Stable interest rates delay possible rise in commodities

Rising US future inflation estimates move forward the phase of significant rate cuts

Published by Luca Sazzini. .

Conjunctural Indicators Commodities Financial Week

The weakness of global demand for raw materials contrasts with financial markets, driven by funds, that are pushing for a new bullish phase in their prices. In this context, the balance is increasingly represented by interest rate variations. In the coming months, we may witness significant movements in the prices of some raw materials. However, without a significant reduction in interest rates, a general increase in commodity prices is unlikely.

In this context, the analysis of inflation in the main world economies and the decisions of the respective monetary authorities is crucial.

US Inflation

The data on the Consumer Price Index (CPI) in the United States showed a decrease in inflation in May.

The headline index remained stable on a monthly basis, but on an annual basis, it fell from 3.4% to 3.3%.

The core index, which excludes the more volatile items like energy and food, decreased on a monthly basis from 0.3% to 0.2% and on an annual basis from 3.6% to 3.4%.

A particularly positive note concerns the significant moderation in the prices of non-residential services. After a decline in the second half of 2023, prices had resumed rising, causing concern among analysts. In May, however, the monthly variation in residential services was zero, a sharp improvement compared to the increases of 0.2% in April and 0.8% in March.

Federal Reserve Monetary Policy

This week's Federal Open Market Committee (FOMC) meeting ended with the maintenance of current interest rates.

The inflation forecasts for the years 2024-2025 were revised upwards to 2.6% and 2.3%, respectively, from the previous estimates of 2.4% and 2.2%. The core inflation forecasts were also revised upwards, with growth in 2024 from 2.6% to 2.8% and in 2025 from 2.2% to 2.3%.

These revisions are not attributable to the inflation data from May and April but to the unexpected price growth recorded in the first quarter of 2024. During the press conference, Powell acknowledged the recent improvements in inflation but stressed that they are not yet sufficient to ensure that inflation is actually converging towards the set target.

The FOMC meeting revealed considerable uncertainty about the number of Federal Reserve interest rate cuts by the end of the year. As usual, the central bank will remain highly data-dependent. If the upcoming inflation data continues to be as positive as the last two months, there could be two rate cuts in September and December 2024. Otherwise, there will be a single rate cut by the end of 2024, still scheduled for the September meeting.

Commodity Price Dynamics

This week, the most intense variations in commodity financial markets concerned oil prices and their derivatives, which recovered the price drops recorded last week.

The rise in oil prices was supported both by the decline in US inventories and the announcement by the US Department of Energy (DoE) of its intention to purchase 6 million barrels of crude oil to increase the strategic reserve.

The industrial metals market, especially non-ferrous metals, consolidates a bearish trend that reverses the upward trend in non-ferrous metal prices of recent months, amplified by speculative factors.

Food prices show greater stability, except for cocoa, which continues to confirm its high volatility.

ENERGY

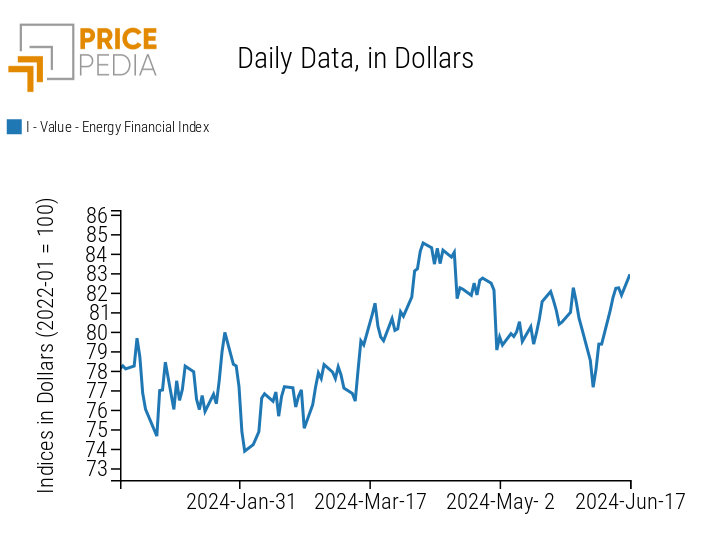

After last week's decline, the energy price index shows a recovery driven by the price of oil.

