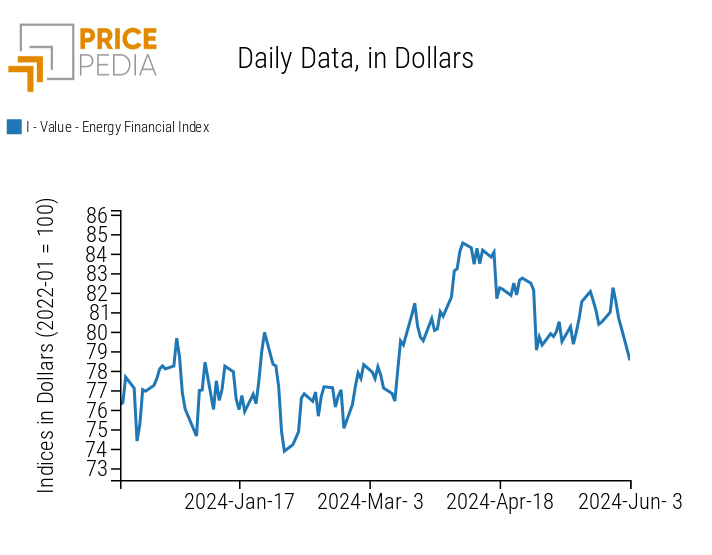

After a rise in the early days of the week, the financial index of energy prices saw a sharp reduction.

