How the Chinese market influences the EU market: the case of tungsten and its compounds

The impact of Chinese prices on tungsten carbides in Europe through the cost structure

Published by Luigi Bidoia. .

Energy Transition Critical raw materialsTungsten is a metal with very special properties. It has the highest melting point of all pure metals (over 3,000 degrees Celsius), making it particularly useful for producing heat-resistant metal alloys, used in applications such as rocket nozzles and turbines. Additionally, when combined with carbon, it forms tungsten carbide, a material with a hardness close to that of diamond. This hardness is essential for the production of cutting tools, drills, and other equipment used in metalworking and rock drilling.

Tungsten is a metal in which China has an undisputed position of strength. China not only holds the largest global reserves of tungsten ores but is also the leader in the production of all tungsten-based compounds. Consequently, the prices of various materials in the tungsten production cycle are primarily determined by the Chinese market, thus influencing prices in all other industrial areas worldwide.

Tungsten Production Cycle

Tungsten is found in nature in the form of ore. China holds over half of the world's reserves and produces more than three-quarters of the globally extracted ore[1]. However, China is a net importer of ores to meet its high demand. Rwanda is the leading global exporter of tungsten ores, followed by Russia, Bolivia, and Australia. In Europe, Spain and Portugal are among the main producers and exporters.

Tungstates

The initial processing of tungsten ores produces sodium tungstate, which is then converted into ammonium paratungstate and ammonium metatungstate. These compounds are collectively known as tungstates. Global production of tungstates is highly concentrated, with China, Taiwan, and Vietnam representing over 80% of world trade, making this commodity one of the critical raw materials for the European Union[2].

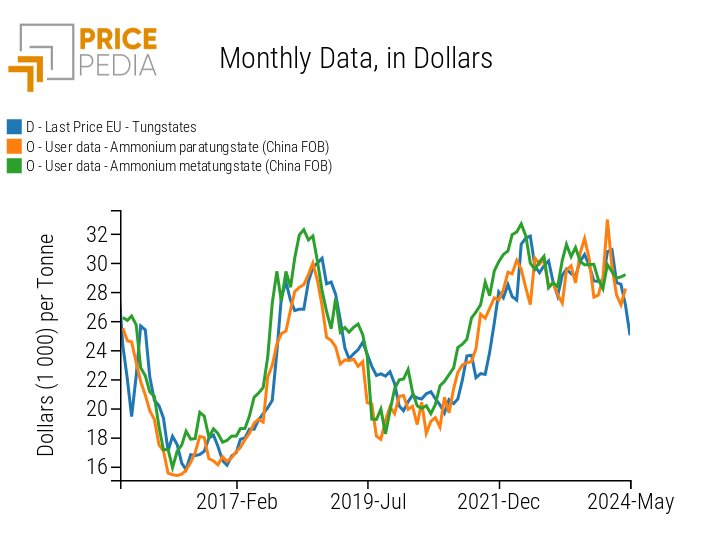

Given this market structure, Chinese export prices of tungstates influence price dynamics in the EU. The following graph shows the EU customs price of tungstates and the Chinese export prices of ammonium paratungstate and ammonium metatungstate[3].

World price in dollars of tungstates

The analysis of the graph clearly shows the substantial alignment of tungstate prices in the two global regions and how Chinese prices generally precede European prices by an average of two months.

Tungsten Oxides and Hydroxides

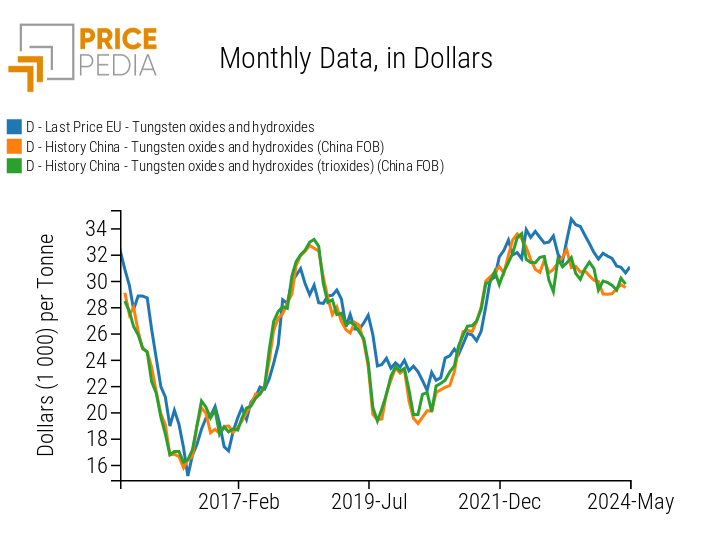

China holds a less dominant position in tungsten oxides and hydroxides, which are the most important chemical compounds derived from tungstates. In this market, China competes with the United States and Vietnam for the top exporter position. Additionally, the international market sees significant presence from many other countries, such as South Korea and Japan in Asia, and the Netherlands and Germany in Europe. Even in this situation, the Chinese market still drives global prices, as shown in the graph below.