PricePedia Financial Index of Energy Prices in Dollars

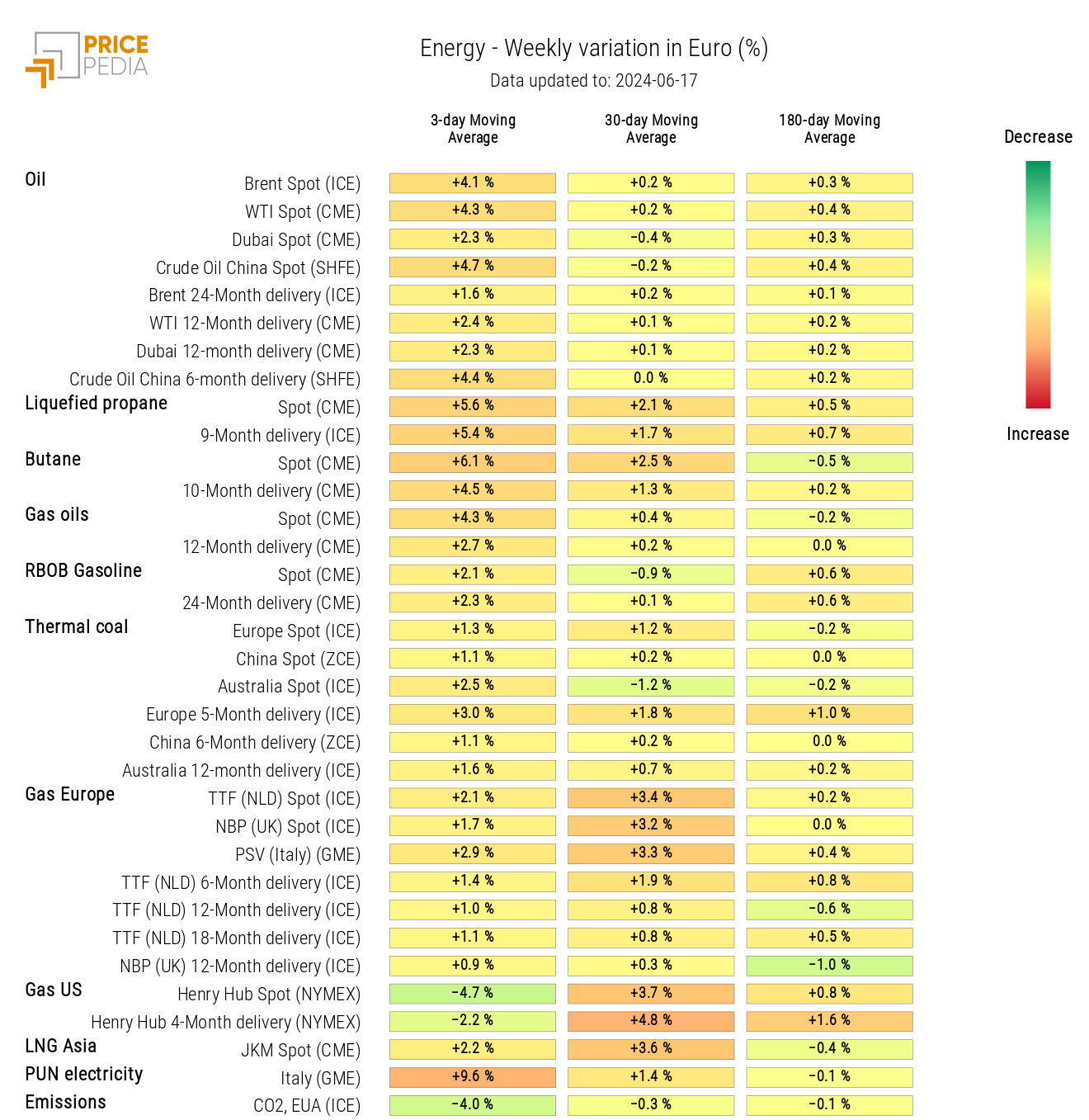

The heatmap highlights a strong increase in the prices of petroleum products and natural gas.

