PricePedia Scenario for June 2024

Commodity prices amid demand uncertainty and short-term financial market pressures

Published by Pasquale Marzano. .

Last Price Forecast

The PricePedia Scenario has been updated with information available as of June 6, 2024, the day when the President of the European Central Bank (ECB), Christine Lagarde, announced a reduction of 25 basis points in monetary policy rates, as already illustrated in the weekly article on the performance of financial commodities Second week of falling financial commodity prices.

In recent months, financial markets have discounted expectations of future demand growth, leading in some cases to significant increases already in April and May. Although the June rate cut was anticipated by analysts in recent months, uncertainty about the dynamics of future cuts remains high, both in Europe and the United States.

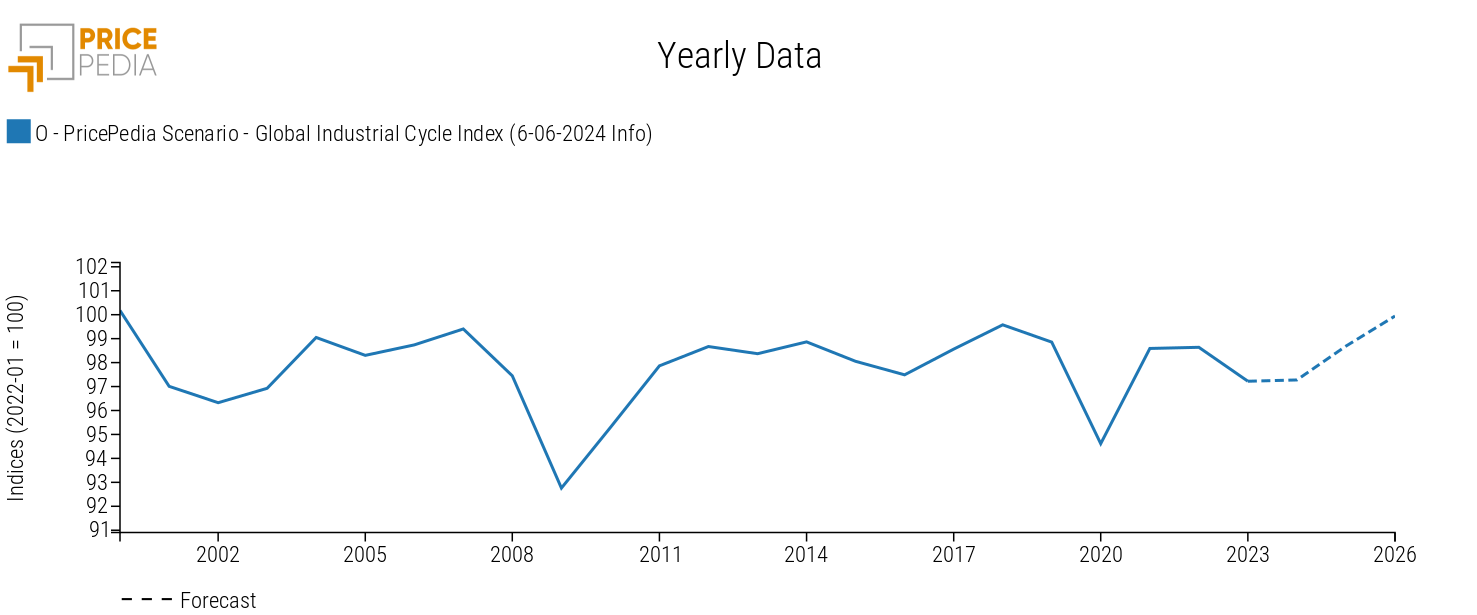

Moreover, this phase of uncertainty seems to contribute to the persistence of the current weakness of the global commodity demand. The following graph shows the global industrial cycle index[1] developed by PricePedia, which represents a proxy for global demand for industrial commodities.

Compared to the previous scenario[2], the dynamics of the index are confirmed, with substantial stability in 2024 at the relatively low values of the previous year. A marked increase is observed in the average of 2025 and continues throughout the first half of 2026, reaching the levels of the first part of 2022.

Commodity Price Forecast

At this stage, the real commodity markets tend to be dominated by demand difficulties compared to future growth expectations, which, at times, are observed in the financial commodity markets.

