Commodity prices between inflationary pressures of financial markets and weak demand

PricePedia's Monthly Update for May 2024

Published by Pasquale Marzano. .

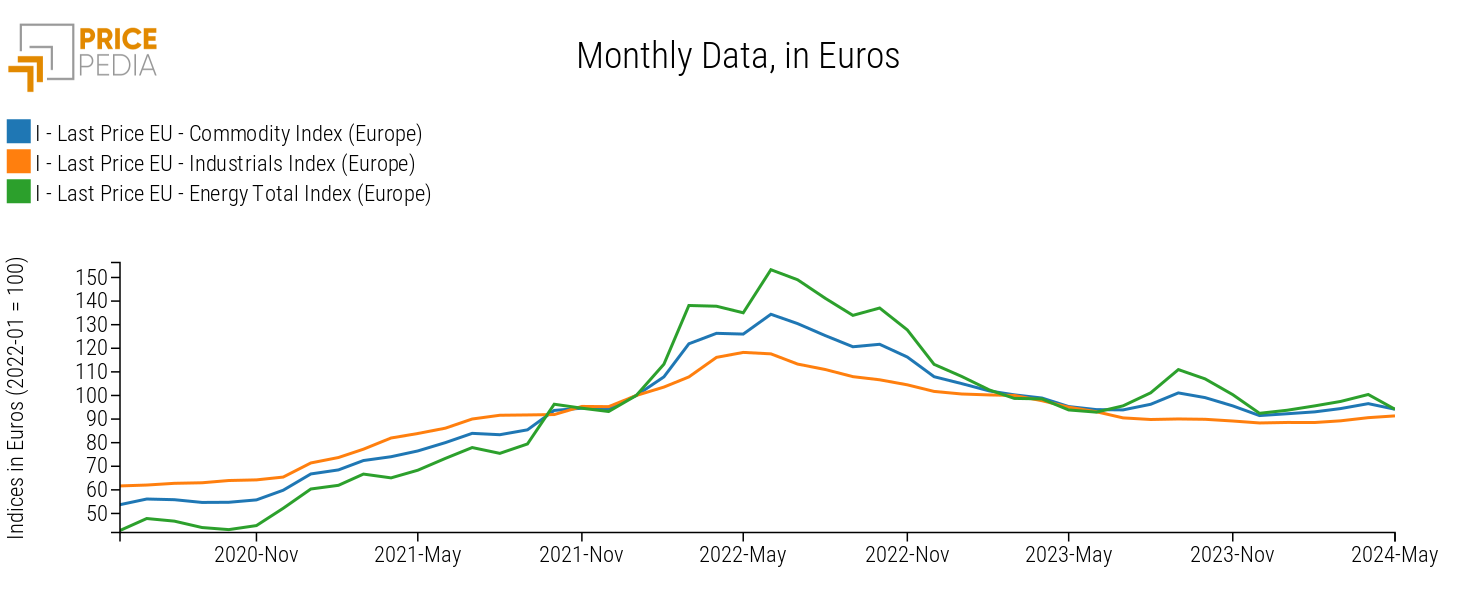

EU Customs Global Economic TrendsThe PricePedia monthly commodity price update for May 2024 has been published. The following graph shows the time series of PricePedia aggregate indices for Total Commodity[1], Industrials[2], and Total Energy, with their respective levels in January 2022 set as the base 100.

In May 2024, prices of Energy commodities in the physical market recorded a decrease of -6.3% compared to the previous month. This correction interrupted the upward trend that began in January 2024.

Regarding core industrial commodities, there is substantial stability (+0.8% compared to April 2024), with differentiations at the level of individual categories. The commodity category experiencing the most significant upward pressure is Non Ferrous Metals, which tends to quickly follow developments in financial markets.

Commodity Prices by Category

Below is an illustration of how the prices of individual categories are moving in the short term. Specifically, the graph shows the month-on-month variations of May 2024 compared to April 2024, in euros, for the PricePedia aggregated indices of the categories that make up the Total Commodity index (Industrials, Energy, and Food) and the Precious Metals category.

Graph 2: May 2024, variations (%) in euro with respect to April 2024

Source: PricePedia

As mentioned above, Non Ferrous Metals is the commodity category showing the largest increases in May (+3.8%). This growth is slightly lower than that recorded by the corresponding financial index[3] (close to 5%). The difference in growth is justified by the greater presence of processed goods (such as wires, sheets, pipes, etc.) in the composition of the index related to the physical market.

In this phase, the link with financial markets also characterizes the Food commodities, whose prices in May recorded a growth of +3.3%, supported by increases in their financial prices in recent months.

The price index for Wood and Paper also increased (+1.6% compared to last April). In this case, the increases are mainly related to the paper supply chain, while wood prices remained stable.

For Ferrous Metals and Plastics and Elastomers, prices are substantially stable. The remaining categories show a slight decline, close to -1%.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Medium-Term Trend

Although in recent months some categories have shown the first signs of growth, this has not yet led to new generalized tensions in the commodity markets. This is observable in the following graph, which shows the changes in euros recorded in May 2024 compared to May 2022, the month when the Industrials Index (Europe) reached its historical peak.

Graph 3: May 2024, variations (%) in euro with respect to May 2022

Source: PricePedia

In May 2024, prices for all the categories considered are lower than the average value of May 2022. Compared to that period, the greatest weakness is seen in the prices of Ferrous Metals (-30%). Almost all categories are now at least -16% lower than the levels of two years ago. Only Precious Metals and Food show a limited decrease of -4.4% and -2.8%, respectively.

Conclusions

The physical commodity markets continue to be characterized by substantial price stability. At this stage, global demand conditions do not seem able to start and sustain a new growth cycle. Only commodities whose physical prices are more influenced by financial quotations are recording more significant increases. This is the case, for example, of copper, where expectations of significant future demand increases are supporting financial prices and, consequently, influencing physical prices. Another case is paper, where increases are mainly due to the new growth phase of paper pulp quoted on NOREXECO.

1. The PricePedia Total Commodity index is the aggregation of Industrials, Food and Energy indices.

2. The PricePedia Industrials index is the aggregation of indices related to the following categories: Ferrous Metals, Non-Ferrous Metals, Wood and Paper, Chemicals: Specialty, Organic Chemicals, Inorganic Chemicals, Plastics and Elastomers, and Textile Fibers.

3. Industrial Non Ferrous Metals Financial Index (LME) available in Daily Data Prices >> PricePedia Financial Indices >> Metals. Pasquale Marzano

Economist and data scientist. At PricePedia he deals with the analysis of commodity markets, forecasting models for raw material prices and management of reference databases.