HeatMap of Energy Prices in Euros

PLASTICS

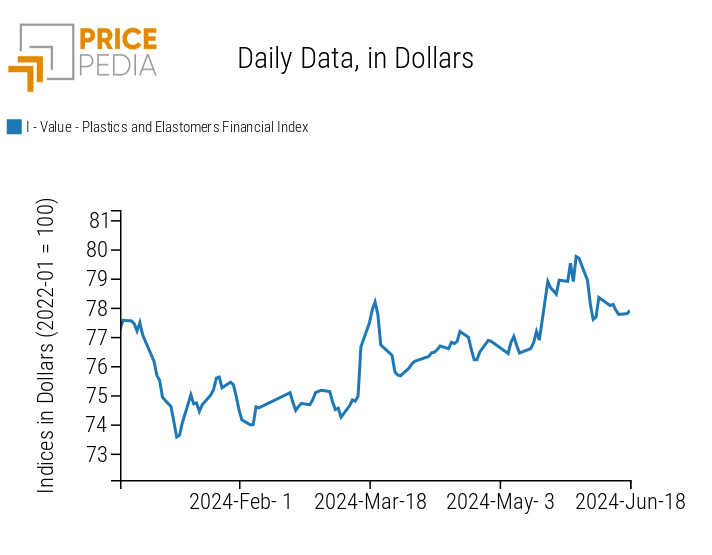

After last Friday's strong positive swing, the financial index of plastic prices resumes its decline.

PricePedia Financial Index of Plastic Prices in Dollars

FERROUS METALS

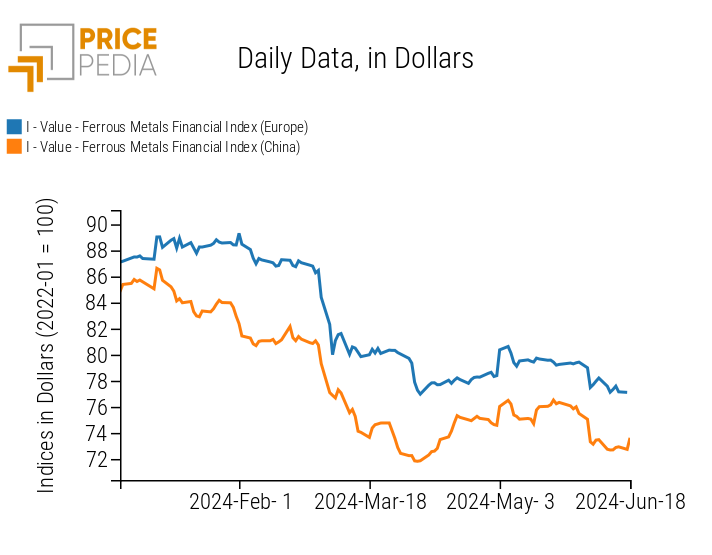

The decline in the financial indices of ferrous metals continues. Since the beginning of 2024, the two indices of ferrous metals, Europe and China, have decreased in dollars by -12% and -14%, respectively.

PricePedia Financial Index of Ferrous Metal Prices in Dollars

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

NON-FERROUS INDUSTRIAL METALS

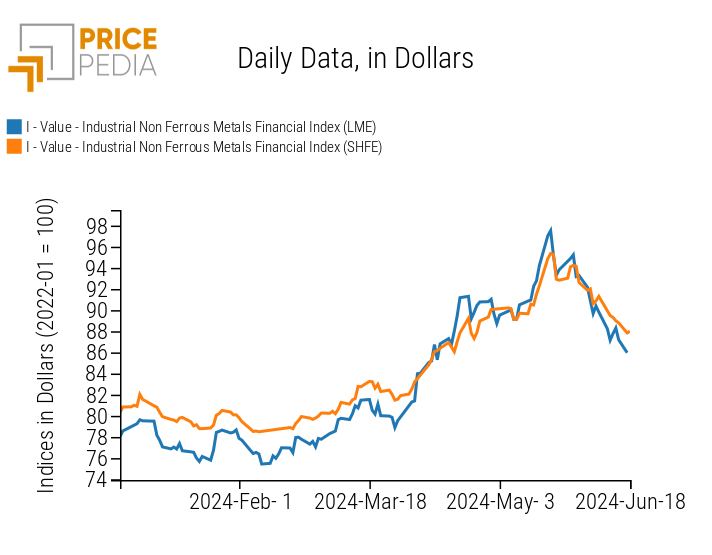

The reduction in the prices of non-ferrous industrial metals quoted on the London Metal Exchange (LME) and the Shanghai Futures Exchange (SHFE) persists.