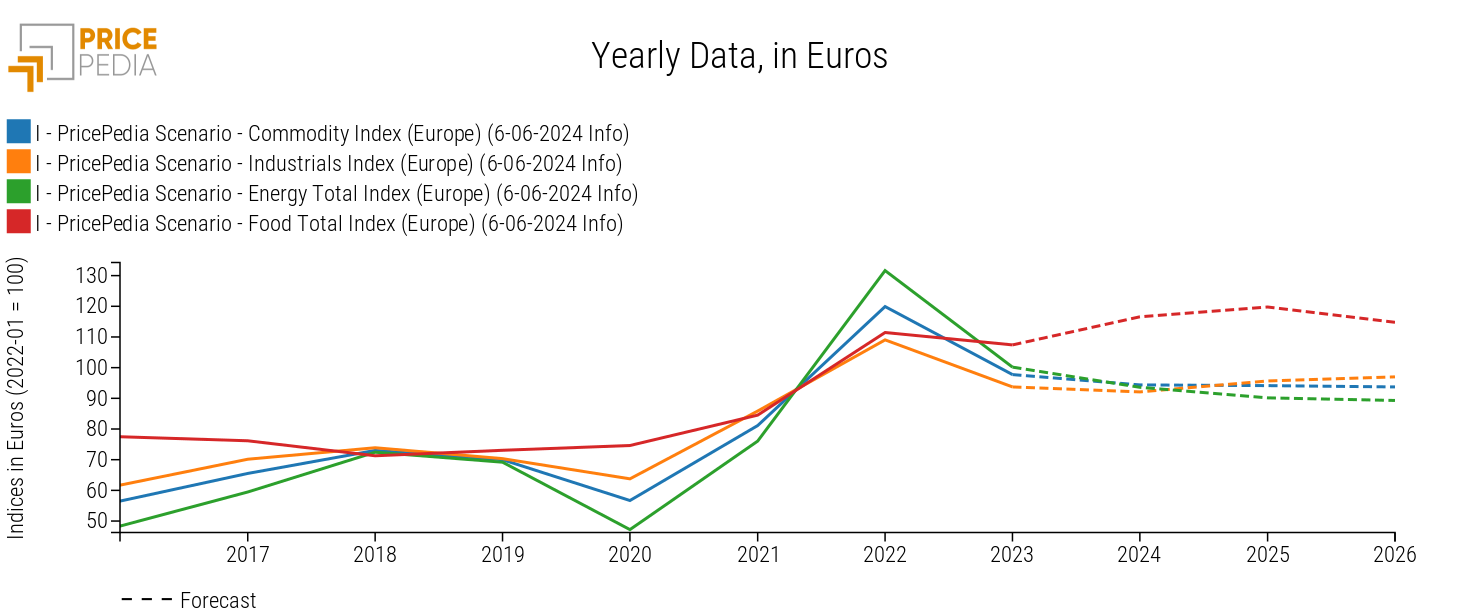

Below is the price forecast for the main commodity aggregates (Industrial[3], Total Commodity[4], Energy, and Food).

Except for Food, which is expected to register an average increase of over +8%, all the commodities considered are expected to show a reduction in values, on an annual average in 2024, compared to the previous year. In 2024, the most significant reduction is expected for Energy (-6.6%), closely linked to the price of oil. The latter is expected to present a downward trend that will continue over the next two years. However, it is plausible that the price per barrel will move around a range close to $80, given the effective supply control being exercised by OPEC.

The reduction in core Industrial commodities is less intense, which on average in 2024 is expected to be -1.7% compared to 2023 values. The expected reduction in the 2024 average reflects the already acquired variation in prices, which have resulted in being generally lower than in the first part of 2023. In fact, considering the monthly price dynamics, it is clear that for some months prices have been recording positive, albeit limited, variations. From the relative minimum point in December 2023, indeed, by May 2024 there was an increase of about +3.4%. In the coming months, the upward trend in prices will continue and will tend to strengthen in 2025, when the aggregate is expected to increase by almost +4% compared to the average values of the previous year.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

What has been observed for the Industrial index can also be noted in some commodities in the chemical supply chain. In these cases, a much more pronounced reduction is expected in 2024 compared to the aggregated Industrial index.

The following table shows the annual average price changes in euros for some aggregates in the chemical supply chain.

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| I-PricePedia Scenario-Organic Acids Index (Europe) (6-06-2024 Info) | −19.38 | −8.33 | +1.67 |

| I-PricePedia Scenario-Alcohols Index (Europe) (6-06-2024 Info) | −17.25 | −6.40 | +6.55 |

| I-PricePedia Scenario-Organic Anidrids Index (Europe) (6-06-2024 Info) | −16.61 | −2.71 | +6.00 |

| I-PricePedia Scenario-Sulfuric Acid and Sulfates Index (Europe) (6-06-2024 Info) | −31.85 | −7.75 | +11.97 |

| I-PricePedia Scenario-Nitrogen compounds Index (Europe) (6-06-2024 Info) | −43.17 | −6.09 | +1.70 |

| I-PricePedia Scenario-Metallic compounds Index (Europe) (6-06-2024 Info) | +2.91 | −5.68 | +3.29 |

| I-PricePedia Scenario-Metalloid compounds Index (Europe) (6-06-2024 Info) | −9.11 | −6.21 | +5.48 |

Again, the decline in the 2024 average is due to levels in the first part of 2024 being lower than those in the first part of 2023. However, already in the second half of the year, the prices of chemical products will be characterized by an upward trend. The latter will tend to consolidate in 2025, and in some cases, could lead to price increases of over +6%.

1. The global industrial cycle index is constructed by purifying the actual dynamics of industrial production from its trend. Since the supply of commodities tends to vary according to long-term economic growth expectations, while the demand for commodities is more linked to actual cyclical uses, the global industrial cycle index tends to reproduce the conditions of tension between demand and supply on the commodity market: when it increases, it means that the demand for commodities increases more than the supply; vice versa when it decreases.

2. See the article Industrial Cycle Recovery and Commodity Prices in 2025.

3. The PricePedia Industrials index results from the aggregation of the indices relating to the following product categories: Ferrous, Non-Ferrous, Wood and Paper, Chemicals: Specialty, Organic Chemicals, Inorganic Chemicals, Plastics and Elastomers and Textile Fibres.

4. The PricePedia Total Commodity index results from the aggregation of the indices relating to industrial, food and energy commodities. Pasquale Marzano

Economist and data scientist. At PricePedia he deals with the analysis of commodity markets, forecasting models for raw material prices and management of reference databases.