PricePedia Financial Index of Energy Prices in Dollars

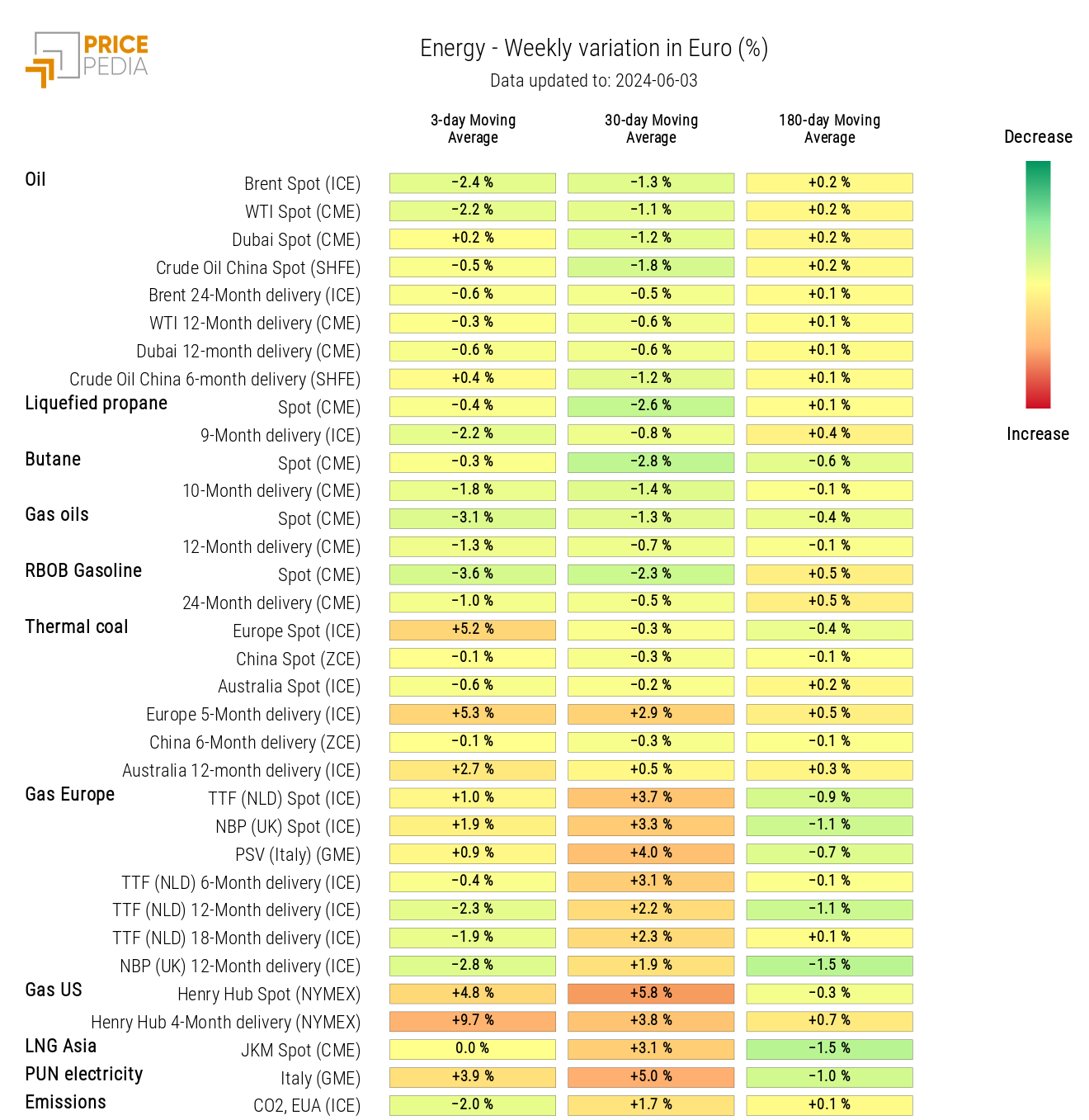

The heatmap of energy prices shows a reduction in oil prices and an increase in US natural gas prices (Henry Hub) after last month's increase.

HeatMap of Energy Prices in Euros

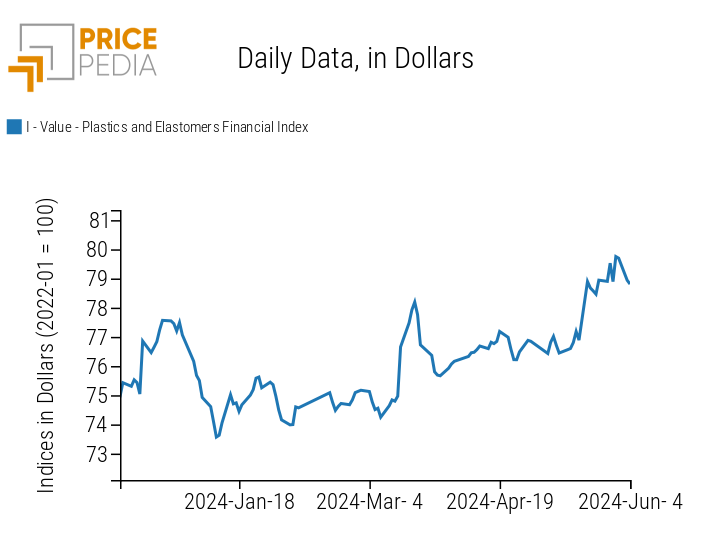

PLASTICS

The financial index of plastics is experiencing fluctuations that are increasingly turning into an upward trend.

PricePedia Financial Indices of Plastics Prices in Dollars

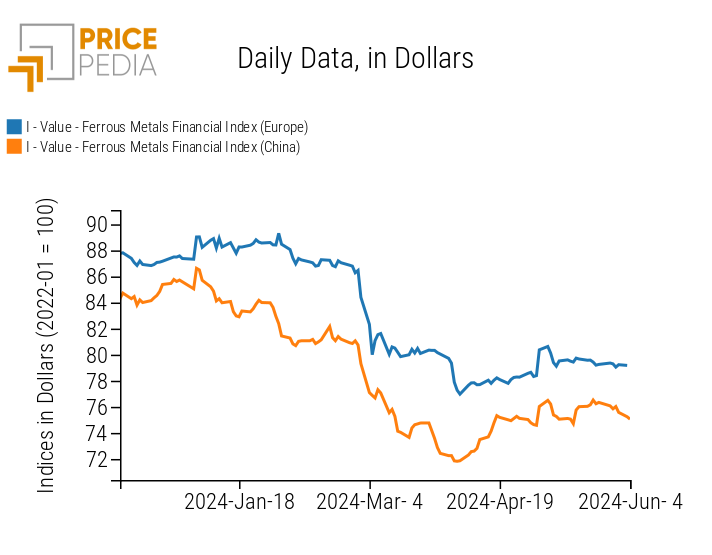

FERROUS METALS

Both ferrous indices confirm their stability, following a mostly lateral price trend.

