Coping with uncertainty by preparing for commodity market risks

Market risk of a commodity is a key component of a company's procurement risk

Published by Luigi Bidoia. .

Procurement Procurement Risk ManagementIf you query Google Trends about which business topics are of greatest interest worldwide in its search engine, the topic of risk management ranks far behind topics such as marketing, leadership, and organization. The same is even more true for Italy, with almost no searches on the topic of risk management. Most companies worldwide, and particularly in Italy, are therefore focused on immediate concerns, leaving little room for the necessary investments for better management of potential future negative events.

An in-depth look at the interest in the topic of risk management reveals, however, that the area of management related to purchasing has, in recent years, reached the same level of interest as the topic of interest rate risk, far outstripping that of exchange rate risk. This result confirms that, in recent years, the purchasing and finance areas have been the main sources of business uncertainty.

The prospect of a reduction in interest rates in the near future suggests a decrease in business interest in the risk associated with interest rate movements.

Conversely, all conditions seem to be in place for the purchasing function to become the leading edge in corporate risk management.

The Risk for the Purchasing Function

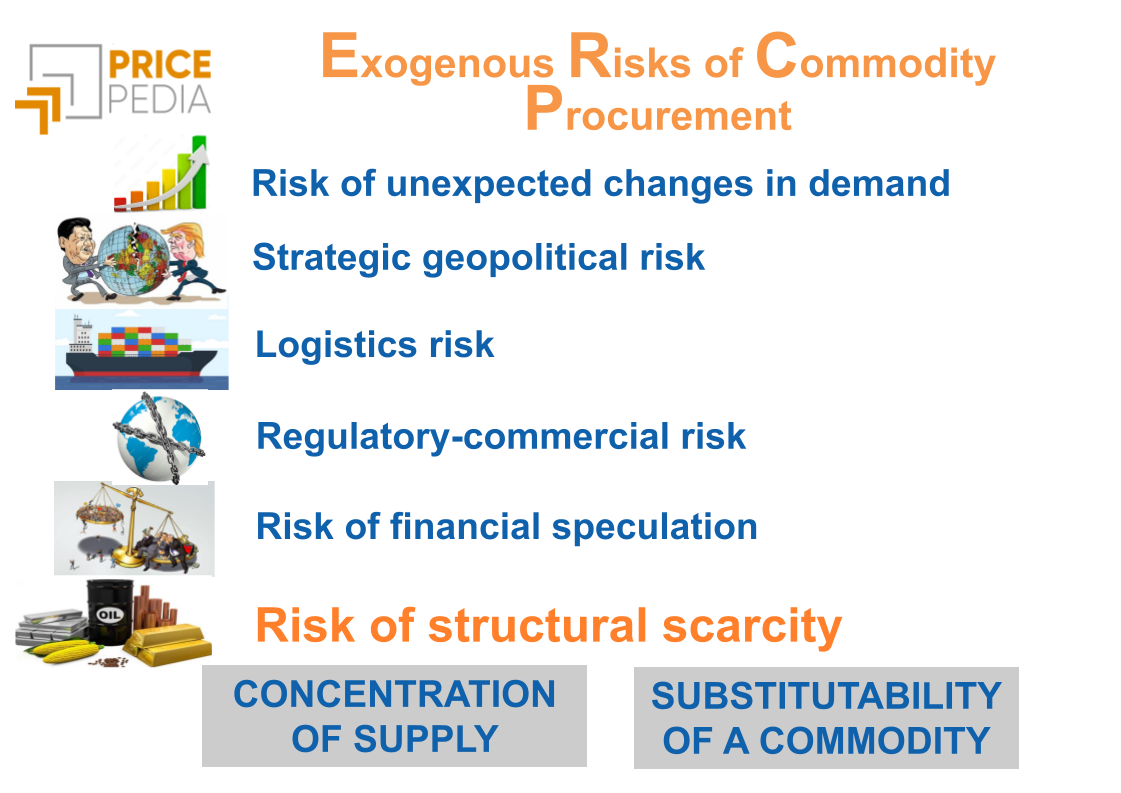

The risk associated with the purchasing function is generally referred to as procurement risk and includes all factors that can cause damage to the company from the purchasing side: from suppliers' ability to meet delivery times to unexpected price variations; from congestion in transportation infrastructure to the raising of barriers on imports from abroad.

