Anti-dumping measures against China: the case of PET

The Commission's Procedure against low-cost Chinese PET

Published by Pasquale Marzano. .

Plastics and Elastomers basic thermoplastics Polyethylene terephthalate (PET) Import tariffsIn the article Commodity tariffs prices, it was shown how the European Union is implementing a strategy aimed at protecting the single market from unfair trade practices, such as dumping. In recent years, the number of European Commission procedures aimed at detecting dumping has increased, as have the products subject to anti-dumping measures. The most recent case is that of the provisional duties applied to imports of electric vehicles from China. The likelihood that these measures will become definitive in November 2024 is high. In the context of the trade war between the EU and China, a significant case where provisional duties were confirmed and made definitive concerns EU imports of Chinese polyethylene terephthalate (PET).

PET is a thermoplastic widely used for the production of bottles and packaging in general. It can be 100% recycled without any loss of technical, physical, or chemical characteristics of the recycled product (rPET) compared to the virgin product (vPET). This means that vPET and rPET are often substitute goods for the same final uses.

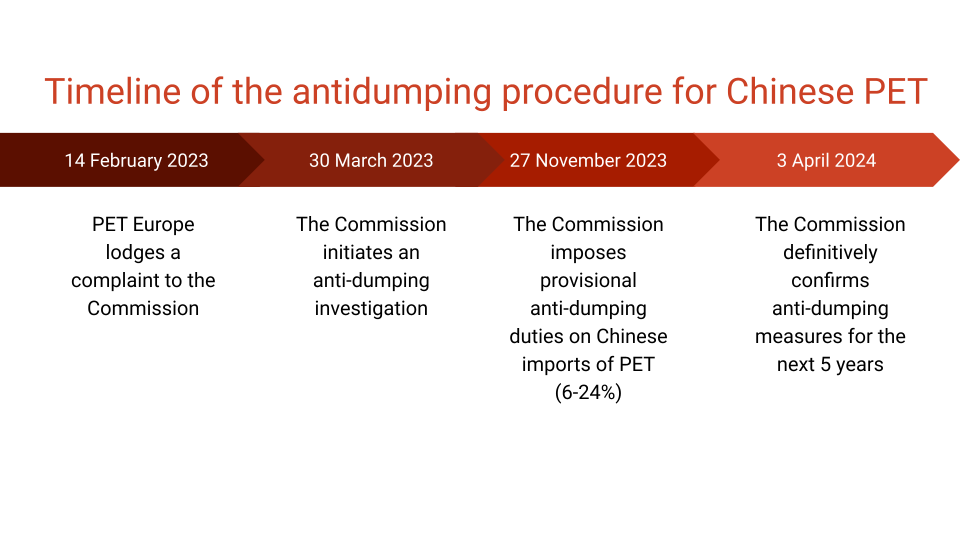

The Commission's Investigation

The Commission's investigation began on March 30, 2023, following a complaint by PET Europe, an association of European PET industry producers, and concerned EU imports of Chinese PET[1] during 2022. According to PET Europe, during the reference period, China exported high volumes of PET to the EU market at artificially low prices, harming the EU PET industry. On November 27, 2023, the Commission decided to provisionally apply anti-dumping duties on PET imports from China, ranging from 6.6% to 24.2%[2] depending on the exporting producer. On April 3, 2024, these measures were confirmed and made definitive for the next five years.

Timeline of the Commission's Anti-Dumping Procedure for PET Imports from China

As in the case of titanium dioxide, the Commission's procedure identified numerous distortions related to Chinese PET that result in artificially low prices for European imports from China. The production factors of China's PET industry are, in fact, under the direct or indirect control of the Chinese government, as is the terephthalic acid industry, one of the main raw materials used in thermoplastic production.

Increase in Chinese Imports

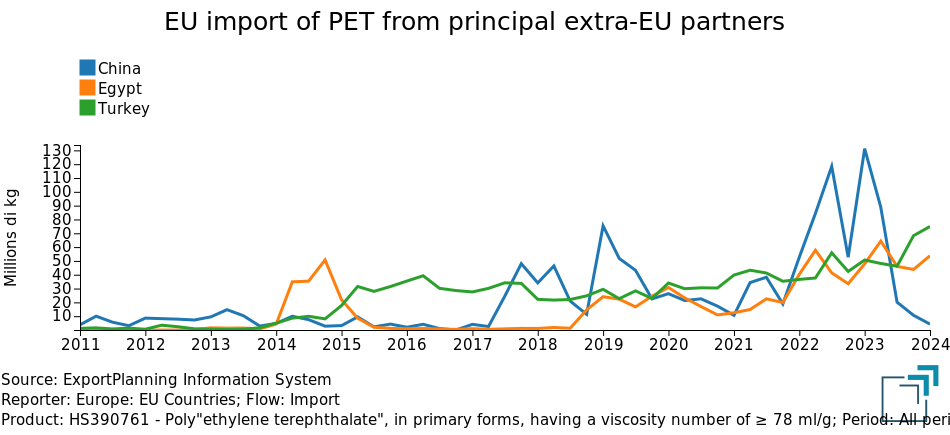

What led the Commission to introduce anti-dumping measures against Chinese PET imports is the fact that low-cost supplies from the Asian country increased significantly in 2022, harming the profitability of the European industry.

