Iodine: the effects of a high concentration of world supply

Accident at a Chilean plant supported the doubling of world iodine prices

Published by Luca Sazzini. .

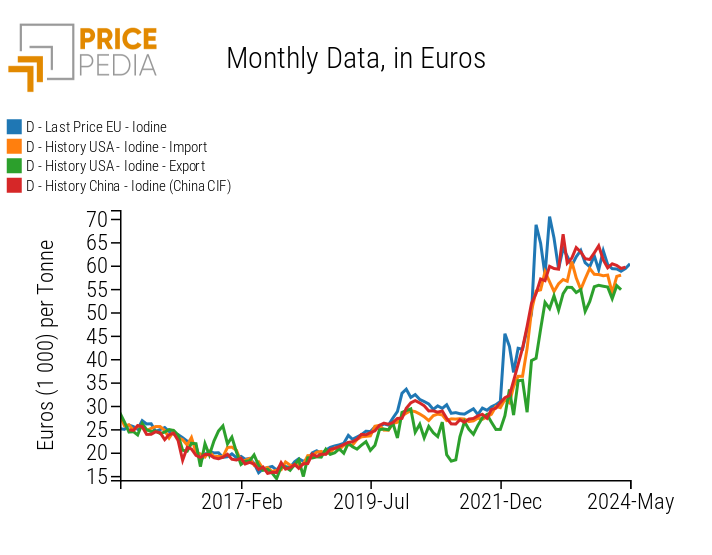

Inorganic Chemicals Price DriversA product that recorded strong growth in the 2021-2022 biennium and has remained around its peak price levels is iodine. In fact, after the sharp rise in 2021-2022, iodine prices seem to have stabilized near their peak points.

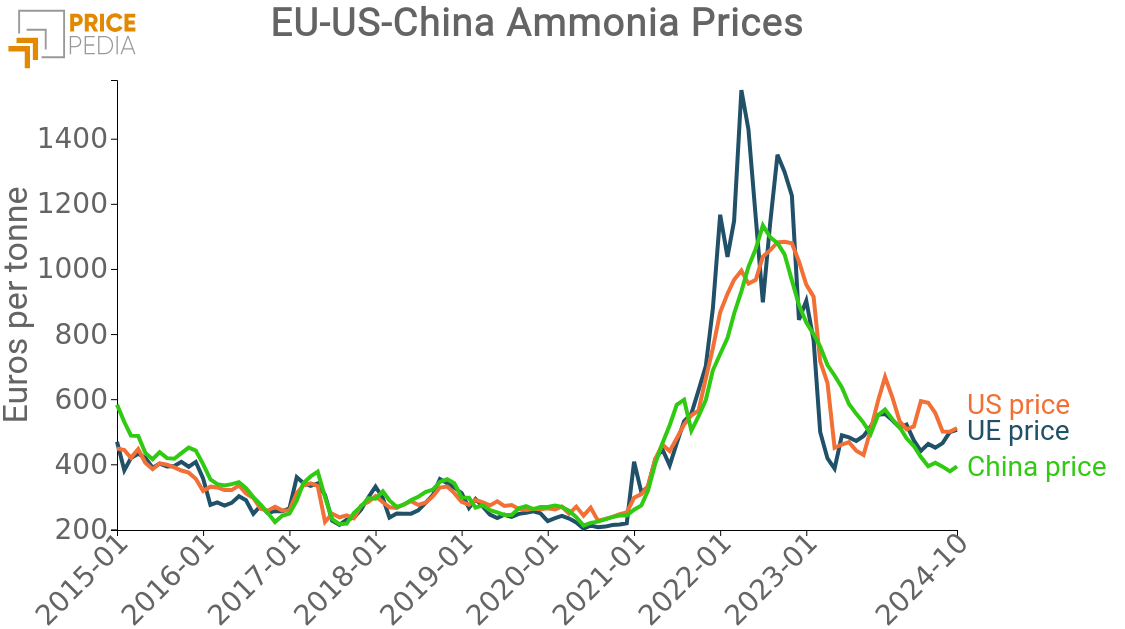

This price dynamic of iodine is common to the European, American, and Chinese markets, as shown in the graph below.

Historical series of customs prices of iodine in major regional markets

From the analysis of the graph, two fundamental aspects of iodine price dynamics are highlighted:

- the strong alignment between European, American, and Chinese prices which, in addition to sharing the same dynamic, have very similar price levels. The correlation between these prices is always above 0.95 (on a maximum of 1), suggesting the existence of a global iodine market characterized by strong price contamination between the various regional markets;

- the sharp price increase in the 2021-2022 biennium, which disrupted the iodine price dynamics, bringing them to structurally higher levels than those of previous years.

To analyze in more detail the particular price dynamics of iodine in recent years, a table containing the annual average prices of the various iodine markets from 2018 to today is provided.

Annual averages of customs prices (euro/ton) of iodine in different regional markets

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|---|---|

| D-Last Price EU-Iodine | 19563 | 24581 | 30885 | 29096 | 52784 | 61240 | 59418 |

| D-Storico Cina-Iodine (Cina CIF) | 18913 | 24172 | 29081 | 27733 | 47193 | 62086 | 59847 |

| D-Storico USA-Iodine - Export | 18645 | 22561 | 25226 | 24427 | 39282 | 54064 | 54471 |

| D-Storico USA-Iodine - Import | 19146 | 23759 | 27838 | 27647 | 45013 | 57606 | 56581 |

After an initial growth phase from 2018 to 2020, followed by a stabilization of the annual average in 2021, iodine prices more than doubled, reaching their peak in 2023.

