The case of titanium: between abundance and criticality

The limited substitutability of metallic titanium and the concentrated supply of titanium dioxide make it a critical raw material

Published by Luigi Bidoia. .

Energy Transition Critical raw materialsFrom the point of view of substitutability, metallic titanium is one of the most critical raw materials. In many of its applications, it can only be replaced with other metals at high costs and with a significant loss of effectiveness[1].

This is particularly true in the aerospace industry, where titanium can be replaced with aluminum, superalloys, and steel. However, none of these materials offer the same performance as titanium. Aluminum and superalloys can compete in terms of weight and corrosion resistance, while steel offers high mechanical strength. However, none of these substitutes can combine lightness, corrosion resistance, and mechanical strength like titanium.

The same applies to the medical industry, where zirconium, magnesium, and special steels fail to provide an optimal combination of biocompatibility and corrosion resistance at relatively low costs. The limited substitutability of titanium also extends to applications in the automotive and military industries.

Despite the importance of metallic titanium, its global consumption is relatively limited. In contrast, the consumption of titanium dioxide (TiO2) is very high, with over 95% of the raw titanium ore used to produce TiO2.

In this context, it is useful to explore the interrelationships between the market for metallic titanium and titanium dioxide, and how price variations in one affect the prices of the other.

The global market for titanium minerals

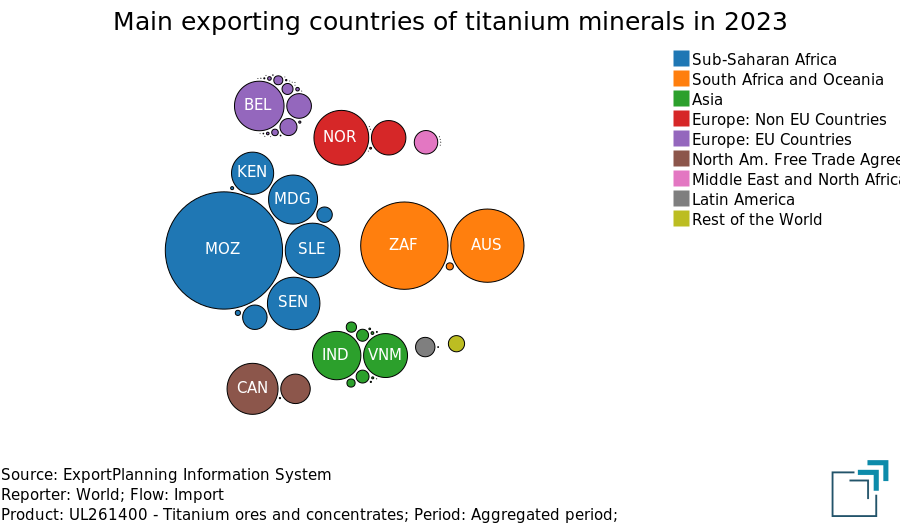

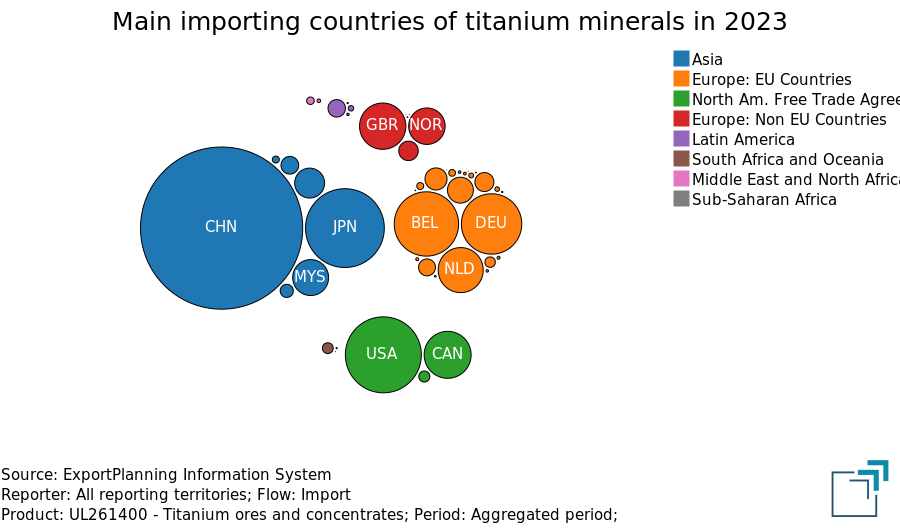

The global market for titanium minerals is very diversified both on the supply and demand sides. The two bubble charts below show the main exporting and importing countries in 2023.

