Update of molybdenum prices to July 2024

Analysis of commodity families of molybdenum prices

Published by Luca Sazzini. .

Energy Transition Silicon Price DriversMolybdenum is a rare metal contained in various types of minerals, but only molybdenite is suitable for its industrial production into marketable products.

At the industrial level, it finds applications in numerous sectors including:

- Metallurgy: as an alloying agent in combination with iron, chromium, nickel, and tungsten for the production of steels and alloys characterized by high hardness and corrosion resistance;

- Chemical industry: used as a catalyst to improve the cleanliness of industrial chemical reactions;

- Electronics: for its conductivity and thermal resistance properties;

- Aerospace industry: where a combination of lightness, strength, and durability is necessary;

- Pigments and dyes: molybdenum oxides are used for the production of pigments for yellow and green colorations used in paints and ceramics.

This article, in addition to providing an update on the financial prices of molybdenum, presents an analysis of customs prices for each type of molybdenum traded in the three main regional markets worldwide: the EU market, the USA market, and the China market.

Financial Price Analysis

In the financial markets, molybdenum prices are quoted in the form of roasted molybdenum concentrates (RMC) on the London Metal Exchange (LME).

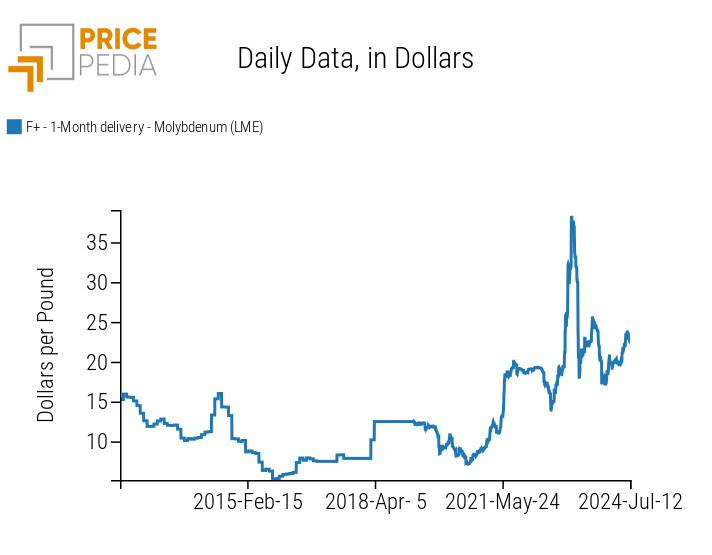

The following chart shows the historical series of LME spot prices, expressed in dollars per pound.

Financial Prices of LME Roasted Molybdenum Concentrates

The chart illustrates the high volatility of molybdenum financial prices.

The period characterized by the most intense price variations was the price cycle of 2022-2023, which began with a supply shortage that caused a market deficit. During that period, many mines remained inactive and others even closed, leading to a shortage of molybdenum supply in the global market, which resulted in rising prices. These prices then began to decline in March 2023, when there was a reduction in demand from downstream markets.

Following this price cycle, a second, much less intense cycle was recorded, followed by a price increase in 2024.

Customs Price Analysis

Within customs markets, molybdenum prices are traded in different types of commodities.

Molybdenum Ores

Molybdenum ores and concentrates are primarily used to produce metallic molybdenum, an essential component for numerous alloys, particularly stainless steel.

The following table shows the dynamics of the annual average prices of molybdenum recorded at the customs of the main three geographical commercial areas: EU, USA, and China.

Annual Averages of Customs Prices for Molybdenum Ores

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|---|

| D-Last Price EU-Molybdenum Ores | 10756 | 7671 | 12081 | 17559 | 17854 | 21400 |

| D-Historical USA-Molybdenum Ores (USA CIF) | 11752 | 8219 | 11829 | 17029 | 22306 | 17155 |

| D-Historical China-Molybdenum Ores (China CIF) | 8087 | 6009 | 9998 | 13157 | 13542 | 14929 |

After an initial decline recorded in the 2019-2020 biennium, the annual average customs prices of molybdenum ores in Europe and China started an upward trend that persists to this day. The only molybdenum ore price to record a reduction over the past year was that of US imports, which was more sensitive to the decline in financial prices.

Net of the lower level of Chinese prices, the customs prices of the three geographical areas show a very similar trend, with correlation coefficients always above 0.9 out of a maximum of 1.

Roasted Molybdenum Ores

Roasted molybdenum ores and concentrates are produced by heating molybdenum ores and concentrates to remove impurities such as sulfur, arsenic, and lead.

