Commodity market risk

A measure of market risk of a commodity can only be based on the knowledge and analysis of its determinants

Published by Luigi Bidoia. .

Management Procurement Risk ManagementIn the article Coping with uncertainty, by preparing for commodity market risks, the concept of market risk of a commodity was introduced as a fundamental component of procurement risks for a manufacturing company. This article presents an analysis of the determinants of this risk, as a first step towards developing an effective measurement system.

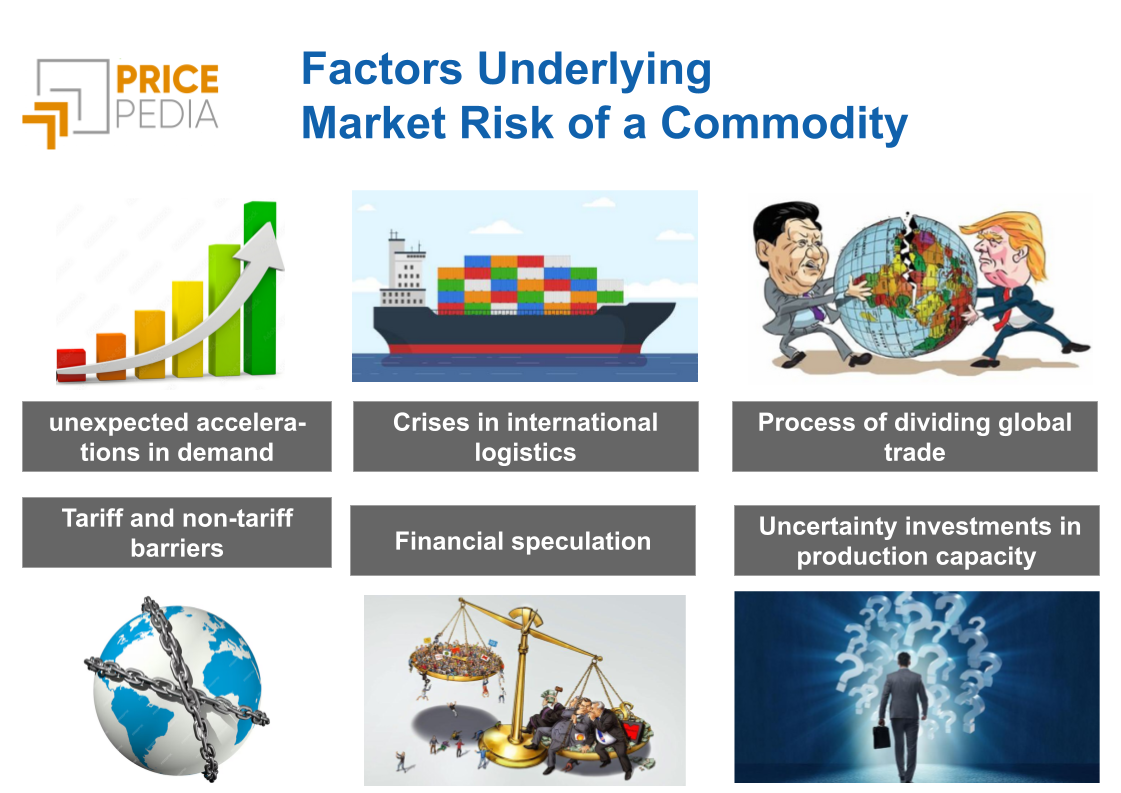

Factors Underlying Market Risk of a Commodity

The main factors that determine the market risk of a commodity can be grouped as follows:

- unexpected accelerations in demand;

- potential crises in international logistics;

- the process of dividing global trade into "friendly regions";

- increases in tariff and non-tariff barriers;

- effects of financial speculation on physical prices;

- growing uncertainty about investments in production capacity.

The analysis of these factors and their aggregation allows us to measure the market risk that can be associated with different commodities.

Unexpected Accelerations in Demand

Generally, in a perfect competition market, changes in demand are adequately met by equivalent changes in supply through relatively contained price variations. Through price variations, the market informs the supply side of different demand dynamics, leading the supply to adjust until the single market price returns to the level of marginal costs. Price variations within a certain range are therefore physiological and functional to maintaining the balance between supply and demand.

In cases where demand registers very high increases compared to past growth, it may happen that supply cannot achieve equally high increases, pushing prices to levels so high that market rebalancing occurs more through a reduction in demand rather than an increase in supply.

