Impact of purchasing policies of user companies on commodity markets

An analysis of recent events and future prospects

Published by Luigi Bidoia. .

Procurement Procurement IntelligenceExtraordinary Events in Commodity Markets

The events in the commodity markets over the past four years represent an extraordinary occurrence not only for this century but probably also for previous ones. The exceptional nature does not lie so much in the price increases recorded in financial markets, whose high variability is an intrinsic characteristic, but in what has happened in the physical commodity markets. It had never happened that such a high number of commodities experienced such significant price increases in such a short period of time.

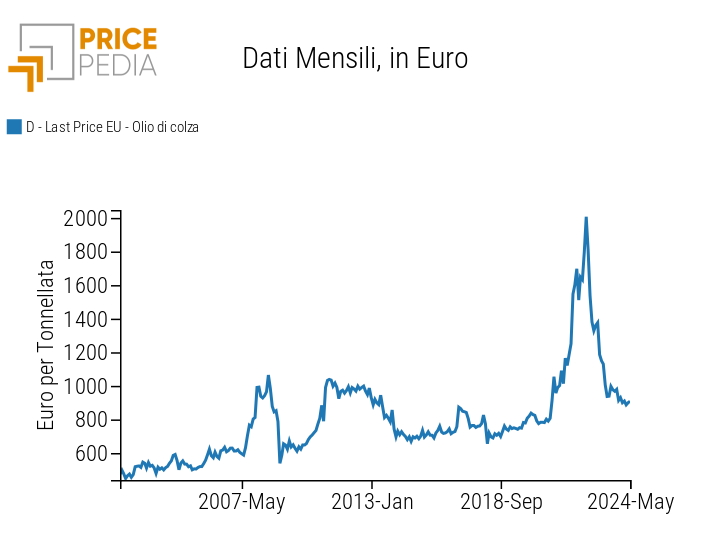

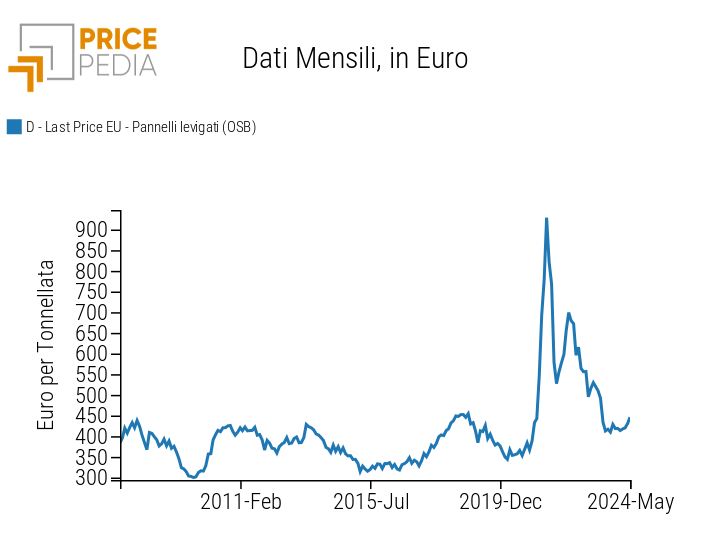

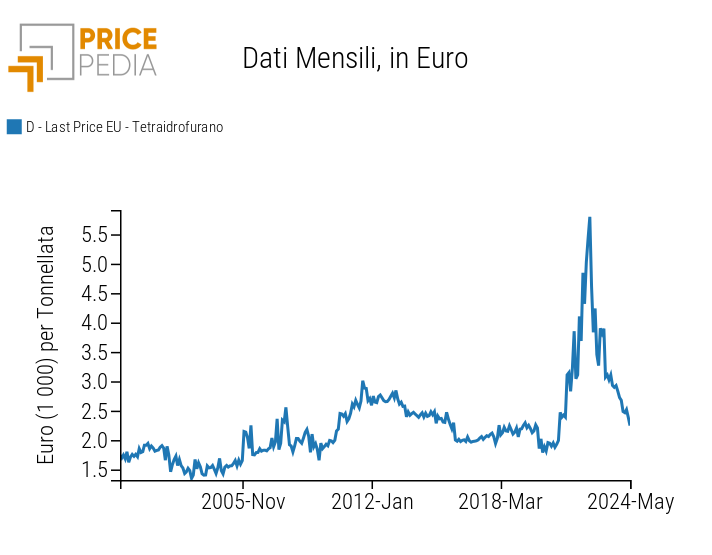

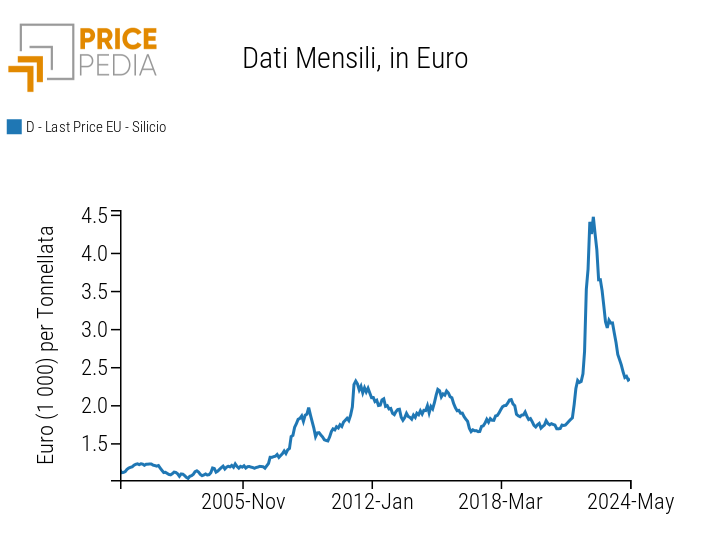

The following charts show the monthly historical price series of four particularly relevant commodities in this context: rapeseed oil, Oriented Strand Board (OSB), tetrahydrofuran, and metallic silicon.

Customs Prices in Euros of Four Commodities

| Rapeseed Oil | Oriented Strand Board (OSB) |

|

|

| Tetrahydrofuran | Metallic Silicon |

|

|

Price Anomaly Between 2021 and 2022

In all four reported cases, the anomaly represented by the price increase in the 2021-2022 biennium, followed by a subsequent drop, is evident. These examples are just part of a broader phenomenon. Commodities that show a similar pattern, with limited variability in the first 20 years of this century, a strong growth in the 2021-2022 biennium followed by an equally strong reduction, represent over 10% of the more than 500 prices analyzed by PricePedia.

The event behind the price growth in 2021-2022 is naturally the COVID-19 pandemic, which disrupted global production and distribution chains, causing a supply shortage in the face of a demand that, supported by public resources, overall held up.

Transition from "Just in Time" to "Just in Case" Policies

If the COVID-19 pandemic can be considered a "black swan," with a limited probability of recurring, the mechanism that led to a strong global supply deficit in many commodity markets was not as exceptional. This mechanism involves the rapid shift from "just in time" purchasing policies to "just in case" purchasing policies[1], which led to a significant increase in the demand for commodities for precautionary purposes, to which the supply was unable to respond with equally significant increases.

Indirect Measures of Inventory Accumulation

An indirect measure of this accumulation of commodity inventories by user companies can be derived from national accounting statistics. If we consider the stock of inventories held by companies in the 27 European Union countries, both upstream and downstream of the production and distribution processes, it increased in quantity by an average of 1.3% per quarter between 2019 and 2023. In the four quarters between the fourth quarter of 2021 and the third quarter of 2023, the total inventory stock increased at a double rate, equivalent to 2.5% per quarter.

This is the period in which the EU economy was consolidating its growth at a rate of 0.7% per quarter, supported by the continuous increase in consumption and exports. In this situation, it is reasonable to assume that downstream inventory accumulation was modest, relegating the increase in inventories recorded in national accounting to the growth of raw materials and semi-finished goods held in upstream warehouses.