PricePedia Financial Index of Non-Ferrous Industrial Metal Prices in Dollars

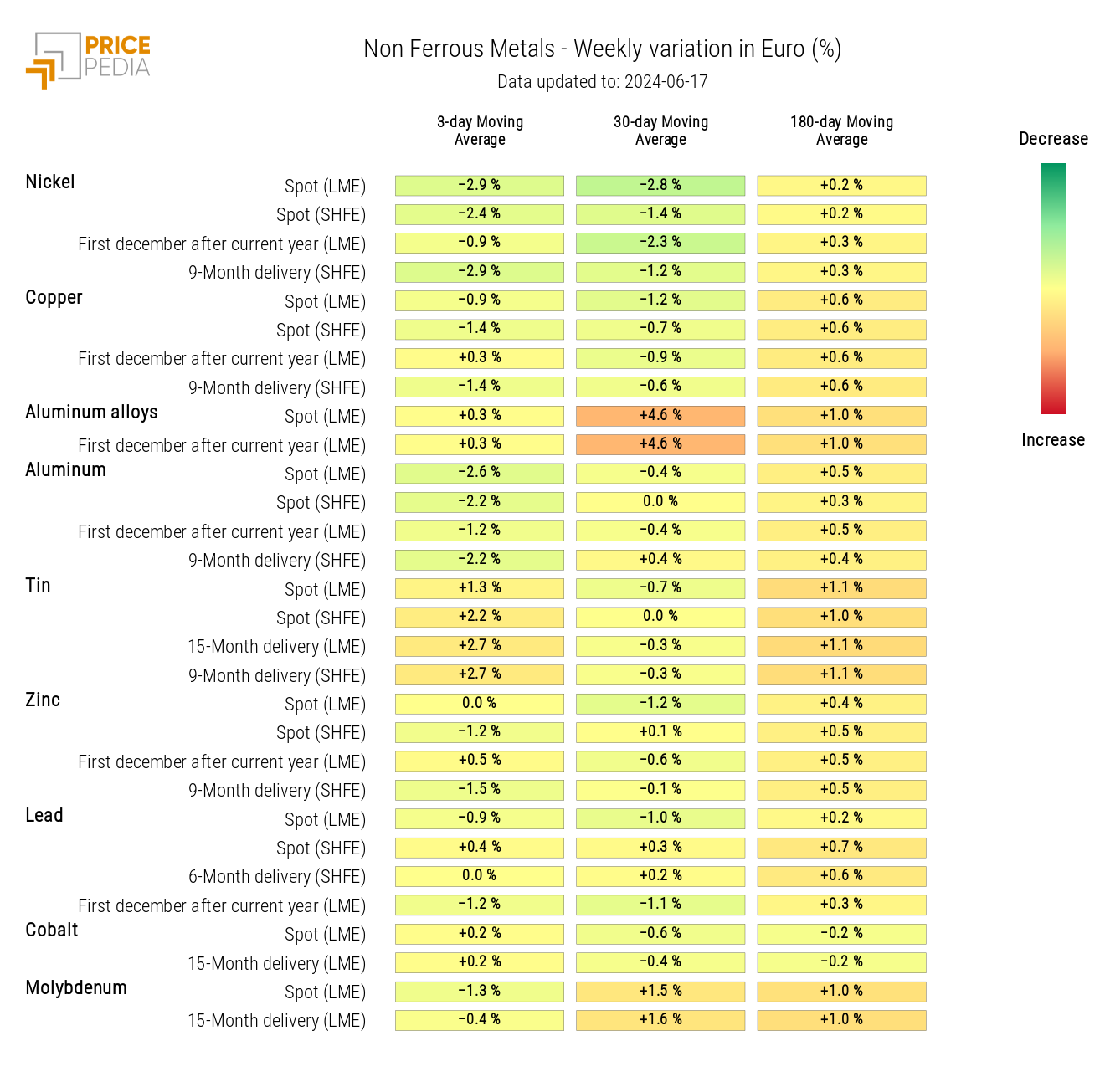

The non-ferrous heatmap signals a drop in the prices of nickel, aluminum, and lead, against an increase in tin prices.