PricePedia Financial Indices of Ferrous Metals Prices in Dollars

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

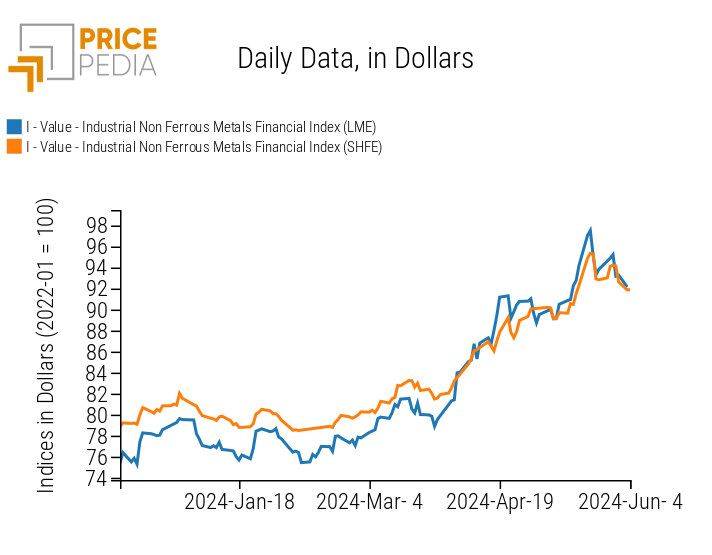

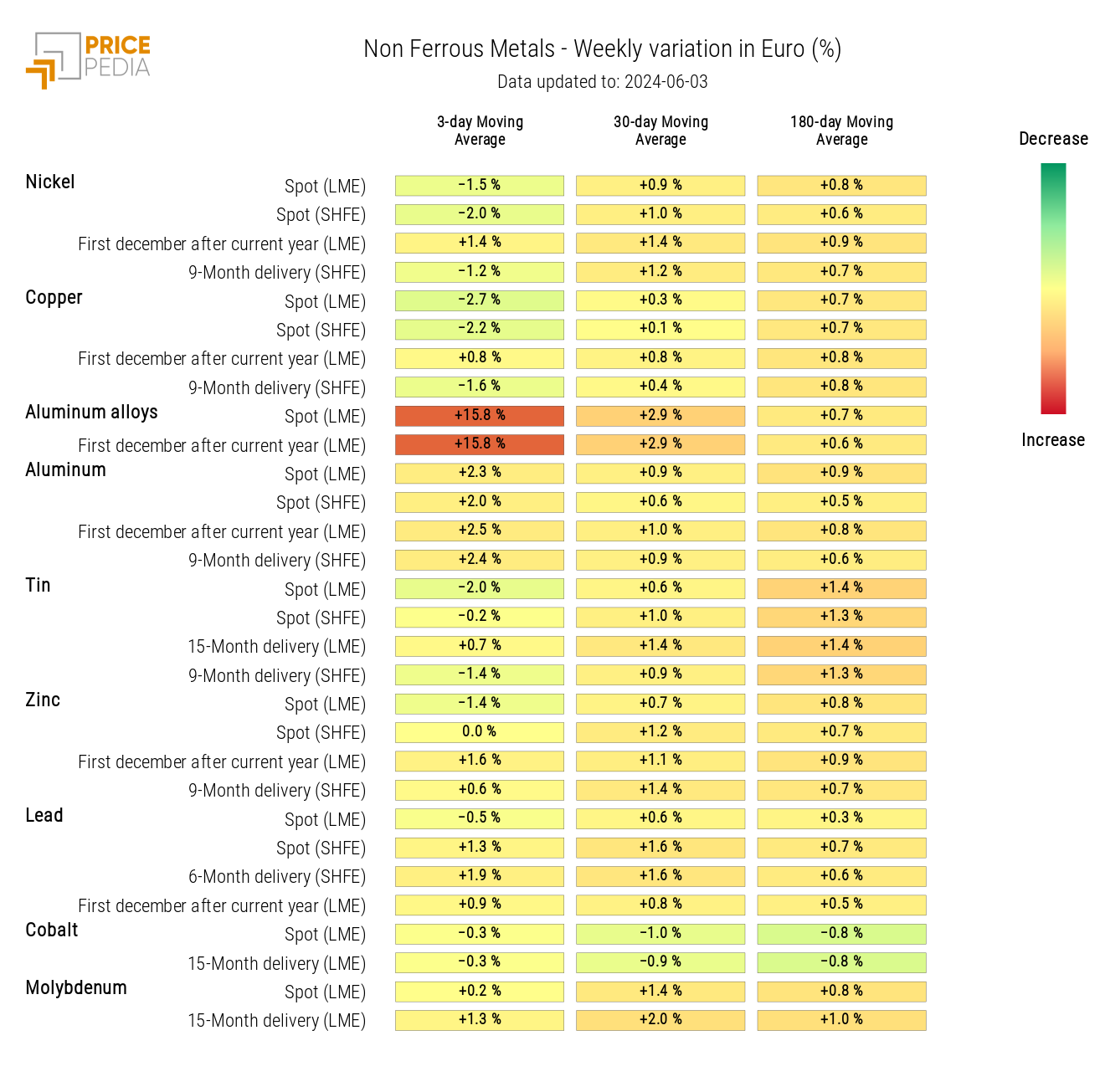

INDUSTRIAL NON-FERROUS METALS

After last week's collapse of non-ferrous metals, the two PricePedia indices of non-ferrous metals traded on the LME and SHFE recorded a slight fluctuation.