The data, at least for Europe, confirm a strong increase in commodity inventories by user companies between the end of 2021 and mid-2022, precisely during the phase when many commodity prices reached previously unimaginable levels. Therefore, if the primary cause was the disruption of production and distribution chains caused by the pandemic, the mechanism that turned the initial supply risk into a rush to fill warehouses was a consolidated behavior of user companies. These increased purchases of commodities were naturally favored by low interest rates, which remained at minimum levels until June 2022.

Commodity Price Stability in 2023

After a sharp decline between the second half of 2022 and the first part of 2023, for many months now, physical commodity prices have been registering substantial stability, in the face of global industrial production and corresponding commodity demand being stationary or declining.

Since the end of March 2024, the prospects of a short-term interest rate reduction and a new phase of growth in global industrial production, combined with scenarios of possible strong increases in the demand for raw materials linked to the energy transition, have been reflected in increases in financial commodity prices, especially metals. Copper quoted on the London Metal Exchange, at the end of May, exceeded $10,000 per ton.

Future Prospects and Market Monitoring

The most likely scenario currently foresees a contained increase in physical raw material prices in the coming years. However, the fear that, during a recovery in commodity demand and low interest rates, increases similar to those of 2021-2022 may occur again is more than justified.

The factor that should prevent the recurrence of similar situations is the good diversification of supply that characterizes commodity markets. Should this diversification decrease due to the emergence of constraints on free trade in international commerce, the likelihood of seeing double-digit price increases for several consecutive months would increase.

This risk suggests constant and careful monitoring not only of the intensity of the next industrial recovery and its effects on global commodity demand but also of all those political and economic events that could result in a lower diversification of supply in international commodity markets.

Conclusion

In summary, the past few years have demonstrated how volatile and sensitive commodity markets are to global events and supply and demand dynamics. The COVID-19 pandemic triggered a process that led to exceptional variations in commodity prices, influenced both by the disruption of production chains and by changes in companies' procurement strategies.

Although the near future predicts a contained increase in raw material prices, the risk of a new price shock cannot be completely excluded. It is essential to closely monitor market trends, economic policies, and geopolitical developments that could reduce supply diversification. Only through constant vigilance and ready adaptability can we effectively manage this high level of uncertainty.

[1] For more information on the transition of purchasing policies from ‘just in time’ to ‘just in case’, see Supercycle or just in case