The sub-Saharan area is the region with the main exporting countries of titanium minerals. Among these, Mozambique is by far the largest exporter, followed by Kenya, Madagascar, Senegal, and Sierra Leone. South Africa and Australia share the podium of the top exporters with Mozambique. Other important exporters include India and Vietnam among Asian countries, and Canada and Norway among Nordic countries. Belgium is also among the main exporters, but a large part of its exports consists of re-exports of imported minerals.

China, despite having the largest mineral reserves and extracting almost twice as much titanium as Mozambique, plays a very marginal role as an exporter. Most of the mineral extracted in China is processed by the Chinese industry into metallic titanium and especially into titanium dioxide. The United States also has significant mining activity, but in this case too, production is primarily directed towards the domestic market[2].

Among the importing countries, China stands out for its high demand for titanium minerals required by the processing industry. Following China are all the industrial countries with a significant titanium industry: from Japan to Malaysia in Asia, from the United States and Canada in North America, from Germany to the Netherlands in the EU, to the United Kingdom and Norway in the rest of Europe.

Given the significant number of both exporting and importing countries, the global titanium minerals market can be considered a free market, with prices formed based on the interaction of supply and demand. Price dynamics are influenced by the average growth of general prices in various economies and, in part, by the lagged price of titanium dioxide. When the price of titanium dioxide is high, the profitability of producing companies increases, leading them to ramp up production and, consequently, the demand for titanium minerals.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

The global supply of titanium dioxide and metallic titanium

Titanium minerals are mostly used to produce titanium dioxide, while a smaller portion is destined for the production of metallic titanium. The production of titanium dioxide is relatively simpler because titanium naturally tends to oxidize. In contrast, the production of metallic titanium is much more complex.

Titanium dioxide is mainly marketed in the form of white pigments, also known as titanium white.