World price in dollars of tungstate oxides and hydroxides

The graph shows the EU customs prices for tungsten oxides and hydroxides, compared with Chinese export prices of tungsten trioxide and other oxides and hydroxides. It is evident that the three series move similarly. Additionally, statistical analysis indicates a trend where Chinese prices precede EU price movements by two months.

Tungsten Carbides

China is the world's leading exporter of tungsten carbides. The global supply of carbides is relatively diversified, with significant contributions from European countries like Austria and the Czech Republic. The top five exporting countries account for just over 70% of the global trade in carbides, compared to 95% for tungstates. Tungsten carbides are particularly important as they represent 65% of global tungsten consumption. They are used for manufacturing metalworking and rock drilling tools, where their high abrasion resistance is crucial for all mechanical parts subject to wear[4].

Overview of Price Dynamics Along the Supply Chain

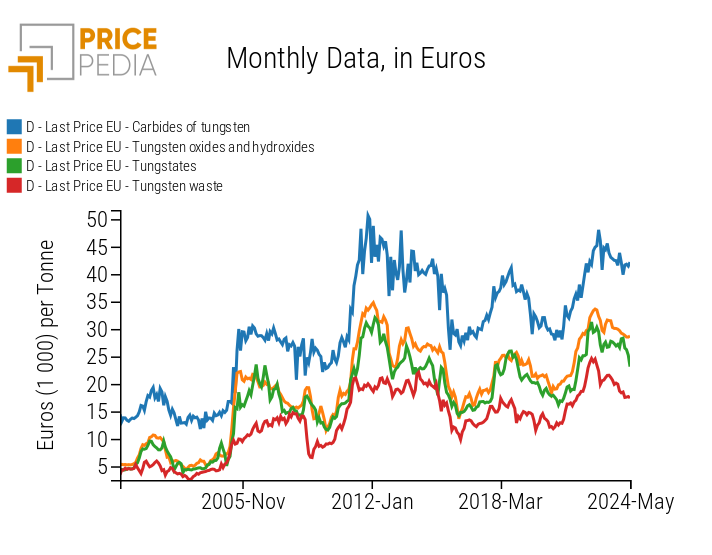

The third graph below shows how all prices along the tungsten supply chain have consistently moved in perfect alignment with one another.

The graph includes four EU customs prices in euros, related to:

- Tungsten scrap (waste and scrap);

- Tungstates;

- Tungsten oxides and hydroxides;

- Tungsten carbides.

The graph also shows the price of tungsten scrap, whose importance as a substitute for ores, as a source of tungsten, has increased in this century, reaching 35%. Tungsten has a relatively high recycling rate compared to other metals[5].

EU customs prices in euro for tungsten compounds

The analysis of the price dynamics highlights how the price of tungstates influences the prices of other products, including scrap. The effect of the Chinese market in determining global prices of tungstates and tungsten oxides and hydroxides is reflected in the prices of tungsten carbides in Europe.

Conclusions

Tungsten carbides are essential for providing hardness and abrasion resistance to metallurgical alloys. The global supply of carbides is relatively diversified. However, prices in the EU market are strongly linked to the supply and demand conditions in the Chinese markets for tungstates and tungsten oxides and hydroxides. In the EU market, the price of carbides reflects the costs of tungstates and oxides. Thus, the price formation in the EU market depends on what happens in China, not only for products where China has a strong leadership position but also for derived products.

[1] Source: U.S. Geological Survey (USGS): MINERAL COMMODITY SUMMARIES 2024

[2] For more information, see the Critical Raw Materials Act, issued by the European Parliament and Council on April 11, 2024. For a specific analysis by the EU Commission on tungsten, see the EU fact sheet on tungsten

[3] Sodium tungstate represents an intermediate phase in the chemical production process of other tungstates. For this reason, it is rarely marketed as a final product.

[4] Source: International Tungsten Industry Association

[5] Source: United Nations Environment Programme: Recycling Rates of Metals - A Status Report