PricePedia Financial Indices of Industrial Non-Ferrous Metals Prices in Dollars

The heatmap of non-ferrous metals shows an increase in the prices of primary aluminum and, especially, secondary aluminum alloys.

HeatMap of Industrial Non-Ferrous Metals Prices in Euros

FOOD COMMODITIES

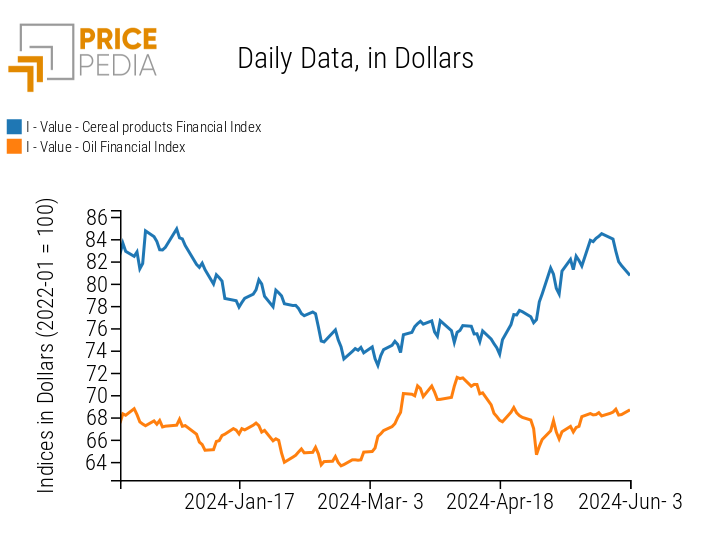

An analysis of financial indices for food commodities indicates a drop in cereal prices and a rebound in tropical prices.

The index for edible oils remains the most stable among the food indices, recording only slight price variations over the week.