Below is the dynamic of the annual average prices of roasted molybdenum ores, as was done for molybdenum ores.

Annual Averages of Customs Prices for Roasted Molybdenum Ores

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|---|

| D-Last Price EU-Roasted Molybdenum Ores | 13690 | 9751 | 16726 | 22451 | 27916 | 25388 |

| D-Historical China-Roasted Molybdenum Ores (China CIF) | 14063 | 11905 | 17001 | 22635 | 22587 | 21928 |

The prices reported in the table highlight a common trend in the annual average prices over the last 5 years.

The trend recorded for roasted molybdenum ores matches that of molybdenum ores, with the only difference being that the former shows a reduction in the annual average prices in the biennium 2023-2024.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Ferro-molybdenum

Ferro-molybdenum is a metallic alloy typically composed of 90% iron and 10% molybdenum. Its main feature is its excellent corrosion resistance, making it indispensable in various industrial applications.

Below is a table containing the annual average customs prices of ferro-molybdenum.

Annual Averages of Customs Prices for Ferro-molybdenum

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|---|

| D-Last Price EU-Ferro-molybdenum | 15969 | 12273 | 20421 | 27501 | 34887 | 30088 |

| D-History USA-Ferro-molybdenum (USA CIF) | 16766 | 12611 | 20292 | 28481 | 32915 | 28416 |

| D-History China-Ferro-molybdenum (China FOB) | 16231 | 12651 | 17089 | 24950 | 31149 | 26612 |

The analysis of the table highlights the same price trend observed for roasted molybdenum ores.

The price levels of metallic alloys are very similar in each of the three macro-regions analyzed. The only slight difference that emerges in terms of levels is that during the upward phase of 2022-2023, the customs prices of Chinese ferro-molybdenum exports were on average lower than the European prices and those of US imports. China, being the world's largest molybdenum extractor, experienced a lower supply deficit compared to other regional markets.

Molybdenum Oxides and Hydroxides

In various customs markets, molybdenum is also traded in the form of oxides and hydroxides. Molybdenum oxide is produced by heating molybdenum ore in the presence of oxygen, while molybdenum hydroxide is obtained by dissolving molybdenum oxide in a solution and then precipitating the hydroxide.

Below is a table of the annual average customs prices of molybdenum in the form of oxides and hydroxides.

Annual Averages of Customs Prices for Molybdenum Oxides and Hydroxides

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|---|

| D-Last Price EU-Molybdenum oxides and hydroxides | 16965 | 13605 | 20469 | 26376 | 33065 | 29067 |

| D-History USA-Molybdenum oxides and hydroxides (USA CIF) | 18846 | 13710 | 20792 | 29251 | 35563 | 30279 |

| D-History China-Molybdenum oxides and hydroxides (China FOB) | 19083 | 14626 | 20224 | 28823 | 38700 | 33991 |

The analysis of the table highlights the alignment of the prices of molybdenum oxides and hydroxides both in terms of levels and dynamics. In particular, the dynamics of oxides and hydroxides, in addition to being common in various regional markets, are aligned with the prices of other types of molybdenum present in the various regional markets.

Molybdates

Molybdates are chemical compounds derived from dissolving molybdenum oxide in a basic solution. Industrially, they are mainly used for the production of pigments, catalysts, and corrosion inhibitors.

The following table compares the dynamics of the average customs prices of molybdates, recorded in the 3 main geographical areas.

Annual Averages of Customs Prices for Molybdates

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|---|

| D-Last Price EU-Molybdates | 14307 | 11552 | 14587 | 20589 | 24896 | 21936 |

| D-History USA-Molybdates (USA FOB) | 12556 | 10725 | 13876 | 20652 | 26990 | 22827 |

| D-History USA-Molybdates (of ammonium) (USA CIF) | 15636 | 12265 | 17254 | 24848 | 30167 | 25871 |

| D-History China-Molybdates (China FOB) | 16083 | 12398 | 17202 | 24854 | 30290 | 27263 |

The price dynamics of molybdates follow the same trend as the other types of molybdenum previously analyzed.

This aspect suggests the presence of a single global molybdenum market, characterized by strong interrelations between different regional prices.

Conclusion

Molybdenum is considered a strategic metal due to its importance in the energy transition. Its properties allow it to be used in many applications as a substitute for more expensive critical metals, such as tungsten.

The customs prices of Europe, the United States, and China have proven to be strongly aligned for the various types of molybdenum traded in customs markets, suggesting the existence of a global market characterized by strong interrelations between different regional prices.

The analysis of molybdenum prices revealed significantly lower average levels in the first half of 2024, compared to the average prices of 2023.