Demand growth can accelerate unexpectedly in two different situations:

- when structural changes occur on the demand side, driven by shifts in consumer and user preferences, regulatory interventions, or technological changes. This is the case, for example, with the strong growth that might characterize the demand for copper in the near future, linked to the energy transition;

- when the purchasing policies of user companies change simultaneously, as happened in the 2021-2022 cycle[1].

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Possible Crises in International Logistics

In this century, the increase in global trade has led to significant development of the transportation system and, more generally, international logistics. Thanks to growing integration, this system has increased its efficiency but at the expense of its flexibility and vulnerability to unexpected shocks. These limitations became evident during the pandemic, when various lockdowns reduced activities at many major ports, disrupting the entire system. Similarly, these limitations are now emerging due to reduced transits through the Panama Canal and, especially, the Suez Canal.

The Process of Dividing Global Trade into Friendly Regions

The process of dividing global trade into "friendly regions" refers to the growing tendency of countries and economic blocs to develop and intensify trade relations with nations that share similar political, economic, and social values, while reducing relations with nations perceived as rivals or less reliable. This represents a strategic response to increasing geopolitical tensions and concerns about national security and economic stability. While this may lead to greater security and predictability for the countries involved, it can also reduce the benefits of globalization and increase the costs of international trade.

This process increases market commodity risk because the severance of trade relations with a country could result in supply shocks if some of the commodities were sourced from the "distanced" country. This was the case, for example, with many commodity markets following the interruption of trade with Russia after its aggression against Ukraine.

Increase in Tariff and Non-Tariff Barriers

The trade war initiated by Trump in 2018 against China was a turning point when international trade shifted from a phase of increasing globalization to one of heightened protection of national markets. On average, during the period 2010-2019, various countries worldwide introduced just over 3000 trade restriction actions annually. In the three-year period 2020-2022, the average number of annual interventions doubled, exceeding 6000.

In many academic and political circles, it has been questioned whether market liberalization alone can bring benefits to all countries in the world. Consequently, measures capable of protecting a market from foreign competition have been increasingly considered. While most of these measures protect a local industry, they can also alter the competitive environment of a market and generate price increase shocks[2].

Effects of Financial Speculation on Physical Prices

The physical prices of some commodities, as reported by specialized agencies (Price Reporting Agencies, PRA), represent the underlying asset for their financial prices quoted on various exchanges. In theory, it should be the physical price that influences the financial price. However, in practice, there are many commodities where the physical price is completely determined by the financial price. The most striking cases are those of oil and copper, but the phenomenon is widespread (see the article Relationship between Physical Prices and Financial Prices).

Financial prices are more volatile than physical prices due to speculation and market expectations. If market participants expect a future event that could significantly influence the price of the commodity quoted on that market, they increase their demand for futures with maturities following the expected event, leading to an increase in the futures price. This increase, through arbitrage operations, tends to quickly transfer to the spot financial price and, consequently, to the physical price of the commodity. The result is that the physical prices of a commodity also quoted on financial markets exhibit much greater volatility than would be justified by actual changes in its supply and demand and its costs.

Growing Uncertainty in Investments in Production Capacity

The adjustment of commodity supply in the long term requires adequate investments in production capacity. In a free market, these investments occur only if the expected returns on investments can remunerate the capital invested at a rate higher than the returns on low-risk assets, such as government bonds of the major world economies. In recent years, the real yield of these bonds has increased due to the sharp rise in global public debt levels and more restrictive monetary policies to control inflation. At the same time, uncertainty about the returns on industrial activities has increased due to regulatory, economic, and geopolitical instability. The result is growing caution in increasing production capacity, even in cases where there are robust expectations of future demand growth.

Conclusions

The market risk of a commodity is the result of multiple determinants. Some, such as unexpected accelerations in demand, represent anomalies in the adjustment mechanisms of a perfect competition market. Others, such as international logistics, the segmentation of international trade, and trade barriers, relate to issues that have emerged from the globalization process of the world economy. Finally, other factors refer to the growing importance of finance in the modern economy and the need for continuous realignment between financial and physical markets.

Studying these factors is a fundamental step in designing and implementing a system capable of measuring the market risk associated with each commodity.

[1] For an in-depth analysis, see the article Impact of user companies' purchasing policies on commodity markets.

[2] For an in-depth analysis, see the article Tariffs and Commodity Prices.