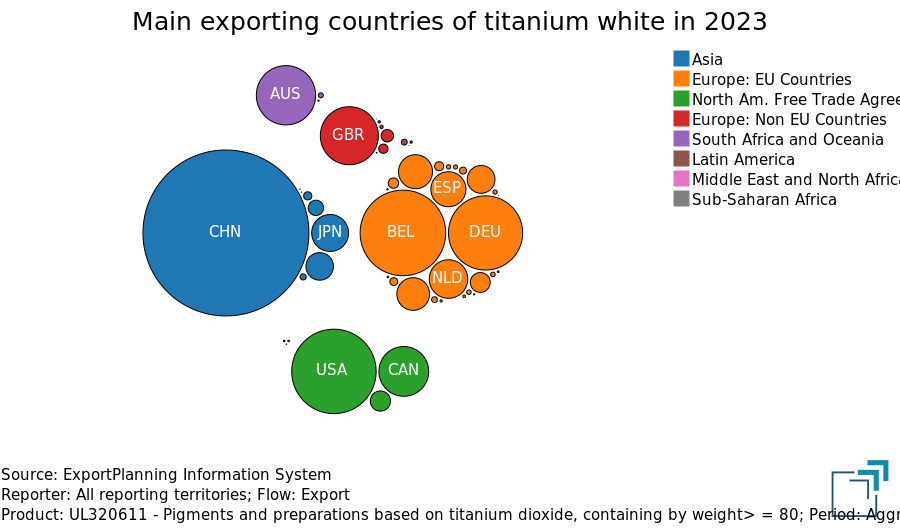

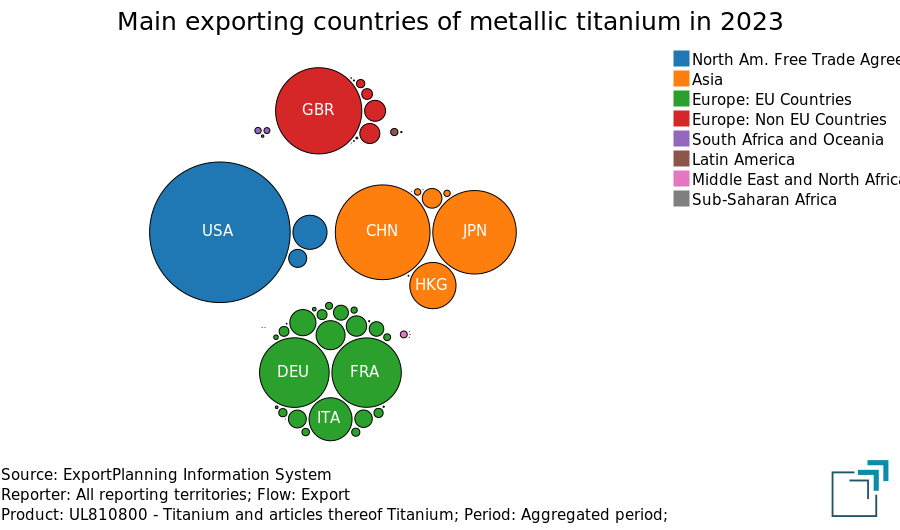

The global specialization in the production and export of titanium white and metallic titanium is very different, as illustrated by the two bubble charts presented below.

In the case of titanium white, the supply on international markets is relatively concentrated, with China holding a solid leadership position. The European Union as a whole also occupies a prominent position. Within the EU, the highest export shares are recorded by Belgium and Germany. The United States, the United Kingdom, and Australia also play a significant role.

In the case of metallic titanium, however, the supply on international markets is much less concentrated. In this case, the leading exporter is the United States, closely followed by China, Japan, and the United Kingdom. The EU, led by Germany and France, also plays a significant role.

European prices of titanium white

As we have seen, in the global market for titanium white, China is by far the largest exporting country. This positioning mainly results in two effects:

- An increasing dependence of the EU on Chinese imports;

- A price of titanium white in the EU market determined by the price of Chinese exports.

EU imports of titanium white

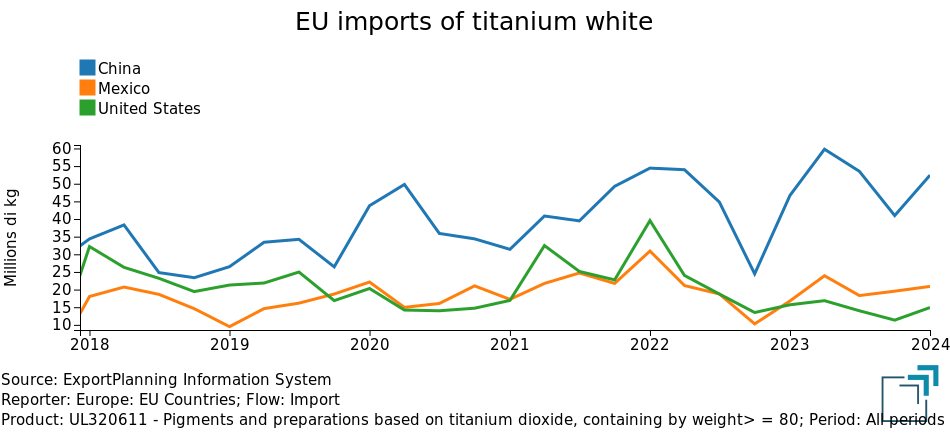

The following chart shows the trend of EU imports of titanium white from the top three countries of origin: China, Mexico, and the United States. Five years ago, the EU import shares from these three countries were quite similar. Subsequently, EU imports from these three countries have diverged, with a continuous increase in flows from China and a decrease in imports from the other two countries. At the beginning of 2024, the quantities imported from China exceed the combined total imported from the United States and Mexico.