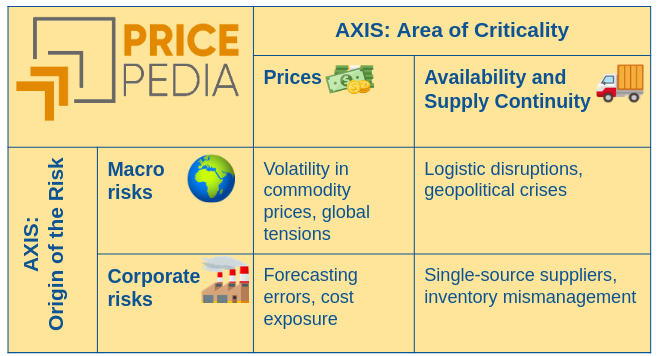

For the purpose of analysis and subsequent risk management, it is useful to distinguish within procurement risks between systemic market risks and specific company risks.

The former are related to commodity price variations and their availability on the market. These are external risks and independent of the actions of the individual company. The latter are internal to the company and can be mitigated through specific actions, such as supplier diversification, stockpiling, and improvements in supply chain organization.

Specific company risks can only be analyzed through the study of the characteristics of the individual company. For instance, a fundamental element of the company is its production processes and the substitutability of production inputs with different materials. It is evident that the specific risk of material shortages is also linked to the ability or inability to replace a production input with different materials while maintaining costs and quality.

Conversely, systemic risk can be analyzed starting from the characteristics and functioning of the markets in which the materials purchased by the company are traded. These analyses are the specific object of study of PricePedia.

From a general perspective, all purchases made by a company, whether of commodities or differentiated goods, are subject to market (or systemic) risk. However, only for commodity purchases is this risk generally significant compared to specific (or company) risk. It is this risk that therefore deserves to be studied and monitored.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Market Risk of a commodity

Market risk can be viewed from two different angles. The first concerns price variations, which can be high and unexpected; the second concerns the availability of the material on the market. In the case of commodities, these two angles tend to provide the same measure, referred to as commodity risk.

Characteristics of a Commodity

The term commodity refers to any purchase material whose price is determined based on the rules of a perfect competition market[1]. In this case, the market is able to determine, through the interaction of supply and demand, a single market price.

The functioning of this type of market is such that price variations are always perfectly aligned with variations in the relative supply of the good. If, in fact, the supply of the good relative to its demand decreases, the price necessarily increases; conversely, if the relative supply of the good increases, the price necessarily decreases. Given this market functioning, price risk and market availability risk always move in alignment: when one increases, the other also increases; when one decreases, the other also decreases.

It is therefore useful to analyze commodity risk as a whole, without distinguishing between price risk and market availability risk.

The most typical commodities are raw materials. However, many basic materials that do not always fall into the category of raw materials are also considered commodities. For example, H-section steel profiles or adipic acid are not strictly raw materials, but can be usefully considered as commodities. The analysis of commodity risk includes a wide range of purchases that go beyond raw materials, extending to many transformed goods that are not easily differentiable.

Conclusions

Many companies are lagging in introducing risk management tools within their organizations, indicating a predominance of a reactive approach to economic events rather than a proactive one. In cases where risk management is introduced in the company, the procurement area competes with the finance area for the role of trailblazer. In the years following the pandemic, the procurement area, in fact, had to face an explosion of risks, the management of which is now seen as a priority. Among these risks, a significant role is played by market commodity risk, which surged during the 2021-2022 biennium. A detailed analysis of the factors determining it suggests that it will continue to be one of the most important risks at the corporate level in the coming years, especially for manufacturing companies.

[1] The competitive market form can be distinguished into a perfect competition market and a monopolistic competition market.