| PricePedia Financial Indices of Food Prices in Dollars | |

| Cereals and Oils | Tropicals |

|

|

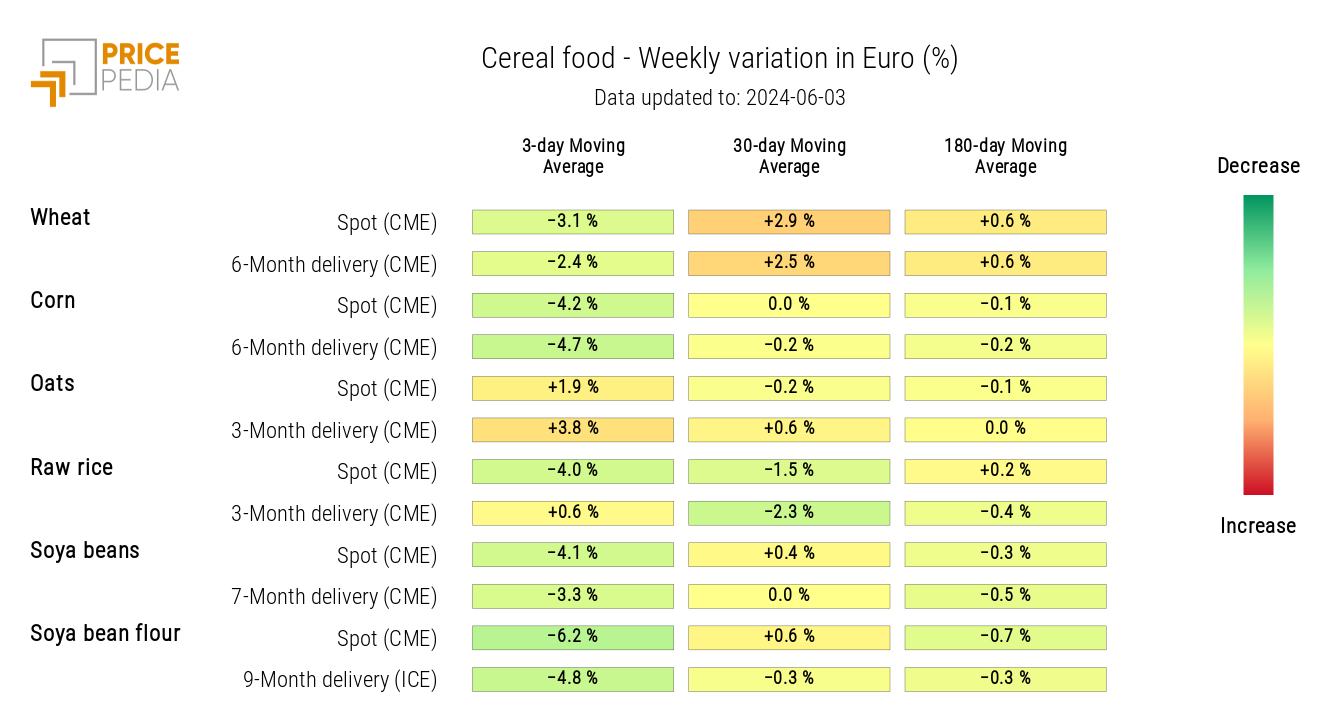

CEREALS

The heatmap of cereals shows a general price decline, with an increase in the price of oats.

HeatMap of Cereal Prices in Euros

TROPICALS

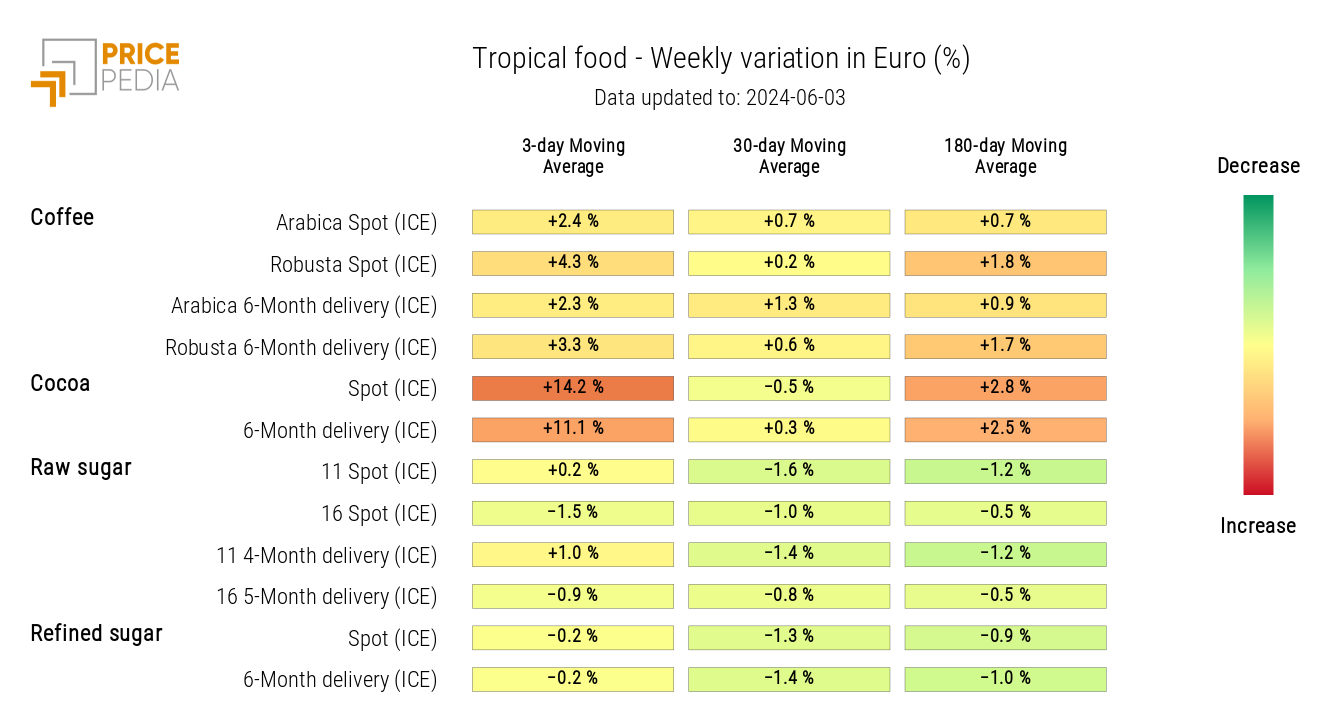

The heatmap of tropicals shows an increase in the weekly variation of the 3-day moving average of coffee and, especially, cocoa prices.

HeatMap of Tropical Food Prices in Euros