Comparison between EU customs prices and Chinese export prices of titanium white

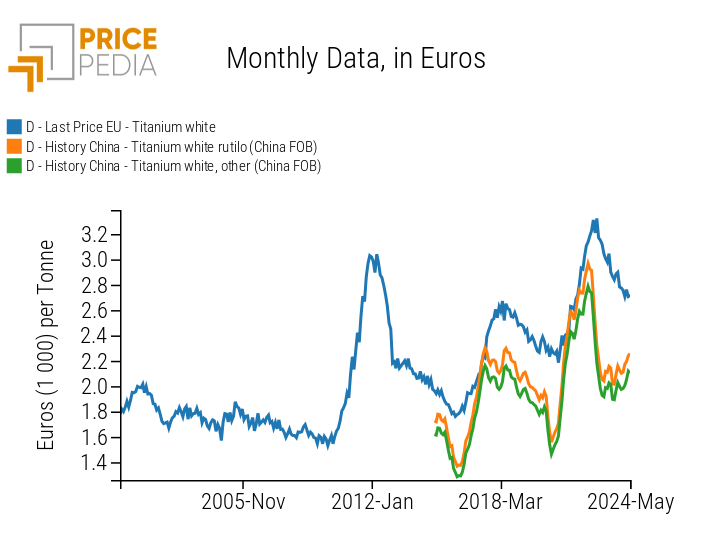

The importance of Chinese exports on global markets and the EU market is reflected in a direct effect of Chinese export prices on EU customs prices, as clearly shown in the chart below.

It compares the prices of Chinese exports of titanium white with the corresponding customs prices from PricePedia.

Comparison between EU customs prices and Chinese export prices of titanium white

The comparison between these prices reveals the following facts:

- The price of Chinese exports has always been significantly lower than the EU customs price, indicating a competitive price advantage of material from China.

- The EU customs price perfectly follows the dynamics of the Chinese export price with an average delay of 4 months[3].

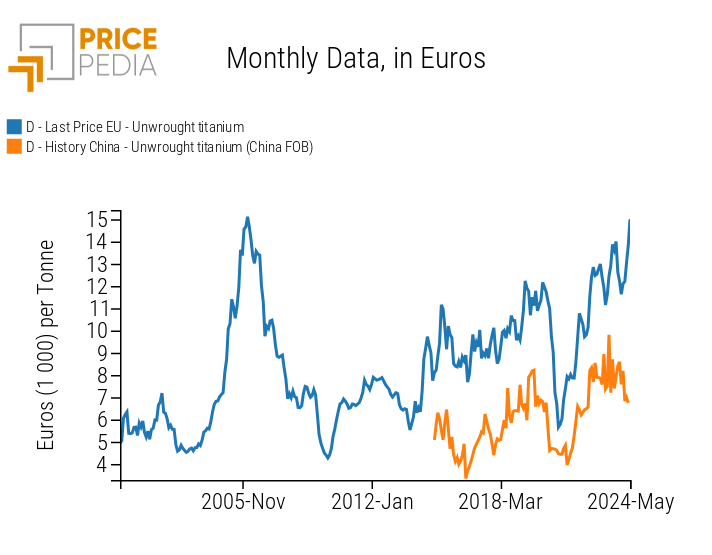

European prices of metallic titanium

When comparing the price of Chinese exports of metallic titanium with the corresponding EU customs price, the Chinese price is also significantly lower than the European price, indicating a competitive advantage of material from China. However, the dynamics of the two prices are less aligned compared to those of titanium white prices, confirming the lesser importance of Chinese exports in this case on global markets.

Comparison between EU customs prices and Chinese export prices of metallic titanium

Conclusions

The criticality of metallic titanium lies in its limited substitutability in various applications. In the event of a shortage of this material, costs for user companies could be high. However, the international supply is ample, which helps mitigate the supply risk for European companies.

In contrast, titanium white does not present substitutability issues with other materials. However, the international supply is significantly more concentrated compared to metallic titanium. In the global market for titanium white, leadership is firmly in the hands of China, thanks to its high price competitiveness. In this situation, the European price of titanium white is closely aligned, with a few months' delay, to the Chinese export price.

[1] Due to its low substitutability, metallic titanium has been classified as a critical raw material by the EU Commission. For further information, see the EU fact sheet on titanium

[2] Source: U.S. Geological Survey (USGS): MINERAL COMMODITY SUMMARIES 2024

[3] A regression exercise with an Engle and Granger model indicated that the Chinese export price (lagged by 4 periods), along with European inflation, can explain over 90% of the long-term dynamics of the EU customs price for titanium white. The Chinese export price and EU inflation are also able to explain over 25% of the monthly variations in the EU price of titanium white.