HeatMap of Non-Ferrous Industrial Metal Prices in Euros

FOOD

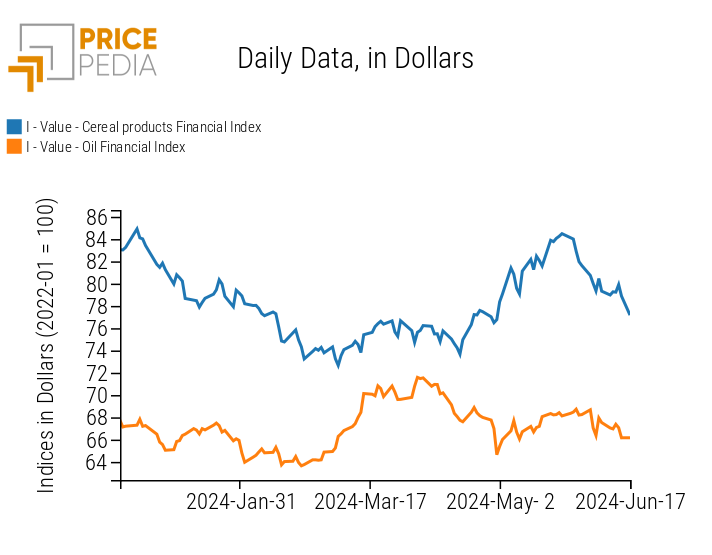

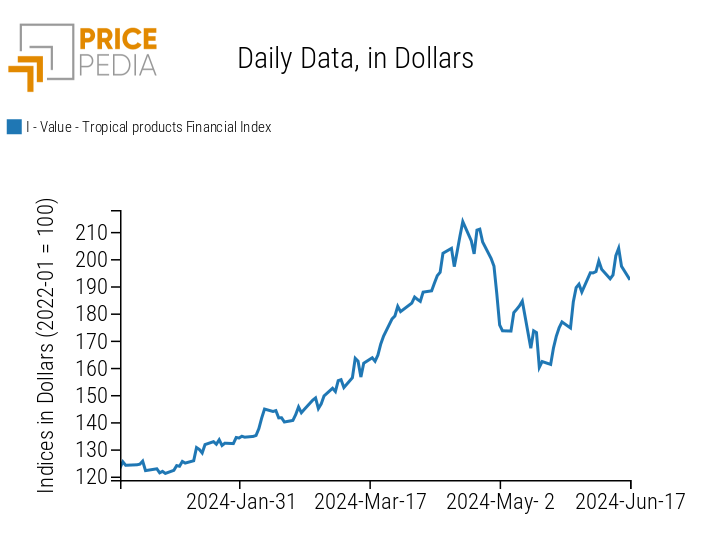

The analysis of financial indices of food shows greater price stability, leading to mostly lateral fluctuations.