The following graph shows the dynamics of EU PET imports from major non-EU partners (source ExportPlanning).

EU PET Imports from Major Non-EU Partners

Imports from China increased significantly during 2022, even compared to imports from Turkey and Egypt. The growth of imports continued in the first quarter of 2023, more than doubling compared to the same quarter in 2022. From the third quarter of 2023 onwards, Chinese imports dropped drastically.

The increasing presence of low-cost Chinese PET in the market of the Union has, according to the Commission, harmed European PET producers, who were unable to keep their selling prices (which were falling) in line with production costs (which were rising).

EU-China Price Comparison

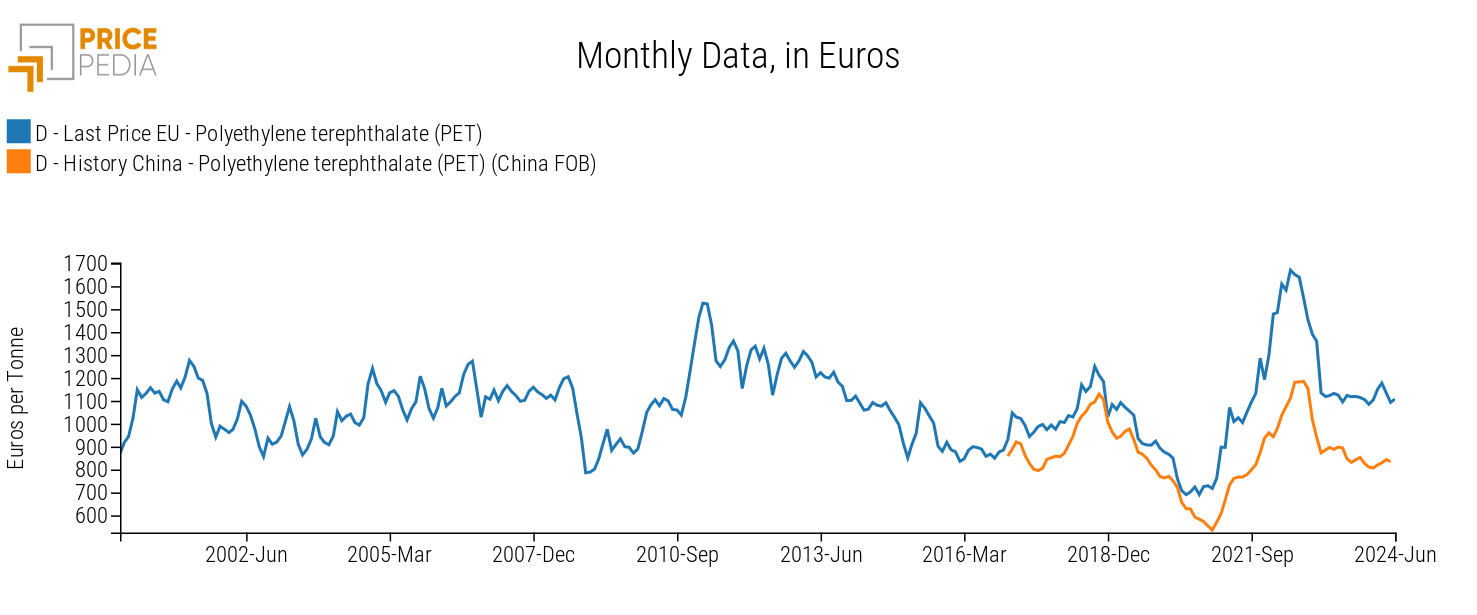

The following graph shows a comparison between Chinese PET export prices and corresponding PricePedia customs prices.

PET Prices: EU-China Comparison

The two prices are closely aligned, although the level of European PET prices is always higher than the corresponding China FOB price. During 2022, the differential between the two quotations increased significantly, due to a more pronounced decrease in the Chinese price, which acted as a "moderator" in the European market.

From 2023 onwards, the Chinese price continued to exhibit a slightly declining trend, due to structural factors identified by the Commission that aimed to keep prices artificially low.

The moderating role played by the Chinese price is even more evident in the following table, which shows the annual changes in the two quotations starting from 2019.

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|---|

| D-Last Price EU-Polyethylene terephthalate (PET) | −10.62 | −23.92 | +37.45 | +46.23 | −26.29 | +1.08 |

| D-History China-Polyethylene terephthalate (PET) (China FOB) | −11.48 | −27.47 | +17.05 | +40.54 | −18.95 | −4.08 |

Again, a substantial alignment of the changes in the two prices compared to the previous year can be observed. The substantial difference emerged in 2021 when European prices increased by almost 40%, compared to an increase of "only" 20% in the Chinese price. Subsequently, the magnitude of the changes in European and Chinese prices remained substantially the same.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

1. The product referred to is Poly(ethylene terephthalate) in primary form, with a viscosity index equal to or greater than 78 ml/g (CN390761.00).

2. EU Regulation 2023/2659 establishing provisional duties on PET imports from China.

Pasquale Marzano

Economist and data scientist. At PricePedia he deals with the analysis of commodity markets, forecasting models for raw material prices and management of reference databases.