In 2021, the global price of iodine was below 30,000 euros/ton in all major regional markets, while in 2023, prices in the European and Chinese markets exceeded the threshold of 61,000 euros/ton. Even in the American market, which among the three markets is characterized by slightly lower levels, the price dynamics are similar to those of the other two regional markets. In the 2021-2023 triennium, the average prices of iodine imports and exports increased from values of 28,000 and 24,000 euros/ton, respectively, to levels of 58,000 and 54,000 euros per ton.

In the first months of 2024, iodine prices underwent a slight reduction but remained close to the average prices of 2023. In the European and Chinese markets, iodine prices continue to hover around 60,000 euros per ton, while in the US market, the average price between import and export is about 55,000 euros/ton.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

The Importance of Iodine in Modern Industry

From an industrial perspective, iodine has numerous applications within modern industry. Among these, the production of pharmaceutical products, disinfectants, and antiseptics are particularly important. Iodine is also used both as a component and as a catalyst in many chemical processes. It is a critical input as a contrast medium for X-rays and CT scans. Finally, it is employed in the production of LCDs (liquid crystal displays) and other advanced electronic components.

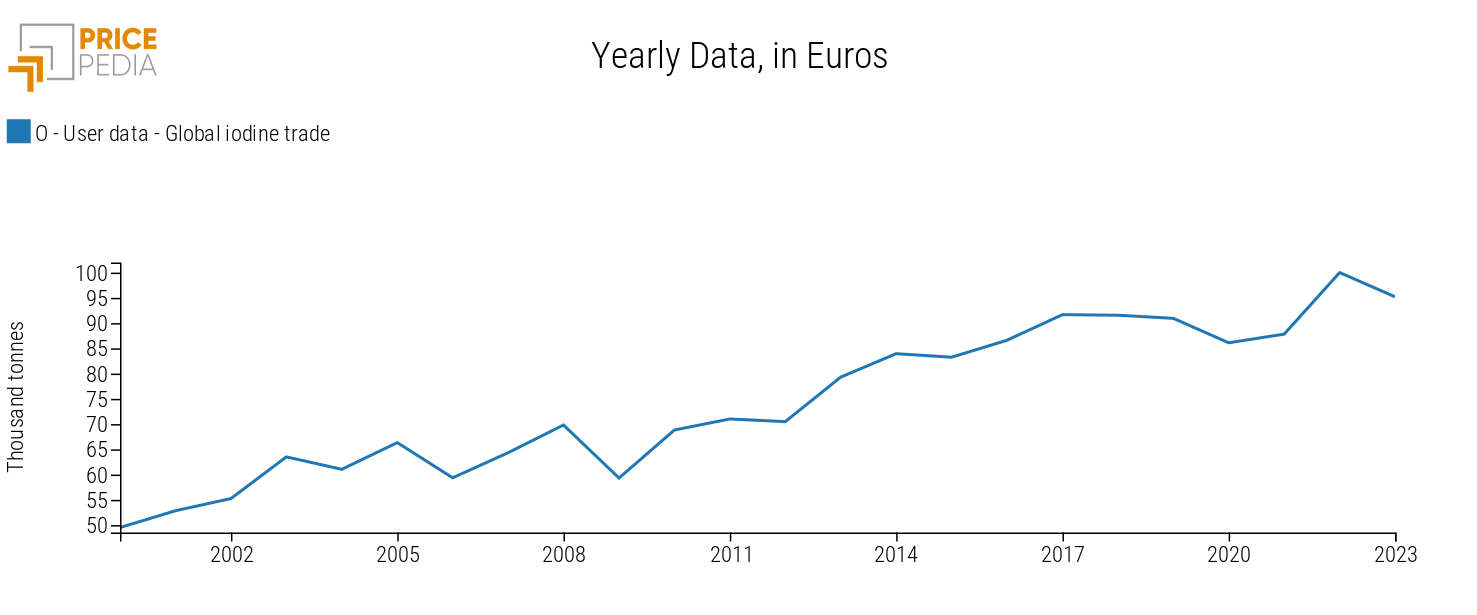

The importance of iodine within modern industry is also demonstrated by its continuous growth in global trade, due to an ever-increasing demand for iodine.

Below is a graph of the growing trend of global iodine trade from the 2000s to today.

Trend of global iodine trade

Except for some adjustment phases, the graph shows a clear upward trend in global iodine trade, with the volume doubling over 20 years.

Concentration of Iodine Supply

In the case of iodine, the main issue shared by the regional markets of America, Europe, and China is the excessive dependence on exports from Chile, the world's largest iodine producer.

To have a clearer view of Chile's importance within global iodine trade, the bar graph of the main iodine exporting countries in 2023, expressed in current euros, is shown below.

Bar graph of the main global iodine exporters

The above image shows that Chile is by far the world's largest iodine exporter, followed by Belgium and Japan.

Belgium, although being the second most important exporter worldwide, is not among the main iodine producers, as the exported iodine is not produced in Belgium but imported mainly from Chile. This further amplifies the concentration of iodine in Chile, which alone controls more than 60% of global production.

In this situation, even a temporary interruption of a Chilean plant is enough to create a supply shortage in the global iodine market. This is exactly what happened in July 2021, when a fire occurred at the Nueva Victoria plant, the most important iodine producer in northern Chile. Following the incident, the global price of iodine sharply increased, never returning to previous price levels.

Conclusions

The analysis of the iodine market revealed that the abnormal price growth from July 2021 to the early months of 2023 is due to the high concentration of global supply in Chile.

In particular, the unexpected interruption of a single plant in Chile caused iodine prices to more than double, maintaining these levels to date.

During this century, there has been an increasing trend in global iodine trade, making Chile's supply ever more important.

The current iodine prices are such as to stimulate greater global supply. However, until this is significantly realized, market risks related to iodine will remain particularly high.