| PricePedia Financial Index of Food Prices in Dollars | |

| Cereals and Oils | Tropicals |

|

|

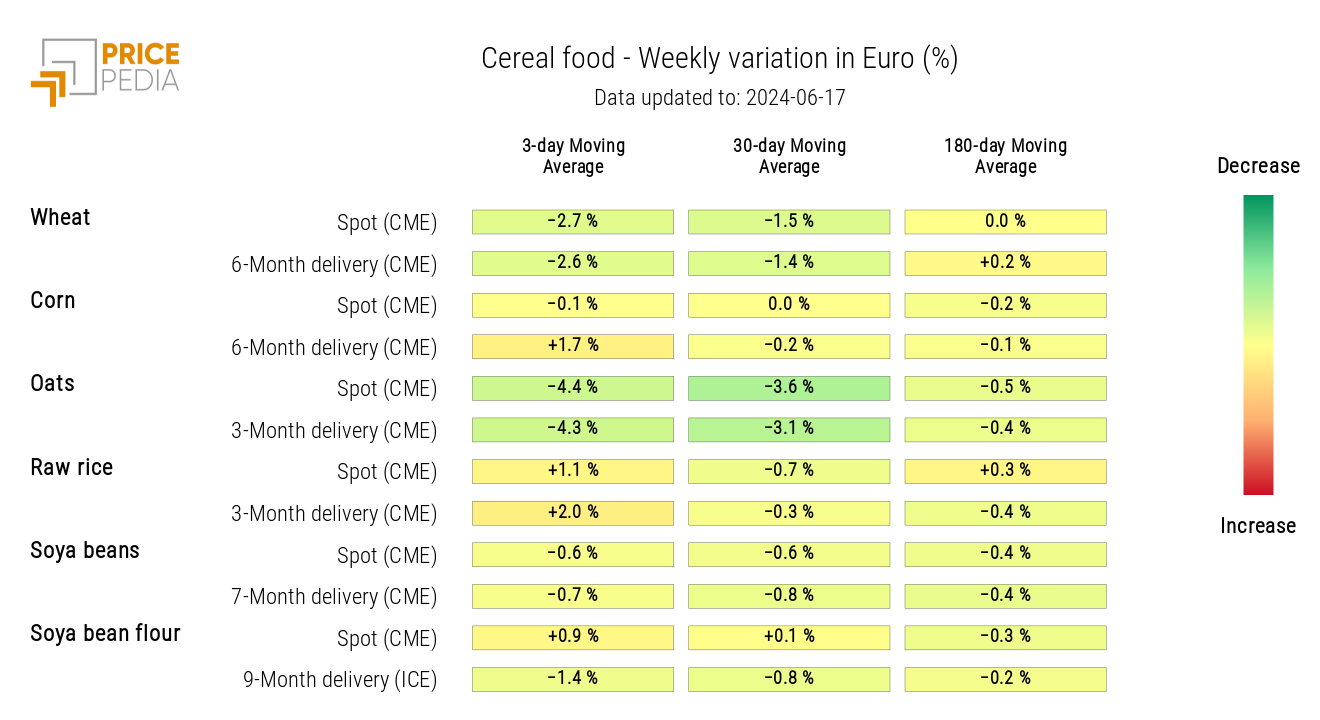

CEREALS

The cereal heatmap highlights an increase in the prices of corn, rice, and flour, against a reduction in wheat and oats.

HeatMap of Cereal Prices in Euros

TROPICALS

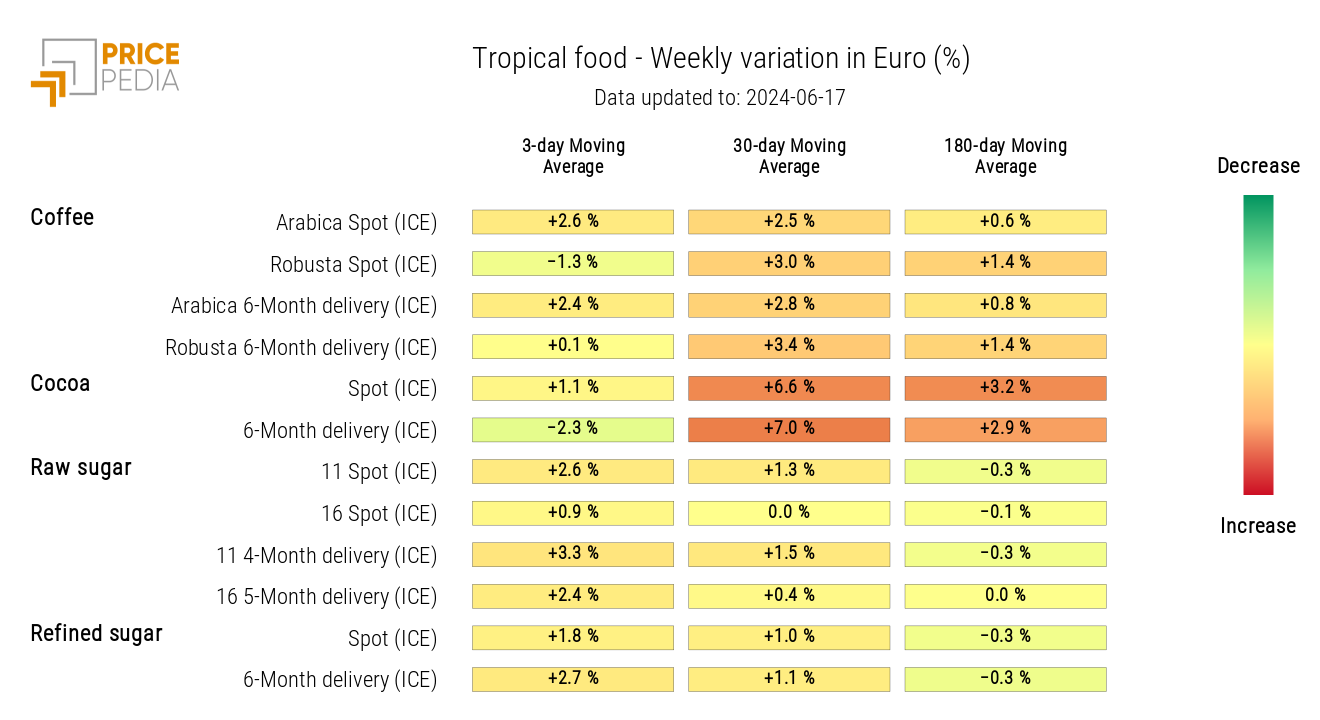

The following heatmap indicates a general but slight increase in the spot prices of tropical foods.

HeatMap of Tropical Food Prices in Euros